Friedlander testifies to the House Committee on Financial Services regarding US leadership on central bank digital currency development

House Committee on Financial Services

Subcommittee on National Security, International Development and Monetary Policy

Hearing on

“The Promises and Perils of Central Bank Digital Currencies”

July 27, 2021

I want to thank Chairman Himes, Ranking Member Barr, and other members of the subcommittee for the opportunity to discuss the critical subject of central bank digital currencies (CBDCs).

I am honored to testify on behalf of the GeoEconomics Center at the Atlantic Council.1This testimony reflects the contributions and research of our senior fellows (cited throughout) and our center leadership and staff: Josh Lipsky, Ole Moehr, Nitya Biyani, Niels Graham, William Howlett, and Varsha Shankar My name is Julia Friedlander, and I serve as the C. Boyden Gray senior fellow and deputy director of the center. I joined the center last year to run our work on economic statecraft—the use of financial, economic, and regulatory tools in national security and foreign policy. I have served in the federal government as an economist at the Central Intelligence Agency, senior advisor at the Treasury Department’s Office of Terrorism and Financial Intelligence, and most recently for three years on the National Security Council staff. This combined decade of federal service has given me an acute sense of how financial regulation plays a key role in national security and the responsibility of all branches of the US government in global leadership and standard-setting based on entrepreneurialism, rule of law, and respect for the rights of the individual. All of these things play a part in how we as a country approach CBDCs and the model we can set for countries around the world.

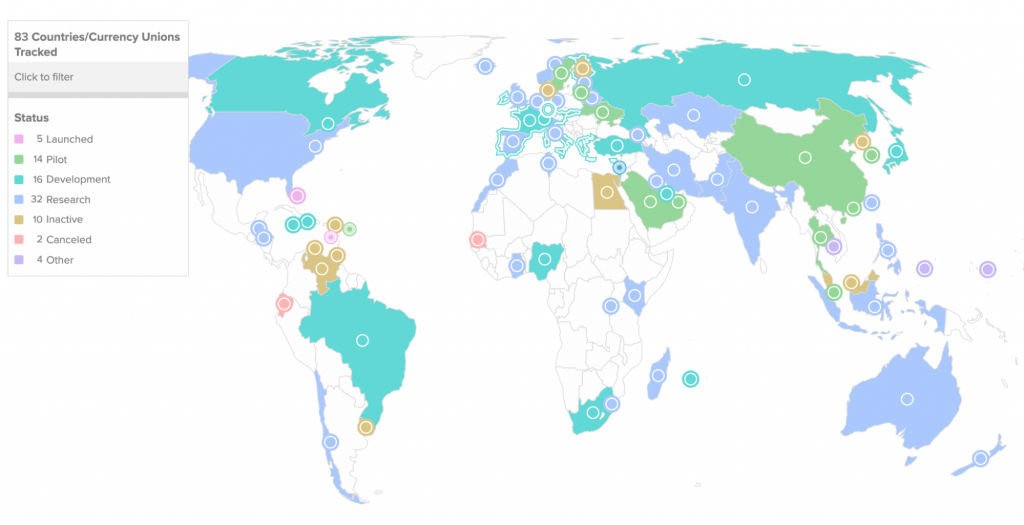

In this testimony, we provide an overview of our research on the topic, focusing on our new CBDC tracker database and interactive toolkit, and its key findings. We will discuss the global expansion of CBDCs and why countries are pursuing them. One point to emphasize from the start: this is not a question of the US and Europe versus China; it is a global issue. Our database features eighty-one countries—more than double the number we identified as active in exploring CBDCs one year ago. These countries account for over 90 percent of the global economy. But of the four historically most influential central banks in the world, (the US Federal Reserve, the European Central Bank, the Bank of Japan, and the Bank of England), the United States is furthest behind in its work on digital currencies. Through our center’s work, we make the case that the US, as the leading economic and financial power in the world, is in a unique position to shape the trajectory of CBDCs. This leadership is imperative. Without new standards and international coordination through fora like the Group of Twenty (G20) and the Financial Action Task Force (FATF), the global financial system could face an interoperability problem. Equally important, the US could miss out on an opportunity to foster financial inclusion, increase cybersecurity, and maintain dollar dominance.

