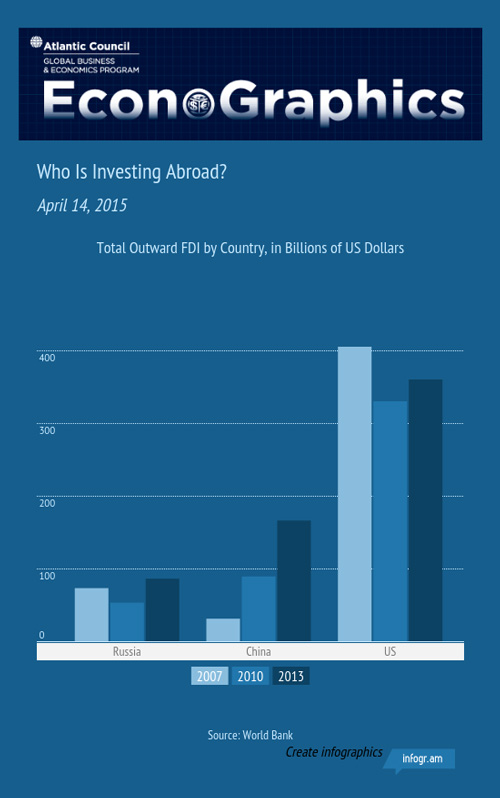

While the US still leads the world in outflowing Foreign Direct Investment (FDI), the emerging markets are catching up quickly. Chinese outflowing FDI, in particular has grown tremendously: since 2005, it increased more than 30-fold in 8 years from $5 billion to $166 billion. While initial Chinese foreign investments focused on natural resource industries, over time the investments have spread to diverse industries like agriculture, manufacturing, and professional services. BRIC FDIs are emerging as key growth drivers for low income countries, improving their business environment, building infrastructure, creating jobs, and adding much-needed revenue to government coffers.

At the same time, this international investment strategy is a powerful political tool for increasing Chinese influence over fragile economies. It is also a way for the BRIC countries to play a role in advanced economies where, as a legacy of the great recession, many big companies are seeking foreign investors to shore up their accounts.

Sources:

http://data.worldbank.org/indicator/NY.GDP.MKTP.CD

https://www.fas.org/sgp/crs/misc/RS21118.pdf