Avoiding entanglement: G20 responses in a Taiwan crisis

Table of contents

Executive summary

This report examines three case countries from the Group of Twenty (G20), Brazil, South Korea, and Indonesia, and their likely responses to both US and Chinese economic statecraft in several hypothetical scenarios related to the escalation of tensions and risks of conflict over Taiwan. This study is designed to assess the policy trade-offs that countries outside of the G7 and US alliance networks may face. The report assesses Brazil, South Korea, and Indonesia’s economic and financial linkages with China, alongside a review of historical sanctions policies, and insights from selected interviews with key stakeholders. The report then identifies China’s likely goals for interactions with G20 nations under a Taiwan contingency, as well as each case country’s respective economic and policy reactions.

US and G7 foreign policy goals and requests for these countries would likely be limited to the enforcement of economic and financial sanctions. They will likely include consensus building among G20 members to express political support for China to de-escalate. Beijing would have its own set of economic statecraft tools that could potentially be deployed, which are discussed in our previous report, Retaliation and Resilience: China’s Economic Statecraft in a Taiwan Crisis.

China is unlikely to deploy punitive or “negative” economic statecraft tools such as sanctions or export restrictions against non-G7 countries in a Taiwan crisis scenario. China’s past statecraft practice, its diplomatic strategy toward developing economies, and its existing economic influence over much of the G20 reduce the need for such punitive measures, as Beijing would have interests in portraying its economy as open for business as usual, even as political tensions increase. Obviously, these calculations may change for Beijing depending upon US or G7 outreach to any country with which Beijing had an extensive economic relationship, where China may see threats as a more useful tool.

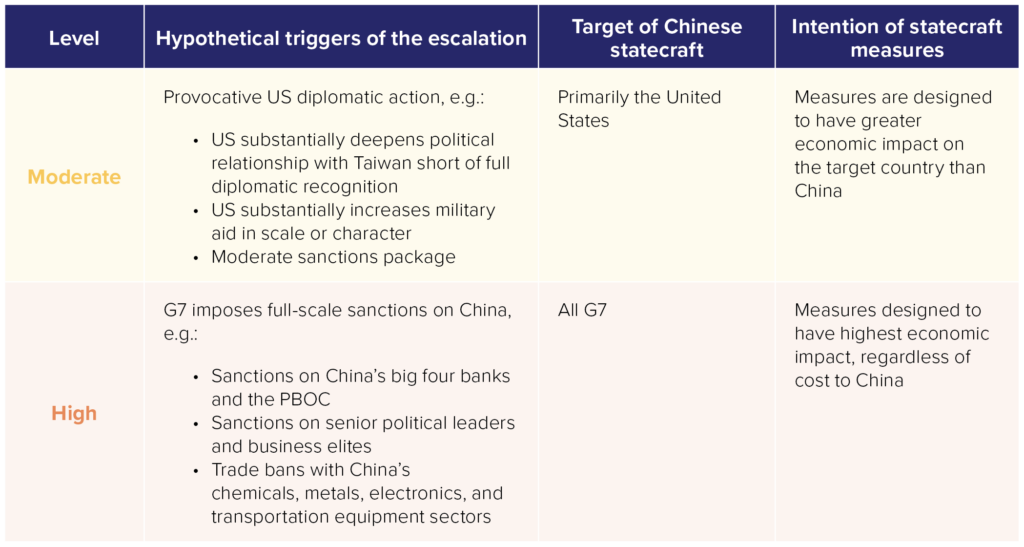

For the purposes of this study, we used the same definitions of “moderate” and “high” escalation as defined in our previous report:

- In a “moderate” escalation scenario in which limited US or G7 economic sanctions are applied, China will primarily seek to preserve business as usual with G20 countries and focus on obtaining diplomatic support, or at the very least neutrality, from countries like Brazil. Compliance with China’s legal assertions of sovereignty over Taiwan—via possible customs requirements or navigation restrictions—could also prove important. China has little need to augment its existing economic influence over the countries in this study with punitive statecraft such as threatened sanctions or export controls.

- In a “high” escalation scenario of more widespread financial sanctions on China’s banks and the central bank, coercive economic statecraft against the three case countries is marginally more likely, but still a low probability. As G7 pressure on the rest of the G20 to enforce secondary sanctions increases, China may be willing to use more direct measures to forestall a wider, comprehensive response to changing conditions in Taiwan. Of the case countries, South Korea is most likely to be affected by any negative statecraft.

It is difficult to predict with certainty how G20 nations are likely to respond overall to both US and Chinese diplomacy during these scenarios, and this is true for Brazil, South Korea, and Indonesia specifically. As Taiwan is not a central diplomatic or political issue for any of the case countries, responses will likely be dictated by each nation’s own existing policies and declared self-interest, as well as their perceptions of the importance of preserving relations with either China or the United States.

G20 responses to Chinese and G7 economic statecraft

All G20 members—including the three case countries—will be affected by a Taiwan crisis by tighter global trade and financing conditions regardless of their foreign policy decisions. A Taiwan crisis will affect multiple variables in the global economy from freight and shipping costs to commodity prices. In terms of trade linkages, G20 economies are generally more exposed to China’s economic statecraft tools than the G7, with 13 percent of exports or $541 billion in annual trade volumes potentially subject to disruption.1United Nations COMTRADE Database, Rhodium Group analysis. G20 total excludes European Union and African Union aggregates. International Trade Centre (ITC) Trade Map data based on Korea Customs and Trade Development Institute (KCTDI) statistics is used for South Korea’s exports in 2023. However, G20 economies are less exposed to China’s punitive statecraft in terms of financial linkages, given lower volumes of foreign direct investment in China (around $149 billion in outward direct investment stock from G20 economies excluding the G7 in 2022)2International Monetary Fund, Coordinated Direct Investment Survey (CDIS) data, and Rhodium Group analysis. G20 total excludes European Union and African Union aggregates. Data for Saudi Arabia is not available. Data on Argentina’s 2019 position and Russia’s 2021 position are used, as data for more recent years is unavailable. or cross-border portfolio flows, along with China’s incentives to extend options for financing and trade facilitation outside of potential US and G7 sanctions.

- Brazil is most likely to face little risk of punitive economic statecraft from China, given its economic ties to China and shared membership in the BRICS grouping of economies along with Russia, India, South Africa, and others. Past cases suggest Brazil’s financial sector will seek to comply with any sanctions on Chinese entities or secondary sanctions, but with little fanfare. Compliance will be implemented as necessary to avoid any legal entanglement with the United States. However, Brazil’s policy response will likely be influenced by the nature and extent of the international response to escalation in Taiwan.

- South Korea represents the most complex case in this report. Korean decision-making in a Taiwan crisis is most likely to align more closely with the G7 (compared to the rest of the G20, especially under the Yoon administration). It is, therefore, more likely to elicit a coercive economic statecraft response from China. At the same time, South Korea’s economic linkages to China are extensive, and supply chains in automobiles and semiconductors are still tightly bound to Chinese entities, despite recent efforts to diversify. Memories of previous negative statecraft by China—such as Beijing’s limits on tourism flows and other economic interactions when South Korea deployed a US missile defense shield in 2017—may also produce a more muted response.

- Indonesia is not likely to face a significant punitive economic statecraft response from China in a potential Taiwan crisis. Though Indonesia is indirectly linked to Taiwan via overlapping territorial claims in the South China Sea, China’s trade and investment weight provide strong incentives for Indonesia to maintain its foreign policy stance of nonalignment in a Taiwan scenario.

