Election 2020: What’s at stake for energy policy?

Introduction

The 2020 US presidential election will have a profound impact on global energy markets and broad implications for US trade, foreign, energy, and climate policies. Today, the Republican and Democratic parties are farther apart on these issues than at any other moment in recent history. The Republican Party, led by US President Donald J. Trump, will continue to prioritize his “energy dominance” agenda.1Tom DiChristopher, “Trump wants America to be ‘energy dominant.’ Here’s what that means,” CNBC, July 1, 2017, https://www.cnbc.com/2017/06/28/trump-america-energy-dominant-policy.html This agenda favors expanded production and access to all fuels, with a focus on abundant US fossil fuel resources and a sharply circumscribed role for emissions reductions and climate policy. Early proposals from the Democratic presidential candidates suggest an alternative vision where formulating a national climate policy—with an emphasis on largescale emissions reduction—would foster rapid decarbonization through a massive investment in clean energy infrastructure and the deployment of zero- and low-carbon fuels throughout the US economy.

On foreign and trade policies, a second Trump Administration will maintain its nationalistic and isolationist tone, which prioritizes transactional relationships over conventional alliances and shared values. Reshoring of manufacturing and jobs will be at the heart of trade agreements. Although a Democratic administration may share the sense of skepticism toward globalized and multilateral trade, the party’s leading presidential candidates firmly support the traditional US alliance system, place greater emphasis on human rights and democracy, and would enshrine leadership on climate change as a cornerstone of foreign relations and, especially, future trade agreements.

The competing visions of a Republican and a Democratic administration could hardly be more disparate. This issue brief compares the salient energy policies under two scenarios. The first is a reelected Trump Administration. The second anticipates a Democratic administration. Each scenario is collated under domestic energy, climate change, foreign, and trade policies. The authors conclude that industry and external stakeholders should prepare for a volatile outlook regardless of the outcome on November 3, 2020. The deep and entrenched energy challenges that face the United States and the mounting pressure from climate change cannot be fully managed or surmounted by a single US presidential administration, however dynamic. Much depends on the 2020 electoral cycle, but policy uncertainty will persist regardless of the outcome of the election.

Scenario one: Donald J. Trump is reelected

The Trump Administration’s energy agenda in its first term provides a guidepost for its probable approach in a second term. On the domestic front, this includes completing the deregulation agenda, expanding domestic production and export dominance, further curtailing the consideration of climate concerns in permitting of infrastructure, and restricting the right of US states to exceed federal minimum environmental standards. On the international stage, a second term for Trump will likely mean a constrained role for US leadership abroad and pursuit of bilateral trade agreements that protect domestic industries.

Completing the deregulatory agenda

The Trump Administration has pursued, with varying degrees of success, a robust slate of deregulatory policies throughout the US energy sector. Since the administration’s earliest days, US officials have prioritized the growth of US fossil fuel production and exports through a stated policy of “energy dominance.”2President Donald J. Trump Is Unleashing American Energy Dominance,” White House, May 14, 2019, https://www.whitehouse.gov/ briefings-statements/president-donald-j-trump-unleashing-american-energy-dominance/. Trump himself has proclaimed that under his leadership “the golden era of American energy is now underway.”3Ibid.

The administration has pursued a thorough rollback aimed at rewriting—and in some cases rescinding—a range of environmental and land use policies at the federal level. At the US Department of the Interior (DOI), the administration has curtailed protections in the Endangered Species Act, attempted to open nearly all of the Outer Continental Shelf to offshore oil and gas leasing, and replaced the Obama-era Methane Waste Prevention Rule.4“Trump Administration Improves the Implementing Regulations of the Endangered Species Act,” US Department of the Interior, August 12, 2019, https://www.doi.gov/pressreleases/endangered-species-act; “Secretary Zinke Announces Plan For Unleashing America’s Offshore Oil and Gas Potential,” US Department of the Interior, January 4, 2018, https://www.doi.gov/pressreleases/secretary-zinke-announces-plan-unleashing-americas-offshore-oil-and-gas-potential; and Timothy Gardner, “Trump administration eases ruleon methane leaks on public land,” Reuters, September 18, 2018, https://www.reuters.com/article/us-usa-interior-methane/trump-administration-eases-rule-on-methane-leaks-on-public-land-idUSKCN1LY2N7. At the Environmental Protection Agency (EPA), the administration has developed the Affordable Clean Energy (ACE) rule to replace the Clean Power Plan, finalized a new Waters of the United States (WOTUS) rule to limit federal authority to block infrastructure under the Clean Water Act, relaxed emissions standards for new coal-fired power plants under the New Source Performance Standards, and eased technical requirements and timelines for methane leak repair.“5EPA Finalizes Affordable Clean Energy Rule, Ensuring Reliable, Diversified Energy Resources while Protecting our Environment,”

US Environmental Protection Agency, June 19, 2019, https://www.epa.gov/newsreleases/epa-finalizes-affordable-clean-energy-rule-ensuring-reliable-diversified-energy; “EPA and Army Propose New ‘Waters of the United States’ Definition,” US Environmental Protection Agency, December 12, 2018, https://www.epa.gov/newsreleases/epa-and-army-propose-new-waters-united-states-definition; “EPA Proposes 111(b) Revisions to Advance Clean Energy Technology,” US Environmental Protection Agency, December 6, 2018, https://www.epa.gov/newsreleases/epa-proposes-111b-revisions-advance-clean-energy-technology; and Ellen Knickmeyer and Cathy Bussewitz, “EPA moves to revoke rules on oil industry methane leaks,” Associated Press, August 29, 2019, https://www.apnews.com/e2872a46eb3e43bd928707bba2f2c031. At the Department of Transportation, the administration has proposed the Safer Affordable Fuel-Efficient (SAFE) Vehicles Rule, which would amend existing Corporate Average Fuel Economy (CAFE) by retaining the model year 2020 standards for both programs through model year 2026. The EPA, meanwhile, has tried to revoke California’s waiver of preemption under Section 209 of the Clean Air Act to set tougher vehicle fuel efficiency standards.6National Highway Traffic Safety Administration, “Corporate Average Fuel Economy,” US Department of Transportation, accessed October 3, 2019, https://www.nhtsa.gov/laws-regulations/corporate-average-fuel-economy. Perhaps most importantly, the administration is using executive authority to assert federal supremacy over energy infrastructure in unprecedented ways. It is developing new Council on Environmental Quality (CEQ) guidance on the implementation of the National Environmental Policy Act and limiting states’ authority to stall or deny infrastructure under the Clean Water Act, an area particularly rife with tension between the federal government and progressive state governments that are skeptical of new fossil fuel infrastructure.7“Executive Order on Promoting Energy Infrastructure and Economic Growth,” White House, April 10, 2019, https://www.whitehouse.gov/presidential-actions/executive-order-promoting-energy-infrastructure-economic-growth/.

Against this backdrop, Republican control of the US Senate has proven instrumental, most notably in the confirmation of key political appointees at the federal agencies who share the president’s vision and have worked to implement it. In a Trump reelection scenario, it is likely that the Senate will remain in Republican hands even if full control of Congress proves elusive for the party. Accordingly, our discussion below assumes a compliant Republican-controlled Senate in a reelection scenario.

“Energy dominance” encore?

The Trump Administration has prioritized expanded domestic fossil fuel production, midstream infrastructure buildout, and downstream export infrastructure (e.g., new approvals for liquefied natural gas, or LNG, export terminals) as the core of “energy dominance.” Critically, however, many of the administration’s hallmark efforts—ACE, future Corporate Average Fuel Economy (CAFE) standards, and EPA and DOI methane regulation—are just now seeing final or even draft rules announced in the Federal Register. Democratic state governments are vowing to fight these federal efforts in court.8Pamela King, “Blue states urge court to take down Trump carbon rule,” E&E News, August 13, 2019, https://www.eenews.net/ stories/1060940949. More broadly, federal rulemaking is deliberately slow, leaving ample time for litigation, and may ultimately end up in the US Supreme Court, which now has a conservative majority. Other efforts couched in executive authorities (e.g., One Federal Decision9One Federal Decision (OFD) refers to concentrating authority over the issuance of a permit to a singular, not multiple, agency in order to simplify and expedite review. As described in Executive Order 13807, “each major infrastructure project shall have a lead Federal agency, which shall be responsible for navigating the project through the Federal environmental review and authorization process … All Federal cooperating and participating agencies shall identify points of contact for each project, cooperate with the lead Federal agency point of contact, and respond to all reasonable requests for information from the lead Federal agency in a timely manner.” protocol for permitting and time limits on environmental reviews) do not carry the weight or impact of legislation and regulation. These could be undone with a mere signature by a Democratic administration. Despite the rollback of policies, very little in the domestic energy space is settled as the campaign season swings into high gear.

