A Report Card on China’s Central Bank Digital Currency: the e-CNY

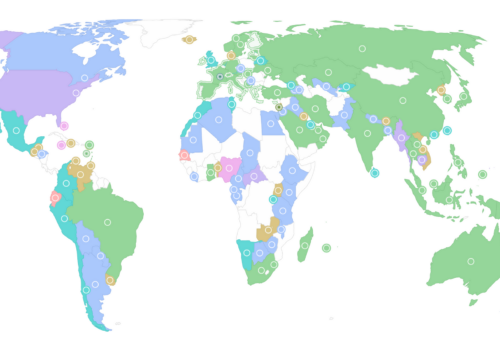

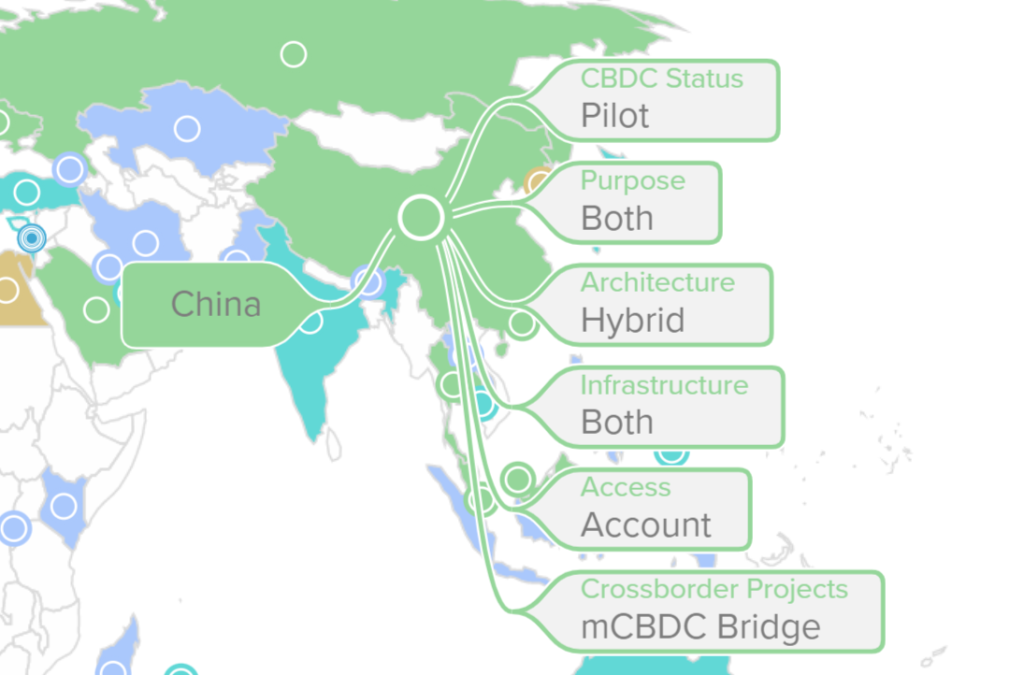

All eyes were on China’s Central Bank Digital Currency, the e-CNY, during the Beijing Winter Olympics Games. The e-CNY pilot operated in ten regions across China before it was introduced to Olympic Games venues in Beijing and Zhangjiakou in February 2022. As reported in the Atlantic Council GeoEconomics Center’s tracker, China leads CBDC adoption and testing, and the Olympic Games provided an international center stage to test the capabilities of the e-CNY. The GeoEconomics Center recently hosted Mu Changchun, Director-General of the Digital Currency Initiative at the People’s Bank of China, and had the opportunity to learn about e-CNY’s latest developments.

What did we learn?

What do they want to achieve?

Use of the e-CNY during the Olympics fulfilled two important policy motivations for the People’s Bank of China (PBoC). First, it was able to test the scalability and throughput of the e-CNY transactions. The current rate of transactions per second (TPS) is 10,000, but transaction capability in the future will reach 300,000 TPS. To contextualize this, compare it with Project Hamilton, the Boston Fed and MIT-led initiative for the digital dollar. Project Hamilton can handle between 170,000 to 1.7 million transactions per second. Moreover, existing forms of payments in China, such as AliPay and TenPay, already handle larger volumes of transactions at high speeds. At its peak, AliPay’s system was able to clear 544,000 transactions per second during 2019’s Single’s Day shopping event. While the e-CNY system completes transactions at higher speed than Visa, (which is at 1,700 TPS), it is still miles behind payment giants like AliPay and TenPay when it comes to scalability and speed.

A related goal of the PBoC was to create greater resilience in China’s payments ecosystem in case of disruption to its domestic markets, which are dominated by AliPay and TenPay. Introducing an alternative to the two payments giants would induce greater competition in the market, and would provide an alternative in case either payments systems are shut down due to cyber attacks or network issues. AliPay and TenPay (consisting of its payments apps QQ and WePay), boast over 900 million monthly active users each in China. The e-CNY was the only alternative to Visa in the Olympic venues, which was the official sponsor of the Games. The e-CNY, however, functions as legal tender, just like cash, and its adoption is key to creating more competition in China’s payments market.

How many people are using it?