Where new economic statecraft (by China or the G7) might affect outcomes, it is likely to be via positive economic inducements such as investments or favorable trade arrangements well before any Taiwan scenario comes into play. Once a crisis is underway, even substantial promises of future economic benefit are unlikely to override established policies and perceptions of economic self-interest within G20 governments.

Against this backdrop, G7 asks of the rest of the G20 members are similarly likely to be modest. With the G7 likely fractured on questions about sanctions enforcement, the most likely requests will be to support G7 sanctions to the maximum acceptable extent and to avoid exports or transshipment (or even merely increased exports) of dual-use goods or critical technologies. Notably:

- The G7 approach to G20 members that are US military treaty allies (e.g., South Korea, Australia) is more complicated, and the United States and G7 could ask for more substantive cooperation in these cases.

- Requests for supportive statements calling upon China to de-escalate or reduce tensions would likely accompany any G7 request for sanctions compliance.

- Coercive statecraft from the G7 related to sanctions compliance is unlikely, except as necessary to stop flows of critical goods, weapons, or technology to China in the event of escalation.

In a moderate escalation of tensions over Taiwan, maintaining economic ties with Beijing will be a lower-cost option for G20 economies, as China will have incentives to maintain the perception of business as usual and refrain from punitive statecraft tools. In a more extreme scenario, complying with US or G7 sanctions will likely be the lower-cost option for G20 economies given the more significant consequences to global trade and economic conditions that would unfold.

A Taiwan crisis: Situating the G20, China, and Taiwan

In any scenario for escalation of tensions over Taiwan, China’s approach to the rest of the Group of Twenty (G20) is likely to be very different from its approach to the G7. China’s economic statecraft tactics generally incorporate country conditions and dependencies upon trade and capital flows, deploying tools opportunistically to maximize incentives to align with Beijing’s preferred policies and minimize costs to China’s economy. G20 countries that are not part of the G7 have very different economic exposures and linkages with China, necessarily changing the contours of potential economic statecraft they face. Trade stands as one example; while G7 countries are exposed to China through trade channels, with over $358 billion3All values given in $ are in US dollars unless otherwise noted. in annual exports exposed to potential disruptions from economic statecraft,4Logan Wright, Agatha Kratz, Charlie Vest, and Matt Mingey, Retaliation and Resilience: China’s Economic Statecraft in a Taiwan Crisis, Atlantic Council and Rhodium Group, April 2024, https://www.atlanticcouncil.org/in-depth-research-reports/report/retaliation-and-resilience-chinas-economic-statecraft-in-a-taiwan-crisis/. G20 countries are even more dependent on China as a source of export demand. China absorbed nearly 13 percent of G20 exports (ex-G7) in 2023, compared to roughly 7 percent of G7 exports in the same period (see figure 1). Although China’s lack of effective financial statecraft tools (to date) places some limits on its leverage against the G7, its existing (and well-honed) trade statecraft tools have the potential to be even more effective against G20 countries.

Figure 1

In comparison, Taiwan’s relatively small share of G20 trade and investment flows does little to counterbalance China. This asymmetry allows China’s economic statecraft measures to serve as significant mechanisms to counter G7 objectives and obtain alignment from third countries in a Taiwan escalation scenario.

Escalation scenarios

This report adopts the exact scenario framework we deployed for our 2023 report on G7 sanctions, Retaliation and Resilience: China’s Economic Statecraft in a Taiwan Crisis, to evaluate China’s likely statecraft responses in scenarios of escalating military tension over Taiwan. This scenario framework encompasses both past cases of economic statecraft as well as China’s response to new developments and the potential intensification of a crisis. The scenarios are characterized not by the severity of the initial events behind a Taiwan escalation—for example, whether China launches military exercises—but by the G7’s response to those escalatory steps. As before, we consider two scenarios:

Moderate-escalation scenario: China responds to the United States taking an escalatory diplomatic action in the Taiwan Strait, such as a substantial deepening of the political relationship with Taiwan, a step change in military aid, or a limited sanctions package in response to Chinese aggression toward Taiwan. In this scenario, China reacts with economic statecraft measures targeting the United States designed to impose relatively higher costs on the United States than China. China’s willingness to use statecraft is constrained by the necessity to maintain a strong business environment amid high geopolitical tensions.

High-escalation scenario: China retaliates against a maximalist G7 sanctions package that includes full blocking sanctions on China’s major banks and the People’s Bank of China (PBOC), sanctions on senior political figures and business elites, and trade bans on products relevant to China’s military development.5Charlie Vest and Agatha Kratz, Sanctioning China in a Taiwan Crisis, Atlantic Council and Rhodium Group, June 21, 2023, https://www.atlanticcouncil.org/in-depth-research-reports/report/sanctioning-china-in-a-taiwan-crisis-scenarios-and-risks/. China adopts a much stronger and broader set of economic statecraft measures against the entire G7, with the intent to impose costs as high as possible on the sanctioning economies.

Both scenarios stop short of war or the initiation of kinetic conflict between China and the United States or other G7 countries. Rather, they are meant to provide a context to evaluate the potential use of China’s statecraft tools. We consider only economic statecraft responses in a Taiwan escalation scenario, although China is also likely to consider military and quasi-military actions that are outside the scope of this paper, such as undersea cable cuttings, cyberattacks, quarantines of commercial ships, or blockades.

Table 1. China’s response and economic statecraft under moderate- and high-escalation scenarios

Although the report does not focus on inciting events, we note that the most likely triggers would still come from China, or alternatively, US or G7 action toward Taiwan, rather than a third country (from a G20 member, for example) acting unilaterally against China or deepening engagement with Taiwan. None of the case countries are seeking to substantially increase political ties with Taiwan or provide defense aid at present, making them more likely to begin as observers in any escalation scenario.