The key question for energy producers in 2020 is: will the Trump Administration’s deregulatory, pro-fossil fuel agenda be entrenched or reversed? In a reelection scenario, entrenchment will prevail, but not without consequences.

The administration will continue pursuing lower cost and regulatory barriers for permitting all types of fossil fuel projects. The Trump Administration’s April 2019 executive orders on infrastructure and permitting are meant to exert federal control over permitting.10“Executive Order on Promoting Energy Infrastructure and Economic Growth,” White House, April 10, 2019, https://www.whitehouse.gov/presidential-actions/executive-order-promoting-energy-infrastructure-economic-growth/; “Order on the Issuance of Permits with Respect to Facilities and Land Transportation Crossings at the International Boundaries of the United States”, the While House, April 10, 2019, https://www.whitehouse.gov/presidential-actions/order-issuance-permits-respect-facilities-land-transportation-crossings-international-boundaries-united-states/. The administration will defend the draft EPA rules published on August 9, 2019, limiting state and tribal authorities under Section 401 of the Clean Water Act.11“Administrator Wheeler Issues Proposed Rule on Clean Water Act Quality Certification In Charleston, South Carolina,” US Environmental Protection Agency, August 9, 2019, https://www.epa.gov/newsreleases/administrator-wheeler-issues-proposed-rule-clean-water-act- quality-certification. If the administration is successful, states and interested stakeholders may be increasingly handicapped when it comes to opposing or even delaying new infrastructure buildouts by requesting stays or seeking to overturn existing permits by challenging the administration’s implementation of federal environmental laws. These issues are unlikely to be decided in the courts by November 2020, but likely will be by 2024. Lower courts have already rejected several of the “fast-track” regulatory decisions because they contravene federal legislation. Of the marquee cases at the center of the regulatory battles, as of October 4, 2019, the US Supreme Court has agreed to hear the case concerning Atlantic Coast Pipeline’s (ACP) previously revoked Forest Service permit during the court’s current term.12Greg Stohr, “Dominion’s Atlantic Coast Gas Pipeline Gets High Court Hearing,” Bloomberg Business, October 4, 2019, https://www.bloomberg.com/news/articles/2019-10-04/dominion-s-atlantic-coast-pipeline-gets-supreme-court-hearing. In the meantime, the lower courts are divided (even the eventual Supreme Court ruling will not fully decide ACP’s fate) and numerous pertinent issues remain unresolved among various levels of regulators. A doubling down on federal supremacy over permitting will, if successful, improve the outlook for fossil fuel operators and builders invested in these massive projects, and raise the prospects for oil and gas production, takeaway capacity, and exports.

At the Federal Energy Regulatory Commission (FERC), Trump’s reelection would ensure a Republican majority on the key five-member commission entrusted with reviewing and approving infrastructure for interstate transmission of electricity, natural gas, and oil. With the departure of Commissioner Cheryl LaFleur at the end of August 2019, two of five seats at the commission are vacant. FERC will, as a result, likely move more slowly through ongoing applications and project decisions.13Rod Kuckro and Jeremy Dillon, “LaFleur’s exit will leave 3 commissioners — and anxiety,” E&E News, July 18, 2019, https://www.eenews.net/stories/1060753713. A reelected Trump Administration will bring FERC to full strength with a Republican majority, facilitating expeditious approval timelines for applicants and a likely favorable view of fossil fuel midstream infrastructure (e.g., oil, gas, and product pipelines) and export projects (e.g., LNG terminals). Although recent legal setbacks may require FERC to conduct more thorough reviews of downstream greenhouse gas (GHG) emissions for fossil fuel infrastructure applications, a Republican majority at FERC under a Trump Administration would neither require operators to calculate the upstream or downstream impact of their projects nor offset emissions so long as the permits themselves can withstand legal scrutiny.14Specifically, in March 2019, the DC District Court ruled against the Bureau of Land Management (BLM) at the Department of the

Interior (ruling available at https://www.courtlistener.com/opinion/4601289/wildearth-guardians-v-jewell) in favor of plaintiffs who alleged that BLM failed to “sufficiently conside[r] climate change when authorizing oil and gas leasing on federal land in Wyoming, Utah, and Colorado.” The court held that BLM had to use some type of quantifiable methodology to estimate both the cumulative and downstream impacts of the leases it approved. Importantly, the court rejected the argument that the emissions were too speculative

to calculate. Like the 2017 Sabal Trail case that found FERC was obliged to estimate downstream impacts of a pipeline, the court affirmed the National Environmental Policy Act (NEPA) statutory requirement that “an agency consider the direct, indirect, and cumulative impacts” of a proposed project requires credible, scientific analysis of downstream and cumulative emissions. The ruling held that analysis of the full emissions cycle is not overly speculative and, consequently, federal agencies (FERC included) must prepare environmental analyses which reach this standard or risk having issued leases and permits overturned.

On land use, a reelection would empower the administration to continue opening public lands and possibly offshore acreage for oil and gas leasing despite significant opposition from local and tribal organizations. One analysis earlier in 2019 estimated that the DOI has offered nearly 16.8 million acres of federal land for oil and gas leasing since Trump took office, with a centerpiece effort to open as much as 1.6 million acres in the Arctic National Wildlife Refuge (ANWR) in Alaska.15Darryl Fears and Juliet Eilperin, “The Trump administration is opening millions of new acres to drilling — and that’s just the start,”Washington Post, March 15, 2019, https://www.washingtonpost.com/climate-environment/2019/03/16/trump-administration-opens- millions-new-acres-drilling-thats-just-start/. A reelected administration will double down on these efforts. Recent efforts to revise to the national Endangered Species Act and alter specific species protections (e.g., for the greater sage-grouse) in major oil and gas producing states are designed to ease new private upstream development, although some of these efforts are already facing litigation.16Lisa Friedman, “Court Blocks Trump’s Plan to Ease Bird Protections on Oil Lands,” New York Times, October 16, 2019, https://www.nytimes.com/2019/10/16/climate/trump-sage-grouse.html. Plans to restrict or rewrite protections for ecologically sensitive or cultural sites (e.g., the new Bears Ears oil and gas leasing program) have similar goals. These outcomes may not be confined to on-shore. The DOI’s efforts to rewrite the five-year offshore leasing plan ended ignominiously earlier in 2019 as a result of fervent state opposition spearheaded by bipartisan governors from coast to coast.17Valerie Volcovici, “Trump administration sidelines U.S. offshore drilling plan after court ruling,” Reuters, April 25, 2019, https://www.reuters.com/article/us-usa-energy-offshore/trump-administration-sidelines-us-offshore-drilling-plan-after-court-ruling-idUSKCN1S127Y. An administration guaranteed four more (final) years could resurrect the five-year plan and open huge swaths of the US coastline to new oil and gas drilling without fear of political repercussion. A successful effort to revamp and finalize the extant five-year plan would make a successor administration’s job of curtailing it more arduous and time-consuming.

