Venezuela’s Cryptocurrency: Should OFAC be Petrofied?

The short answer is no.

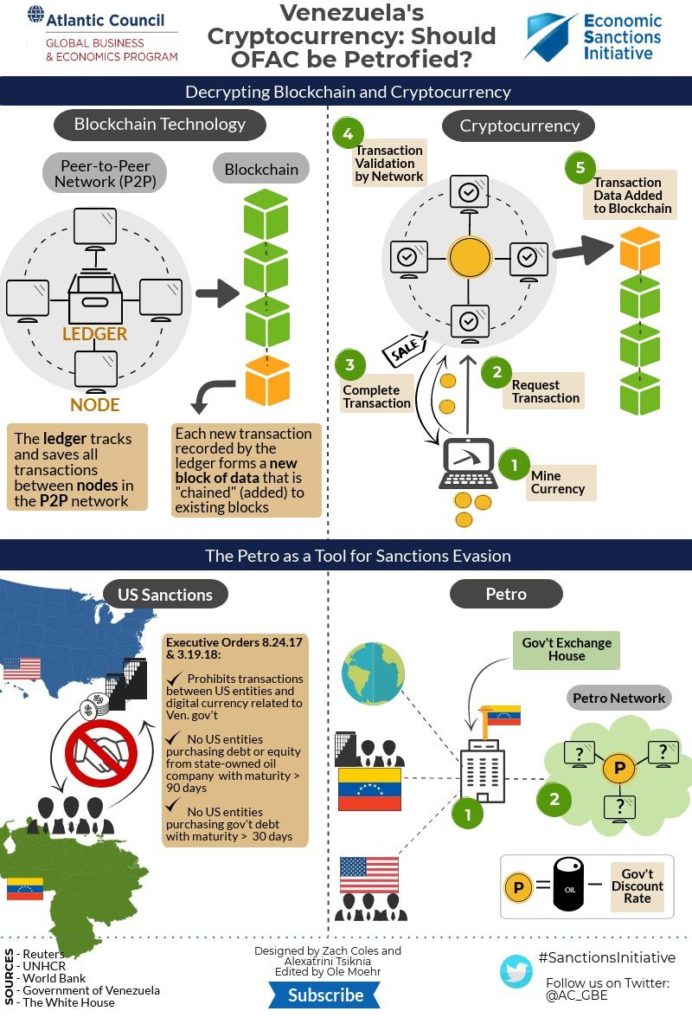

On March 19, the Trump Administration issued an executive order (EO) banning any transactions involving US persons and Venezuela’s much talked about cryptocurrency. The EO expands existing US sanctions placed against the Venezuelan regime. This edition of our EconoGraphic explores the potential for Venezuela’s cryptocurrency, the Petro, to challenge US sanctions efforts aimed at limiting the Venezuelan’s government’s access to financing.

But let’s back up for a second. Here is a primer on cryptocurrency:

Blockchain is the foundational technology of all existing cryptocurrencies. A blockchain is a digital account of bilateral interactions contained within a network that is populated by nodes. The records created are permanent and open to public discovery by any node within the same network. Every alteration to the blockchain must be verified by a certain number of nodes before it is approved. Approval is granted based on rules that are created within the ‘genesis’ block, the first block of the chain. Each node then has access to the updated blockchain ledger. However, no single node possesses more information or power over the network than any of its colleagues. A decentralized network enables the factual representation of information in an environment where trust may be absent. From here, the jump to a cryptocurrency is small. Blockchain information in a cryptocurrency is simply a record of transactions. Each node is accompanied by a pseudo-anonymous, as opposed to absolutely anonymous, profile. The public record of a profile typically includes overall levels of wealth, transaction history, and who the recipient was. The cryptocurrency itself is a cryptographically strong ‘hash’, an encryption algorithm that has been designed to be incredibly costly to decrypt. The initial ‘mining’ requires taxing computations that create a secure ‘hash’. This ‘hash’ could be uncovered by others later, but it requires substantial quantities of energy that often result in net losses of money because of electricity costs.

The Petro represents an attempt by the Venezuelan government to find an alternative way to access global financial markets. In August of 2017, the US government imposed sanctions (EO 13808) to limit Venezuela’s ability to access new credit sources. US persons are prohibited from buying bonds and other debt securities from the Venezuelan government with maturities greater than 30 days. Likewise, acquiring new debt securities from the state-owned oil company (Petroleos de Venezuela, S.A.) with maturities greater than 90 days is also prohibited. Yesterday’s executive order banned the purchase of any digital coins, tokens, or currencies by US persons and any entities that reside within the United States (extending to foreign branches as well).

Given the Petro’s architecture, however, it appears unlikely that it could succeed in circumventing US sanctions. Venezuela’s cryptocurrency design significantly deviates from that of traditional cryptocurrencies. According to a white paper by the Venezuelangovernment, the regime will control almost every aspect of the digital currency. In addition to violating the egalitarian principle of a decentralized network, the Petro has one known central hub where all traffic must pass through: the Venezuelan government. Caracas aims to release a set quantity of pre-mined coins at a fixed price. Preceding this release, the Maduro government issued ‘tokens’ redeemable for Petros that allegedly raised $735 million. In contrast to other cryptocurrencies, the process to obtain the Petro will expose users to a non-anonymous network. Furthermore, entities interested in acquiring Petros would have to go through a government-run cryptocurrency exchange house where they would exchange traditional fiat currency for the Petros. The white paper explains that the value of a Petro will be pegged to the dollar value of Venezuelan crude, minus a discount rate determined by the government. However, there is no evidence suggesting that the Petro can be exchanged at that value.

Despite fears that the Petro would be an effective tool to facilitate sanctions-evading transactions, the evidence suggests otherwise. Without delving into the catastrophic state of the Venezuelan economy, the Petro fails to provide adequate economic incentives to attract foreign investment. Venezuela must convince foreign entities that the Petro, unlike the mismanaged Bolivar, will hold and retain value. The Petro must also reach a critical mass with international buy-in to be sustainable. Again, this is highly unlikely considering Venezuela’s economic fundamentals. Lastly, if US investors and financial institutions did not already have enough reasons to steer clear of the Petro, yesterday’s executive order specifically outlaws circumventing sanctions via the Petro. The US government’s most recent executive order addresses any remaining grey areas with respect to the Petro. More importantly, the EO sets a precedent, as Iran and Russia are reportedly committed to developing their own cryptocurrencies.