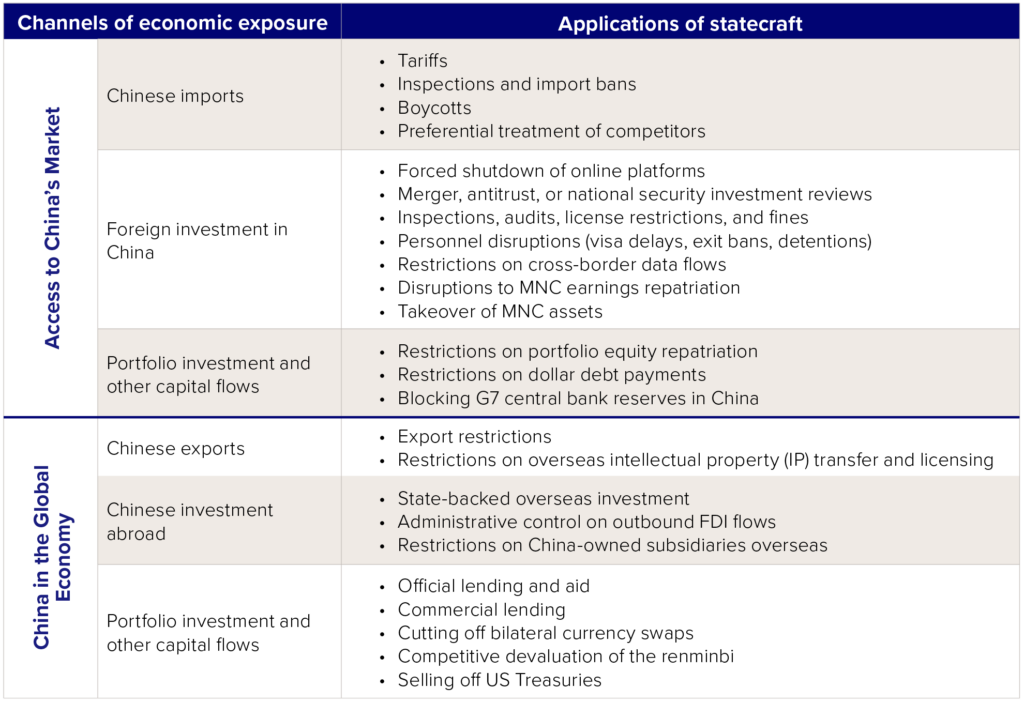

Historical observations of China’s economic statecraft

Several factors are likely to affect China’s use (or nonuse) of economic statecraft to influence G20 countries in the wake of a Taiwan escalation scenario. Historically, China has deployed coercive economic statecraft more frequently against G7 competitors—and Taiwan—than emerging and developing economies, or members of the G20. Negative or punitive economic statecraft—including the tools described in table 2—carries reputational costs for China and undermines its attempts to present itself as a generous economic partner and neutral force supporting global development and win-win outcomes for the Global South.6See, for example, Audrye Wong, “China’s Economic Statecraft: Lessons Learned from Ukraine,” Washington Quarterly 46, no. 1 (2023): 121–36, https://doi.org/10.1080/0163660X.2023.2188830. Chinese analysts also point out that economic statecraft such as trade retaliation conducted on national security grounds—presumptively allowed under World Trade Organization (WTO) rules—risks expanding the scope of national security claims in ways that might backfire on China, allowing the United States to use similar justification against Chinese interests.7See discussion in Ketian Vivian Zhang, “Just Do It: Explaining the Characteristics and Rationale of Chinese Economic Sanctions,” Texas National Security Review 7, no. 3 (2024), https://tnsr.org/2024/06/just-do-it-explaining-the-characteristics-and-rationale-of-chinese-economic-sanctions/.

Table 2. China’s negative economic statecraft tools

More broadly, China’s foreign policy toward developing countries in the G20 and beyond presumes that China’s economic weight and active engagement with the Global South will effectively incentivize it to align with China and adopt its preferred policies. This prioritizes positive economic statecraft—in the form of aid, sovereign lending, investment, and other tools—over coercive measures. It is somewhat misleading to directly compare instances of China’s negative economic statecraft with “instances” of positive statecraft, which involve long-term framework agreements and flows over time. Nevertheless, the fact that China committed an estimated 21,000 aid, loan, and other assistance projects between 2000 and 2021, compared to roughly sixty isolated cases of negative economic statecraft in the same period, illustrates the weight of positive and negative tools in China’s economic diplomacy tool kit.8Positive statecraft estimates include loan and grant projects alongside other aid types as captured in AidData’s Global Chinese Development Finance Dataset (v3.0), https://www.aiddata.org/data/aiddatas-global-chinese-development-finance-dataset-version-3-0. Estimates of negative statecraft from Rhodium Group research, covering 2000–2022, exclude purported boycotts of foreign brands within China.

At the same time, G20 membership does not inoculate a country against economic or strategic coercion by China. G20 member South Korea was subject to some of China’s most costly coercive measures to date in 2017, primarily targeting retailer Lotte and the nation’s tourism industry. China’s de facto trade ban against Lithuania— A country represented at G7 and G20 meetings via the EU’s participation, and which is clearly seen as part of the Western, G7+ bloc on sanctions against Russia—in 2021 and 2022 was even more severe, cutting off almost all exports from Lithuania to China for several months. These measures have caused substantial economic damage. Estimates of the fallout from measures against South Korea in 2017 run as high as 0.4 percent of gross domestic product (GDP); in Lithuania, central bank estimates suggested damage as high as 0.5 percent of GDP in 2022 and 1.3 percent of GDP in 2023.9Estimates cited within Jonas Deveikis, “China Sanctions vs Taiwan investments–Lithuania’s Central Bank Weighs Economic Impact,” January 21, 2022, https://www.lrt.lt/en/news-in-english/19/1593215/china-sanctions-vs-taiwan-investments-lithuania-s-central-bank-weighs-economic-impact. These might form lower bounds for the potential fallout of a “high” Taiwan escalation, should China feel compelled to override past strategic practice to impose severe coercive statecraft.

What might prompt China’s officials to deploy more aggressive negative statecraft against G20 partners? Taiwan already represents the most critical of China’s “core” security interests—alongside Hong Kong and Xinjiang—going to the heart of the Chinese Communist Party’s legitimacy. Past cases suggest China generally has several simultaneous goals when it deploys economic statecraft related to its core interests. These involve coercing a target country to change perceived offensive policies (compellence); demonstrate the potential costs to other countries (deterring or dissuading); and, importantly, express its disapproval and resolve to domestic audiences. But as described below, China’s existing economic leverage over the G20 already strongly incentivizes member countries to align with (or remain publicly neutral toward) China’s issues and policy positions. Import restrictions on specific agricultural goods, such as China’s notorious “pineapple ban” against Taiwan in 2016 or the “banana ban” against the Philippines in 2012 lie somewhere in between: Though they target sectors with extensive reliance on China and are thus intended to cause some harm to target states, they also minimize overall economic costs to China and the intended target.

This means that If China were to deploy economic statecraft against G20 countries, it would primarily be to dissuade other countries from following suit—in say, enforcing US-led sanctions—or to mollify domestic audiences. Past cases of economic coercion are informative, but not instructive, and any of the tools in table 2 might theoretically be deployed. However, China’s toolkit is generally less effective against G20 countries because they feature lower levels of foreign direct investment (FDI) and other investment by multinational companies (MNCs) in China, providing very narrow targets for disruption or expropriation. For example, Brazil’s total stock of FDI in China and Hong Kong stood at less than $1 billion as of 2022,10International Monetary Fund, Coordinated Direct Investment Survey (CDIS) data, 2024. compared to more than $400 billion in G7 FDI assets in China that our previous report identified as at risk in a Taiwan escalation.11Ministry of Commerce of the PRC in Wright et al., Retaliation and Resilience, 17. Likewise, G20 nations such as Turkey and India have few high-profile brands in China that are susceptible to consumer boycotts. Of course, investment linkages exist that may still provide some leverage. Brazil’s Embraer pulled out of its only manufacturing investment in China in 2016, a joint venture manufacturing narrow-body aircraft.12“Brazil’s Embraer Ends Business Jet Production in China,” Reuters, June 1, 2016, https://www.reuters.com/article/markets/us/brazils-embraer-ends-business-jet-production-in-china-idUSE6N177049/. But sales to China’s airlines are still critical to Embraer’s growth prospects and Brazil’s wider aerospace industry.