Curtailed climate policy in the second term

The United States is due to withdraw formally from the Paris Agreement on the morning after the election—November 4, 2020. Since Trump announced his decision in June 2017 to withdraw the United States unilaterally from the climate pact, US delegations have had limited, participatory engagement with the subsequent Conferences of the Parties (COPs) and the president has undertaken a secondary campaign to expunge climate science in total from official White House committees and documents.18Scott Waldman, “Officials removed climate references from press releases,” E&E News, July 8, 2019, https://www.eenews.net/ climatewire/2019/07/08/stories/1060709857. If reelected, Trump will not pause the US withdrawal from the Paris Agreement and the administration will fall back on its skeptical, isolationist position vis-à-vis global climate policy. Lacking firm US leadership, the parties to the Paris Agreement may be increasingly hard-pressed to implement its terms and maintain global cohesion on the need to reduce emissions quickly. In the United States, the Trump Administration will prioritize a hands-off approach to the regulation of all types of GHG emissions, especially carbon dioxide and methane. A second Trump Administration would defend the “inside-the-line” approach of the finalized ACE rule published on June 19, 2019, which relies on limited, internal efficiency improvements at existing power plants to achieve modest emissions reductions.19The original Clean Power Plan, developed by the Obama administration in 2015, also allowed for emissions offsets through efficiency measures, but unlike ACE, the CPP set historic limits on overall emissions at US power plants. These could be achieved through state- specific, flexible standards, but would have been federally enforceable after 2022. EPA estimates projected that CPP, had it gone into effect, would have reduced the electric sector’s carbon pollution by 32 percent nationally (relative to 2005 levels). The new ACE rule will contribute to an approximately 0.7 percent reduction in emissions at power plants. Jean Chemnick and Niina H. Farah, “How the Numbers on the EPA’s New Climate Rule Stack Up,” E&E News via Scientific American, June 21, 2019, https://www.scientificamerican.com/article/how-the-numbers-on-the-epas-new-climate-rule-stack-up/; and Natural Resources Defense Council, “What Is the Clean Power Plan?,” September 29, 2017, https://www.nrdc.org/stories/how-clean-power-plan-works-and-why-it-matters. Methane emissions will likely rise (with one estimate projecting 480,000 tons of additional methane emissions by 2025) on the back of growing production and limited takeaway capacity if revised EPA regulations are fully implemented.20Environmental Defense Fund, “Trump’s EPA aims to gut rules that protect you from methane pollution,” accessed September 9, 2019, https://www.edf.org/climate/trumps-epa-aims-gut-rules-protect-you-methane-pollution.

All of this may suggest a rosy outlook for producers and operators, and continued bearish signals for oil and gas markets from more US supply, but there are some important caveats.21In light of anticipated ample US supplies on the global oil markets, for example, as well as ongoing international trade tensions and a weak economic growth outlook, analysts are projecting bearish markets in the near term although price volatility remains. See: Energy Information Agency, “Short-Term Energy Outlook: Crude Oil,” September 10, 2019, https://www.eia.gov/outlooks/steo/marketreview/crude.php; and Avantika Ramesh, “Crude oil futures higher on bargain hunting, outlook remains bearish,” S&P Global Platts, October 1, 2019, https://www.spglobal.com/platts/en/market-insights/latest-news/oil/100119-crude-oil-futures-higher-on-bargain-hunting-outlook-remains-bearish. Most importantly, progressive state governments will not easily bend to a reelected Trump. They will most likely redouble their efforts to curtail fossil fuel infrastructure and enforce robust climate policies and emissions reductions in lieu of federal leadership. The president can only push federal supremacy so far—states and municipalities retain important rights to regulate land use and water quality. Operators may find opposition as strident as ever with denial of local permits occurring more quickly and frequently. Grassroots activism in opposition to infrastructure is rising, especially as young consumers learn to use their power to influence corporate behavior (e.g., the rising tide against single-use plastic).22Matthew Zeitlin, “Do plastic bag taxes or bans curb waste? 400 cities and states tried it out.,” Vox, August 27, 2019, https://www.vox.com/the-highlight/2019/8/20/20806651/plastic-bag-ban-straw-ban-tax. Polling data is clear that young Americans across the political spectrum are deeply troubled by climate change and may be ready to use their dollars accordingly.23Cary Funk and Brian Kennedy, “How Americans see climate change in 5 charts,” Pew Research Center, April 19, 2019, https://www.pewresearch.org/fact-tank/2019/04/19/how-americans-see-climate-change-in-5-charts/. Populist-driven consumer or product boycotts targeted at industry and partner companies, as well as pressure on the major investment firms to divest from fossil fuels, could accelerate under a second Trump term.

Finally, industry should not discount the risk of international backlash. As overseas buyers, particularly in Europe, look for additional ways to decarbonize, trial efforts at international border adjustments for carbon may quickly follow. Unregulated methane flaring, for example, could be an impetus (justifiable or not) for new penalties on US LNG even as the market remains hotly competitive for suppliers. Investment and climate disclosure (or lack thereof) is another area where pressure on US multinational companies will mount, especially as European multinational companies press forward with mandated disclosures. The Trump Administration has already tried, via the Securities and Exchange Commission (SEC), to block climate-focused corporate shareholder resolutions. It is not clear, however, for how long the administration can insulate US companies from this particular rising tide.24Marco Poggio, “Trump Order Takes Aim at Shareholders Pushing Companies to Address Climate Risks,” Climate Liability News, April 17, 2019, https://www.climateliabilitynews.org/2019/04/17/shareholder-climate-resolutions-trump/.

Fundamentally, the Trump Administration’s top priorities are the reshoring of US jobs and manufacturing, and the delinking of global supply chains. This stands in stark contrast to conventional US policy favoring multilateral trade and more robust market interconnections.25See, for example, the July 15, 2019, Executive Order on Maximizing Use of American-Made Goods, Products, and Materials (available at https://www.whitehouse.gov/presidential-actions/executive-order-maximizing-use-american-made-goods-products-materials/) as well as the January 31, 2019, Executive Order on Strengthening Buy-American Preferences for Infrastructure Projects (available at https://www.whitehouse.gov/presidential-actions/executive-order-strengthening-buy-american-preferences-infrastructure-projects/) If it succeeds, industry may find that US producers’ access to burgeoning international markets will ultimately contract; over the long term, a weakened, hyper-nationalist global economy bodes poorly for the GDP, energy demand growth, and ease of trade.

Foreign policy: Will congress compete for control?

Assuming that ongoing trends continue and major black swan scenarios (e.g., eruption of a war in the Middle East or a global recession) are avoided, the foreign policy outlook in a reelection scenario may still produce headwinds for industry. The Trump era has seen a rise in authoritarian and revanchist governments around the world, repression of opposition parties, targeting of minority populations, intimidation of neighboring governments, and expansion of regional or global hegemony—in some cases with Trump’s tacit approval. Congressional reaction to authoritarian actions, even if those actions have the blessing of the Trump Administration, could produce sanctions and other obstacles to trade with Russia, China, Turkey, or other countries.

Russia will continue to upgrade its Arctic facilities and military capacities as it looks for ways to develop the region’s lucrative resources despite US sanctions. A confident Russian government, certain of US neutrality, may seek further inroads (political, military, or otherwise) in Ukraine and the Baltics. The Russo-Chinese alliance will persist as long as the supply and demand needs of both countries align, and as long as the Chinese view Russian engagement as an inroad to the Arctic. In its own neighborhood, China may be emboldened by a retrenched, divided United States to attempt to control the South China Sea more aggressively (as it did throughout the summer of 2019 in Vietnamese waters), seek new ways to undermine Hong Kong and Taiwan’s autonomy, and intimidate Southeast Asia. Wary of international entanglements, the Trump Administration is unlikely to apply pressure or enforce consequences for rogue behavior.

The US Congress may be less acquiescent even with the Senate safely in Republican hands. Maintaining pressure on Russia (and perhaps also Iran to a lesser extent) is one area where lawmakers could unite across the aisle, especially if provoked by the executive branch via tweet or otherwise.

The surge in sanctions legislation throughout Trump’s first term is likely a trend marker. Future sanctions bills targeting adversarial energy producers could boomerang back to US industry. If US retrenchment continues, Congress will not hesitate to use its most powerful toolset to take back the reins.