In this testimony, we will address the important national security considerations surrounding CBDCs, including the application of anti-money laundering (AML) regulations, the implications for data privacy and cybersecurity, and the potential of digital currency to limit the global implementation of sanctions.

It is important to note, as this committee has made clear, CBDCs are not solely the responsibility of the Federal Reserve or Treasury, but rather, because the issues impact both the US and global economy, the responsibility rests with all parts of the government.

Global overview—the GeoEconomics Center database

We will start with an overview of our new research project, the Central Bank Digital Currency (CBDC) Tracker. A product of months of painstaking research, our database shows the progress that eighty-one countries and/or currency unions are making on CBDCs. In order to make these assessments, the team conducted research on every central bank in the world to ensure we were not missing inactive countries.

Our report details six key findings—and throughout my testimony, I will share other findings based on the way we have cataloged the individual technology and design choices.

First, eighty-one countries—representing over 90 percent of the global economy—are now exploring a CBDC. That is up from thirty-five countries in our original report published one year ago. In our research on and private conversations with central banks, it is clear COVID-19 has played an outsized role in spurring countries to act. The need to deliver an unprecedented fiscal and monetary stimulus with rapid speed led usually cautious central bankers to explore new avenues for innovation in payment systems. Exploration took off as CBDCs became a viable option for many countries.

This is not the only motivation. The rise of cryptocurrencies and stablecoins factors significantly into the thought processes of central bankers with whom we have spoken.2As opposed to truly decentralized cryptocurrencies like Bitcoin, stablecoins are generally pegged to a fiat currency like the US dollar Some fear losing control of monetary sovereignty within their own countries because of the emergence of these digital currencies; others see stablecoins as a potent complement to the existing finance system. But in nearly all cases, central bankers recognize they cannot ignore the advent of new forms of digital money, and it is essential to play a central role in this system rather than remaining an observer.

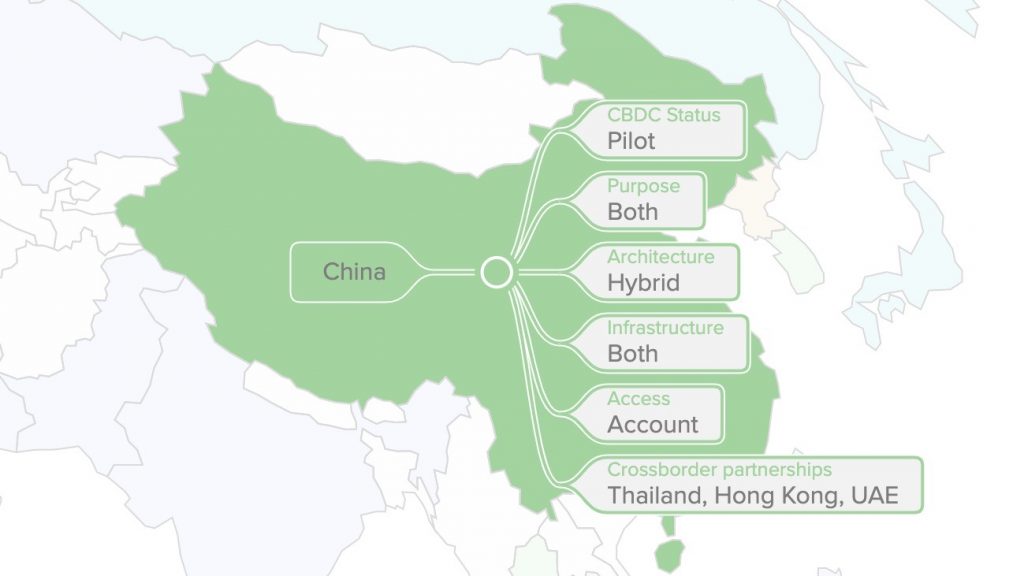

Second, China is racing ahead. In 2017, as a part of a wider push to develop its high-technology sectors, China launched a project called Digital Currency Electronic Payments, or DC/EP. Since then, Chinese officials have said the digital currency will have “controllable anonymity,” allowing the government to provide a level of privacy while also regulating against money laundering and other illicit activity. In April 2020, China piloted the digital currency in four cities, allowing commercial banks to run internal tests like conversions between cash and digital money, account-balance checks, and payments. In August 2020, the pilot program expanded to twenty-eight major cities. As of June 2021, the People’s Bank of China (PBOC) announced that nearly 21 million personal and 3.5 million corporate digital yuan wallets had been opened, with a total transaction value equivalent to about $5.39 billion. The PBOC is testing “programmability” in these pilots, meaning they have created money that expires if not used, or can only be used in certain establishments. There are important fiscal and monetary implications of “programmable” money.3For more on programmability, see “CBDCs: an opportunity for the monetary system,” in Annual Economic Report 2021, Bank for International Settlements, June 23, 2021, https://www.bis.org/publ/arpdf/ar2021e3.htm

