‘We are going to get to the finish line on Russia’s reserves,’ says White House’s Daleep Singh

Watch the full event

Daleep Singh, US deputy national security advisor for international economics, emphasized on Thursday, September 26, that we are in the “most intense period of geopolitical competition since the Cold War,” with Russia and China seeking to disrupt the US-led order. He argued during the Transatlantic Forum on GeoEconomics in New York that economic and technological competition will dominate future conflicts because nuclear powers will try to avoid direct military conflict.

On the issue of immobilized Russian assets, Singh underscored that “political will” should ensure the G7 follows through on its commitment to bring the interest revenue forward into a $50 billion aid package for Ukraine by year’s end. “We are going to get to the finish line on Russia’s reserves.” He highlighted the historical significance of this multilateral effort, stating that “never before in history has a multilateral coalition frozen the assets of an aggressor country… and found a way to harness the value of those frozen assets to fund the aggrieved party.”

He acknowledged technical challenges but, when referring to Russian President Vladimir Putin, emphasized that “the choice is ours, not his.” Singh named Hungary’s Prime Minister, Viktor Orban, as the only European Union leader obstructing the legal changes the United States is asking for to unlock its participation—but suggested that Orban “doesn’t have as much leverage as he may perceive.”

Regarding economic statecraft, Singh advocated for a balanced approach, warning that restrictive tools like “sanctions, export controls, [and] tariffs” don’t “win hearts and minds.” He emphasized the need for positive tools that promote “supply chain resilience,” “technological preeminence,” and “energy security.” This aligns with the GeoEconomics Center’s expertise in the matter, with research from last year’s Transatlantic Forum in Berlin and Nonresident Senior Fellow Nicole Goldin’s recent issue brief, “Toward a financial inclusion agenda for the global majority.”

He also expressed concern over the lack of financial firepower for large-scale investments, arguing that the private sector lacks the incentive to invest in long-term, high-risk projects. Singh called for initiatives like a “strategic resilience reserve” or public authorities with more flexibility and scope to fill this gap. More highlights from his conversation with Atlantik-Brücke CEO Julia Friedlander are below.

Industrial policy and global competition

- Singh argued that industrial policy is crucial because the private sector alone cannot address major challenges like the “loss of supply chain resilience,” “fading technological preeminence,” and the “hollowing out of our industrial base.”

- He highlighted the positive results from recent government interventions, such as tax incentives and research and development investments, which have driven “sustained above-trend growth” and a resurgence in “innovation and productivity.”

- Singh noted that the delay in adopting a more active government role was due to policy muscles which had “atrophied” over the past forty years. It has taken time to “course correct” from a laissez-faire approach.

- On global competition, Singh stressed the need for a “multiplayer, multistage game theory” approach, especially regarding China, which “floods the market” with state-backed overcapacity in key sectors like steel, solar, and semiconductors.

- He outlined the US strategy to strengthen domestic capacity, form alliances with countries that “play by the same rules,” and use “restrictive measures” like tariffs to prevent unfair competition and safeguard national security.

China’s role in Russia’s war machine

- Singh emphasized that Russia has turned its economy into a “war machine” and is now relying on rogue states like Iran and North Korea, which have become “witting cogs in this arsenal of autocracy” to sustain its military capabilities.

- Singh found China’s actions over the last years particularly baffling, questioning why a country that claims to seek “better relations with Europe” and wants to be seen as a “responsible stakeholder” is now supporting the biggest threat to European security and aiding Pyongyang’s nuclear program.

- Singh noted China’s deflationary slump and reliance on external demand but questioned why it continues to “antagonize all the major sources of external demand,” calling Beijing’s role in the war a “strategic wedge” rather than a win.

- Singh stated that sanctions aren’t about shock and awe but about “stamina,” pointing out that there are signs of China pulling back from financing Russian military inputs.

- He suggested that China has the power to “pull the plug tomorrow on the factory to the war machine” and warned that failure to act would result in “profound reputational damage” for Beijing.

Humility, creativity, and structural reform

- Singh emphasized the importance of humility in addressing global challenges, especially in light of “the uncertainties of our domestic political climate, geopolitical backdrop, and global macroeconomic regime,” which are all intensifying and feeding on one another.

- He called for a cultural shift in national security, advocating for “bottom-up creativity” and less top-down hierarchy. Singh stressed the need for individuals to “speak up, take risks, admit when you’re wrong,” and challenge assumptions to avoid risk management failures.

- Singh underscored the importance of historical perspective, drawing parallels between the current era and the early twentieth century. He cited examples including the first US-led wave of globalization (1870–1913), emphasizing structural reforms like the creation of the Federal Reserve and income tax to address inequality, as relevant lessons today.

- Singh highlighted the need for modern structural change, pointing to recent legislation like the Inflation Reduction Act, CHIPS and Science Act, and infrastructure bills as good steps, while also urging policymakers to focus on repairing the social contract at home and rebalancing global leadership.

Watch the full event

Further reading

Fri, Sep 20, 2024

Funding the European defense surge

Econographics By

The EU is enhancing defense collaboration and investment but faces challenges in uniting member states and securing common funding.

Wed, Sep 18, 2024

Stabilizing the US-China trade conflict

Sinographs By

Both China and the US can still find negotiation space for positive-sum outcomes which advance their economic and national security interests.

Thu, Sep 12, 2024

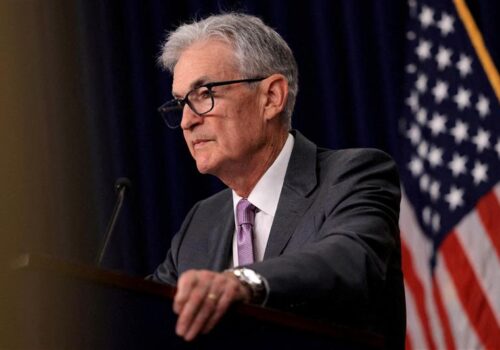

It’s not too early to start grading Jerome Powell’s historic tenure

Econographics By

Jerome Powell's legacy hinges on his bold monetary actions during crises and how effectively these interventions will be unwound in the future.