Summer reading list: Future of money edition

These are our top picks for your summer reading list on the future of money: everything from trying to understand the news better to what’s next in the world of innovation.

On central bank digital currencies

The European Central Bank has done something novel—it explained to the public why it is interested in a CBDC. If and when it does issue a digital euro, the outreach will pay dividends.

This speech by Agustín Carsten is one of the best in recent memory on the potential impact of a CBDC and on the fundamentals of trust that fuels all fiat currency.

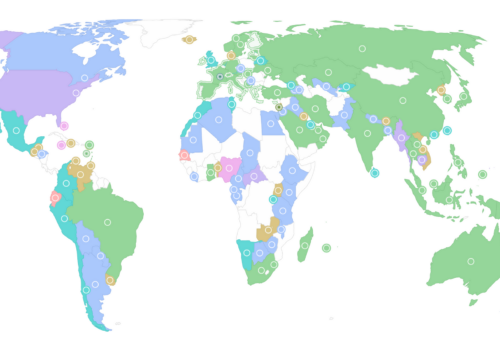

Our CBDC tracker captures the global development of CBDCs for over 100 countries. It is a living document that is updated periodically as developments arise.

On stablecoins

This year, the stablecoin markets saw immense volatility, market crashes and an industry wide reckoning to go back to the basics—what is a stablecoin, and how exactly is it stable?

I find this blog post by Neha Narula at the Massachusetts Institute of Technology’s’s Digital Currency Initiative very illuminating on the technology choices available to stablecoin issuers and how it all comes together.

“On the Economic Design of Stablecoins” by Christian Catalini and Alonso de Gortari is an early look at the risks pertaining to stablecoins, and it evaluates how risky a stablecoin is based on the reference assets underlying the algorithm.

We saw Catalini and Gortari’s predictions play out this year as TerraUSD and Luna—two algorithmic “stable”coins issued by Terra—dramatically lost their peg to the dollar. Coindesk provides a detailed timeline of the team and vision behind Terra and the days leading up to its collapse.

On the crypto crash

Terra’s collapse triggered the crypto crash this summer—as the market capitalization of the industry fell 70 percent. What happened, and how are industry, consumers and regulators responding to the crash?

Want to understand the crash? Here’s an explainer on the broad market trends leading up to the crash.

As tokens crashed, companies liquidated and exchanges halted trade, individual investors lost billions, sometimes overnight, in crypto markets. Sirin Kale wrote a feature on these investors for The Guardian.

On regulation

The crypto crash created an urgency for regulation to protect consumers and investor interests. These principles were laid out earlier this year in President Biden’s Executive Order on digital assets. Here’s our explainer on it.

On the US side, there’s quite a bit of debate about how to classify digital assets and which agencies will have regulatory jurisdiction over them. Gilad Edelman for WIRED explains these developments.

Meanwhile, the European Union (EU) passed the Markets in Crypto-Assets law, which had been under deliberation for a while, partly due to its clause on how mining impacts the environment. Here is the EU’s perspective on the proof of work clause.

On national security

As the US Treasury Department’s Office of Foreign Assets Control (OFAC) designates cryptocurrency entities such as Tornado Cash, SUEX, and others, all eyes are on the financial crime and sanctions evasion potential of cryptocurrencies.

Cryptocurrency analysis group Elliptic published its annual report on financial crime in crypto. The report describes the different types of mal-actors in the crypto ecosystem and the techniques they use to get money into and out of tokens and exchanges.

Jason Bartlett at CNAS published a report on a group of North Korean hackers, the Lazarus Group, who were behind more than $600 million in leakages across different exchanges in 2018-2020.

And on the future:

What does the future of crypto and Web 3.0 look like? A look at some innovative applications of DLTs, and the opportunities and challenges they might produce.

In a first of its kind use-case in the public sector, a Chinese bank issued loans using China’s CBDC, the e-CNY. Loans appear in e-CNY denominations in users’ wallets and can be repaid using the wallet as well. More details on this will be forthcoming, but this is a novel crossover of DeFi lending protocols into the public sector.

As cities like Miami, Austin, and New York begin to offer their own city-based tokenized offerings, Adam Willems for WIRED looks at these CityCoins, and whether they could reshape tax laws in the United States.

I really enjoyed this piece on game developers in the crypto industry. It is an interesting meditation on the existing tensions between art and science, as well as new and old modalities of labor and work culture.

Here’s an old piece on the flourishing crypto channels in Lebanon, a country affected by continuing economic crises. It is a touching look at how humans adapt technology in times of adversity.

Are you a beginner looking to understand the world of crypto, CBDCs, stablecoins and more? Sara Harrison’s A Normie’s Guide to becoming a Crypto Person and the New York Times series The Latecomer’s Guide to Crypto are where you should start.

Ananya Kumar is the Assistant Director for Digital Currencies with the GeoEconomics Center.

Related reading

At the intersection of economics, finance, and foreign policy, the GeoEconomics Center is a translation hub with the goal of helping shape a better global economic future.

Image: Futuristic dots pattern on dark background. Colored music wave. Big data digital code. Technology or Science Banner. 3D rendering