On December Third, European Central Bank (ECB) President Mario Draghi, announced that quantitative easing (QE) would continue as the EU marches along its road to recovery.

The QE program expands liquidity by creating additional currency as well as purchasing government bonds, in an attempt to push the inflation rate up to the ECB’s target of two percent. The ECB began this push last year by reducing interest rates to .05%, and took it a step further by beginning its QE program in March 2015. With the ECB seemingly set on perpetually extending QE, the question must be asked, will it be enough? The answer is most likely no.

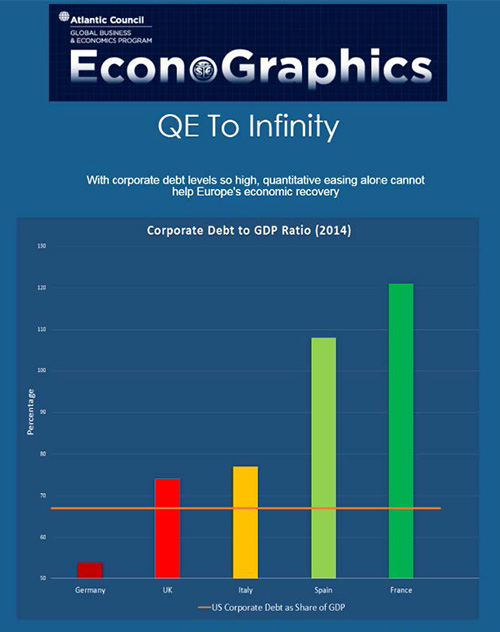

European countries must take political action as monetary policy alone cannot tackle the structural reforms needed in many European economies. Looking at non-financial corporate debt as a share of GDP gives us an imperfect indicator of the significant changes needed in the Eurozone. The entire Euro area is at eighty percent of GDP, with countries like Spain (108%) and France (121%) facing significant challenges. This issue, coupled with high levels of non-performing loans, requires decisive political action by European leadership. Without it, all the quantitative easing in the world will not provide a solution.