What to watch as Trump ratchets up global tariffs

JUST IN

First there was Liberation Day, then came Judgment Day. US President Donald Trump is hiking tariffs on much of the world, with a 35 percent tax on Canadian imports beginning today and a series of rates ranging from 10 percent (United Kingdom) to 50 percent (Brazil) on other US trading partners, which will take effect next week once customs officials can implement them. The new rates come after Trump struck a flurry of framework deals with several major economies to avoid still higher rates, but they nonetheless represent a major shakeup to the global trading system. What does this all mean for the US economy? How are India and Brazil, two major US trading partners that did not get a deal, reacting? What comes next? Our experts answer below.

TODAY’S EXPERT REACTION BROUGHT TO YOU BY

- Josh Lipsky (@joshualipsky): Chair of international economics and senior director of the Atlantic Council’s GeoEconomics Center, and former International Monetary Fund advisor

- Barbara C. Matthews: Nonresident senior fellow at the Atlantic Council’s GeoEconomics Center and former US Treasury attaché to the European Union

- Mark Linscott (@marklinscott5): Nonresident senior fellow with the Atlantic Council’s South Asia Center and former assistant US trade representative for South and Central Asian Affairs

- Valentina Sader (@valentinasader): Deputy director at the Atlantic Council’s Adrienne Arsht Latin America Center

The big picture

- Stepping back, Josh tells us that “in the span of seven months, Donald Trump has remade a global trading system that took over seventy years to construct.” When the president took office in January, the effective US tariff rate on the world was 2.5 percent. Josh calculates that once you combine today’s country rates with sectoral levies on goods such as copper and pharmaceuticals, “the US rate will be closer to 20 percent—the highest since the nineteenth century.”

- Trump’s order puts most of these tariffs into place on August 7, which some have interpreted as giving more time for countries to strike deals. Looking at the fine print, Josh surmises “this isn’t another delay to negotiate. It’s a short delay to get implementation right.” Why? Because the announcement also includes rates for “transshipment,” when goods pass through a third country to get to the United States. “If these rates weren’t happening, the administration wouldn’t be focused on how countries might soon try to avoid them.”

- Ahead of today’s deadline, Trump announced deals with the European Union, the United Kingdom, Vietnam, the Philippines, Japan, South Korea, and others. These “are not merely trade deals,” Barbara points out. Rather, through security, energy, and investment commitments, they are designed to “re-align geoeconomic interests and tie countries closer to the United States.”

- Barbara notes that “transshipment hubs for Chinese goods across Southeast Asia have delivered concessions to the United States and received more favorable tariff treatments for their exports, earning rebukes from China in the process.” Meanwhile countries that have not gotten deals include Australia (which supplies iron to China for steelmaking), Canada (which the White House says has not been tough enough on Chinese fentanyl), and India (which buys oil and natural gas from Russia).

- For the countries that did make deals, Mark wonders what the ultimate value is: “They provide limited tariff relief, the terms are entirely unclear because agreement texts haven’t been released, and it seems likely that they can be abandoned at any moment at the whim of the president.”

Sign up to receive rapid insight in your inbox from Atlantic Council experts on global events as they unfold.

India’s missed opportunity

- India is now on the hook for a 25 percent tariff—and possibly higher if Trump follows through on threatened “secondary tariffs” on Russia’s trading partners for Moscow’s war in Ukraine. Mark points out that as trade talks heated up, New Delhi avoided direct engagement with Trump in the final days before the deadline.

- “Every deal to date has involved the president putting his final imprint on it, and India hoped, unrealistically, it could get away with silence, relying on what it had already offered in negotiations,” Mark tells us.

- Mark believes talks will continue, as Prime Minister Narendra Modi and Trump directed in February, to work on a wide-ranging Bilateral Trade Agreement. But “I wouldn’t rule out a more immediate reciprocal tariff deal in the coming days or weeks” Mark says, “if Modi picks up the phone to seal it directly with Trump.”

Brazil’s way out

- Trump has tied Brazil’s 50 percent tariff rate to unfair trade practices and its regulation of US social media companies—but also to its prosecution of former President Jair Bolsonaro for attempting a coup. “Brazilians have not taken well what they perceive to be a clear intervention on domestic affairs and an independent judiciary,” Valentina tells us.

- Notably, Valentina says, there are nearly seven hundred exemptions to the Brazil tariffs, including aircraft, oranges, and cellulose, though the tariffs will still hit coffee, beef, and sugar. “For Brazil, the tariffs are not good, but they expected worse,” she adds.

- On Thursday, hours before the tariff executive order was released, Brazil’s foreign minister and several senators, “including two former Bolsonaro ministers and one longtime friend of” President Luiz Inacio Lula da Silva, were in Washington to plot out the next stage of negotiations, Valentina says. “One thing is clear,” she notes, “Brazilian sovereignty is off the table.”

What’s next

- Those countries still seeking a deal with Trump now “will need to think asymmetrically,” Barbara says, perhaps by focusing on critical minerals and technology products the United States needs. “With Russia joining China as a geostrategic priority for the United States, the remaining negotiations can be expected to seek stronger concessions regarding supply chains that run through Moscow and Beijing.”

- There is also always a chance of Trump reversing course or putting off the tariffs, as he did in the spring. “We are only beginning to see the costs of tariffs, which will play out in the months to come,” Josh says. “This may be the one pain point that could cause Trump to backtrack before the midterm elections, but it would be a mistake to bet on it.”

- These shifts are about more than Trump, Josh says, they are about breaking up an “increasingly brittle system” of global trade: “There’s no going back to the old way of doing business.”

Further reading

Mon, Jul 28, 2025

Trump and von der Leyen made a deal. But the US and EU are drifting apart on trade.

New Atlanticist By Frances Burwell

Many elements of the Turnberry deal still need to be finalized, and the difficult process could drive the two sides even further apart.

Thu, Jul 17, 2025

The numbers that define the US-Brazil trade partnership

New Atlanticist By Valentina Sader, Ignacio Albe

The US president has threatened to impose a 50 percent tariff on Brazil in August. Before then, take a deep data dive into the current bilateral trade relationship.

Tue, Jul 15, 2025

Beware the ‘dangerous disconnect’ between Trump and the markets on tariffs

Inflection Points By Frederick Kempe

The US president’s approach to tariffs is about leveraging the United States’ economic power for ends that go beyond trade.

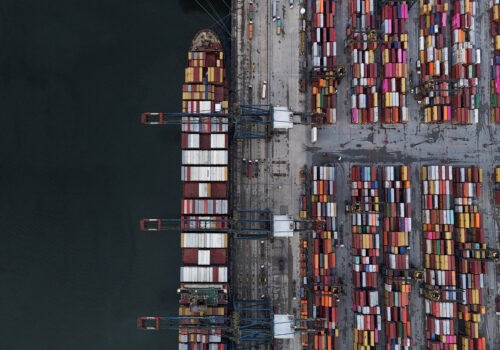

Image: A view of a port under the Port Authority of Thailand, following the announcement that U.S. President Donald Trump would impose tariffs of 36% on goods from Thailand starting on August 1, in Bangkok, Thailand July 8, 2025. REUTERS/Athit Perawongmetha