Well, euphoria in Germany is certainly on the rebound, with a sudden surge in the ZEW investor confidence index and newspaper articles all over the place predicting the imminent renaissance of European economic growth, despite the fact that in 3 of the 5 big European economies – the UK, Italy and Spain – there is little in the way of evidence to back this view up.

The French economy is certainly holding up reasonably well, but the situation in Germany still remains deeply problematic due to the complete dependence of the economy on exports. Despite this we have a shower of articles (Below I present an extract from Frank Atkins writing in the Financial Times) explaining how “Europe’s Economic Recovery is Gaining Steam” and the “German economic recovery powers ahead”. I have already written up a an extensive summary of the actual state of play in the German economy, which is largely supported by a strong government stimulus programme, and a recovery in industrial output for export to levels which are more in line with the actual current level of demand than were the extremely low levels seen at the turn of the year (which were the product of demand being met from inventory run downs).

German economic recovery powers ahead

By Ralph Atkins in FrankfurtGermany’s economic recovery has leapt into a higher gear, according to a closely watched survey that showed private sector activity expanding this month at the fastest rate for 15 months and lifting the overall eurozone economy’s performance

The purchasing managers’ index for Europe’s largest economy jumped to 54.2 in August, from 49.0 in July, signalling an unexpectedly brisk pace of expansion. The growth was driven by the service sector, where employment actually rose, but manufacturing also showed a further rebound.

The figures were the latest economic data from continental Europe to surprise on the upside and suggested the region had overtaken the US and UK in the pace of its recovery. France’s economy is also now expanding clearly, according to a separate purchasing managers’ index for the eurozone’s second largest economy.

The euro gained 0.5 per cent on the dollar to $1.43 and 0.2 per cent on the pound to £0.86

Germany’s rebound appears to have been powered by the country’s pioneering “cash-for-clunkers” incentives for new cars purchases and a pick-up in global demand for its exports. Earlier this week, the Bundesbank reported that consumer spending was likely to have risen further in the second quarter and described German shoppers as “remarkable in continuing to defy the negative effects of the global economic and financial crisis”.

The Bundesbank argued that a “further marked pick-up in overall economic output is possible in the third quarter”.

However, Axel Weber, Bundesbank president, has sought to rein in expectations, warning in a German newspaper interview this week that “the economy is not yet standing on its own feet, and the financial markets are still reliant on central bank help”. Other European Central Bank policymakers have also warned that a self-sustaining recovery may take longer to emerge – which also suggested the ECB will be in no rush to reverse the exceptional steps it took to combat the eurozone’s recession.

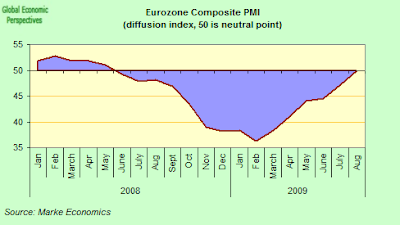

Evidently Frank Atkins is right up to a point (and his position may indeed even seem more extreme than it is due to poor headline writing). It is certainly the case Europe’s economies continued to show signs of improvement in August – following a better than anticipated perforemance in Q2 – with the Markit Flash Eurozone Composite Output Index rising to 50 from 47 in July, thus ending a fourteen-month sequence below the no-change mark of 50. The Flash Purchasing Managers Index for the manufacturing sector stood at a 14-month high of 47.9 in August compared to 46.3 in July, while the services PMI rose to a 15-month high of 49.5 versus 45.7 in July. Markit only publishes flash readings for two eurozone economies, France and Germany. PMI readings give us the best up to the moment snapshot of where activity is at at any given point.

The Markit Flash Germany Composite Output Index stood at 54.2 in August, which was the highest reading for fifteen months, following an index reading of 49 for July. The German Flash services PMI rose to 54.1 in August from 48.1 last month. A very strong rebound for a single month, but do watch out, since elections are coming, and beyond that tricky little data point there is no evident explanation for this impressive rebound. It is suspicious for its strength, in what is an otherwise tepid environment.

Whilet he Flash Manufacturing PMI moved up to 49 from 45.7. A solid improvement, but we are still just short of expansion.

So obviously we should also take into account the latest PMI readings for the Eurozone, which were certainly positive, but hardly sufficient to start uncorking the champagne bottles. Basically, I would note two more things about the recent German performance.

i) We are in the direct run up to an election. This phenomenon has well known side effects for public spending etc. Certainly every project which can be will be being brought forward at this point. We need to wait and see what things look like in October before drawing too many conclusions.

Indeed, on this point, note what the Federal Statistics Office said in their latest press release on German public debt:

“As reported by the Federal Statistical Office (Destatis), the core budgets of the Federation and the Länder – as defined in public finance statistics – recorded a considerable financial deficit in cash terms in the first half of 2009. For the Länder, the financial deficit totalled EUR 15.4 billion, while in the first half of 2008 a financial surplus of EUR 3.1 billion was recorded. In the core budget of the Federation, the financial deficit rose to EUR 14.7 billion compared to EUR 13.1 billion in the first half of 2008. It should be noted, however, that the financial burdens of the Federation caused by the financial and economic crisis become obvious mainly in its extra budgets “Financial Market Stabilisation Fund” and “Investment and Redemption Fund”. Relevant statistical data will not be available until the end of September.”