The PBOC has also begun laying the groundwork for the digital currency to be used in cross-border transactions. Aiming for broad circulation in 2022, the PBOC and the Hong Kong Monetary Authority began “technical testing” for use of the digital yuan in April 2021. This is in addition to a separate announcement in February 2021 that the PBOC had joined central banks from Thailand, the United Arab Emirates, and Hong Kong to conduct a digital currency cross-border wholesale (bank-to-bank) payment project. Last week, the PBOC announced it would allow foreign visitors to use digital yuan in the lead-up to the 2022 Winter Olympics. Our understanding based on research and interviews is that foreigners will need to provide passport information to the PBOC and/or private payment service providers, but will not need a Chinese bank account to use digital yuan. This has not yet been confirmed by the PBOC.

Third, of the four most influential central banks (the Federal Reserve, the European Central Bank, the Bank of Japan, and the Bank of England) the US is furthest behind. Earlier this month, the European Central Bank announced its intention to develop a digital euro within four years.4For discussion on the digital euro and the motivations of the ECB, see Marc-Olivier Strauss-Kahn, “A Digital Euro,” Atlantic Council, accessed July 21, 2021, https://www.atlanticcouncil.org/economy-business/a-digital-euro/. For the ECB’s announcement, see “Eurosystem launches digital euro project,” European Central Bank, July 14, 2021, https://www.ecb.europa.eu/press/pr/date/2021/html/ecb.pr210714~d99198ea23.en.html As we will explain later in this testimony, there are upcoming opportunities for the US to play catch-up.

Fourth, five countries have now fully launched a digital currency. The first was the Bahamian Sand Dollar, which has much to teach other countries about financial innovation and the way a CBDC can interact with the commercial banking system. John Rolle, governor of the Central Bank of the Bahamas, has made clear that combating illicit finance and promoting financial inclusion are top priorities. Therefore, the Sand Dollar was designed with a tiered wallet system—common to many CBDC pilot projects—that would be useful in the US and other advanced economies.

Fifth, fourteen countries, including Sweden and South Korea, are now in the pilot stage and preparing a possible full launch. This means that nearly all the G20 countries are in some stage of CBDC development, and, as I will explain, that makes the G20 a useful forum for international collaboration on CBDCs. The lesson from the pilot and fully launched countries is that there are different motivations countries have for creating CBDCs. Some nations hope to bring more people into the financial system. But in more advanced economies, like Sweden, concern about the dominance of private digital currencies makes a CBDC an important tool to maintain monetary sovereignty. However, CBDCs are often described as a tool for data surveillance, solely because that is one of China’s motivations. Our research shows that is very rarely what spurs a central bank to develop these tools. Instead, it is the opportunity to foster financial inclusion and enhance monetary and fiscal policy. China’s use of CBDC should not color the entire technology.

Sixth and finally, our database not only provides individual country status but also unpacks countries’ design and security choices. Our research highlights that without governing standards and international coordination, the financial system may be headed for a significant currency interoperability problem in the near future. Right now, countries are overly focused on their own domestic use cases for CBDCs and therefore are choosing individual technology systems and security systems based on criteria that work best for themselves. If systems are built in national silos, there may be massive problems when digital currencies are exchanged or used in cross-border transactions. This can only be remedied by international coordination, and we have heard a clear message from other central banks: they are eager for US leadership on digital currencies.