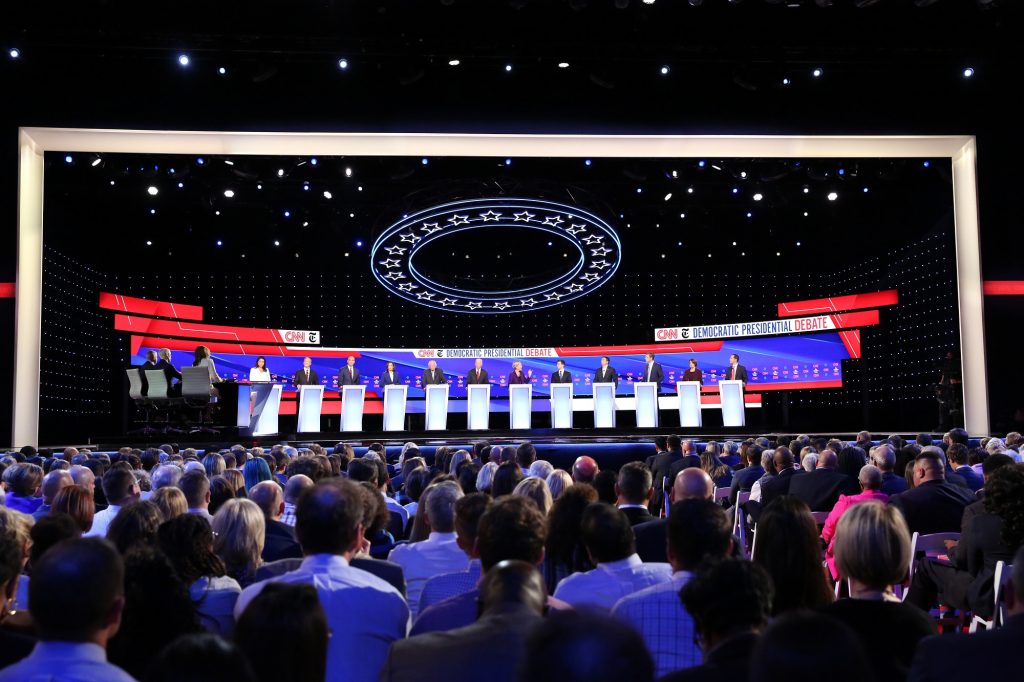

REUTERS/Leah Millis

The administration will continue to prioritize bilateral alliances with governments, including in Israel and Saudi Arabia, that oppose Iran. This strategy has already fostered instability in the Middle East, especially as Tehran opts for kinetic, asymmetric responses to US pressure, such as the attacks in September 2019 on Saudi oil processing infrastructure.26Geoff Brumfiel, “What We Know About The Attack On Saudi Oil Facilities”, NPR, September 19, 2019, https://www.npr.org/2019/09/19/762065119/what-we-know-about-the-attack-on-saudi-oil-facilities. The Trump Administration has not as yet articulated exactly what a new deal with Iran will entail, and Iran will seek fresh leverage before it commits to any humiliating compromises.

Trade policy: More tariffs ahead?

The Trump Administration has left an indelible stamp on US trade policy. This has been marked by a robust use of tariff powers, shaking extant alliances, and undermining decades of conventional wisdom in support of multilateral trade agreements in favor of a new brand of economic nationalism. US tariffs on steel imports have raised the cost of energy infrastructure. This protectionist agenda is far more likely to push manufacturers to different low-wage countries, even as automation accelerates globally.27A recent US Chamber of Commerce analysis, for example, noted a surge in companies relocating to Southeast Asia. See: Scott Horsley, “China Falls Out Of Fashion For Some U.S. Brands,” NPR, August 30, 2019, https://www.npr.org/2019/08/30/755498788/china-falls-out- of-fashion-for-some-u-s-brands. Retaliatory Chinese tariffs have dramatically curtailed US oil and natural gas exports to China and have made financing LNG export facilities that aspire to export to one of the world’s fastest-growing LNG markets challenging.28Scott DiSavino, “U.S. LNG exporters face headwinds due to trade war with China,” Reuters, May 16, 2019, https://www.reuters.com/ article/us-usa-trade-china-lng-analysis/u-s-lng-exporters-face-headwinds-due-to-trade-war-with-china-idUSKCN1SM2D0. Frictions with Mexico over steel and automobile tariffs and the threat of tariffs on goods to pressure Mexico on migration issues have led to concerns in what is today the largest export market for US natural gas and petroleum products over the reliability of US natural gas exports.29Jude Clemente, “Trump’s Tariffs Disrupt USMCA And The U.S. Oil & Gas Boom,” Forbes, June 16, 2019, https://www.forbes.com/sites/ judeclemente/2019/06/16/trumps-tariffs-disrupt-usmca-and-the-u-s-oil-gas-boom/#1d25ee6f21bd. These headwinds for US exports from trade tensions are likely to persist. While the United States-Mexico-Canada Agreement (USMCA) may win ratification in 2020, the balance of the Trump Administration’s trade agenda to negotiate comprehensive bilateral deals with Europe, Japan, and China is likely to be suspended pending the election results in 2020. If Trump is reelected, his administration may make (slow) progress toward negotiating final agreements, but industry should not expect rapid or fully satisfactory results.

A second Trump Administration will thus likely mirror the first in terms of aggressive support for US fossil fuels, limited engagement on any aspect of climate policy, and a nationalistic trade and foreign policy agenda. The key differences in a second term will be the ability to complete the first term’s rulemaking, to reshape regulatory bodies, to achieve victory in the courts as Republican appointees populate the judiciary, and to refocus—and potentially rebrand—the United States as a supporter of economic nationalism, transactional diplomacy, and foreign policy restraint. With the freedom and flexibility inherent to a new electoral mandate and the elimination of the pressure of campaigning, a reelected administration will be less constrained than before to follow its deepest instincts and redesign US energy policy in its image. In this environment, finding areas of cooperation within Congress and particularly between the legislative and executive branches will be challenging. Nevertheless, there are a few areas where Republicans and Democrats may be able to work together in Congress. As we have seen over the past two years, it is likely that both sides of the political aisle will defend a robust budget for the Department of Energy, especially its research and development capacities as well as the national laboratories. Certain technologies, especially efficiency; carbon capture, sequestration, and transport; battery storage and hydrogen production; and fuel cell development could find enough support among bipartisan coalitions (even if some on both sides are not fully on board with all of these emerging toolsets and their respective applications). Importantly, however, a recalcitrant White House that pushes full steam ahead with deregulation could be a problematic ally to congressional Republicans seeking to build bipartisan support in any of these areas, making compromise more challenging.

Scenario two: Election of a Democratic president

It is impossible to project with certainty which two individuals will populate the 2020 Democratic ticket, let alone the final details of their energy and climate proposals. Nevertheless, the “baseline” for a future Democratic platform has been clearly demarcated in recent months. The future of any such proposals depends heavily on the eventual makeup of Congress. As we have seen under Trump, the White House has considerable power to steer policy by virtue of executive authority, but any major decisions on government spending require congressional input and oversight. Even if Democrats take the Senate in 2020, their majority will not be filibuster-proof. While it is possible to end the filibuster, even Democrats are divided over crossing this Rubicon, and opting instead for a liberal use of budget authority (requiring a simple majority to pass) is more likely. Governing, as ever, is far removed from campaigning. Our scenarios assume that a Democratic administration will face serious congressional—and likely judicial—limitations on what it can and cannot implement, if not a divided government outright.

A climate-focused energy policy

If a Trump reelection means doubling down, then a Democratic victory will mean doubling back, with a return to the 2016 status quo as the minimum starting point.