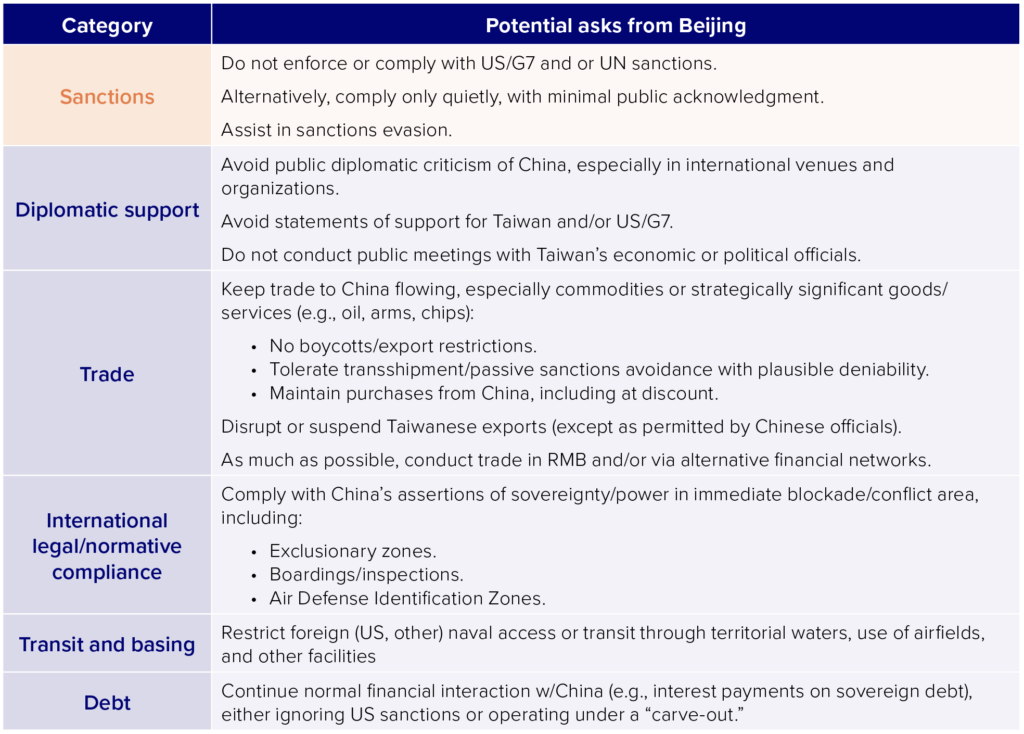

China’s strategy toward the G20

In a scenario of escalating tensions over Taiwan, China’s goals in its approach to G20 countries would naturally depend on the conditions behind that escalation, as well as the response of G7 countries individually and collectively. As our previous report argued, China is likely to attempt to split or divide G7 countries to forestall a collective response, and limit the scope, duration, and intensity of that response. Nevertheless, some form of US or G7 response involving sanctions or other economic statecraft is likely, and the G20 will be key to China’s attempts to counteract or circumvent those measures. G20 countries are potentially valuable to China as sources of diplomatic cover, but also as economic nodes and alternative economic partners that will be necessary for China to minimize the damage to its own economy, whether from the market reaction to a Taiwan escalation, explicit G7 or G20 foreign policy, or other factors. The ways in which China might be expected to solicit G20 support in a Taiwan escalation, including in our case countries, are detailed in table 3.

Table 3. China’s asks in a Taiwan crisis

Although some of these asks are economic in nature, diplomatic support is also crucial. In the event of escalation over Taiwan, the United States and G7 will likely seek out statements of support for de-escalation and calls for China to reducing the resulting tensions, including from G20 members. China would also seek statements of neutrality or asking countries to respect Chinese sovereignty claims over Taiwan, while avoiding diplomatic engagement with Taiwanese officials that might imply greater recognition of Taiwan’s sovereignty.

Normative or legal compliance could be a tricky area as well for G20 countries, as China would likely request acknowledgements or acceptance of air defense identification zones and exclusion areas that may implicate commercial and trade traffic from G20 members. These are decisions that have significant implications for China’s sovereignty claims but require little cost for G20 members to implement.

China would have ample opportunity to deploy some of these economic statecraft tools against developing economies as part of an overall strategy to improve its economic and political position under a scenario of escalating tensions over Taiwan.

Three case studies of G20 countries responding to China’s economic statecraft

To explore G20 economic statecraft dynamics, this report examines three country case studies: Brazil, South Korea, and Indonesia. Each country represents a different category of potential exposure to China’s economic statecraft tools. Brazil is a robust commodity exporter. South Korea has an advanced economy with strong technological and manufacturing links to China. And Indonesia is a rapidly developing economy, deploying investment and other financing from China to drive an economic transformation, while at the same time actively contesting China’s territorial claims in the South China Sea.

For each country, the report outlines:

- Existing and historical policy toward Taiwan and foreign conflict;

- Economic relations between each country and China, including the composition and share of trade and investment flows;

- The extent of sovereign finance from China to the country;

- Supply chain interconnections and other economic factors;

- Past sanctions practice and alignment, with either China or G7 countries. This includes recent international sanctions against Iran, Russia, North Korea, and Venezuela (where applicable).

We synthesize these data sources to identify China’s most likely asks of each country in “moderate” and “high” escalation scenarios, respectively, as well as each country’s most likely policy outcome(s). Where available, we supplement policy and data analysis with interviews of policymakers, former officials, and experts from each country.

Brazil’s experience with China is affected both by its robust trade relationship with and increasing trade dependence on China, which would likely ensure Brazil’s public neutrality in the event of a Taiwan-related scenario. However, its financial sector and strong linkages to global commodities markets provide incentives for Brazil to comply—overtly or quietly—with potential G7 sanctions.

In the case of South Korea, any Taiwan scenario—and Seoul’s reaction to both China’s and the G7’s economic statecraft in the wake of a Taiwan scenario—will be heavily colored by the prospects of wider regional conflict that might involve North Korea. Tightly interconnected value chains and the legacy of China’s measures in the wake of a 2017 dispute over a US missile shield (i.e., Terminal High Altitude Area Defense, or THAAD) deployed in South Korea would heavily impact Seoul’s response.13Darren Lim and Victor Ferguson, “Chinese Economic Coercion During the THAAD Dispute,” ASAN Forum, December 28, 2019, https://theasanforum.org/chinese-economic-coercion-during-the-thaad-dispute/; and Tucker Reals, “Why THAAD Is Controversial in South Korea, China and Russia,” CBS News, May 2, 2017, https://www.cbsnews.com/news/why-thaad-is-controversial-in-south-korea-china-and-russia/.

Lastly, Indonesia’s robust trade and investment relationship with China—and its opportunistic approach to previous international sanctions regimes—suggest it would offer only moderate support for any G7 measures in the wake of a Taiwan escalation. But its own history of maritime disputes with China, as well as its burgeoning military partnership with the United States, might complicate that picture.

Brazil

| Overview |

| Brazil is unlikely to embrace strong G7 measures against China in the wake of any Taiwan-related crisis. China’s economic ties with Brazil are extensive and incentivize Brazil to maintain neutrality. Accordingly, China is not likely to deploy punitive statecraft tools against Brazil. But this economic relationship is more complex than is commonly understood, extending beyond commodity trade in soybeans and oil. Despite ties with China via the BRICS organization and widely publicized agreements to increase renminbi-denominated trade—a likely ask of China in a Taiwan escalation scenario—Brazil’s cooperation with China does have practical limits. Brazil’s financial sector will likely comply with G7 secondary sanctions; greater degrees of alignment with either the G7 or China will likely depend on the scenario and the global response in emerging markets and the Global South. |

Brazil is unlikely to actively support high-level G7 sanctions or economic statecraft in the wake of a Taiwan crisis, but also remains unlikely to accede to China’s political requests either. Brazil’s long-standing pursuit of neutrality in most international conflicts, the peripheral nature of the Taiwan issue to domestic policymakers, and its strong reliance on China as a trade and investment partner all would influence Brazil’s response to a Taiwan escalation and mute Brazil’s diplomatic and policy reaction. But discussions with Brazilian analysts and policymakers also suggest that Brazil would still enforce US secondary sanctions—if only to preserve smooth functioning of its financial sector—and would not seek to amplify China’s already-outsized influence in emerging-market blocs such as the expanded BRICS.