National security implications

In the world of finance and financial regulation, the first mover has a distinct advantage in setting the international operating environment. Because of the size of dollar-based commercial, financial, and debt markets, the US naturally serves as a force multiplier for international standard-setting. As countries design their CBDCs and define crucial features related to privacy and interoperability, active US leadership will help craft the domestic use of CBDCs globally, their eventual internationalization, and serve as a counterweight to countries looking to deploy standards that do not serve the US interest.5See Michael Greenwald, “The New Era of Digital Asset Foreign Policy,” Belfer Center for Science and International Affairs, Harvard Kennedy School, July 20, 2021, https://www.belfercenter.org/publication/new-era-digital-asset-foreign-policy Failing to act now will leave the US on the outside looking in.6Fred Kempe draws a parallel with how the US failed to lead on developing 5G standards until it was too late. See Frederick Kempe, “Why the US can’t afford to fall behind in the global digital currency race,” Atlantic Council, February 28, 2021, https://www.atlanticcouncil.org/content-series/inflection-points/why-the-us-cant-afford-to-fall-behind-in-the-global-digital-currency-race/

This testimony covers three main national security aspects: illicit finance, dollar dominance, and cybersecurity.

Illicit finance and privacy

The US government and private sector have traditionally served as global leaders in designing and implementing AML and counterterrorism financing regulations, particularly after 9/11 with the passage and implementation of the USA PATRIOT Act. Our research shows encouraging signs that countries actively researching or testing CBDCs employ know-your-customer (KYC) procedures similar to those used by the traditional banking sector, and meet AML standards defined by the FATF. This entails a risk-based “tiered wallet” approach. The higher the tier, the more stringent the KYC requirements. For example, the Bahamas has implemented a three-tiered approach: Tier I basic wallets require no due diligence but are limited to holding five hundred dollars, Tier II premium wallets require the same standards as bank accounts and can hold up to eight thousand dollars, and Tier III wallets are meant for organizations, with a one-million-dollar ceiling.7For a detailed explanation, see “Consumer-Centric Aspects of the Proposed Regulations for the Bahamian Digital Currency,” Central Bank of the Bahamas, March 26, 2021, https://cdn.centralbankbahamas.com/documents/2021-03-26-12-00-35-PSD-Policy-Paper-on-Consumers-Issues.pdf This approach is motivated by the need to balance adherence to KYC rules with the Bahamas’ efforts to increase financial inclusion. While this tiered approach appears popular in pilot and launch countries, it is too early to say it is a trend. It is clear that a tiered approach may enable central banks to fulfill their financial inclusion goals but caution is in order.8For more on how a digital dollar would impact financial inclusion and illicit finance in the US, see Eswar Prasad, “Cash Will Soon Be Obsolete. Will America Be Ready?,” The New York Times, July 22, 2021, https://www.nytimes.com/2021/07/22/opinion/cash-digital-currency-central-bank.html While attempting to streamline payments systems, an every-country-for-themself race to the finish line risks creating a chaotic situation: a patchwork quilt of regulations and operating platforms that could render even well-intentioned KYC programs largely ineffective.

There are also significant definitional questions. What one country deems appropriate, enhanced due diligence may count as another’s data privacy violation and illegal state-led surveillance, complicating cross-border transactions at minimum but also raising risks to personal safety and of industrial espionage. For example, China’s use of facial-recognition technology and other artificial intelligence technologies for KYC purposes and to identify customers and tighten access raises privacy and counterintelligence concerns that would encumber interoperability.9The digital yuan is largely motivated by data collection and surveillance. See Jeremy Mark, “Why China’s digital currency threatens the country’s tech giants,” Atlantic Council, July 15, 2021, https://www.atlanticcouncil.org/blogs/new-atlanticist/why-chinas-digital-currency-threatens-the-countrys-tech-giants/ The combined efforts of the US and its closest international partners to define personal privacy and human rights within payment systems will minimize the proliferation risk of models that eschew these concerns for expediency, enhanced surveillance capabilities, or both. As discussed later in this testimony, a forthcoming technical white paper from the Boston Federal Reserve may deliver important, globally relevant responses to these issues.