A Democratic administration will be deeply skeptical of new fossil fuel infrastructure, especially large interstate and international projects where public opposition from activists (for example, the Keystone Pipeline) is all but guaranteed. It will be sympathetic to national and grassroots activists who oppose new buildouts and may tacitly support state-level efforts to delay or refuse new fossil fuel projects. A Democratic president might prefer to strengthen the National Environmental Policy Act (NEPA) to clarify the scope of climate and emissions reductions disclosure, and include explicit mitigation mandates in federal environmental law. In the absence of Democratic control of Congress, a Democratic administration would revise the CEQ guidance and regulations (as the Trump Administration is doing now, but in the opposite direction) as the next best option. Certainly, a Democratic administration will return to Obama-era policies around the implementation of the Clean Air and Clean Water Acts and revive its expansive WOTUS definition to slow or constrain new buildout. At FERC, a Democratic administration will—at minimum—fill out the agency with two new Democratic commissioners. It will likely seek commissioners whose records suggest support for measurement and offset of significant GHG emissions for major infrastructure projects (as articulated by current Democratic Commissioner Richard Glick).30In some recent pipeline infrastructure approvals, FERC has been accused of failing to incorporate the full climatic impacts (e.g., downstream emissions) of a given project. FERC Commissioner Richard Glick noted in a May 2019 interview with Vox (available at https://www.vox.com/energy-and-environment/2019/5/22/18631994/climate-change-renewable-energy-ferc) that FERC “has consistently been avoiding its responsibility to consider whether the climate change impacts of a natural gas facility—especially pipelines, the downstream impacts, and even the direct impacts—are significant, whether the greenhouse gas emissions have a significant impact on the environment.” See also: Commissioner Richard Glick, “Dissent regarding Transcontinental Gas Pipe Line Company, LLC,” May 3, 2019, https://www.ferc.gov/media/statements-speeches/glick/2019/05-03-19-glick.asp#.XXfg2S3Myi4. US Sen. Elizabeth Warren (D-MA), a Democratic presidential candidate, has suggested an overhaul and renaming of FERC to “Federal Renewable Energy Commission” with the stated mission of reducing GHG pollution.31Elizabeth Warren, “100% Clean Energy for America,” Medium, September 3, 2019, https://medium.com/@teamwarren/100-clean-energy- for-america-de75ee39887d.

Ironically, a Democratic administration may be inclined to employ Trump-era tools, specifically federal supremacy. An administration with ambitious renewables generation goals, for example, may try to expedite federal approvals for locally controversial infrastructure (e.g., offshore wind fields).32Across the board, the Democratic presidential candidates have promised more than $1 trillion in investments in energy efficiency and zero-carbon energy infrastructure. However, as recent developments in the European offshore wind industry illustrate, green infrastructure can often be as controversial and face as concerted a backlash as fossil fuel infrastructure. Where projects face local opposition, federal supremacy may prove important in pushing marquee projects to completion. The Democratic presidential candidates (and much of the electorate at large) agree on the importance of expanding renewables generation; the most ambitious plans envision a wholesale replacement of fossil fuel energy throughout the US economy in power generation, buildings, and transportation. Demanding that utilities achieve 100 percent clean, renewable electricity by the 2030s, for example, would be an unprecedented and prescriptive intrusion of federal power into the US electricity markets and infrastructure investment decisions. Moreover, hard political realities may temper these proposals when it is time to craft policy. One recent estimate suggests that, taken together, there are “nearly one million jobs in the petroleum, coal, and natural gas sectors,” while a further 130,000 Americans are employed in fossil-fuel power generation; in addition, millions more livelihoods (builders, retailers, public service providers) are adjacent to or supported by the energy industries.33Citi Research, “Global Multi-Asset View: Road to the White House 2020 – Energy Policy & Implications,” September 3, 2019, 10-11. The impacts on labor of a rapid, systemic transformation will require careful attention, as will the unavoidable impacts of a rapid, systemic shift on the US gross domestic product (GDP) and Wall Street with serious and immediate consequences for retirees and others.

A ban on new public lands leases for fossil fuel development could be an immediate, high-priority agenda item; it is preeminent on nearly every Democratic presidential candidate’s platform. Beyond the relatively narrow confines of public lands, a Democratic administration will pursue quick, high-publicity “wins” for progressives. These may include forbidding future leases in the ANWR in Alaska, a revival of the restrictive Obama-era five-year offshore plan, or perhaps a moratorium on new offshore drilling, the reinstatement of pre-Trump-era species protections, and the reestablishment of controversial protections for sensitive ecological regions and national parks. Beyond the relatively small percentages of oil and gas currently produced on public lands, it is much less clear how a Democratic administration would pursue the more complicated goals of stopping or preventing specific forms of fossil fuel production everywhere (as some progressive candidates have vowed).34In this latter category, US Sen. Bernie Sanders (D-VT) and US Sen. Elizabeth Warren (D-MA) have offered the most transformational proposals. See: Elizabeth Warren, “100% Clean Energy for America,” Medium, September 3, 2019, https://medium.com/@ teamwarren/100-clean-energy-for-america-de75ee39887d; and Bernie 2020, “The Green New Deal,” accessed September 9, 2019, https://berniesanders.com/issues/the-green-new-deal/. Some proposals from the most vociferously progressive candidates indicate that they will ban hydraulic fracturing on all US soil, including privately owned land where the vast majority of US oil and gas is produced.35The last publicly available estimates (for FY2016) suggest that onshore energy production on BLM-managed public lands accounted for 7 percent of all oil and 10 percent of all natural gas produced domestically. See: US Department of the Interior, “Oil Gas Development: Examining Access to Oil and Gas Development on Federal Lands,” June 29, 2017, https://www.doi.gov/ocl/oil-gas-development-0. If private lands can be targeted for hydraulic fracturing, further inroads against other types of upstream development are not inconceivable. Of course, such ambitions will prove far easier said than realized. Getting little help from Congress, such efforts would likely force the administration into a long and difficult rule-making process at EPA and might prove legally vulnerable without legislative changes to the Clean Air and Clean Water Acts. Faced with an expansive domestic policy agenda (tax reform, healthcare reform, immigration, gun control), even an ambitious progressive administration may hesitate to expend that level of commitment to stall or outright block some types of fossil fuel development from sea to sea. Moreover, the attacks on the Saudi oil processing facilities at Khurais and Abqaiq in September 2019 highlighted the importance of energy self-sufficiency for supply security and price stability. Even a Democratic administration will be loath to cede the energy security that has been the focus of US energy strategy since 1973 until low-carbon alternatives are readily available.

Climate policy: Historically high ambitions

Every Democratic presidential candidate has said that the United States will rejoin the Paris Agreement under their leadership; since rejoining can be done via executive powers, this will be a Day One priority and will immediately reinvigorate the global conversation on climate change. A Democratic president will resubmit the US Nationally Determined Contribution (NDC)—a required submission for any party to the agreement—and will likely commit to deeper emissions cuts over the original Obama Administration version in line with carbon neutrality by 2050.36The original US NDC committed the United States to reducing emissions by 26-28 percent from 2005 levels by 2025. Some Democratic presidential candidates’ proposals are more ambitious and prescriptive in nature, aiming for zero emissions from power generation

and transport by 2030 (Washington Gov. Jay Inslee, Sanders, Warren) or zero-emission power generation by 2035 (Andrew Yang). The candidates are roughly aligned on net-zero emissions by 2050. If the Trump Administration can defend the ACE rule, a Democratic administration will need one to two years to develop and finalize a replacement akin to a Clean Power Plan 2.0. A new plan must feature deep emissions cuts facilitated by a total phaseout of coal, rapid uptick of renewable generation, and constraints on new natural gas generation. Democrats are increasingly thinking in terms of economy-wide emissions, not simply replacing or phasing out coal-fired power generation, to secure what they see as critical deep reductions. The transportation sector, which is prominent in the Green New Deal and many Democratic candidates’ climate strategies, will be a target. Whereas the Trump Administration is looking to revoke California’s state authorities under the Clean Air Act to enforce tighter emissions standards, a Democratic administration may see the California standards as a baseline (not ceiling) for new CAFE standards in a reinvigorated push toward fuel efficiency and technological innovation. Warren, who has adopted many key tenets of the climate strategy of Washington Governor Jay Inslee’s now defunct presidential campaign, has promised historically “ambitious” efficiency standards “reaching a requirement for 100 percent zero emissions for all new light- and medium-duty vehicles by 2030.”37Elizabeth Warren, “100% Clean Energy for America,” Medium, September 3, 2019, https://medium.com/@teamwarren/100-clean-energy- for-america-de75ee39887d. CAFE standards are among the policy areas where a Democratic administration’s priorities may dovetail with those of industry and the private sector (notably, some US and international automakers) investing in high-efficiency and low-carbon technological improvements within their sectors.

