New opportunities for MENA women to plug into global commerce

On October 13, the Atlantic Council’s empowerME Initiative held a workshop on “Women in the global supply chain: The importance of increasing women’s access,” featuring a keynote fireside chat with UPS International Public Affairs and Sustainability President, Penelope “Penny” Naas, and a panel discussion with Facebook Vice President for the Middle East, Africa, and Turkey, Derya Matras, PepsiCo Vice President and General Manager for GCC-Levant Foods, Tamer Mosalam, and Chalhoub Group Chief Innovation Officer, Dina Sidani. Atlantic Council empowerME Director and Resident Senior Fellow, Amjad Ahmad, moderated the workshop.

This workshop is part of the Igniting Women’s Entrepreneurship and Innovation in Saudi Arabia program led by the Atlantic Council’s empowerME Initiative in partnership with the US Mission to Saudi Arabia, the American Chamber of Commerce Saudi Arabia, and Quantum Leaps. The program brings US entrepreneurs, experts, and business leaders together with their Saudi counterparts to build relationships, share knowledge, and develop partnership opportunities via hybrid workshops and networking sessions.

Key takeaways:

Women’s inclusion in supply chains and business in Saudi Arabia

- Penny Naas noted that “the data is a bit mixed. In some places, women have been disproportionately impacted by COVID. We’ve had to balance home responsibilities with work responsibilities. In certain countries, women are doing better, but in most countries, women are facing more challenges.” She said UPS leverages its expertise and resources to help women-owned companies and female business leaders pivot to the new normal of business and build resilience across their operations and supply chain management. She added that “resilience goes hand-in-hand with diversity. When you think about the most dynamic ecosystems in nature, they are also the most diverse. As we think about supply chains and how we build back and re-design after the pandemic, it seems to me a fantastic time to think about how to diversify our supply chains.”

- Tamer Mosalam said: “I think Saudi Arabia is a great example of a vision that decision-makers are very vocal and disciplined about. Both the government and the private sector are engaged on this. Within the vision, women’s empowerment is happening fast. This gives confidence and creates an impact on society and the growth of economy. This is happening at the government level and spilling over to the private sector.” He mentioned the newly announced Saudi investment strategy, which has a goal of 60 percent GDP growth from the private sector. He said this emphasis on the private sector’s expansion would also help with gender equality.

Corporate programs to support women entrepreneurs

- Naas outlined UPS’s three-pronged approach to helping more women engage in to global trade and supply chains since the majority of small and medium enterprises (SMEs) don’t start out exporting. The first step is helping people understand the requirements to export their goods, followed by learning how to effectively market oneself as a woman-owned business, and the final step is ensuring that the laws and rules are not discriminatory. She pointed to barriers to women’s access to digital tools for business opportunities and said the private sector should work to break them down.

- Naas praised steps governments are taking to ensure women are included in the workplace and can succeed as entrepreneurs. She mentioned that UPS partnered with Saudi Arabia’s General Authority for Small and Medium Enterprises (Monshaat) this month to launch the first women exporters e-commerce boot camp for fifty women-owned companies to learn skills and knowledge about exporting globally.

- Matras mentioned the challenges small and medium businesses have faced during the pandemic, pointing to the 2020 Global State of Small Business Report that revealed 70 percent of small businesses reduced sales in the Middle East and North Africa and 40 percent reduced employment. Matras pointed out that “the most resilient digitalized quickly,” and so the question is how to educate small businesses and upskill their workers, especially for business to consumer models and in terms of reaching the right consumers. She said that “marketing costs are the biggest expense, so they need to use these tools effectively, especially in the initial stages.” She noted that Facebook’s #LoveLocal campaign in the Middle East has trained more than ten thousands SMEs and given voice to them to tell their stories.

- Sidani explained that the Chalhoub Group tries to understand the pain points of their organization and the opportunities these offer. She said one point they identified is smaller brands, which lack adequate corporate support, accelerators, and incubators at the regional level. As she put it, “I could see [a] gap in how we handle those smaller brands—they were falling through the cracks. These brands needed support.” She explained that Chalhoub Group got some of these brands involved in “test quickly, scale quickly, or fail quickly” programs via their retail tech accelerator, and “then we used that methodology to say why not test smaller brands and give them market access, which is the biggest value proposition we can give them.” Part of the support they provide is earmarked funding for content creation and marketing, Sidani added. She mentioned the fashion lab Chalhoub Group launched in Saudi Arabia focused on designs coming from Saudi that will hopefully go global, and explained that they are also working with Facebook to support these smaller brands via content creation and marketing, including learning how to tell the right story and have the right content.

