China is failing to address its economic challenges

China’s National People’s Congress completed its 2024 session this week with nary a word about addressing the country’s most serious economic problems.

The government did announce economic targets for the coming year and expounded upon its lofty pursuit of high-tech industrialization. But the week of meetings offered no real insight into how Chinese leader Xi Jinping intends to deal with a deepening property crisis, trillions of dollars of local government debt, falling prices, soaring youth unemployment, the loss of business and consumer confidence, and a rapidly aging society.

For a government that takes pride in announcing reams of policy blueprints and diktats, the absence of any detail on how it plans to take on these interlocking issues left the inevitable conclusion that Beijing simply doesn’t know how to proceed. In contrast with some past sessions, the nominal legislature failed even to raise polite questions about the road ahead, and journalists were denied a customary post-Congress news conference with the premier.

Beijing’s silence sends a message to China’s citizens that they are on their own in an anemic economy. All they got was a vague promise in Premier Li Qiang’s work report to the Congress to “see that no large-scale return to poverty occurs.”

That will be small consolation for Chinese from all walks of life who have tasted prosperity over the past two decades but now are struggling to make ends meet. As the Bloomberg columnist Shuli Ren wrote after the premier’s speech, “it is now clearer than ever that the Communist Party is walking further away from its own people.”

Without higher levels of consumer spending, Beijing’s efforts to stimulate the economy increasingly will be akin to pushing on a string.

Inevitably, Li’s report contained an optimistic forecast of economic growth “around 5 percent” of gross domestic product (GDP) in 2024, following the government’s claimed 5.2 percent gain last year. (By contrast the Rhodium Group estimates that China’s economy grew only 1.5 percent in 2023, the difference at least partially explained by the frequent fungibility of Chinese government statistics.)

As my Atlantic Council GeoEconomics Center colleague Hung Tran outlined at the beginning of the Congress, the government’s growth forecast is based on a fiscal deficit of about 3.8 percent of GDP. Government spending will be augmented by nearly five trillion yuan of bond issues and most of the proceeds of a one trillion yuan bond issue from late 2023.

Much of that spending is expected to go to infrastructure—which China already has built so much of that new investments are unlikely to have significant economic returns. It is also expected to go toward developing higher value-added industries, such as green technology and semiconductors. However, there was no sign that the government was prepared to channel resources to boost household spending, which is necessary if growth is to revive. Without higher levels of consumer spending, Beijing’s efforts to stimulate the economy increasingly will be akin to pushing on a string.

Similarly, while the premier’s work report called for the government to “foster a new development model for real estate” and to “make concerted efforts to defuse local government debt risks while ensuring stable development,” there was no discussion of devoting serious resources to either challenge. With local government debt totaling more than thirteen trillion dollars and nearly three dozen real estate companies defaulting on bonds and loans, the government’s silence on these issues did little to reassure domestic or foreign investors. Over the weekend, China’s housing minister received attention for saying that insolvent property developers should go bankrupt or be restructured, a statement that did not indicate a significant policy shift.

Moreover, there was no explanation of how the money flowing to state-owned enterprises in the government’s drive for “high-quality development,” led by what Xi calls “growth poles” of new productive forces, will offset the government’s sharp turn in recent years away from private sector innovators who have helped drive the economy. A regulatory crackdown on leading private companies in the e-commerce and online services sectors has sapped the economy of vitality: Total investments by corporate giants such as Alibaba, Tencent, and Baidu plummeted 40 percent in 2023, and employment in the sector has been hit by layoffs, depriving millions of recent college graduates of job opportunities.

Nor was there any discussion of how Beijing intends to fund its touted “silver economy” that would reorient domestic demand toward supporting senior citizens, who are estimated to reach 30 percent of the population by 2035. The only concrete commitment in the work report was an increase in the monthly benefit for the rural and “non-working” urban senior citizens of a paltry twenty yuan ($2.78).

Xi appears focused on pushing an outmoded approach to state-led modernization—a twenty-first-century version of the Maoist drive in the 1950s to build heavy industry. The Chinese leader, speaking to a provincial delegation at the Congress, appeared to go out of his way to declare that “we must not declare a model” and “establish [new industries] first and then break” the old ones. But there can be no doubt that he is intent upon breaking the mold of private sector-led growth.

The problem is that he is placing his expectations on a government that is ill-equipped to take on this task. China is not only saddled with debt and facing the need for belt-tightening. As the premier’s work report acknowledged, the bureaucracy is riddled with inefficiency, waste (especially involving priority government projects), and corruption. This, combined with all the country’s deep-seated economic problems, suggests that the “modern industrial system with advanced manufacturing as the backbone” that Xi seeks is being built on a fractured foundation.

Jeremy Mark is a senior fellow with the Atlantic Council’s GeoEconomics Center. He previously worked for the International Monetary Fund and the Asian Wall Street Journal. Follow him on Twitter: @JedMark888.

Further reading

Thu, Mar 7, 2024

Unpacking China’s 2024 growth target and economic agenda

Econographics By Hung Tran

At the opening of China’s National People’s Congress (NPC) Premier Li Quang delivered his first Government Work Report, setting the key economic and social policies and targets for this year.

Mon, Mar 4, 2024

Global China Newsletter: Two Sessions, zero reasons for economic optimism?

Global China By Dexter Tiff Roberts

The second 2024 edition of the Global China Newsletter.

Mon, Feb 5, 2024

China Pathfinder update: Lack of policy solutions in second half of 2023 belies official data

Issue Brief By

Through the second half of 2023, the gap between China’s impressive official data and visibly underwhelming consumer demand, unresolved local government debt problems and an unprecedented drop in foreign direct investment was stark.

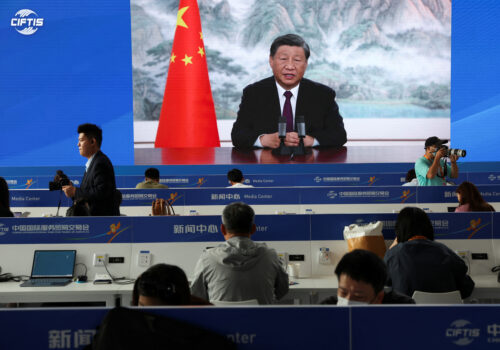

Image: Chinese President Xi Jinping and other leaders sing the national anthem at the closing session of the National People's Congress (NPC) at the Great Hall of the People in Beijing, China March 11, 2024. REUTERS/Tingshu Wang