Stated positions on Taiwan

Taiwan is simply not a major foreign policy issue in Brazil. Since establishing diplomatic relations with the PRC in 1974, Brazil has professed adherence to the “One China” principle (distinct from the US description of a one China policy), and explicitly reaffirmed support for the principle in 2022 and 2023.14Marcelo Rech, “Brasil se mantém fiel ao princípio de ‘uma só China’ em meio às tensões na Ásia,” InfoRel, August 10, 2022, https://inforel.org/2022/08/10/brasil-se-mantem-fiel-ao-principio-de-uma-so-china-em-meio-as-tensoes-na-asia/; “Press Release: Joint Communiqué between the Federative Republic of Brazil and the People’s Republic of China on the Deepening of Their Global Strategic Partnership-Beijing, 14 April 2023,” Brazil Ministry of Foreign Affairs, April 14, 2023, https://www.gov.br/mre/en/contact-us/press-area/press-releases/joint-communique-between-the-federative-republic-of-brazil-and-the-people2019s-republic-of-china-on-the-deepening-of-their-global-strategic-partnership-beijing-14-april-2023; and “Brasil reitera posição contra independência de Taiwan durante visita de chanceler da China,” Jornal do Comércio, January 19, 2024, https://www.jornaldocomercio.com/internacional/2024/01/1139844-brasil-reitera-posicao-contra-independencia-de-taiwan-durante-visita-de-chanceler-da-china.html. More broadly, Brazil has pursued a global foreign policy based on neutrality, especially when it comes to extra-regional conflicts including Ukraine,15Ryan Berg and Carlos Baena, “The Great Balancing Act: Lula in China and the Future of U.S.-Brazil Relations,” Center for Strategic and International Studies (CSIS), April 19, 2023, https://www.csis.org/analysis/great-balancing-act-lula-china-and-future-us-brazil-relations. Brazil and China also unveiled a joint proposal for peace talks during the UN General Assembly meetings in September 2024. See Simon Lewis, “China, Brazil Press On with Ukraine Peace Plan despite Zelenskiy’s Ire,” Reuters, September 27, 2024, https://www.reuters.com/world/china-brazil-press-with-ukraine-peace-plan-despite-zelenskiys-ire-2024-09-27/. although it has also been critical of Israel’s response in the wake of Hamas’s attack of October 7, 2023.16Eléonore Hughes, “Brazil’s President Withdraws His Country’s Ambassador to Israel After Criticizing the War in Gaza,” AP News, May 29, 2024, https://apnews.com/article/brazil-lula-israel-ambassador-withdrawn-af9d295d989a86c4fcd8ca4531350f42; and “Brazil Postpones Israel Arms Deal for Second Time Over Gaza Genocide,” Middle East Monitor, August 13, 2024, https://www.middleeastmonitor.com/20240813-brazil-postpones-israel-arms-deal-for-second-time-over-gaza-genocide/.

Economic interaction with China

Economic and financial ties with China—and the latent dependence on China that those ties represent—would also likely incentivize Brazil to adopt a muted response to any Taiwan-related escalation. Brazil is a unique case among the G20: Although China is Brazil’s largest trading partner, like many other G20 countries (and BRICS countries, too), it is one of the few that runs a trade surplus with China.17As of 2023, most countries in the world—just over 150—ran a trade deficit with China. Large commodity exporters like Brazil and Angola were rare exceptions. See Jürgen Matthes, “China’s Trade Surplus–Implications for the World and for Europe,” Review of European Economic Policy 59, no. 2 (2024): 104–11, https://www.iwkoeln.de/en/studies/juergen-matthes-chinas-trade-surplus-implications-for-the-world-and-for-europe-eng.html. Brazil’s economy is thus highly exposed to China, which absorbs more than half of Brazil’s total exports (see figure 2) and a plurality of its top three exports: soybeans (70 percent), crude oil (40 percent), and iron ore (60 percent).18Ministério do Desenvolvimento, Indústria e Comércio Exterior data accessed via International Trade Centre, 2024, https://www.trademap.org/.

This reliance has helped and hurt Brazil in the past. While Brazil was hit hard by China’s growth slowdown in 2015-2016, China’s outperformance in 2020 during its COVID-19 lockdown phase helped Brazil maintain export and current account performance. Brazil’s trade with China extends beyond commodities and primary inputs to metal ores and even aircraft (from Brazilian plane maker Embraer). This exposes Brazil to broader change in China’s investment and property market conditions, on top of its commodity exports.19This reliance is asymmetric. Brazil provides only a small portion of crude imports—Middle Eastern countries and Russia are now China’s primary suppliers of crude. For other goods, like soybeans and iron ore, China would have few alternative suppliers at scale save for the United States and Australia. Importantly, despite a 2023 agreement meant to expand RMB-denominated trade and discussions of a new BRICS currency, much of Brazil’s trade with China is still transacted in US dollars.

China is also a substantial source of FDI for Brazil. Brazilian industry analysis estimates total investment by China in Brazil totaled $73 billion between 2007 and 2023, with three-quarters of that value going to FDI projects in electricity or oil. Chinese companies have ownership of 10 percent of Brazil’s national energy-generation capacity and about 12 percent of energy-transmission capacity.20Tulio Cariello, “Chinese Investments in Brazil 2023: New Trends in Green Energy and Sustainable Partnerships [Investimentos Chineses No Brasil 2023: Novas Tendências Em Energias Verdes E Parcerias Sustentáveis],” Brazil-China Business Council, September 2024, 9–16, https://static.poder360.com.br/2024/09/estudo-investimentos-china-no-brasil.pdf. Likewise, most Chinese loans to Brazil between 2010-2021 funded projects in the energy and mining industries (figure 2).

Beyond regular returns, the power sector has the most developed regulatory framework of all Brazilian sectors, which has contributed to new Chinese investment, particularly following a pullback in developed market investment after several corruption scandals in Brazil (e.g., the 2014-2021 task force probe called Lavo Jato, or Car Wash).21Author interview with think tank researcher, Rio de Janeiro, July 2024; interviewees were promised anonymity and aggregated presentation of interview results. For more on the probe’s effects, see Amelia Cheatham, “Lava Jato: See How Far Brazil’s Corruption Probe Reached,” Council on Foreign Relations, last updated April 19, 2021, https://www.cfr.org/in-brief/lava-jato-see-how-far-brazils-corruption-probe-reached. These investments slowed during the Bolsonaro era in Brazil from 2019 to 2022, even as Bolsonaro‘s criticisms of Chinese economic engagement in critical Brazilian industries became more moderate after his election.22Guy Burton, “What President Bolsonaro Means for China-Brazil Relations,” Diplomat, November 9, 2018, https://thediplomat.com/2018/11/what-president-bolsonaro-means-for-china-brazil-relations/. Even though Brazil is one of the only countries in Latin America to receive significant new sovereign loans from Chinese banks since 2020, major loans to Brazil have similarly declined since 2016.

These economic relations remain in flux. Newly reelected President Luis Ignacio Lula da Silva has reemphasized bilateral ties and signed fifteen bilateral agreements with China totaling around $10 billion during his 2023 visit. But Brazil also launched trade investigations into Chinese imports, most notably steel and chemicals.23Bryan Harris et al., “Investigations Reflect Fears of Flood of Cheap Chinese Products but Could Strain Brasília’s Ties with Beijing,” Financial Times, March 17, 2024, https://www.ft.com/content/8703874e-44cb-4197-8dca-c7b555da8aef.

Figure 2. Snapshot of China-Brazil ties in exports and loans

As Brazil is a major supplier of commodity exports to China, should China attempt to stockpile soybeans and crude oil (as might be expected before a high-escalation scenario). Brazil’s trade exposure to China would only be expected to spike.

