In recent weeks, attacks on ships in the Red Sea have significantly raised shipping costs and caused delays for traded goods, from hospital supplies to food and clothes. Though the global energy supply is so far uninterrupted, a broader conflict in the region would mean disruptive attacks on energy and transport infrastructure, whether through Iranian naval action or Iranian proxies. North America must prepare itself for a coming crisis in the global energy supply, particularly the United States—where President Biden recently announced his decision to pause the approval of new liquefied natural gas exports.

STAY CONNECTED

Sign up for PowerPlay, the Atlantic Council’s bimonthly newsletter keeping you up to date on all facets of the energy transition.

Red Sea attacks continue to threaten shipping

In November 2023, Houthi rebels began attacking commercial ships in the Red Sea and surrounding waters. The Houthis, a Fiver Shiite political faction and the de facto government of western Yemen, are a US-designated terrorist group closely aligned with Iran. They are targeting commercial vessels as a way to oppose Israel’s war against Hamas. In response, the United States helped launch a multinational naval coalition to safeguard navigation in the Red Sea, and it has since struck Houthi military targets several times. However, this has not yet stopped Houthi attacks.

The Red Sea conflict has forced ships to reroute around the Cape of Good Hope. This has disrupted the trade of commodities, including oil and gas, by raising freight rates, increasing shipping times, and reducing the number of ships available. Despite these disruptions, key oil prices such as the Brent benchmark have not yet spiked. Natural gas prices also remain relatively low, as overall demand is still being mitigated by full European gas stocks, a relatively warm winter in some places, and a slowdown in the Chinese economy and other economies, such as Japan and Germany. According to Reuters, US gas exports have played a key role in maintaining global price stability, especially in Europe, but also in Asia.

However, if the disruption in the Red Sea continues unabated, it will invariably drive up global costs for oil and liquefied natural gas (LNG). Freight rates for oil and petroleum product tankers continue to climb—in some cases by nearly 500 percent since November. Additionally, transport times and costs have gone up for oil and LNG shipments from the Middle East to Europe and Asia.

The near future remains uncertain. A wider conflict in the Middle East capable of physically interrupting oil or gas supply is increasingly likely. Recent press reports claim a war between Hezbollah and Israel may be “inevitable,” which in turn would force Iran to act. Iran’s military could easily disrupt the key shipping routes, forcing many countries to seek out supplies shipped via alternative means, notably from North America.

Iran’s actions will be key to the energy outlook

How Iran would respond to all-out conflict between Hezbollah and Israel remains an open question, but historical trends give no reason for optimism.

Primarily, Iran’s past actions in the Gulf mean more frequent harassment of Western-linked tankers is almost guaranteed. This strategy may have already started. In January, Iranian forces seized a Greek tanker off the coast of Oman, though they claim the seizure was reprisal for US sanctions against Iranian oil. The Iranian military is also building up its capabilities. In December, the Revolutionary Guard announced the establishment of a new, volunteer naval force intended to carry out “deep sea missions.” Iran’s navy is building a drone carrier intended for “long-range strike[s].”

There are two obvious ways for Iran to militarily act: the Iranian navy attacks or seizes commercial ships; or Iran-aligned militias attack a major Gulf energy producer, such as Saudi Arabia. Iran has previously resorted to both tactics.

During the Iran-Iraq War of the 1980s, the Iranian armed forces sank and seized tankers leaving Iraqi ports. In 2019, Iranian-led Houthi forces used drones and missiles to damage an oil processing plant in Abqaiq, Saudi Arabia. In 2021, Houthi rebels carried out a similar attack against a Saudi oil terminal in Jazan. The Houthis also attacked energy facilities in the United Arab Emirates with drones.

