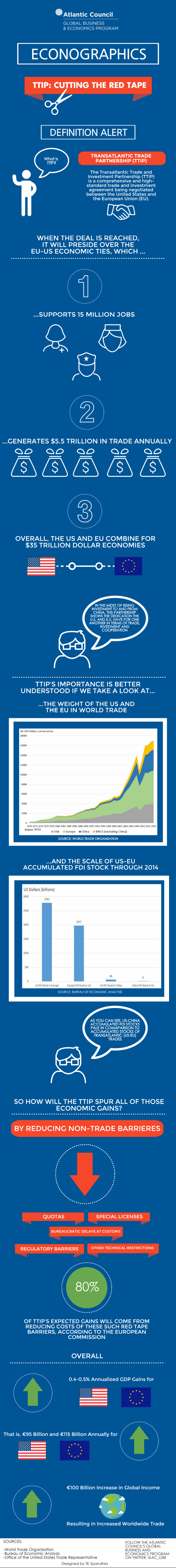

The 12th round of negotiations for the Transatlantic Trade and Investment Partnership (TTIP) unfolded this week in Brussels between the EU and their American counterparts. At a time when both parties are stuck with weak growth (and persistent high unemployment in Europe), the importance of TTIP cannot be understated. When the deal is reached, it will govern the ties between combined $35 trillion dollar economies, with $5.5 trillion in commerce every year that generates up to 15 million jobs on both sides of the Atlantic. In terms of Foreign Direct Investment (FDI), the US and the EU are each other’s primary destination. Even in the wake of rising investment to and from China, it pales when compared to accumulated stocks of transatlantic FDI, as can be seen in the graphic.

TTIP will spur trade and Investment on both sides of the Atlantic by granting market access for EU and US firms, reducing tariffs and regulatory barriers. Average tariffs are already relatively low but can be reduced further, and are still considerable high for certain sectors like the auto industry. However, most of the TTIP economic gains will come from lowering Non-Trade Barriers (NTBs), which include a range of regulations like quotas, special licenses, bureaucratic delays at customs and other technical restrictions. According to the EC, 80% of TTIP’s expected gains will come from reducing costs of such red-tape barriers.

Overall, a comprehensive TTIP agreement will likely have a positive impact on growth, not only for the parties involved but also for the rest of the world. TTIP will increase global income by as much as €100 billion, according to a study by the Centre for Economic Policy Research.