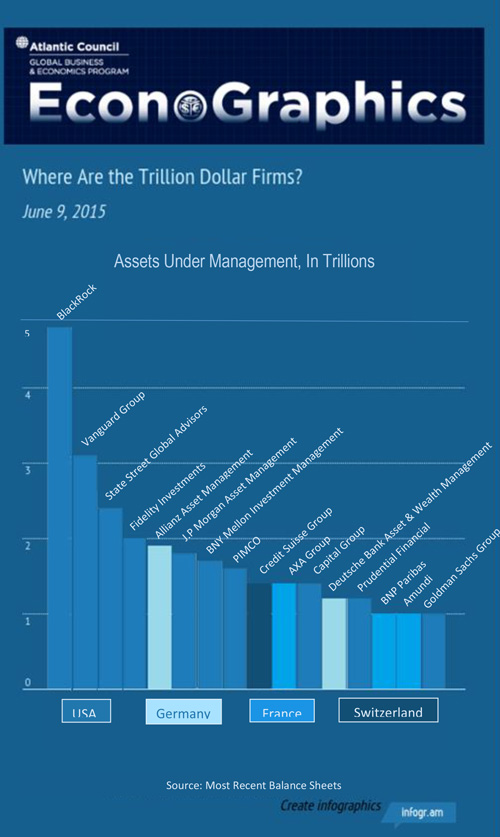

Of the 16 investment firms in the world that hold more than $1 trillion in assets, the US leads with 12 representatives, including well-known firms like BlackRock, Vanguard Group, and the asset management arms of Goldman Sachs and Bank of New York Mellon.

In sum, the top 16 asset managers in the world hold over $29 trillion, a staggering amount. For comparison, the nominal GDP of the US is just over half that amount, at $16.75 trillion.

The US Federal Reserve holds approximately $4.4 trillion in assets—less than BlackRock—and the European Central Bank just $2.7 trillion, which would place it 3rd on the chart.

In an era with high public indebtedness and decreased lending by the banking sector, asset management firms thus represent a large source of finance for economic growth. To unlock the potential of this $29 trillion pool, states may take a look at improving their investment and regulatory environments to attract greater institutional investment, and therefore, growth.