Please note, this is the May 2023 edition of Atlantic Council’s Russia Sanctions Database.

Russia is one of the world’s most sanctioned countries. By imposing an unprecedented package of sanctions after Russia’s invasion of Ukraine this year, the West hoped to make Russia a global economic pariah. There is significant overlap on sectoral sanctions but large discrepancies still exist between jurisdictions’ listings of entities and individuals.

The Atlantic Council’s new Russia Sanctions Database tracks the level of coordination among Western allies in sanctioning Russian entities, individuals, vessels, and aircraft—and shows where gaps still remain.

Our database now includes more than 12,900 designations against Russia. 75 percent of them target individuals and around 24 percent of them target entities.

Out of the 1,973 Russian entities in our database, 1009 are sanctioned only by the United States. The UK, EU, Canada, Japan, Switzerland, and Australia need to catch up.

The United States has imposed more than 3,126 sanctions against Russia, the highest number so far. It is also the only jurisdiction sanctioning 158 Russian vessels and 22 planes.

G7 allies are targeting financial facilitators enabling Moscow to evade sanctions. The US and UK sanctioned 54 entities and individuals in Russia’s global evasion network.

57 percent of Russian oil exports are now going to India and China, making Russian oil exports much less diversified, and vulnerable to demand fluctuations by the two countries.

How have sanctions affected the Russian economy? Here’s what we know.

As Russia began its brutal invasion of Ukraine in February 2022, it also made data on the key indicators of the Russian economy classified, citing the protection from Western sanctions as the reason for doing so. One year later, even Russian economists aren’t sure how the economy is performing. This is why Russian Central Bank Governor Elvira Nabiullina is pushing for the declassification of the data on economic indicators, which could pour cold water on President Vladimir Putin’s claims about the country’s resilience towards Western sanctions.

Let’s wait and see if Nabiullina succeeds. But in the meantime, take a look at some of the key statistics we still have access to—and how the war and sanctions have made an impact on them.

Sanctions are cutting off Moscow’s access to revenue and plunging Russia’s budget into deficit. In 2022, the one-off tax on Gazprom’s record profits helped fill the budget, but Moscow might no longer have that option in 2023. This February, Russia’s revenue from oil and gas is down 46 percent year-on-year. It will likely stay at lower levels throughout 2023, as the Group of Seven (G7) allies imposed their second price cap, this time hitting Russian refined petroleum products, in February and are considering lowering the price of crude oil below sixty dollars per barrel. Russia fills 40 percent of its budget with energy revenues, and with oil revenue cuts in 2023, it will have to either spend less on the war against Ukraine or redirect funds from other social programs.

Additionally, the smaller deficit in January 2023 compared to December 2022 can be explained by the accrual of government spending which happens every year in Russia. It is more enlightening to compare year-on-year between January 2022 and January 2023, where the former is in healthy surplus and the latter clearly in the red.

Since Putin’s invasion of Ukraine started, Russia’s oil exports have become less diversified and more heavily reliant on India and China. In 2021, Europe was the primary destination for Russian oil exports. In 2023, the picture looks completely different. India and China together are now the destination of 57 percent of Russian oil exports, making Russia vulnerable to demand fluctuations in the two markets. Russia now has less bargaining power too, as the oil price cap gives buyers more leverage to negotiate prices below the cap. Additionally, the costs of transporting oil to much further destinations reduces Russian margins even further.

By December, Russia experienced the sharpest year-over-year drop in industrial production since the pandemic. Automobiles and labor-intensive industries that require advanced inputs from Western firms suffered the heaviest production cutbacks. This challenge will only become more acute as military mobilization and a massive outflow of citizens, including urban educated Russians and also small-town factory workers, threatens to cause more labor shortages.

However, not all industries performed poorly. Production of arms, bombs, and ammunition experienced 7 percent growth last year, entirely driven by the need for weapons on the battlefield. For military production, Russia needs chips, semiconductor components, and raw materials such as lithium. However, Western export controls are supposed to restrict the flow of these technologies to Russia. So how is Russia boosting military production if it is in fact deprived of Western inputs? It is now clear that Russia is circumventing sanctions.

In hot pursuit of financial facilitators and sanctions evaders around the world

The Group of Seven (G7) nations are intensifying efforts to target financial facilitators that enable Moscow to evade multilateral sanctions. In March, G7 allies issued an advisory to financial institutions describing types of Russian sanctions evasion, which include, but are not limited to:

- Using “family members and close associates to ensure continued access and control” of property and assets;

- Using “real estate to hold value;”

- Using complex ownership structures and shell companies or other legal entities and arrangements to avoid detection and disguise connection to assets and property;

- Using financial facilitators and enablers to avoid direct involvement in sanctions evasion activity and continue to access funds; and

- Transferring assets and funds to countries that have not sanctioned Russia, including the United Arab Emirates, Turkey, China, Brazil, and India, among others.

