The Trump trade wars are coming back. Here’s what to expect this time.

For any policymakers or economists who doubt US President-elect Donald Trump will follow through on his campaign promise to impose across-the-board tariffs on foreign imports, let me offer a word of caution. During the US-China trade wars in 2018, I was an advisor at the International Monetary Fund (IMF). In the fall of the following year, an IMF team put together a model showing that the ripple effects from just that relatively small dispute could cost the global economy upward of $700 billion, or roughly the size of Switzerland’s gross domestic product (GDP) at the time. The private reaction from some senior Trump officials was “That’s it?”

Trump means what he says when it comes to tariffs. So his return to the White House signals that the United States is likely headed toward another trade conflict, and this time it won’t be limited to US trade with China. Yet waging this war is going to be harder and more costly than many around the president currently expect.

It’s important to start with the understanding that Trump believes that tariffs are one of the most powerful economic tools available—and one that doesn’t reverberate back on US consumers. To put it in his own words during the campaign, “tariffs are the greatest thing ever invented.”

Trump’s belief in tariffs is deeply rooted, tracing back to the 1980s and the economic competition between the United States and Japan. It may be the longest, most consistent policy view he has held on any issue.

Trump’s focus on tariffs is not simply a negotiation tactic, as some on Wall Street are hoping. The incoming president is resolved to fill out his administration with those who will fully support his vision on trade. Former US Trade Representative Robert Lighthizer, who will likely have an expanded portfolio, sees the world less in terms of allies and adversaries and more in terms of countries that run trade surpluses and those that run trade deficits with the United States. The executive authority on tariffs is expansive, and the courts are likely to uphold even some of Trump’s more sweeping actions, just as they did back in the first term.

As much as Trump believes in tariffs, he also is highly sensitive to market signals.

But here’s what’s different this time around. The global economic landscape has shifted dramatically in the past eight years. Germany’s GDP growth was 2.7 percent in 2017. Today the country is teetering on the brink of a recession and mired in political dysfunction. China was growing at 7 percent in 2017. But its GDP growth will be somewhere south of 5 percent this year and, as the Atlantic Council’s GeoEconomics Center and Rhodium Group estimate in our China Pathfinder project, it’s likely to stay even lower in the years to come. One might think, then, as the Wall Street Journal argued this week, this gives Trump more leverage over both allies and adversaries in negotiations. But it’s not quite so straightforward.

First off, both US allies and adversaries have had time to adapt to Trump’s methods. They now understand how he operates, how trade threats may or may not turn into trade action, and what levers they can pull in return to avert the worst outcomes. Watch carefully in the coming months how Europe tries to work with the United States on electric vehicles from China, for example, in a way that triangulates mutual interests. Also keep a close eye on India, a country that Trump recently labeled a “very big abuser” of trade. Indian Prime Minister Narendra Modi is hoping that his personal relationship with Trump helps his country avoid the early wave of action.

But the second and more important factor is inflation. When Trump was first in office, the main question for policymakers was how the United States could consistently achieve 2 percent inflation after years of below-target readings coming out of the global financial crisis. Today, higher-than-wanted inflation is front and center in US and global politics; in fact, it was one of the reasons Trump was elected. If tariffs cause higher prices, it will give the Federal Reserve cover to scale back on its rate cuts. That will then place Trump’s desire for low rates in direct conflict with the mandate of the Federal Reserve chair, Jerome Powell—the last thing the markets want to see. As much as Trump believes in tariffs, he also is highly sensitive to market signals. Just look back to 2018 and how the markets negatively reacted to his criticism of Powell at the time, which forced him to back off.

So, what then will the opening salvo in the new trade war look like? A probing exercise instead of a full-scale assault. It likely will start on January 20 with an attempt by Trump to revive the phase one trade deal he negotiated with China at the end of his first term. The agreement by China to purchase a range of US agricultural goods was never fulfilled, in part, as Beijing would argue, because of the COVID-19 pandemic. Few believe the deal has any hope of seeing the light of day again, but it serves as a useful starting point before the new tariffs come into place. Don’t expect 60 percent tariffs on China across the board but do expect real and tangible new tariffs that will impact the global economy sooner than many may think.

The most important takeaway about the second Trump trade wars is that they will follow the formula of all sequels—more action, more locations, and higher stakes. But the results are far from guaranteed.

Josh Lipsky is the senior director of the Atlantic Council’s GeoEconomics Center and a former adviser to the International Monetary Fund.

Further reading

Mon, Oct 21, 2024

China’s economic stimulus isn’t enough to overcome that sinking feeling

New Atlanticist By Jeremy Mark

Local governments are struggling under large amounts of debt, the property sector is heavily burdened, and Chinese leadership is preoccupied with just keeping the economy afloat.

Wed, Nov 6, 2024

Donald Trump just won the presidency. Our experts answer the big questions about what that means for America’s role in the world.

New Atlanticist By

When Trump returns to the presidency on January 20 next year, a number of global challenges will be awaiting him. Our experts outline what to expect.

Wed, Oct 2, 2024

China’s sputtering engine of growth leads its imports to downshift

Sinographs By Jeremy Mark

China's slowing economic growth, declining imports, and rising emphasis on import substitution are reverberating globally, impacting trade partners and reshaping geopolitical and economic dynamics.

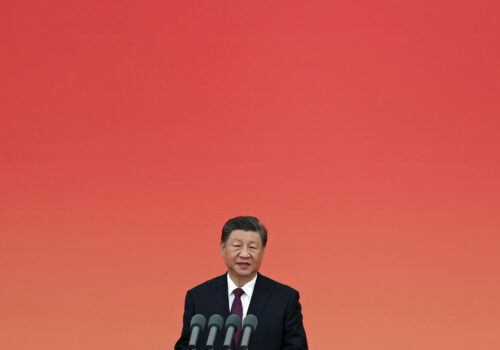

Image: US President Donald Trump attends a bilateral meeting with China's President Xi Jinping during the G20 leaders summit in Osaka, Japan, June 29, 2019. REUTERS/Kevin Lamarque