Challenges to US dollar dominance and sanction effectiveness

The expanding role of CBDCs raises natural questions about the future role of the US dollar to settle international transactions and to serve as the global reserve currency. Geopolitical factors and fiscal policy already cause short-term swings in the attractiveness of the dollar, as exemplified during the coronavirus economic crisis. But the dollar retains its standing due to the practical advantages of its use in international transactions and the fundamental attractiveness of the US economy as a safe haven for investment. Despite concerted attempts by adversaries to unseat the dollar, these factors make its dominance resilient.10See Carla Norrlöf, “China and Russia announced a joint pledge to push back against dollar hegemony,” The Washington Post, April 9, 2021, https://www.washingtonpost.com/politics/2021/04/09/china-russia-announced-joint-pledge-push-back-against-dollar-hegemony/ Over the short to medium term, we see limited challenges to the dollar posed by CBDCs. Institutions and market depth are advantages of the US dollar that can’t be overcome by a CBDC like the digital yuan.11See Hung Tran, “Can China’s digital yuan really challenge the dollar?,” Atlantic Council, November 30, 2020, https://www.atlanticcouncil.org/blogs/new-atlanticist/can-chinas-digital-yuan-really-challenge-the-dollar/ At this stage of development, most CBDC programs are focused exclusively on domestic use cases, not international transactions.12That said, some programs currently focusing on domestic uses are partly motivated by international implications. For example, see the discussion on the geopolitical background to the digital yuan in Yaya J. Fanusie and Emily Jin, “China’s Digital Currency: Adding Financial Data to Digital Authoritarianism,” Center for a New American Security, January 26, 2021, https://www.cnas.org/publications/reports/chinas-digital-currency

However, in the medium to long term, if CBDCs do demonstrate superior effectiveness in the speed and cost of transaction, they could begin to undermine the dollar’s status in the absence of American leadership in their design.13Barbara C. Matthews and Hung Tran, “Advanced economies under pressure in the central bank digital currency race,” Atlantic Council, August 25, 2020, https://www.atlanticcouncil.org/blogs/new-atlanticist/advanced-economies-under-pressure-in-the-central-bank-digital-currency-race/ If countries are able to build wholesale, cross-border CBDC mechanisms at scale, these payment systems could begin to replace SWIFT and other messaging systems as the preferred bank-to-bank transfer system. This could reduce the share of international trade and capital flows denominated in dollars. This could be exacerbated by the shrinking share of global trade involving the US.14For example, see Amin Mohseni-Cheraghlou, “China and Sub-Saharan Africa Trade: A Case of Growing Interdependence,” Atlantic Council, July 22, 2021, https://www.atlanticcouncil.org/blogs/china-and-sub-saharan-africa-trade-a-case-of-growing-interdependence/ Thus, the use of CBDCs as a payments technology could begin to cause cracks in the dollar’s ubiquity in international transactions.15For more discussion on how CBDCs could impact reserve currencies, see CPMI, BIS Innovation Hub, IMF, and World Bank, “Central bank digital currencies for cross-border payments: Report to the G20,” Bank for International Settlements, July 9, 2021, https://www.bis.org/publ/othp38.htm, 17-18

Relatedly, it is this transaction aspect of dollar dominance that enables the US to police global finance and levy powerful sanctions around the world. At first glance, countries under pressure from US sanctions could ostensibly build coherent systems that sidestep the US financial system entirely. But this argument does not consider the myriad opportunities currently exploited by illicit financial actors to evade sanctions, government detection, or financial regulation through poorly regulated jurisdictions, complex legal structures, and intermediaries. Systematic Russian evasion of Western sanctions on Syria or Chinese evasion of UN measures against North Korea already occur with alarming efficiency outside the reach of enforcement. For those operating explicitly to avoid detection, any design choice for a CBDC would provide greater oversight by regulators and law enforcement than authorities often have into complex trade-based money laundering schemes. In addition, efforts by illicit actors to evade US sanctions on behalf of an authoritarian government do not preclude simultaneous efforts by that actor to evade the heavy hand of that very same government, for different reasons.

Cybersecurity

A digital dollar would be an attractive target for cyberattacks by nefarious actors, including nation states and hackers linked to organized crime, to attain sensitive data and funds and destabilize the global financial system.16For a discussion of why “the CBDC ecosystem will be a high-value target,” see Cyrus Minwalla, “Security of a CBDC,” Bank of Canada, June 2020, https://www.bankofcanada.ca/2020/06/staff-analytical-note-2020-11/ These are not reasons to avoid a CBDC, but instead challenges to overcome in its design and a chance for US leadership. If the US decides to join the system later when standards have been set, we may be forced to accept lower cybersecurity standards to enable interoperability with other CBDCs. This is a singular moment where the US can help determine standards that might set the rules of the road for decades.

