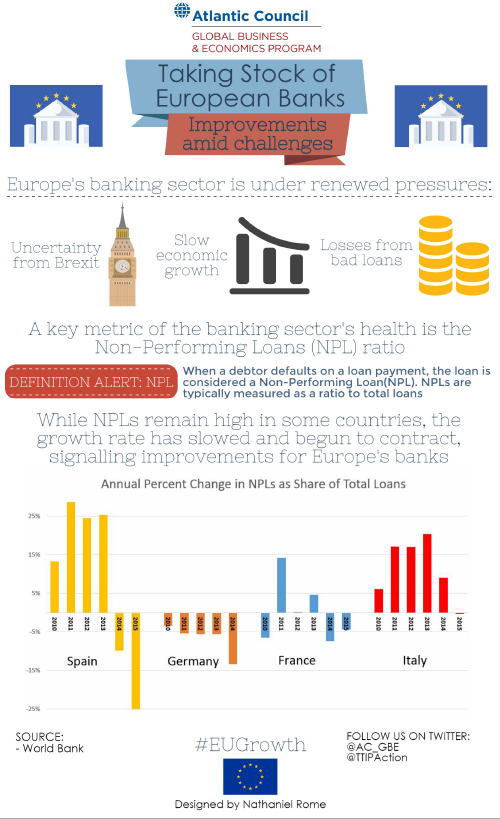

Since the British referendum, Europe’s banking sector has come under renewed scrutiny from financial markets as well as European Union officials and finance ministers. A primary focus is on Italy – which has accumulated $400 billion in gross bad loans – and the EU-Italy talks about how to recapitalize the weak Italian banks. Another focus is Germany following the IMF determination that Deutsche Bank AG posed the greatest risk to the financial system. European banks face uncertainty from the British referendum and have struggled in the face of slow European economic growth, which has averaged only 1 percent annually over the past five years.

An important metric of bank health is the non-performing loans (NPL) ratio. A loan becomes non-performing when a debtor defaults on a loan payment. The ratio is computed as the value of NPLs divided by the total value of loans that a bank has issued. In Italy, the NPL ratio is near 18 percent, far outpacing the EU average of 5.6 percent.

Looking broadly at the major European economies, NPL ratios have shown signs of improvement. Spain has seen dramatic progress since 2013, Germany has consistently reduced their NPL ratio, France has shown improvements, and Italy, for the first time in a decade, had a reduction in NPL ratio last year. This is a good sign for European banks. Banks, like those in Italy, will need to continue addressing the high stock of NPLs. The long term health of the European banking sector will improve if the NPL ratio continues to fall.