Please note that last little line – “Relevant statistical data will not be available until the end of September.” – ie after the elections which will be held on 27 September.

ii) Bundesbank president Axel Weber may be over optimistic when it comes to the deflation threat, but he is far from being full of “irrational exhuberance” about the present timid bout of growth. This kind of view, however, is seldom reflected in those attention grabbing headlines. It would be a pity if all this new found German growth, like those famous wave of babies who were supposed to have been being born in Dussledorf last year, should turn out just to be a blip, undetectable when the annual figures are counted up.

Indeed the present situation (even down to the headlines) is very reminiscent of the reaction after the first quarter of 2008, when that famous decoupling thesis was first launched in all its splendour, which is why I am reproducing extracts from an article by Karl Zawadzky written at the time. He said then “the indicators suggest that the German government is on the safe side with its growth prediction of 1.7 percent. Some economic experts are already speaking of 2 percent or more.” In fact German GDP started shrinking almost immediately after the words were written and 2008 whole year growth came in at only 1.3% according to the Federal Statistics Office (and more like 1% on a calendar adjusted basis, allowing for the extra day in February) as I was already more or less forecasting in July 2008 (just for those of you who think economists never get anything right).

My feeling is that by the time we get to the end of the third quarter of 2009 we will all be back to reality, including those among us who write newspaper headlines.

Opinion: German Economy Powers Ahead

by Karl Zawadzky: business editor Deutsche Welt RadioThe German economy surged in the first quarter of this year, defying a global slowdown. DW’s Karl Zawadzky remains optimistic about Germany’s ability of maintaining its current financial boom.

Experts are predicting that economic growth will slip this year. They cite the financial crisis, high oil and gas prices and the expensive euro.

But the German economy is currently quite robust — perhaps even more robust than many experts think. The surprisingly strong jump in economic activity during the first quarter is evidence of this. While gross domestic product increased by only 0.3 percent in October, November and December, it rose by 1.5 percent in the first three months of 2008.

Domestic markets get attention

For years, business activity has been fuelled by ever increasing export records. But now, focus has shifted to domestic markets. There were few impulses from abroad that spurred the German economy during the first quarter. The rising prices of key imports crude oil and gas, but also the expensive euro, which put the breaks on German exports, played a decisive role.

Little reason for pessimism

But the German economy is still on track for growth. Even in the first quarter, personal consumption rose after many weak years. Employment was up 1.8 percent compared to spring 2007 and the rise in wages in some sectors promises the biggest increase in buying power in years. That will boost consumption. The German economy is powering ahead, propelled by its own strength.

The indicators suggest that the German government is on the safe side with its growth prediction of 1.7 percent. Some economic experts are already speaking of 2 percent or more.

Compared to other countries in the EU, Germany is proving to be the bloc’s economic engine and is powering through the current financial crisis quite well. While the German economy grew by 1.5 percent in the first quarter, the EU reported an average growth rate of only 0.7 percent.

Certainly German analyst and investor sentiment rose sharply in August to its highest level in over three years. The ZEW economic think tank’s closely-watched monthly survey, said rising industrial orders and a pick-up in exports had brightened the outlook for Germany. The Mannheim-based institute’s economic expectations index for Germany rose to 56.1 in August from 39.5 in July, taking the indicator to its highest level since April 2006.

But we should never forget that while German exports swang back to solid growth in June, surging by 7 per cent in June, optimism was also boosted by a 4.5 per cent rise in industrial orders in June – powered almost entirely by export orders – they are still significantly down on the level they attained one year ago.

While industrial production output numbers for June, tempered hopes for a further rebound, since they fell back 0.1 per cent compared with the May’s figures which showed a 4.3 per cent rise over April.

And in terms of domestic consumption it really is difficult to see any powering ahead in German retail sales, since while the rate of decline may have eased somewhat in July as only a marginal drop was shown in month-on-month sales (the index rose from 46.0 in June to 49.8) the index has now been registering contraction since sales began falling in June of last year. And I doubt things are going to get much better on this front anytime soon.

Oh, and one last little detail. Germany’s economy is not – as Frank Atkins again had it in last Friday’s FT – offering a ray of hope for the global economy, since Germany is running a current account and trade surplus, which is to say that, on aggregate it is actually draining demand from the rest of the world, rather like those famous energy inefficient solar panels, it uses up more energy producing itself than it actually supplies.

Edward Hugh is a Barcelona-based s a macro economist, who specializes in growth and productivity theory, demographic processes and their impact on macro performance, and the underlying dynamics of migration flows. This essay was previously published at A Fistful of Euros.