Our research shows that countries are currently split in their security choices for CBDCs. Fifteen, including South Korea, have chosen a form of permissioned Distributed Ledger Technology (DLT), which enables trusted partners to verify transactions. Seven others, like China, have chosen a fully centralized conventional system. Another ten countries are using both, while fifty-one are undecided.17“Central Bank Digital Currency Tracker,” Atlantic Council, https://www.atlanticcouncil.org/cbdctracker/ CBDCs that rely on conventional CBDC databases, which share many of the technical features of traditional central bank databases, and DLT-based systems are both susceptible to large-scale attacks. However, the 2016 Bank of Bangladesh hack and consequent Fedwire transactions are evidence that the current system also has vulnerabilities.18For a discussion of the Bank of Bangladesh hack and Fedwire vulnerabilities, see Mark J. Bilger, “Cyber-Security Risks of Fedwire,” Journal of Digital Security, Forensics, and Law 14, no. 4 (April 2020), https://commons.erau.edu/cgi/viewcontent.cgi?article=1590&context=jdfsl, 6-7 The difference is that while a hack of the Federal Reserve today would set off massive alarms, it would not pose the risk of changing the value of a dollar. That would be theoretically possible with a CBDC. The point is that all electronic payment systems are vulnerable to cyberattack, but CBDCs pose new risks. We should treat all government payment systems as critical infrastructure and smart design choices from the inception phase of a CBDC can ensure the plumbing underlying our digital economy is secure.

With regards to privacy, the biggest cybersecurity risks involve sophisticated cyberattacks that could penetrate large databases of the Federal Reserve or intermediaries in the CBDC system, such as banks and payment service providers, and provide hackers with large troves of personal data.

Depending on the specific design choice, a CBDC can put the onus to prevent cyberattacks on end users to protect their private keys, which give them access to their CBDC holdings.19For a good overview of cyber risks related to CBDCs see John Kiff et al., “A Survey of Research on Retail Central Bank Digital Currency,” IMF Working Paper, International Monetary Fund, June 2020, https://www.imf.org/~/media/Files/Publications/WP/2020/English/wpiea2020104-print-pdf.ashx Many end users might use private digital wallets, not unlike an app that stores credit cards on an iPhone or Android device, for their private keys and digital dollar holdings. Evidence from existing digital currencies suggests that end users are prone to lose or forget their private keys. Moreover, hackers are adept at exploiting design weaknesses in digital wallets and accounts to steal passwords, private keys, and actual money. Stolen passwords and keys in turn often result in fraudulent transactions. When considering the risk profile and design of a CBDC system, it is therefore important to establish liability rules for all participants.20For a discussion on security risk and liability rules, see Charles M. Kahn and Francisco Rivadeneyra, “Security and convenience of a central bank digital currency,” Bank of Canada, October 5, 2020, https://www.bankofcanada.ca/wp-content/uploads/2020/10/san2020-21.pdf Depending on the specific CBDC structure, either the account provider (e.g. a bank) or the customer receiving a payment are liable for verifying transactions. Policymakers and regulators must keep these incentive structures in mind when designing CBDC systems. Currently, we find countries applying the same standards on CBDCs as they do traditional payment systems and regulators enforcing both along parallel tracks. But there is confusion among regulators about what will happen if and when a digital dollar is created or a dollar-pegged stablecoin becomes even more widely used. That is why this is the moment for US leadership on digital currencies.

International Leadership

Despite the rapid progress on CBDCs around the world, the Federal Reserve has approached the creation of a digital currency warily. On repeated occasions, Chair Jerome Powell has emphasized that, as the issuer of the world’s reserve currency, it is more important to be right than to be first. This is, of course, a prudent approach to a complex problem. The risk, however, is that in waiting too long, the Federal Reserve will allow a fractured digital currency ecosystem to evolve in a way that does not protect privacy and security, and over time undermines US interests.21On the need for US leadership to shape design standards, see Nikhil Raghuveera, “Design choices of Central Bank Digital Currencies will transform digital payments and geopolitics,” Atlantic Council, April 23, 2020, https://www.atlanticcouncil.org/blogs/geotech-cues/design-choices-of-central-bank-digital-currencies-will-transform-digital-payments-and-geopolitics/

How might this happen? Over time, countries may develop new cross-border systems to settle transactions instantaneously. The dollar would then be seen as a technological laggard, opening the door to currency rivals. This is not only a theoretical threat. In the private sessions we convene at the Atlantic Council, we have heard from other nations that they are eager to hear from the US on this issue, and without US guidance they may look to the design models out of China for ideas on how to build a CBDC.22China’s model creates a ‘plug and play’ authoritarian digital currency system, and the US must offer an alternative route. See Greenwald, “The New Era of Digital Asset Foreign Policy.”