Past sanctions alignment

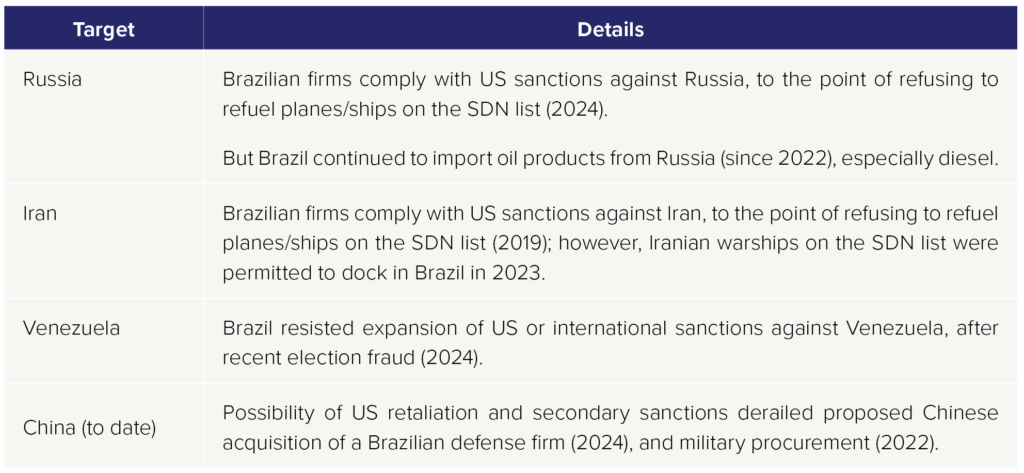

Brazil has grudgingly complied with previous US and United Nations (UN) sanctions regimes, including specially designated nationals (SDN)—the individuals/entities controlled, owned, or acting for or on behalf of targeted countries—designations related to Russia and Iran. The threat of secondary sanctions also has influenced Brazil’s defense relationship with China. This reflects Brazil’s status as a regional financial hub—including Latin America’s five largest banks by total assets—which would be squarely threatened by the imposition of strong secondary sanctions.24Samantha Lipan and Marissa Ramos, “Latin America’s 30 Largest Banks by Assets, 2024,” S&P Global Research, April 30, 2024, https://www.spglobal.com/marketintelligence/en/news-insights/research/latin-americas-30-largest-banks-by-assets-2024. Brazilian authorities routinely collaborate with US and UN officials on sanctions targeting money laundering and transnational criminal groups.

Table 4. Brazilian cooperation with domestic and international sanctions (select cases)

However, US or G7 sanctions squarely targeting Brazil’s relationship with China would likely be much more fraught. The risk of negative or punitive economic statecraft against Brazil from China is low, as Brazil’s likely neutrality will probably suit China’s preferences in a Taiwan contingency. Several Brazilian foreign policy experts have argued that neutrality would be most strategically optimal for Brazil in a Taiwan escalation,25Gabriel Ronan, “Crise China e Taiwan: como o conflito afeta a economia do Brasil?,” O Tempo, August 4, 2022, https://www.otempo.com.br/mundo/crise-china-e-taiwan-como-o-conflito-afeta-a-economia-do-brasil-1.2710810. lessening the need for China to apply coercive leverage in a moderate or even high scenario. China would also likely be more reluctant to target a fellow BRICS member, especially during a tentative rapprochement between China and Brazil after Bolsonaro’s exit. Recent BRICS communiqués have explicitly condemned “unilateral trade measures” and perceived violations of the WTO system.26The Ministry of Foreign Affairs of the Russian Federation, “Joint Statement of the BRICS Ministers of Foreign Affairs/International Relations, Nizhny Novgorod, Russian Federation, 10 June 2024,” June 10, 2024, https://mid.ru/en/foreign_policy/news/1955719/; and Department of International Relations and Cooperation of South Africa, “XV BRICS Summit Johannesburg II Declaration,” August 23, 2023, https://brics2023.gov.za/2023/07/05/summit-declarations/.