The PBoC has not released official numbers on e-CNY adoption and usage since October 2021. However, earlier this year, some Central Bank officials said that there are 261 million wallets, with total transaction values over RMB 87 billion (~$13.75 billion). Based on the more comprehensive October 2021 numbers,123 million individual wallets and 9.2 million corporate wallets were opened with a transaction volume of 142 million and transaction value of RMB 56 billion (~$8.8 billion). This means that the average balances are RMB 3 (~$0.47) for individual wallets and RMB 31 ($4.90) for corporate wallets. The relatively high number of wallets suggests that many wallets were opened, but are not being used for transactions or holding e-CNY balances.

The adoption numbers double between October 2021 and January 2022, which is an interesting phenomenon. This might be due to greater publicity and coverage during the Olympics. But it remains to be seen how many users of e-CNY are active. In an Atlantic Council event on February 14, 2022, Mu Changchun, Director-General of the Digital Currency Initiative at the PBoC stated that there weren a “couple million Renminbi” worth of transactions every day during the Olympics. We expect final numbers from the PBoC shortly.

How does it actually work?

e-CNY users can choose between individual or corporate wallets, which offer different transaction limits. Wallets can also be software based — the e-CNY mobile app, which allows users to manage their e-CNY transactions — or hardware based, an electronic card that allows for touch-based transactions. In his speech at the Atlantic Council, Mu Changchun mentioned that foreign users primarily used hardware wallets at the Olympic Games venues. He also presented a video showcasing how the hardware wallets work, including their offline functionality.

Users can download the standalone e-CNY wallet application from their app stores, or they can use the AliPay and TenPay apps as the interface managing their e-CNY transactions. There are eight other authorized arbiters of the e-CNY app, including the Agricultural Bank of China, Bank of China, China Construction Bank, Bank of Communications, Postal Savings Bank of China, and China Merchants Bank.

How did they build it?

In terms of technology choices, China is using a centralized ledger to record retail transactions and, in parallel, implements a tributed ledger for the reconciliation period at the end of the day. This indicates that China is exploring the use of blockchain technology in its digital currency. The PBoC, like many other Central Banks, would like to remain technology agnostic for now. However, its hybrid technology choice suggests it would be willing to move to a permissioned distributed ledger technology (DLT) in the long run.

But what about the privacy issues?

There is a tradeoff between the anonymity requirements of the digital wallets, and balance and transaction limits. Wallets with lower balance and transaction limits can keep their anonymity, but upgrades to transaction limits require higher identification and know your customer (KYC) standards. For example, to obtain a wallet with a balance limit of 10,000 e-CNY, transaction limits of 2,000 e-CNY per transaction and 5,000 e-CNY per day, customers only need to provide a registered phone number. However, upgrading to higher balance, as well as daily and individual transaction limits, requires ID and banking information. Can linking wallets to phone numbers provide adequate privacy to individual users? China seems to think so. Mu Changchun cited China’s new Personal Data Protection law, which would help keep the anonymity of such financial data.

Can caps on balance and transaction limits be enough for China to crack down on money laundering and illicit activities? China has been experimenting with anonymity and KYC tradeoffs. However, China is also going to use AI and big data technology in its matrices to crack down on suspicious and illicit activities. They believe that embedding e-CNY with advanced technologies, along with caps on balances and limits, will limit money laundering incidents.

Risk Management

Central Banks are primarily concerned about threats to their monetary sovereignty. Their ability to conduct monetary policy could be blunted with the introduction of private digital currencies such as cryptocurrencies and stable coins. The e-CNY holdings do not carry any interest, limiting its competitiveness with Renminbi holdings. The PBoC also offers a deposit insurance mechanism for deposits under RMB 500,000 (~$79,000), which would prevent a drastic shift toward e-CNY. Moreover, in case of financial distress, the PBoC is also prepared to charge a small fee for frequent withdrawals from the e-CNY system.

Remember: these are still early days, despite millions of people already using e-CNY. The e-CNY forms a relatively small portion of the money supply in China, as it is less than 0.0055% of the M0 and 0.0002% of the M2.

How is China going to use it internationally?

China has plans for cross-border wholesale testing underway in addition to its use in the domestic market. It is working with the Bank of International Settlements on its mBridge project, along with Hong Kong, Thailand, and the United Arab Emirates to develop a prototype for an interoperable wholesale CBDC. China is also working on interoperability of the e-CNY with Hong Kong’s Faster Payment System, building toward a launch of the e-CNY in Hong Kong. PBoC officials stated that they will follow the “do no harm” principle in cross-border testing and will ensure that all compliance concerns are being met.

China’s e-CNY is the largest, most public testing ground for the efficacy of a CBDC. The e-CNY system interacts with commercial banks, payments providers, AI and big-data vendors, other central banks, and international institutions. The pilot is further ahead of many other advanced countries, who are still only researching CBDC development.China’s interest in the cross-border functionality of the e-CNY and its relatively advanced stage of development position it well to set standards in CBDC developments globally.That is the role that China is eager to play according to our conversations with Mu Changchun. There is no word as yet of a full-scale launch of the e-CNY, but watch this space for more.

Ananya Kumar is the Assistant Director for Digital Currencies with the GeoEconomics Center.

At the intersection of economics, finance, and foreign policy, the GeoEconomics Center is a translation hub with the goal of helping shape a better global economic future.