It is better for the US to innovate from a position of strength. This does not necessarily mean issuing a digital dollar—although that could be an appropriate course of action. Instead, the US can galvanize coordination on the international level and ensure countries create digital currencies that are both safe from attack and can safeguard citizens’ data.

Currently, there is a patchwork of regulatory bodies that claim some jurisdiction over CBDC development. The Group of Seven (G7) has a digital currency working group, the Bank for International Settlements (BIS) has convened the large central banks to share best practices, the FATF has issued guidance on stablecoins, and the International Monetary Fund and World Bank convene ad hoc working groups on the issue.23“G7 Finance Ministers and Central Bank Governors Communiqué,” G7, June 5, 2021, https://www.gov.uk/government/publications/g7-finance-ministers-meeting-june-2021-communique/g7-finance-ministers-and-central-bank-governors-communique. Bank of Canada et al., “Central bank digital currencies: foundational principles and core features,” Bank for International Settlements, October 9, 2020, https://www.bis.org/publ/othp33.htm. “FATF Report to G20 on So-called Stablecoins,” FATF, July 7, 2020, https://www.fatf-gafi.org/publications/fatfgeneral/documents/report-g20-so-called-stablecoins-june-2020.html. CPMI et al., “Central bank digital currencies for cross-border payments.” So far, these groups have made a modicum of progress on standard setting, but the US has been unable to bring a concrete set of solutions to the table.

Thankfully, that will likely change in the near future. In September, the Boston Federal Reserve, in collaboration with MIT, will release a white paper on the possible design of a digital dollar. This is extraordinarily important technical work that will make open-source code available to the public. This means the Boston Federal Reserve may provide a technical roadmap for countries to build and scale CBDCs in a safe and secure way.

Assuming it provides such a roadmap, the US should make this white paper a key part of negotiations ahead of the G20 leaders’ summit in Rome this October. It is the G20, which includes fast digital currency movers like China, Saudi Arabia, and Russia, that provides the best forum for international coordination going forward. As our research shows, only two G20 nations—Argentina and Mexico—have not begun consideration of a CBDC. Three countries are in pilot, eight in research, and seven in development. If the US can present its own model to these nations, which before the pandemic represented over 70 percent of the global gross domestic product, and encourage agreement on basic standards, it will be a stepping stone to a more cohesive and seamless digital currency exchange system in the coming years.24The BIS lays out three possible models for creating interoperability among CBDCs. For a discussion of their features, see CPMI et al., “Central bank digital currencies for cross-border payments,” 9-10

Moving beyond central banks

It is important to note that central bank digital currencies are not only about central banks. Every country which is successfully piloting a CBDC has done so in coordination with its finance ministries. That is because, as outlined above, the regulatory concerns—especially in connection to illicit financial flows—are as important to deployment of a CBDC as the technical design.

The role of the private sector is equally important.25To understand how CBDCs are used to neutralize the private sector in China, see Jeremy Mark, “Why China’s digital currency threatens the country’s tech giants.” It would be a mistake to narrowly think of CBDCs as only a government problem, when, in fact, as our research shows, both the advent of cryptocurrencies like Bitcoin and stablecoins like [the Facebook-initiated] Diem have motivated governments around the world to pursue CBDCs.26See the Atlantic Council CBDC Tracker and Hung Tran, “The digital Yuan, digital Euro, and the Diem: Key issues for public debate,” Atlantic Council, April 6, 2021, https://www.atlanticcouncil.org/in-depth-research-reports/issue-brief/the-digital-yuan-digital-euro-and-the-diem-key-issues-for-public-debate/ The US will need to reassure countries that dollar-based stablecoins will have proper regulatory oversight and will be backed by accountable reserve holdings. Treasury Secretary Janet Yellen’s convening of the Presidential Working Group on stablecoins last week was a step in the right direction.