Recent joint US and UK targeted designations on a network of people and entities helping Russian oligarch Alisher Burhanovich Usmanov dodge sanctions demonstrate the sophistication and scale of sanctions evasion techniques. Members of this network have touchpoints in twenty jurisdictions around the world and operate in the law, financial services, wealth management, trust, and company service provider industries and use their businesses to facilitate sanctions evasion and money laundering. It is noteworthy that, with this designation, Treasury’s Office of Foreign Assets Control (OFAC) revoked a general license, which means that any entity that is 50 percent or more owned by Usmanov is blocked, regardless of whether it is on OFAC’s Specially Designated Nationals and Blocked Persons List. As a result, from a US perspective, this designation may reach well beyond the fifty-four individuals and entities included in the joint action.

On the sidelines of World Bank/International Monetary Fund meetings earlier this month, US, UK, and European Union senior officials met with financial institutions to share information on Russian sanctions evasion tactics and techniques, including Russia’s use of its intelligence services. Meanwhile, the US Department of Justice is looking into bankers from Credit Suisse and other financial institutions for possible involvement in Russian sanctions evasion.

G7 allies’ efforts to enforce sanctions and counter Russian sanctions evasion shine light on the global nature of the crime and the need for a global public and private sector response. Focusing efforts in jurisdictions where financial facilitators and sanctions evaders are operating is a good first step. But how far are G7 allies willing to go to crack down on sanctions evasion within their own jurisdictions? How much are financial institutions and other companies willing to invest in compliance to alert and protect against this activity and safeguard their assets and reputations? Let’s wait and see. In the meantime, take a look at the global reach of Usmanov’s sanctions evasion facilitation network.

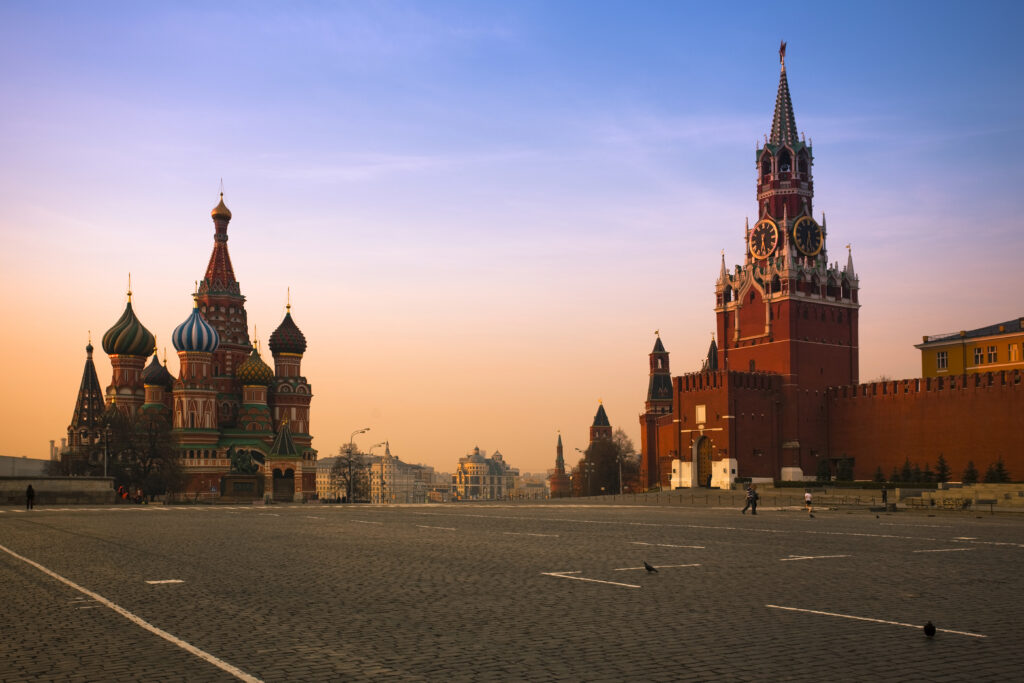

Image: Red Square is the most famous city square in Moscow, and arguably one of the most famous in the world. The square separates the Kremlin, the former royal citadel and currently the official residence of the President of Russia, from a historic merchant quarter known as Kitai-gorod. As major streets of Moscow radiate from here in all directions, being promoted to major highways outside the city, Red Square is often considered the central square of Moscow and of all Russia.