New digital opportunities and challenges

- Naas commented that these days a “physical presence is no longer sufficient” for a business. She added that the “omni channel world presents tremendous opportunities” and that she has been extremely impressed with social media usage in Saudi Arabia. Naas noticed that Instagram in particular is very helpful in sales because businesses can sell directly to consumers. She added that “as people pivot to new digital realities, thinking about how you use these new channels is something more companies have to think about and take advantage of.”

- Matras emphasized Saudi Arabia’s “highly connected and mobile population,” stating that “metrics show they are very engaged and have some of the highest consumption levels globally, especially video.” She argued that this situation presents a substantial opportunity to diversify businesses in the non-oil economy.

- Matras also discussed the messaging trend, saying that “consumers want to talk to businesses like talking to their friends. They don’t want to wait on a call center line or write emails. This trend is picking up in the Middle East. We call it conversational commerce.” She also described the future of “communication becoming much more immersive,” building on the text, photo, and video evolution online to what will soon become more immersive videos like augmented reality filters and then eventually virtual reality and the metaverse. Matras noted that “these experiences are changing the business and consumer relationship and offer exciting opportunities for businesses and talent.”

Business sectors to watch

- Matras highlighted numerous exciting business opportunities such as in e-commerce and the ed tech space as seen with the WhatsApp program for low-tech distance learning in Africa. In coming years, other sectors she expects to thrive include telemedicine, the FinTech industry, gaming, tourism, quick commerce in the food and beverage industry, ride-sharing models such as Careem, and real estate. She added that “the overarching opportunity in the region is remote work. Tech used to be clustered in a few places and access to talent is tough. Remote work showed us we can work online.” There is now a great opportunity to employ remote engineers, break down clusters, remove borders, and help talent in the region, Matras said, noting that “a tech giant in the United States can now recruit engineers in Saudi Arabia and Dubai.”

- Mosalam underscored the immense opportunities in the food and beverage sector, predicting that in the next two to three years, families in Saudi Arabia “will eat out once a day, not once a week or once a month” because the “younger generation is on the go.” He pointed to the success of the HungerStation app and how many consumers got registered. Mosalam also pointed out that childcare and education needs in the country will change as more women join the workforce, which will present business opportunities.

- Sidani emphasized the “massive opportunity in fashion in Saudi Arabia” because “as the kingdom opens up, people want to reflect their identity through art and fashion and going back to their roots.” She shared her view that “innovation doesn’t mean having a crystal ball. It’s having the right team and process in place to experiment and stay ahead of the game.” Sidani said she that is “seeing more entrepreneurs trying to be more local, and I love that we are starting to be more proud of where we come from.”

Advice for entrepreneurs and leaders

- Naas explained UPS’s approach to attracting and growing great women leaders, and she pointed out that UPS has a woman CEO, Carol B. Tomé, “There is no greater thing than to see leadership in action,” she said. Naas also discussed two critical elements for women to thrive in the workplace: mentorship and sponsorship. She defined mentoring as a practice to support women business leaders to develop new skills, and sponsorship as someone or a group of people who will talk about women in talent and personnel meetings when a woman isn’t in the room. She emphasized that women need to have allies – not just their boss – who will ask the company to invest in them. She advised women to work with a mentor to plan how to cultivate those sponsor relationships. She said that finding a great boss is really important for female talent and added: “If you don’t have a great boss, go be your own boss or find a new boss.”

- According to Naas, “finding niche markets is key.” She shared the story of a woman-owned honey business owner in Mexico that UPS works with. Shipping honey is expensive, and the company’s biggest market was in the Middle East, so the owner came to the region and found a distributor. Honey products are very valuable in the region, and her high-quality products exceeded expectations. Naas added that for Saudi Arabia, the Gulf Cooperation Council (GCC) is a phenomenal market opportunity because of the common language, although the GCC does needs to do more to make the customs union function better and improve the flow of goods to tap into the full economic potential.

- Matras shared that the highest growth she sees comes from cross-border businesses that bring more language capabilities and better targeting capabilities. For example, she said, “a conservative fashion brand can target audiences in Germany and the United States” using optimized language and marketing tools.

