CBDCs will need to work across borders. Here are the models exploring how to do it

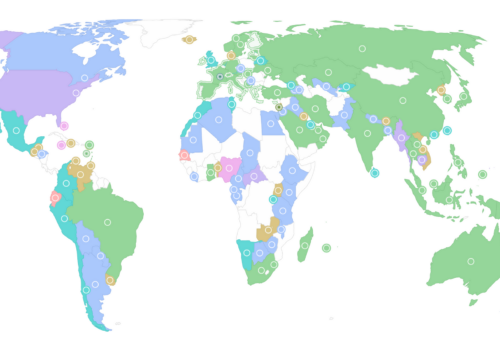

Today, the Atlantic Council GeoEconomics Center released new findings from our flagship Central Bank Digital Currency (CBDC) Tracker showing that 134 countries, representing 98 percent of global GDP, are exploring CBDCs. Countries are not just exploring retail CBDCs (a digital version of cash you can use to buy coffee). They are also prioritizing the development of cross-border and wholesale CBDCs, which can help bank-to-bank transfers across countries. Development of CBDCs is not evenly distributed: large economies such as India, China, Japan, Singapore, and the Euro Area are significantly further ahead than their peers in the United States and UK. Moreover, since Russia’s invasion of Ukraine and the resulting financial sanctions, we have seen cross-border wholesale CBDCs, such as those developed by China, UAE, Thailand and Hong Kong (named Project mBridge) multiply and evolve. Across the twelve other cross-border projects in our research, including Project Dunbar and Project Mariana, we have documented the rise of specific country-blocs developing technology that sidesteps the existing financial system.

Central banks and international financial institutions are realizing that uneven and dispersed technological advancements in digital currencies could actually create further fragmentation of the financial system, deepen digital divides, and create systemic risks. This would undercut the premise of digital currencies, which are supposed to create more efficiency in the existing system. Fortunately, there are some new models of interoperability across borders. A range of policymakers are trying to solve this looming problem, here are the current options:

IMF’s XC Model

The International Monetary Fund (IMF) interoperability model, known as the XC platform, proposes a global centralized ledger to simplify and streamline cross-border payments. It was released in November 2022 as a theoretical project which extends the concept of wholesale CBDCs by integrating commercial banks, payment providers, and central banks into a unified, streamlined platform. The model’s goal is to reduce transaction costs and settlement times.

The platform proposes a three-layer architecture: a settlement layer that acts as the primary ledger, a programming layer for executing smart contracts, and an information layer designed to protect personal data while ensuring compliance and facilitating currency controls as needed. Instead of adopting CBDCs, central banks can issue Certificates of Escrow (CE) for use exclusively on the XC platform. These certificates share characteristics with CBDCs and can later be converted into central bank reserves by financial institutions. According to the IMF, a key advantage of using CEs is that it allows countries to prioritize domestic use cases for their CBDC projects.

Importantly, the XC model is built to be broadly compatible with legacy systems, demanding relatively minimal technological adjustments from central banks. The XC model is a policy and regulatory framework, not a technical solution. It encourages countries to adopt consistent and supportive regulations for cross-border payments, potentially incorporating tokens and distributed ledger technologies (DLTs). However, in order for the model to work, it will need compatible legal and regulatory frameworks to effectively manage risks and ensure compliance across various jurisdictions. Tobias Adrian, Financial Counsellor and Director of the Monetary and Capital Markets Department at the IMF, further explained this point at our conference in November 2023.

BIS Unified Ledger

The BIS Universal Ledger interoperability model advocates for a shared global ledger that supports the issuance and transaction of both CBDCs and tokenized assets. Released just a day after the IMF updated its single ledger XC model, the BIS also aims to address the inefficiencies and silos present in the financial system by enabling safer transactions and atomic settlements within a transparent framework. In the report, the BIS emphasizes the role of trust in central bank digital currency projects in overcoming the limitations and fragmentation observed in current tokenization efforts.

Unlike the XC model which builds on blockchain solutions, the BIS’s unified ledger approach uses APIs (application programming interfaces) creating a more centralized system where transactions have to be processed and validated by authorized entities, such as central banks or designated financial institutions. Within this system, central bank money can circulate on a platform that is not owned and operated by the central bank, which can present risks. It also raises questions about the security, control, and integrity of central bank money when it is managed outside the traditional central banking systems.

The unified ledger model is already being piloted. In October 2023, South Korea launched a wholesale CBDC pilot project exploring BIS’ unified ledger concept. With technical support from the BIS, commercial banks in South Korea utilize a wholesale CBDC for interbank funds transfers and final settlements. These banks will then issue tokenized deposits as payment instruments accessible to the general public within the CBDC network, which is jointly managed by the Bank of Korea (BOK) and other financial institutions in the country. BOK has also joined forces with the BIS Innovation Hub’s Singapore center on “Project Mandala”, which aims to integrate jurisdiction-specific policies and regulatory requirements into a universal protocol for international transactions like foreign investments and payments. This initiative seeks to develop a compliance-by-design architecture for more efficient cross-border transfers for CBDCs and tokenized deposits.

