Biden’s Executive Order on Digital Assets has been Released. Now What?

Yesterday, the Biden administration released an Executive Order (EO) on Ensuring Responsible Development of Digital Assets. It focuses on the development of cryptocurrencies, stablecoin, and Central Bank Digital Currencies (CBDC). To the surprise of some experts, the EO embraces innovation in digital assets, and signifies the beginning of the end of regulatory uncertainty surrounding these digital assets. The EO also encourages inter-agency coordination and a whole of government approach to the research and development of a CBDC. While it is natural to read this EO in the context of current concerns on sanctions evasion, the administration, under the leadership of Deputy National Security Advisor Daleep Singh, has been working on these issues for months.

How did we get here?

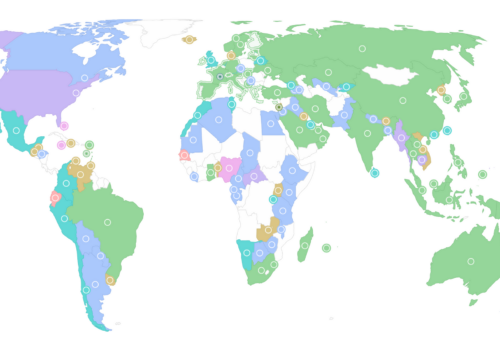

Many factors contributed to the release of the EO this week: first, the EO alludes to the growing market capitalization of cryptocurrencies and their influence in financial markets. The administration is also concerned about concurrent regulatory and financial innovation developments around the world. As Atlantic Council research has shown, over 90 countries have undertaken efforts to explore their own CBDCs, leading to concerns that the United States is lagging behind in technology and policy standards.

Take, for example, China, which has been expanding the pilot program of its retail CBDC, the e-CNY, while concurrently banning the use of cryptocurrency. Or Nigeria, which launched its CBDC, the e-Naira, in October 2021 for retail use. China, Thailand, the UAE and many other countries are also exploring cross-border projects, a testament to their interest in setting technology and policy standards internationally. In fact, reinforcing American leadership in financial markets is a primary theme of the EO, as the United States encounters greater de-dollarization and international standard-setting efforts by other countries. This was the core message of our testimony to Congress and our briefings to the administration over the summer. It is welcome news to see the United States commit to standard setting in this space.

This is not the first time the United States has taken steps to clarify its stance on digital assets, but it is perhaps the most significant. We at the GeoEconomics Center have closely followed the developments of a US CBDC, or the digital dollar, that led to the EO, as summarized in the chart below. As can be seen, several agencies, including the Federal Reserve and Treasury have participated in discussions about research and exploration of the project.

Congress has also contributed to discussions of CBDCs and other digital assets. It heard testimony on the opportunities and challenges presented by a potential US CBDC, the technology underlying CBDCs, as well as on regulation and environmental impact of cryptocurrencies. Moreover, multiple bills advancing the use of a potential CBDC were introduced to the 117th Congress.

Public and government understanding of the use and impact of digital assets, therefore, had been building toward this EO for years. The White House and Congress were paying attention to the developments in financial markets, both domestic and abroad, and wanted to stake a role in the future regulation and development of digital assets with this EO. It is clear the White House, however, felt that action was not happening quickly enough either at the Treasury or the Federal Reserve.

So, what did the White House change with the EO? We explore the 6 main takeaways from the EO here:

- The EO begins with the benefits of the financial technology underpinning these digital assets. It is optimistic that “responsible innovation” can lead to low cost transfers and payments, and improve digitization and modernization of the existing financial infrastructure, as well as make payments safer and faster.

- The second major objective of the EO is risk mitigation. This appears throughout the EO: protecting investors and businesses from the risk of inadequate compliance and privacy protections; ensuring that digital assets, which often experience market volatility, can be safely incorporated into our financial system without compromising its stability; and minimizing the risk of illicit finance and sanctions evasions using these digital assets.

- The EO attempts to create first principles of US involvement in digital assets: this includes promoting democratic values, rule of law, privacy standards, and fostering competition and interoperability, along with maintaining the dollar’s status as the world’s reserve currency.

- The name of the game is regulation that doesn’t stifle innovation. The EO touches on possible regulatory measures in most of its sections. This means upcoming regulation on privacy standards, consumer protection standards, supervisory structures governing these assets, transparency and security standards, climate impact standards, and enforcement measures.

- Section 4 of the EO places “highest urgency” on exploring a US CBDC. This will keep the above first principles in mind, and bolster American leadership on CBDC development. The EO asks for an interagency report on all aspects of the future of money in the next 180 days. The EO also advances US participation in cross-border experimentation of wholesale CBDCs.

- The EO expands the scope of who will coordinate these efforts to include cabinet level secretaries, science and technology bodies, as well as stakeholders like the Federal Reserve, the Securities and Exchange Commission, the Federal Trade Commission, and the Commodity Futures Trading Commission. This reflects the urgency the EO places on making advances on the regulatory and technical front.

Where do we go from here?

Given this comprehensive list of first principles, regulatory needs, and inter-departmental coordination efforts, it is clear that we are just beginning to foster responsible innovation in digital assets. To actually end regulatory uncertainty on digital assets, Congress, the White House, and all other agencies must undertake a massive effort to clarify the legal and regulatory environment for everyone. The EO makes clear that instead of bringing down a heavy hammer on cryptocurrency, the White House is open, under appropriate regulation and oversight, to building a digital currency ecosystem featuring cryptocurrencies, stablecoins, and CBDCs. Whether the subsequent regulatory framework meets that ambition, and whether private industry accepts this compromise, remains to be seen — both throughout the country and on Capitol Hill.

As previously stated in the Fed’s paper on CBDCs, Congress must take the lead on providing authorizing statutes when it comes to the issuance of a CBDC. Congress will likely be more motivated by the EO, and a raft of legislative options will be presented in the coming months. Moreover, these comprehensive efforts will require internal coordination through the G20, the Bank for International Settlements, and the Financial Action Task Force to maintain interoperability and connectivity. The Executive Order was the important first step in ensuring that the benefits of financial innovation can be captured through domestic policy. It rightly identified that clarity and further steps on the issue are in the national security interest of the United States.

Ananya Kumar is the Assistant Director for Digital Currencies with the GeoEconomics Center.

At the intersection of economics, finance, and foreign policy, the GeoEconomics Center is a translation hub with the goal of helping shape a better global economic future.

Related reading

Image: Buying bitcoin online with cellphone