Broader conflict would severely impact energy supplies

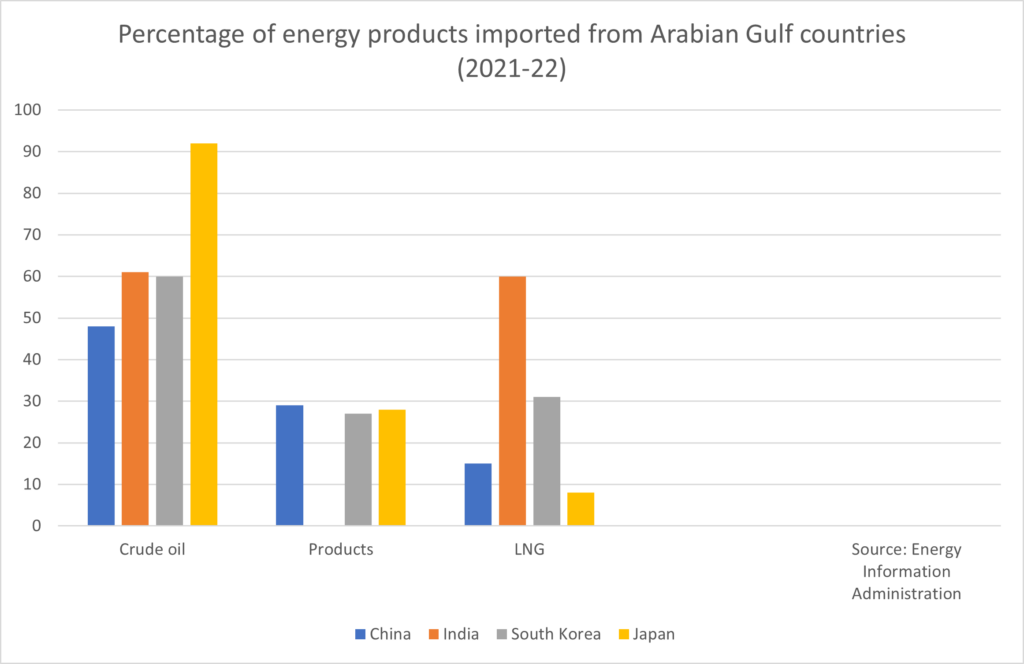

To what extent Iranian military action would cut off the flow of oil and gas is beyond the scope of this analysis. But the impact on the global economy would be swift, including for major economies like China, Japan, South Korea, Taiwan, and India, who all significantly rely on crude oil, refined products, and LNG from the Gulf states. Altogether, around 25 percent of crude cargoes and 20 percent of LNG cargoes pass through the Strait of Hormuz. The EU also relies on oil imports from the Gulf states although less so than Asian countries.

Any large disruption to the Gulf states would leave North America as the most reliable, significant supply of energy. The United States alone exported 91 million tons of LNG in 2023, ahead of Australia and Qatar, which both exported about 80 million tons. Crude oil exports averaged nearly 4 million barrels per day. By one estimate, up to 40 percent of US LNG exports are destination-flexible, meaning they could be easily redirected to buyers in case of a Middle East supply disruption.

North America must bolster global energy security

Every day, it becomes likelier that there will be an escalation of conflict in the Middle East, particularly between Hezbollah and Israel. Such a war and the ensuing Iranian response would jeopardize the global supply of oil and gas due to trade disruptions not only in the Gulf, but also via the drought-affected Panama Canal, which has seen a drop in trade since November 2023. Countries would be left scrambling and forced to turn to reliable production in the United States, Canada, and Mexico. Altogether, the future of the global energy market may soon depend on how North America chooses to respond. The World Bank has estimated that up to 8 percent of global crude supply would be interrupted in case of a conflict. Such an event would also raise the price of LNG and other commodities. Inaction would be easy, and perhaps even politically expedient, but would further strain supplies. Given the risks, it would be best to allow a full development of North American energy possibilities.

Julia Nesheiwat is a distinguished fellow with the Atlantic Council’s Global Energy Center, a member of the Atlantic Council board of directors, vice president for policy at TC Energy, and former US Homeland Security Advisor.

Meet the author

Related content

Learn more about the Global Energy Center

The Global Energy Center develops and promotes pragmatic and nonpartisan policy solutions designed to advance global energy security, enhance economic opportunity, and accelerate pathways to net-zero emissions.

Image: Maritime trade routes are being affected by attacks in the Red Sea.