For industry, especially independent operators, the most immediate changes of consequence may come in methane regulation. The Democratic candidates roundly agree that methane emission reductions are equally (if not more) important than reducing carbon dioxide emissions. Any Democratic president will reinstate stricter technical and leak repair requirements for operators, and demand measuring and reporting of methane leaks, although some have vowed to go further. In 2019, for example, Democratic candidate US Sen. Cory Booker (D-NJ) promised to institute “a requirement for fossil fuel companies to stop methane leaks from both new and existing sources” or face heavy penalties. Another candidate, US Sen. Bernie Sanders (D-VT) has suggested that if he were to become president, the EPA would regulate methane in the same way as it regulates other emissions (such as carbon dioxide) under the Clean Air Act and will toughen the Obama-era rules on leak detection and repair.38Cory 2020, “Cory’s Plan to Address the Threat of Climate Change,” accessed September 9, 2019, https://corybooker.com/issues/climate- change-environmental-justice/corys-plan-to-address-the-threat-of-climate-change/ and Bernie 2020, “The Green New Deal,” accessed September 9, 2019, https://berniesanders.com/issues/the-green-new-deal/.

These proposals could raise upstream costs throughout the domestic oil and gas sector, limit supply, and stall export growth (indeed, this outcome is the official goal for some candidates, notably Sanders and Warren). However, a Democratic administration, particularly one facing a divided Congress, will labor under the same restraints that have slowed the Trump-era rollback. Rewriting rules and arguing for more expansive federal powers to pursue ambitious emissions reductions will be a multiyear process, carrying the risk of legal defeat from the district courts up to the US Supreme Court.

These historically high ambitions may pose risks to a new Democratic president, as expectations may exceed the party’s legislative mandate and the speed of the policy process. However deeply a new administration is committed to its climate agenda, the machinery of government grinds slowly. An attempt to expedite it can mean stinging losses and wasted effort. Moreover, a first-term Democratic president must be extremely careful with constituencies in swing states where the oil and gas industries are major employers and local economies are highly dependent on fossil fuels (e.g., Pennsylvania, Ohio, and Colorado). A complete hydraulic fracturing ban, now supported by some leading Democratic candidates, could dislocate rural and semi-rural economies in these high-value purple states. A new administration cannot afford to anger these voters ahead of the 2022 midterms and a 2024 reelection campaign. Proposals to end crude or fossil fuel exports entirely face a similar problem; the newly acquired mantle of net exporter status has economic benefits for American workers throughout the value chain, and arguably climatic benefits overseas for Asian markets looking for alternatives to coal for power generation and industry.39For example, a recent Center for Strategic and International Studies analysis of Chinese emissions reduction efforts notes the role and importance of increasing LNG imports, while China is presently the third largest buyer of US LNG. See: China Power Team, “How is China managing its greenhouse gas emissions?,” China Power, last updated March 7, 2019, https://chinapower.csis.org/china-greenhouse-gas-emissions/. Even if a progressive Democrat is elected in 2020, the headiness of victory must sooner or later give way to the realities of governance.

To be sure, the rapidly growing sectors around renewable and zero-carbon energy production and operation will see a new dawn under a Democratic presidency, but there are important areas where conventional producers may be able to cooperate with Democratic priorities. Prominent among these are carbon capture technologies (utilization and storage as well as direct capture) and carbon pricing, both of which already enjoy strong and growing industry support and are popular among some of the 2020 Democratic candidates. Carbon pricing in the United States faces an uphill battle in Congress (despite no lack of bills on the table). Carbon capture research and development, on the other hand, could find immediate and robust bipartisan support. US industry is firmly behind improving available technologies and reducing costs as quickly as possible. A Democratic administration, on the other hand, may be inclined (by virtue of necessity) to prioritize carbon capture in order to cut near- and medium-term emissions growth in the midst of climate “emergency,” a characterization that is increasingly a truism on the progressive left.40Broadly, carbon capture has supporters on all sides of the political divide. The Trump Administration has proffered the 45Q tax credit, for example, and the US Department of Energy recently announced $110 million in support for cost-shared research funding for carbon capture, utilization, and storage (CCUS) projects. Likewise, the Energy Futures Initiative (headed by former Obama Energy Secretary Ernest J. Moniz) has released a detailed report on budgetary and policy requirements to upscale various forms of carbon capture in a blueprint for a future administration. Notably, multiple leading Democratic presidential candidates have explicitly endorsed carbon capture technology in their respective proposals, including former US Vice President Joe Biden and South Bend, Indiana Mayor Pete Buttigieg. See: Iulia Gheorghiu, “DOE directs $35M for carbon storage projects eligible for extended tax credit,” Utility Dive, September 16, 2019, https://www.utilitydive.com/news/doe-directs-35m-for-carbon-storage-projects-eligible-for-extended-tax-cred/562978/; “Clearing the Air: A Federal RD&D Initiative and Management Plan for Carbon Dioxide Removal Technologies,” Energy Futures Initiative, September 2019, https://energyfuturesinitiative.org/efi-reports; “Climate: Joe’s Plan for a Clean Energy Revolution and Environmental Justice,” Biden For President, accessed September 9, 2019, https://joebiden.com/climate/; and “Mobilizing America: Rising to the Climate Challenge,” Pete 2020, accessed September 30, 2019, https://storage.googleapis.com/pfa-webapp/documents/Climate-Plan- White-Paper.pdf. Another emerging area where a Democratic administration may bring federal resources to bear is promoting carbon sequestration through the agriculture sector, where decarbonization alone has proven particularly difficult. Among the candidates, Mayor Pete Buttigieg has most prominently featured agriculture and rural communities more broadly in his climate proposals. He has recommended refocusing USDA’s research and development budget to “reduce agriculture’s carbon emissions to net-zero or even net-negative” and supporting soil management techniques geared towards optimizing carbon sequestration through techniques such as crop rotation, advanced grazing methods and nitrogen management.41Pete 2020, “Mobilizing America: Rising to the Climate Challenge”, accessed November 22, 2019, pg. 10, https://storage.googleapis.com/ pfa-webapp/documents/Climate-Plan-White-Paper.pdf. Some of these proposals could feature in Executive Orders, others (such as financial incentives for farmers to sequester carbon) may require congressional approval and tax code alterations. It is less clear, however, if and how nuclear energy will figure into a Democratic presidency. The progressive left, as epitomized by the Sanders campaign, is uncomfortable or neutral with respect to nuclear power (the senator himself has listed nuclear among “false solutions” his administration would fight or deprioritize).42“The Green New Deal,” Bernie 2020, accessed September 30, 2019, https://berniesanders.com/en/issues/green-new-deal/. Other campaigns (former US Vice President Joe Biden, Booker, US Sen. Amy Klobuchar (D-MN), and the now-defunct Inslee campaign) are warmer toward nuclear power, but remain concerned about waste management and safety.43James Conca, “Nuclear Power And The 2020 Presidential Candidates,” Forbes, August 8, 2019, https://www.forbes.com/sites/ jamesconca/2019/08/08/nuclear-power-and-the-2020-presidential-candidates/#6972c9d6c5d9. Like the oil and gas industries, nuclear power has high state-level salience and in some communities provides an economic lifeline; recent state legislative efforts to preserve extant nuclear resources affirm the importance of nuclear facilities to local economies.44For example, the ongoing drama over Ohio House Bill 6, the controversial nuclear bailout law. See: Mike Thompson and Steve Brown, “Ohio’s Nuclear Bailout Is Inspiring An Unprecedented Campaign. But Why Now?,” WOSU Public Media, September 23, 2019, https://radio.wosu.org/post/ohios-nuclear-bailout-inspiring-unprecedented-campaign-why-now#stream/0. This is one area where the moderate/progressive Democratic divide may be in sharpest relief at the federal level, but even a firmly progressive administration may hesitate before pushing back against local efforts in favor of nuclear infrastructure.

Seeking a US competitive advantage and new job markets, a Democratic administration will also explore emerging fields in energy research and development, specifically the advent of artificial intelligence and autonomous tools (drones, trucks, sensory technology), and would invest heavily in modernizing the US grid network within a broader infrastructure package. While Republicans are certainly not opposed to these technologies, especially when used voluntarily and in support of conventional resource development, Democrats will favor mandatory applications to climate and emission reduction (such as methane monitoring). The conventional energy industries are already hard at work in these fields, suggesting another potential open door for joint efforts with the agencies and residual benefits favoring the early movers in these new fields.