Currently, there are concerns in many developing economies about “digital dollarization,” where private US dollar-pegged stablecoins come to dominate an economy. This is a new form of an old problem but one that needs reassurances so countries do not look for dollar alternatives.

As the Treasury develops a regulatory system for stablecoins, the US could outline successful models for public-private cooperation.27See Christopher J. Brummer and Yesha Yadav, “Fintech and the Innovation Trilemma,” Georgetown Law Journal 107, (2019): 301, https://dx.doi.org/10.2139/ssrn.3054770 The scalability of fintech products makes international coordination crucial to encouraging innovation and reducing risk. As our database shows, there are a variety of ways to distribute digital dollars, and one potential method is for central banks to collaborate with existing stablecoin providers in some type of licensing arrangement. Stablecoins, already being used by millions of people in the US and around the world, can work with CBDCs and help encourage more private sector innovation in this space. The US should be a leading voice for such an approach.28For a discussion on how private and public digital currencies fit together, see JP Schnapper-Casteras and Josh Lipsky, “How Janet Yellen can help deliver the digital dollar,” Atlantic Council, February 19, 2021, https://www.atlanticcouncil.org/blogs/new-atlanticist/how-janet-yellen-can-help-deliver-the-digital-dollar/

The key point is that the US should not cede the playing field in this conversation. There is no time to wait to fully engage. In the absence of US leadership, the vacuum will be filled not only by China, but a range of good and bad ideas, some of which are in US interests and some which are not. But the world will not wait for the US, no matter how potent the pull of the dollar.

Actions for Congress

Congress can help the process in a very concrete way—by passing authorizing legislation.

There are a variety of bills currently before the House and Senate which either encourage or explicitly authorize the use of a digital dollar. Federal Reserve Chairman Powell has been clear that he does not believe the current language in the Federal Reserve Act allows him to create a digital dollar, and he will not ‘creatively interpret’ the language to do so.29Jeanna Smialek, “Jerome Powell says the Fed won’t issue a digital currency without congressional approval,” The New York Times, March 22, 2021, https://www.nytimes.com/2021/03/22/business/jerome-powell-says-the-fed-wont-issue-a-digital-currency-without-congressional-approval.html This, then, is a call to action by the Federal Reserve chair to Congress. If Congress believes a digital dollar is useful, it should pass legislation authorizing a pilot program—ensuring a key role for Treasury in the oversight and coordination process—or amend the Federal Reserve Act. As our research shows, in democratic countries with a pilot program, the legislature has been a key player in the process.

This type of legislation would have positive ripple effects around the world. It would send a signal that the US is serious about a central bank digital currency, and therefore other countries should closely coordinate with the US government before deploying a CBDC that may be incompatible with evolving US policy. It would give pause to countries currently exploring cross-border testing with China for fear that a partnership with the digital yuan would preclude a partnership with the digital dollar. The US need not roll out a large-scale CBDC across the country to have this kind of positive impact. We only need to signal our seriousness about the issue and thereby start a new conversation—one focused on security and privacy and grounded in a commitment to protect US interests and the stability of the global financial system.

“As countries design their CBDCs and define crucial features related to privacy and interoperability, active US leadership will help craft the domestic use of CBDCs globally, their eventual internationalization, and serve as a counterweight to countries looking to deploy standards that do not serve the US interest. Failing to act now will leave the US on the outside looking in.”

Conclusion

Eighteen months ago, when the GeoEconomics Center began our research in this area, there was a real debate about whether countries would pursue CBDCs. However, over the course of the pandemic, dozens of countries—for a variety of reasons—concluded that a CBDC would be in their national interest. This leaves the US in a complicated position. As the issuer of the world’s reserve currency, the Federal Reserve has understandably approached the idea of CBDCs with caution. Launching a CBDC is, for the reasons described above, not without risk. But for the world’s largest economy, the global financial leader, and the creator of the Bretton Woods system that elevated the dollar to its current status, the bigger risk would be to do nothing.

The US can and should lead the world in the development of a safe and secure central bank digital currency. Thank you for the opportunity to appear before this Subcommittee and thank you for focusing on this important issue.

Related content

At the intersection of economics, finance, and foreign policy, the GeoEconomics Center is a translation hub with the goal of helping shape a better global economic future.