SWIFT’s New Cross-Border Project

Building on its central role in global financial messaging, SWIFT’s innovation hub has introduced a model to enhance its existing infrastructure for cross-border payments, making them faster, more transparent, and cost-effective. Currently in beta testing, this model facilitates the connection of disparate domestic CBDC networks, enabling them to communicate and transact with one another while leveraging SWIFT’s existing infrastructure and security protocols. The current project is running out of the innovation hub and would require a big operational shift to be expanded to the whole SWIFT ecosystem.

In September 2023, SWIFT announced the participation of three central banks—including the Hong Kong Monetary Authority, the Central Bank of Kazakhstan, and one anonymous central bank—in the next beta phase of its CBDC interoperability project. The project, which initially began in March 2023 with over eighteen participants including MAS and the Banque de France, has now expanded to include more than thirty entities and has already processed over 5,000 transactions in a twelve-week period. This solution leverages SWIFT’s global reach and the existing network effects among financial institutions. It also offers flexibility for countries to maintain their own domestic CBDC infrastructure, while ensuring global connectivity. The model is best thought of as a hub-and-spoke arrangement between various central banks with SWIFT at the center.

Comparing the models

The IMF’s XC Model, BIS Unified Ledger, and SWIFT’s New Cross-Border Project each propose innovative approaches to enhancing cross-border payments, especially focused on addressing fragmentation in the payments system. The models themselves are in various stages of development and reflect a spectrum of solutions which envision varied new architectures, novel tokens, and different roles for the private sector and the public sector. These models do not exist in a vacuum, and are accompanied by parallel efforts by central banks (such as Project CedarX Ubin + and Project Mariana) and private companies (such as the Regulated Liabilities Network) to address similar issues of cross-border fragmentation.

The XC Model and BIS Unified Ledger emphasize centralized architectures that focus on integrating existing financial structures with new technology. In contrast, SWIFT’s initiative seeks to adapt its role in traditional messaging infrastructure to connect CBDC networks, prioritizing interoperability and the reliability of established systems. All three frameworks are being designed to support both CBDCs and tokenized assets—creating one platform to exchange them all rather than separate networks. This “token agnosticism” reveals that these projects do not want to be overly prescriptive of the future financial system, and are in the early stages of development and testing.

Each of these initiatives reflects a different aspect of the evolving landscape of global finance, geared towards a push towards greater efficiency, reduced costs, and enhanced security in cross-border transactions. A central question across these models is that of governance, as each of the proposed models envisions an operator of an inherently global system, a concept that is as blue-sky as it gets. This is going to prove difficult due to geopolitical disagreements, since the countries exploring CBDCs are neither aligned on the role of the existing global institutions at the center of the project, nor do they agree on a specific technological model. While these three models seem unified in their ultimate objective, these projects will have to get more specific about who governs, enforces, and creates the rules of the future of cross-border payments. The alternative is a replication of the existing frictions in our system—leading to less efficiency, higher cost, and a loss in trust in money.

Despite differences, these models reflect a clear realization in the public and private sector that as CBDCs become a part of the financial landscape, there needs to be a mechanism to interchange them across borders. As our research shows, the solution set is varied, and leaves observers with looming questions related to the required standards of governance, regulatory frameworks, and consumer protection. There are no compelling answers yet, but as the cross-border models evolve to include proofs of concept and testing, they will have to find the balance between what is technologically feasible while being practically applicable across the globe.

Ananya Kumar is the associate director for digital currencies at the GeoEconomics Center. She leads the Center’s work on the future of money and does research on payments systems, central bank digital currencies, stablecoins, cryptocurrencies, and other digital assets.

Alisha Chhangani is a program assistant for the Atlantic Council GeoEconomics Center where she supports the center’s future of money work.

At the intersection of economics, finance, and foreign policy, the GeoEconomics Center is a translation hub with the goal of helping shape a better global economic future.

Further reading

Thu, Jan 25, 2024

The Fed is falling behind as other central banks leap ahead on digital currencies

New Atlanticist By Josh Lipsky, Ananya Kumar

And the innovation gap is not just on CBDCs. FedNow, the long-awaited interbank settlement system, has taken years longer than comparable systems in Europe.

Mon, Nov 6, 2023

Central bank digital currency evolution in 2023: From investigation to preparation

Econographics By Alisha Chhangani

Explore CBDC evolution in 2023, including key developments from central banks and what is next for the digital euro.

Thu, Nov 16, 2023

CBDCs will further fragment the global economy—and could threaten the dollar

Econographics By Hung Tran, Barbara C. Matthews

Divergent regulatory and technological standards are evolving along geopolitical fault lines. Such an outcome would be costly.

Image: Stock market or forex trading graph in graphic concept for financial investment or economic trends business idea design. Worldwide finance background. Vector illustration