Zero-emission hydrogen fuel cell technology is another emerging storage solution (alongside new types of battery storage) that a Democratic administration might pursue if clean hydrogen production can be cost-efficient.45Susan Phillips, “Japan Is Betting Big On the Future Of Hydrogen Cars,” NPR, March 18, 2019, https://www.npr.org/2019/03/18/700877189/japan-is-betting-big-on-the-future-of-hydrogen-cars. Major international oil companies (IOCs), notably Total in Japan, are actively working on scaling up hydrogen fuel cell vehicles. Hydrogen research and development could be a source of bilateral cooperation as well, given strong interest in Japan and Europe. Bipartisan support for US national energy laboratories for research and development and energy efficiency measures has had a leveling effect on Republican and Democratic administrations in the past, and should provide significant opportunity for common ground in the future.

Foreign policy: Strategic reassurance . . . with a dose of climate policy

Democrats at every level of government have decried Trump’s approach to foreign policy, particularly his administration’s seeming overtures to authoritarian regimes and geostrategic adversaries. A Democratic administration, especially a progressive one, is unlikely to seek out foreign adventures; nevertheless, the United States’ post-World War II history is clear, in our view, that diplomacy backed by credible use of force is usually the most effective. A Democratic administration will likely rebuild and reempower its State Department as part of a broader multilateral, coalition-centric vision for US leadership. Strategic reassurance to European, Asian, and Latin American allies will be a Day One priority; a new administration will vocally reaffirm the US commitment to NATO, the European Union (EU), and the transatlantic partnership. Industry should beware that a new administration may demand further investigations into 2016 Russian election interference and publicly back one (or more) of the major Russia sanctions bills presently waiting to move in Congress, possibly facilitating a rapid passage within the first 100 days.46At present, the most significant bills at play are Defending American Security from Kremlin Aggression Act (DASKA) of 2019 and Defending Elections from Threats by Establishing Redlines Act (DETER) of 2019. Both bills propose expansive new sanctions on the Russian energy and financial sectors, and they contain provisions which could rebound on US and European industry operating overseas in joint venture and in other contexts alongside Russian operators. Notably, in December 2019 the Senate added provisions from the Protecting Europe’s Energy Security Act of 2019” (PEESA) to must-pass National Defense Authorization Act for Fiscal Year 2020, in order to sanction companies which are supporting the buildout of the Nordstream 2 pipeline. The reemergence of the Nordstream2 sanctions and their rapid advancement via a must-pass bill demonstrates how quickly sanctions legislations can move in the right conditions, as well as Congress’s willingness to employ all tools at its disposal.

A new administration will likely maintain an adversarial relationship with China. Like the Trump Administration, many Democratic presidential candidates see Chinese economic manipulation as the core challenge facing US workers and the manufacturing sector. Sanders has decried “current trade and tax agreements that make it easier for multinational corporations to ship jobs overseas . . . and throwing American workers out on the street.” Warren has criticized China directly, noting “the suppression of pay and labor rights, poor environmental protections, and years of currency manipulation.” The more moderate Mayor Pete Buttigieg of South Bend, Indiana, has affirmed a “serious” challenge from China that cannot be fixed through tariffs.47“Fight For Fair Trade and Workers,” Bernie 2020, accessed September 9, 2019, https://berniesanders.com/issues/fight-for-fair-trade-and-workers/; “Pete Buttigieg on Free Trade,” On The Issues, last updated August 2, 2019, https://www.ontheissues.org/2020/Pete_Buttigieg_Free_Trade.htm; and Elizabeth Warren, “Trade—On Our Terms,” Medium, July 29, 2019, https://medium.com/@teamwarren/trade-on-our-terms-ad861879feca. Economic distortions aside, Democrats have a much longer list of concerns. A new administration will likely press China on rising carbon emissions, coal consumption and exports, rampant human rights violations against religious and ethnic minorities, efforts to dominate the South China Sea and its regional neighbors, and recent attempts to undermine democratic and populist movements in Hong Kong and Taiwan. Using these issues as leverage, a Democratic administration may be able to stabilize the trade relationship with a limited agreement that includes drawing down the current expansive tariff regime on both sides—especially if a deal could include a rapprochement on global climate priorities. Even a modest deal at this stage would be immediately beneficial for US crude and LNG exports languishing under retaliatory tariffs, but the long-term US-China relationship will likely remain more fractious than harmonious. Industry should not rest comfortably, but should prepare for long-term headwinds in the US relationship with the world’s fastest-growing energy consumer.

The starkest foreign policy reversal could come in the Middle East, where a Democratic administration could cast a sharply critical eye on two of the Trump Administration’s most important allies—Israel and Saudi Arabia. In Congress, the Democratic caucus is divided on support for both countries and foreign aid budgets will likely be contested. Bills that sought to limit arms sales or end the war effort in Yemen that were rejected by Trump earlier in 2019 might see a more welcome reception from a Democratic president. A Democratic president might reopen investigations into the 2018 murder of Washington Post columnist Jamal Khashoggi at the Saudi Consulate in Istanbul and could tacitly (or vocally) endorse a version of the Justice Against Sponsors of Terrorism Act (JASTA) legislation, facilitating foreign lawsuits against Saudi Arabia. In the event that the Organization of the Petroleum Exporting Countries (OPEC) restrains oil production to levels that elevate oil prices to unpopular levels, a Democratic US Department of Justice investigation into OPEC as an anti-trust matter, with particular focus on the OPEC+ deal to prop up global oil prices, could strongly appeal to the Democratic base even as mere signaling.

election debate at Otterbein University in Westerville, Ohio, October 15, 2019. REUTERS/Shannon Stapleton

Most Democratic candidates support a renegotiation aimed at resurrecting the Iran nuclear deal, formally known as the Joint Comprehensive Plan of Action (JCPOA). As with the trade agenda, a JCPOA 2.0 will be a priority, but Iranian negotiators will find the bar for complete reversal of the secondary sanctions regime higher than in 2015. If a Democratic administration can secure a handful of additional concessions on nonnuclear issues related to Iran’s regional conduct and ballistic missile program (even if only on paper), it can claim to have secured a deal superior to former US President Barack Obama’s and accomplished what the Trump Administration never could. In that scenario, Iranian crude exports (presently down to 100,000 barrelsper day (bpd) from 2.5 million bpd in April 2018) should quickly bounce back with deeply bearish implications for global oil markets.48Alex Lawler, “Hit by sanctions and rising tensions, Iran’s oil exports slide in July,” Reuters, July 30, 2019, https://www.reuters.com/article/us-oil-iran-exports/hit-by-sanctions-and-rising-tensions-irans-oil-exports-slide-in-july-idUSKCN1UP1UD. Downward pressure on already limp crude prices, an economic headwind to a new US administration, could send OPEC+ (starting with Saudi Arabia) back to the drawing board or even running for cover.

Trade policy: Fairer trade for growth and a counterweight to China

Democrats have so far struggled to craft an alternative answer to Trump’s unconventional trade agenda. Indeed, many progressive Democrats share the administration’s basic skepticism toward multilateral trade, but for wholly different reasons. More broadly, Trump’s vision of economic nationalism—articulated since 2015—will not disappear from the minds of voters overnight. Democratic presidential candidates are divided into those seeking fairer trade and those who have found nearly all prior trade deals fatally flawed. Yet support for trade among Democratic constituencies (and the electorate overall) is on the rise.49Bradley Jones, “Americans are generally positive about free trade agreements, more critical of tariff increases,” Pew Research Center, May 10, 2018, https://www.pewresearch.org/fact-tank/2018/05/10/americans-are-generally-positive-about-free-trade-agreements-more-critical-of-tariff-increases/. Facing these countervailing forces, Democrats cannot simply patch up the Trans-Pacific Partnership (TPP) or Transatlantic Trade and Investment Partnership (TTIP), rush to undo all existing Trump-era retaliatory or product-specific tariffs, offer a cordial handshake to Beijing and proclaim that bygones are bygones however much industry and multinational corporations may hope. Nor will Democrats be willing to admit that the Trump Administration succeeded on any front, particularly trade. It may, however, be willing to build on existing work done under the current US Trade Representative (USTR), seek stronger labor and environmental protections, and craft what it will try to argue are better deals for which it can then claim credit.