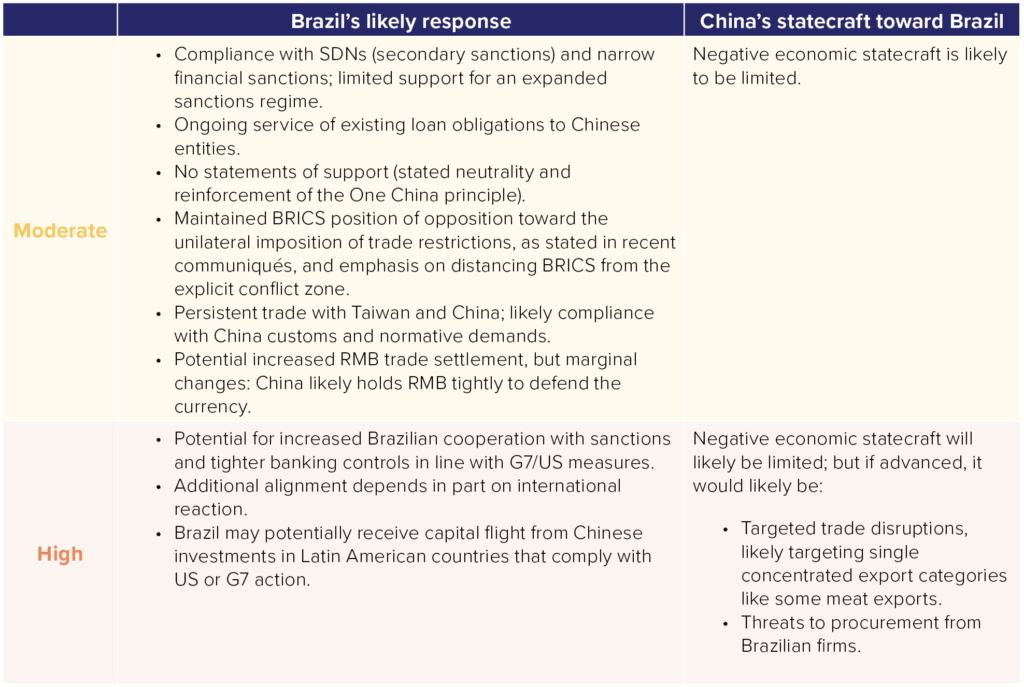

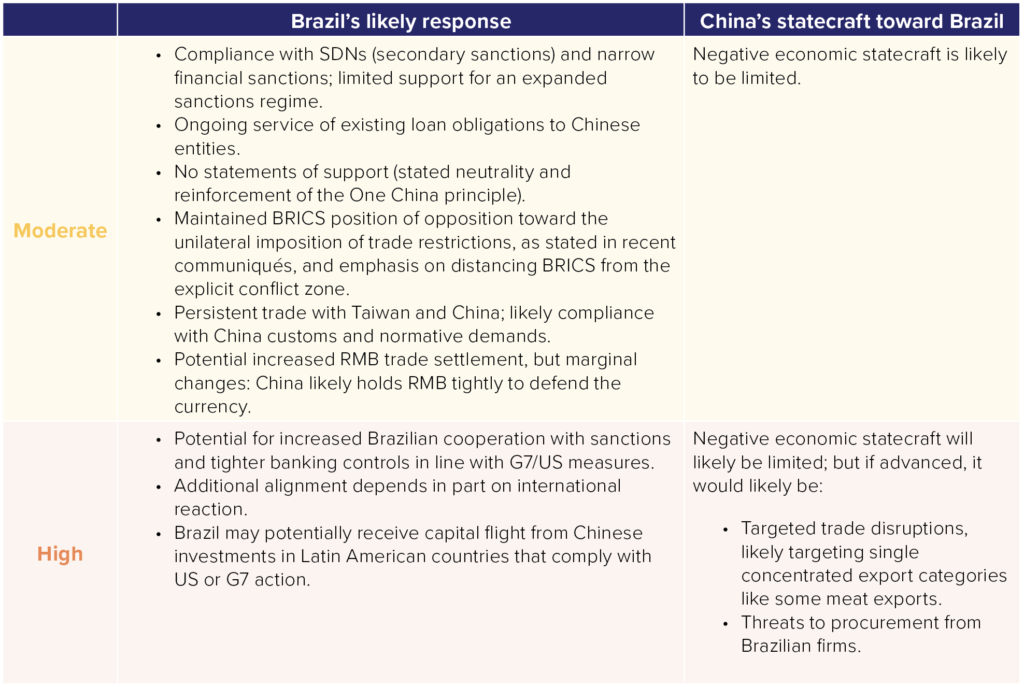

Brazil in a Taiwan escalation scenario

Table 5. Brazil’s anticipated activity by escalation level

The prospects of Brazil joining with the G7 to enforce strict sanctions in a “high” escalation scenario are also remote, though Brazilian financial institutions would still be strongly incentivized to enforce US secondary sanctions and retain access to US dollar clearing markets. The proportion of RMB-denominated trade and overall foreign exchange turnover between Brazil and China has risen in recent years (see figure 3),27Author analysis of Bank for International Settlements (BIS) 2019 and 2022 Triennial Central Bank Survey data. BIS, “Triennial Central Bank Survey of Foreign Exchange and Over-the-counter (OTC) Derivatives Markets in 2022,” https://www.bis.org/statistics/rpfx22.htm. but Brazil still overwhelmingly transacts and denominates its trade in US dollars.28Daniel Gersten Reiss, “Invoice Currency: Puzzling Evidence and New Questions from Brazil,” Banco Central do Brasil, Working Papers No. 382, March 2015, https://www.bcb.gov.br/pec/wps/ingl/wps382.pdf/. Data in this paper is from 2015 but indicates the strong reliance upon the US dollar for both invoicing of exports (around 95 percent) and imports (around 85 percent) in Brazil. In a Taiwan crisis, China might request that Brazil complete more transactions in RMB, as it has done in workaround trade with Russia since 2022. But the likelihood that China would limit global RMB liquidity during an escalation, in order to defend the stability of the currency, puts a ceiling on the volume of transactions that can be processed. China’s bilateral swap lines also are unlikely to come into play (see adjacent box).

Figure 3

Even in a moderate-escalation scenario, and absent any coercive trade actions by China, Brazil’s exports could be affected by disruptions to shipping lanes. For example, most soybean exports proceed either past the Cape of Good Hope in South Africa or through the South China Sea; only a small volume is shipped via the Panama Canal. During a moderate- or high-escalation scenario, this would leave Brazilian shipping exposed to the same higher costs (and possible diversions around the South China Sea or Taiwan Strait) facing European shippers.

In a high-escalation scenario, trade disruptions are likely to be even more severe in the form of increased shipping costs and route diversion. Under such conditions—especially if precipitated by military action or a blockade of Taiwan—China will likely have already stockpiled significant quantities of crude oil and soybeans. Though it would naturally seek to maintain trade flows, this would provide it with little need or desire to deploy coercive trade tools against Brazil. Instead, Brazil’s priorities would likely include keeping the BRICS grouping out of the explicit conflict and counterbalancing likely overt Russian support for China. Compared to other BRICS countries, Brazil would be more amenable to stricter international sanctions packages, though Brazil’s preference for UN sanctions authorization may be an insurmountable hurdle to supporting expanded trade and financial restrictions.

Box 1: China’s bilateral swap lines

China has signed several bilateral currency swap deals with its trading partners starting in 2010, designed at first to insulate China’s trade from risks of tightening US dollar trade finance during the global financial crisis. China’s first swap line with Brazil was signed in 2013 for a total of 190 billion yuan or 60 billion reals, designed to facilitate trade financing. Most of these swap lines were used very sparsely in their early years, and there are no available records of the swap line between China and Brazil being utilized over the past decade (although it may have occurred).

China and Brazil only proceeded to deepen their financial relationship with a memorandum of understanding to set up clearing arrangements for China’s currency in Brazil in February 2023.29Reuters, “China Says It Will Set Up Yuan Clearing Arrangements in Brazil,” February 7, 2023, https://www.reuters.com/markets/currencies/china-says-it-will-set-up-yuan-clearing-arrangements-brazil-2023-02-07/. In March 2023, the financial relationship expanded with an arrangement to trade directly in RMB or Brazilian real, bypassing the US dollar for settlement. The RMB became the second-largest component of Brazil’s foreign exchange reserves as of the end of 2022, at 5.3 percent of reserves or $17.4 billion, likely a result of the rising use of RMB payments by Chinese importers from Brazil.30Reuters, “Yuan Tops Euro as Brazil’s Second Currency in Foreign Reserves,” March 31, 2023, https://www.reuters.com/article/markets/currencies/yuan-tops-euro-as-brazils-second-currency-in-foreign-reserves-idUSL1N3632DU/.

Technically, trading with China in RMB is more feasible in Brazil than in other markets because Brazil runs a trade surplus with China, receiving more RMB as payments for its exports. China runs trade surpluses with most of its trading partners, making it difficult to facilitate trade in RMB (as countries would need to pay in foreign currencies for Chinese exports). The expansion of trade between China and Brazil in RMB can continue as long as Brazilian firms, banks, and the central bank are willing to accept the currency risk of holding RMB-denominated assets, which will involve more direct investments back into China’s financial markets.

Indirect data measures from the Bank for International Settlements (BIS) indicate that the proportion of Brazilian real currency trading relative to the US dollar is still around 95 percent of the total, with similar proportions for RMB trading against the dollar.31Bank for International Settlements, Triennial Central Bank Survey, October 2022, data from tables 4 and 5 concerning foreign exchange turnover, https://www.bis.org/statistics/rpfx22_fx.pdf. Trading activity between the BRL and RMB was too small to be measured in the BIS Triennial Survey, but will probably have picked up marginally starting in 2023.

For economic statecraft purposes, the net effect of the currency swap arrangements and direct trading in China’s currency or the Brazilian real is minimal. The swap lines could be withdrawn, or Brazilian assets in Chinese markets could be frozen or immobilized, but US dollar trading remains highly active in Brazil. China’s leverage over Brazil is much stronger in terms of influence over trade activity and flows, given that China is Brazil’s largest export market.

