The United States is the world’s largest recipient of global foreign direct investment (FDI). On a current-cost basis, the US FDI stock was more than three times larger than that of the second largest destination country in 2014, the most recent year from which statistics are available. Despite the current fragile global economy and great political uncertainty, foreign investment in the United States remains strong. Total FDI stock in the United States grew an average of 6 percent annually from 2009-2014. Meanwhile, FDI in the US in 2015 reached a record of $348 billion, rebounding from 2014 ($172 billion), and well above 2013 inflows ($201 billion).

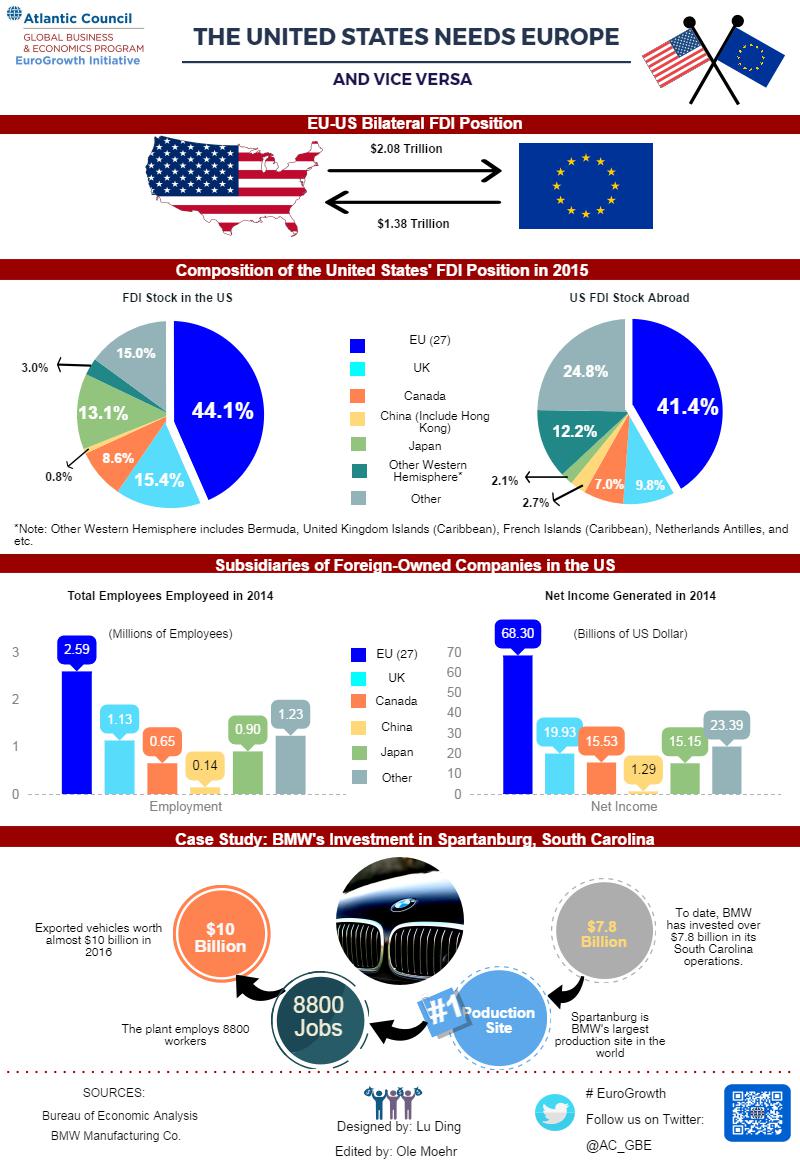

The United States and Europe are each other’s primary source and destination for FDI, with the US providing the largest source of third-country FDI in the European Union (EU) on the basis of stock and flow. In 2015, the FDI net inflow accounted for 2.1 percent of US gross domestic product (GDP) and 3.4 percent for the European Union.

“Although investments from many emerging markets, such as China, have risen considerably on a percentage basis, the EU will continue to be the main source of FDI to the United States for the foreseeable future,” said Andrea Montanino, director of the Atlantic Council’s Global Business & Economics Program.

US affiliates of companies from the twenty-seven EU member states produced $132 billion in goods exports in 2014. These European companies stimulate research and development (R&D) in the United States, spending nearly $24 billion on R&D and accounting for 8.5 percent of the US total investment in R&D by businesses. In turn, these companies employed almost 2.6 million US workers in 2014, up from 2.46 million in 2013. US affiliates of European companies, in general, provide higher compensation than the US average: more than $80,000 per US employee in 2014, as compared to average earnings of $60,000 for workers in the economy as a whole. One OECD study by the Organization for Economic Cooperation and Development (OECD) predicts that potential welfare gains to the EU and the US could reach as much as 3-3.5 percent of their respective GDP.

In addition, the US manufacturing industry is benefiting enormously from FDI inflows, as nearly 70 percent of FDI flows in 2015 and more than 40 percent of jobs at foreign-owned manufacturing firms in the US are created by investment from the EU.

In March 2014, German automaker, BMW, announced an investment of approximately $1 billion in a new X7 production line at their Spartanburg plant in South Carolina. The addition of this production line has made Spartanburg BMW’s largest manufacturing facility in the world. More than half of all the cars produced at Spartanburg are exported. BMW has greatly utilized the strength of US manufacturing and export opportunities offered by US trade agreements to expand their US operations. Of course, this also means potential higher US economic growth and more well-paid jobs.

BMW’s factory in South Carolina is just one example of a European company’s success in the US market. Success comes in many forms and sizes – small and medium-sized enterprises are another important part of the economic ties between Europe and the United States. In short, enhancing the US-EU trade and investment partnership is in everyone’s interest.

This EconoGraphic is the first of a three-part series on why the United States needs Europe and vice versa. The series will lead up to the upcoming launch of the EuroGrowth Task Force’s report on European economic growth and why it matters for US prosperity. The Global Business & Economics Program will launch this timely report on March 10, 2017 at the Atlantic Council.