The USMCA is a case in point. House Democrats insisted on stronger enforcement, labor and environmental provisions and won sufficient gains to obtain the support of the AFL-CIO. With so many Democrats in swing districts dependent on trade, Speaker Pelosi agreed on an updated USMCA. With bipartisan support, passage is likely in 2020. Beyond North American trade, industry should expect a much warmer US-Mexico relationship, especially under a more progressive Democratic administration which will be sympathetic to leftist Mexican President Andrés Manuel López Obrador (AMLO) and his efforts to work with the United States on immigration. If the ongoing negotiations over export pipelines into Mexico can be resolved south of the border, a Democratic administration will be hard-pressed to block increased gas exports to Mexico despite likely tepid support within a Democratic administration for fossil fuels exports.50After the AMLO government questioned extant “take-or-pay” natural gas pipeline contracts between the previous Mexican government and US and Canadian companies, the companies entered into direct negotiations with the government to resolve the dispute. The original contracts saw Mexico committed to a steadily rising fee for gas transport over twenty-five years. A preliminary deal announced in late August 2019 commits Mexico (via CFE) to paying higher fees to ship gas through the pipelines in question for the next ten years, but less in total over the full-time horizon. From the outset, fees will be set to what would have been the average across the original full contract length, and then discounted 5–10 percent. In all, Mexico is expected to save $600 million and the four private operators will each be guaranteed a long-term contract. Robbie Whelan, “Mexico Nears Deal to Resolve Pipeline Conflict,” Wall Street Journal, August 25, 2019, https://www.wsj.com/articles/mexico-nears-deal-to-resolve-pipeline-conflict-11566776655.

A US-EU and a more comprehensive US-Japan agreement may quickly follow an approved USMCA as a Democratic administration will be keen for first-year “wins” and public reaffirmation of important strategic alliances via trade relationships. There may be consideration given to finding a way for the United States to join a rebranded TPP 12 as a counterweight to China. Although industry can confidently expect that major trade deals will go through (and meet a supportive Congress), it should not expect a bright future for Investor-State Dispute Settlement (ISDS) protections. The current USTR has pushed back against comprehensive ISDS throughout its extensive negotiations on the USMCA, and there appears to be no constituency on the other side of the aisle wishing to revive it.51US Sen. Elizabeth Warren (D-MA), for one, has vowed never to support ISDS in any future US trade agreement and has made fight-

ing ISDS provisions a hallmark of her policy platform since 2015. See: Elizabeth Warren, “The TransPacific Partnership clause everyone should oppose,” Washington Post, February 25, 2015, https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=2&cad=r-ja&uact=8&ved=2ahUKEwitu9G99MbkAhUpT98KHSRQAfYQFjABegQIBBAB&url=https%3A%2F%2Fwww.washingtonpost.com%2Fopin- ions%2Fkill-the-dispute-settlement-language-in-the-trans-pacific-partnership%2F2015%2F02%2F25%2Fec7705a2-bd1e-11e4-b274- e5209a3bc9a9_story.html&usg=AOvVaw2FoFf-WI35HKPpgP8bODlV. The agreements will come eventually, but investors should anticipate higher investment risk than they previously enjoyed.

Democrats will not simply polish Trump-era agreements and move them through Congress. They will try to augment future agreements with progressive flavor through environmental side agreements and possibly climate policy demands. Environmental issues (among others) have been a sticking point between the USTR and House Democrats on the USCMA; the Democratic presidential candidates across the ideological spectrum appear united on integrating climate strategy into a new trade agenda. Biden has said his administration will “impose carbon adjustment fees or quotas on carbon-intensive goods from countries that are failing to meet their climate and environmental obligations” and “condition future trade agreements on partners’ commitments to meet their enhanced Paris climate targets.”52“Climate: Joe’s Plan for a Clean Energy Revolution and Environmental Justice,” Biden For President, accessed September 9, 2019, https://joebiden.com/climate/. Warren has promised that any potential free trade agreement partner must pass a litmus test, including membership in the Paris Agreement with an independently verifiable national emissions reduction plan and the elimination of domestic fossil fuel subsidies.53Elizabeth Warren, “Trade—On Our Terms,” Medium, July 29, 2019, https://medium.com/@teamwarren/trade-on-our-terms-ad861879feca. All of these “requirements” may prove fungible and negotiable in practice, but climate policy will become a core component of any new trade agenda as a means to shore up domestic progressive constituencies and put pressure on carbon-intensive economies overseas to clean up their act or risk losing access to US markets. The utility of trade as a driver of global climate policy, and the need for wider coalitions to address Chinese and Russian revanchism may make a fairer trade policy a focal point of a Democratic administration’s international economic policy.

The more things stay the same: Volatility ahead

The disparity between the old and a potentially new administration can be fairly described as a sea change, with numerous immediate and near-term implications for energy markets, producers, and operators. Both scenarios present their own challenges, as well as bearish and bullish market signals. In this sense, the 2020 election is profoundly consequential. Unfortunately, the broader context suggests that the major overarching challenges facing the US and global energy markets will remain unresolved. Nowhere is this problem more stark than with climate change.

Whichever administration takes office in January 2021, it will not be able to solve the long-term energy transition puzzle that has bedeviled policy makers (and their increasingly angry constituents) the world over. Overseas, especially in developing Asia, emissions growth continues to accelerate while low- and zero-carbon fuels struggle to compete against cheap, native coal resources, entrenched local and national interests, challenging land use and geographic problems, subsidized power prices, uncompetitive investment frameworks, and extant, young coal infrastructure.54For further information on the particular challenges faced in Asia, the authors recommend a December 2018 MIT study considering Southeast Asia’s trajectory with respect to the Paris Agreement targets which notes: “Because the ASEAN countries represent a

wide variety of economies… their choice of policy instruments for GHG emission mitigation depends on administrative and technical capacities to introduce and enforce a particular policy, political support for the desired stringency of emission reductions, and willingness to accept the associated economic cost. Currently, the climate and energy policy portfolios of most Association of Southeast Asian Nations (ASEAN) countries are dominated by a patchwork of energy savings measures and targeted support for renewable energy, embedded in broader—and in many cases aspirational—mitigation strategies. While these policies have shown some positive effects, they are not always cost-effective, nor do they yet have the scalability to set in motion a broad transition towards a lower- carbon future.” See: Paltsev, S., M. Mehling, N. Winchester, J. Morris, and K. Ledvina, Pathways to Paris: ASEAN, Massachusetts Institute of Technology Joint Program on the Science and Policy of Global Change, December 2018, http://globalchange.mit.edu/publication/17160.

Despite some new efforts, including the 2018 Better Utilization of Investment Leading to Development (BUILD) Act, to facilitate modern infrastructure in developing countries, US diplomacy (and money) is far behind on the climate challenge. Within the United States, the Democratic primary has shown just how far the progressive climate agenda has become mainstream. All of the Democratic candidates are focused on the urgency of climate change and the drastic measures needed to fight it. The Green New Deal has thrown down the gauntlet for both parties as its advocates will remain a vocal “wild card” for years to come. Trump’s reelection will frustrate and motivate these constituencies, while a new Democratic administration will find itself facing unrelenting pressure and a steep list of demands—most of which will be beyond the political capacity or willpower of any singular presidential administration. Against this backdrop, the physical consequences of climate change will intensify and growing numbers of moderate and independent voters will demand a more comprehensive and effective response from the federal government.

In short, US energy policy is quickly entering uncharted waters. It is not at all clear that any one candidate has viable solutions for the breadth and complexity of the challenges ahead. While these issues remain unresolved, industry should expect that the politics around US production of all fuels, permitting processes, the evolving US energy mix, export, and trade policy will remain treacherous.

About the authors

David L. Goldwyn is president of Goldwyn Global Strategies, LLC, an international energy advisory consultancy, and serves as chairman of the Atlantic Council Global Energy Center Energy Advisory Group.

Andrea Clabough is an associate at Goldwyn Global Strategies, LLC, where she researches and writes on a range of energy policy issues and focuses on oil and gas, renewables, power generation, and geopolitics.

Subscribe to the Global Energy Center newsletter

Sign up to receive our weekly DirectCurrent newsletter to stay up to date on the program’s work.