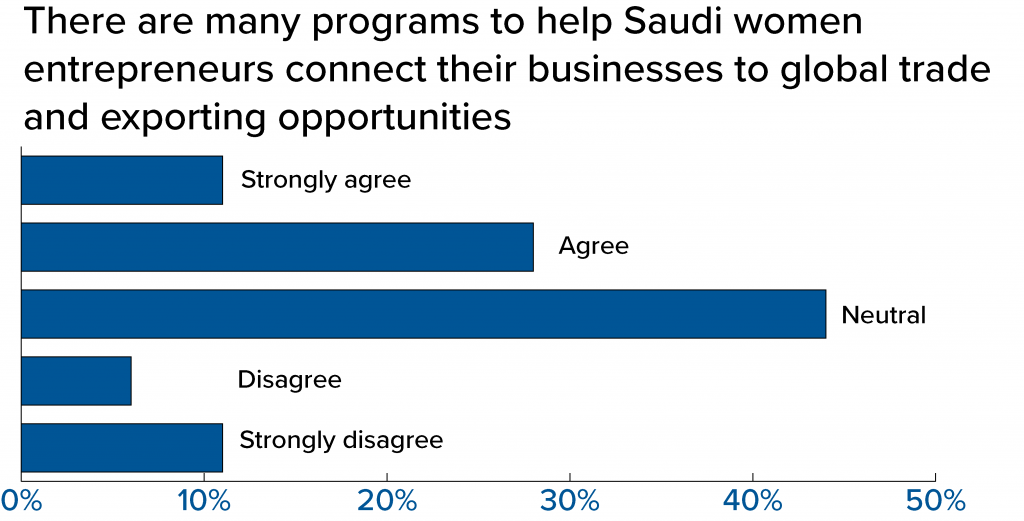

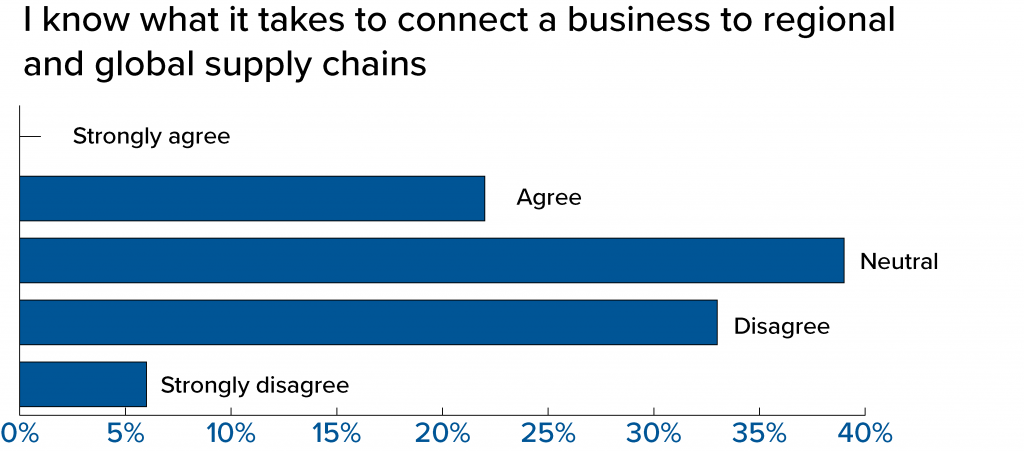

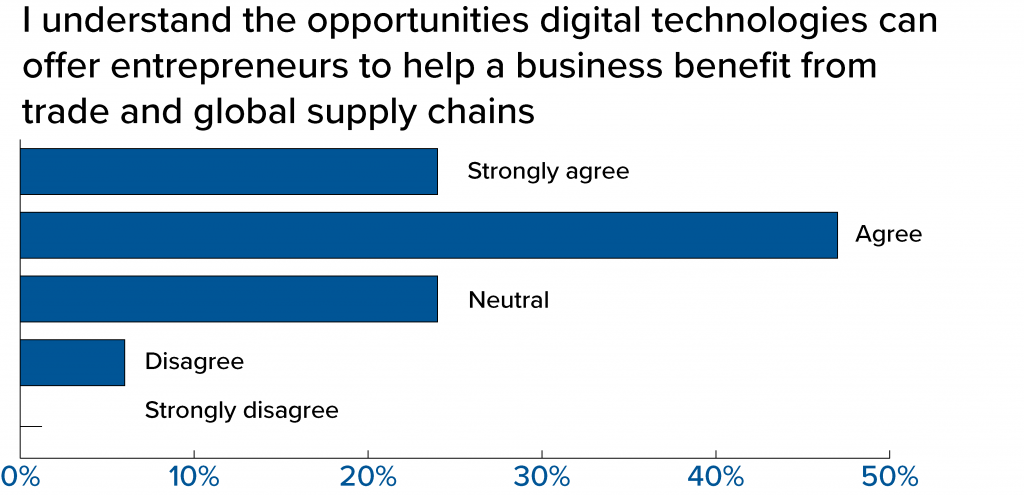

Poll Results

At the workshop, attendees took a poll related to global supply chains and the results indicate that more programs and information about this topic are needed to ensure women can plug into regional and global business opportunities.

Stefanie H. Ali is deputy director of the Atlantic Council’s empowerME Initiative. Follow her @StefHausheer.

empowerME at the Atlantic Council’s Rafik Hariri Center for the Middle East is shaping solutions to empower entrepreneurs, women, and youth and building coalitions of public and private partnerships to drive regional economic integration, prosperity, and job creation.