South Korea

| Overview |

| Escalation of tensions over Taiwan would likely move South Korea closer than other G20 partner countries to alignment with G7 priorities, but South Korea will likely prefer to comply with G7 regulations rather than implement complementary regimes nationally that directly target China, and will continue seeking exemptions for key industries for as long as possible. South Korea will prioritize managing security risks posed by opportunistic attacks from North Korea and the potential for increasing China-North Korea cooperation. This will temper South Korea’s willingness to impose economic restrictions on China, but will increase South Korea’s reliance upon and acceptance of a US security presence in the Indo-Pacific region. Extensive ties in critical technology supply chains that are at the forefront of current US technology restrictions continue to pose high costs and barriers for South Korean compliance on export and investment restrictions. Some industries are slowly decoupling, but are also slow to restructure. Nonstrategic but high-revenue industries, such as consumer goods, will attempt to stay in the Chinese market for as long as possible and pose a continued risk for retaliatory statecraft. Heightened risks of operating in the Chinese market under US restrictions will drive some decoupling and eventually reduce the costs posed by China’s economic statecraft. |

South Korea’s stated positions on Taiwan

South Korea stands apart from US G7 allies for its historically more flexible and reserved position on cross-strait relations. South Korea does not maintain official diplomatic relations with Taiwan, yet it has never officially acknowledged the One China principle and maintains unofficial working dialogues with Taiwan through the Taipei Mission in Seoul. Recent South Korean presidencies have shifted closer toward a US-aligned position. In a 2021 joint statement, President Moon Jae-in stated South Korea’s intentions to work closely with the United States on preserving “peace in the Taiwan Strait,”32White House Briefing Room, “Remarks by President Biden and H.E. Moon Jae-in, President of the Republic of Korea, at Press Conference,” May 21, 2021, https://www.whitehouse.gov/briefing-room/speeches-remarks/2021/05/21/remarks-by-president-biden-and-h-e-moon-jae-in-president-of-the-republic-of-korea-at-press-conference/. and, in 2023, President Yoon Suk Yeol characterized cross-strait relations as a global issue, similar to North Korean relations, and stated his opposition to the use of force to change the status quo.33Reuters, “China Lodges Complaint Over South Korean President’s ‘Erroneous’ Taiwan Remarks,” April 23, 2023, https://www.reuters.com/world/asia-pacific/china-lodges-complaint-over-south-korean-presidents-erroneous-taiwan-remarks-2023-04-23/. These statements, along with Taiwan’s participation in the 2024 Third Summit for Democracy, hosted alongside the United States in Seoul,34Reuters, “China Protests Taiwan Minister’s Role at Seoul Summit Backed by U.S.,” March 18, 2024, https://www.reuters.com/world/china-protests-taiwan-ministers-role-seoul-summit-backed-by-us-2024-03-18/. are a departure from South Korea’s passivity toward strategic balancing in the Indo-Pacific region and show initiative for consensus building among partners. At the same time, South Korea maintains a preference for rhetorically minimizing China’s role and relationship with Taiwan, and for approaching cross-strait relations collectively to reduce the risk of targeted repercussions.

Economic interaction with China

South Korea is a global leader in several industries that are covered by current or proposed US export and investment restrictions on China. Compared to other partners, South Korea’s compliance with US regulatory actions has a greater significance to the G7’s ability to restrict China’s access to advanced technology in sectors such as semiconductors, high-performance computing, and EV batteries. However, South Korea’s economic integration with China is significant, not only in terms of the magnitude of overall economic activity but also for its strong ties in critical goods supply chains. These economic ties pose steep costs for South Korean compliance with restrictions on these sectors.

China is South Korea’s largest export market, accounting for around 20 percent of total exports in 2023, although this share has declined since the 2010s. Two-way trade links in intermediate goods for electronics manufacturing supply chains are substantial, and South Korea depends on Chinese imports for a significant share of critical inputs to its industrial sectors (see figure 4). Electrical machinery and equipment, including finished electronics and semiconductors, is by far the largest class of goods for two-way trade, amounting to $53 billion in exports in 2023 and $50 billion in imports.35Rhodium Group analysis of Korea Customs and Trade Development Institute data (KCTDI), accessed via International Trade Center (ITC) Trade Map. Semiconductors are the most significant component of the bilateral trade relationship, and the industry is an important source of revenue for the South Korean economy. China also is a large market for many nonstrategic South Korean export industries, such as processed plastics, cosmetics, and tourism, and for large consumer-goods MNCs, like Lotte, with substantial sales through affiliates in China. However, intrafirm transfers account for a large portion of China-Korea trade (see figure 4). Barriers to diversification are lower for this proportion of trade. A large share of intrafirm trade is between semiconductor MNCs, Samsung’s and SK Hynix’s manufacturing branches in China, and their domestic counterparts. Intrafirm trade is declining as these and other firms localize more of their operations.

South Korean investment in China is also extensive, particularly when including Hong Kong, and is largely dominated by investments in semiconductor manufacturing. In 2023, new South Korean investments in China dropped substantially, driven by record lows in semiconductor investment. As it becomes more challenging for these firms to equip their fabrication facilities in China, disinvestment may accelerate. However, manufacturing assets in China that rely on access to covered products contribute significantly to South Korea’s economy and require intensive capital investment to derisk, which will pose high costs for alignment on restricting these sectors. The South Korean government recently pledged $29 billion in subsidies over the next five years to help electric vehicle (EV) battery makers move their supply chains out of China to comply with US Inflation Reduction Act EV tax credits that prohibit sourcing from Chinese and other covered countries’ input suppliers.36Heejin Kim, “South Korea Offers $29 Billion in Aid to Battery Makers amid Metals War,” Bloomberg, December 12, 2023, https://www.bloomberg.com/news/articles/2023-12-12/korea-offers-29-billion-aid-to-battery-makers-amid-metals-war?sref=H0KmZ7Wk. This is a positive sign for South Korea’s willingness to invest in long-term access to the US market at the expense of diversification from China.

Figure 4. Elements and impact of China-South Korea trade

Past cases of Chinese economic statecraft have targeted nonstrategic South Korean industries that generate high revenues from the Chinese market, but where restrictions create minimal costs and risks to the Chinese economy (see box). In an escalation scenario, nonstrategic industries will be more likely to maintain their connections to the Chinese market because replacing the scale of Chinese demand with other markets is challenging and these industries are not the primary recipients of government support for diversification from China. These industries will present continued vulnerabilities to China’s economic statecraft tools.

Box 2: China’s economic coercion punished South Korea for deploying THAAD

South Korea was the target of one of the largest-scale cases of China’s economic coercion after its deployment of THAAD in 2016. China targeted South Korea’s tourism and entertainment industries and corporations based in China, and orchestrated national boycotts of South Korean goods from 2016 to 2017. Estimates of 5 to 12-month losses of revenue from the tourism industry alone range from $6.8 to $15.6 billion, while Lotte reported $1 billion in lost revenues from sales in the Chinese market (as shown below). The Bank of Korea estimated that these disruptions reduced South Korea’s GDP growth by as much as 0.4 percentage points.37Korea Times, “Damage from China’s Ban on South Korean Tours Estimated at 7.5 TLN Won,” December 3, 2017, https://www.koreatimes.co.kr/www/biz/2020/12/602_240286.html.

Past alignment with US and G7 sanctions

Commercial interests limited South Korea’s initial response to G7 actions following the 2014 Russian invasion of Crimea. However, by 2022, South Korea adopted wide-ranging financial restrictions against Russia, in line with G7 sanctions packages (table 6). This was due, in part, to national security concerns over Russian support for North Korea. South Korea has ostensibly complied with relevant US restrictions on China but has sought carve-outs that limit the de facto results of South Korean cooperation. In 2024, South Korean semiconductor makers received an indefinite exemption from US export controls on the export of chips and semiconductor manufacturing equipment to China.

Table 6. South Korea’s alignment with the United States in past cases of sanctions

The Yoon presidency has been more willing to expand the use of economic security tools compared to previous administrations, expanding the scope of restrictions against Russia and North Korea. However, the current administration continues to avoid directly targeting China and future administrations may revert to a more conservative use of economic security tools. In an escalation scenario, South Korea is more likely to signal compliance with US sanctions, as seen in its belated chip alignment, while seeking carve-outs and exemptions that limit impacts on key industries and continue to avoid targeted restrictions on China.

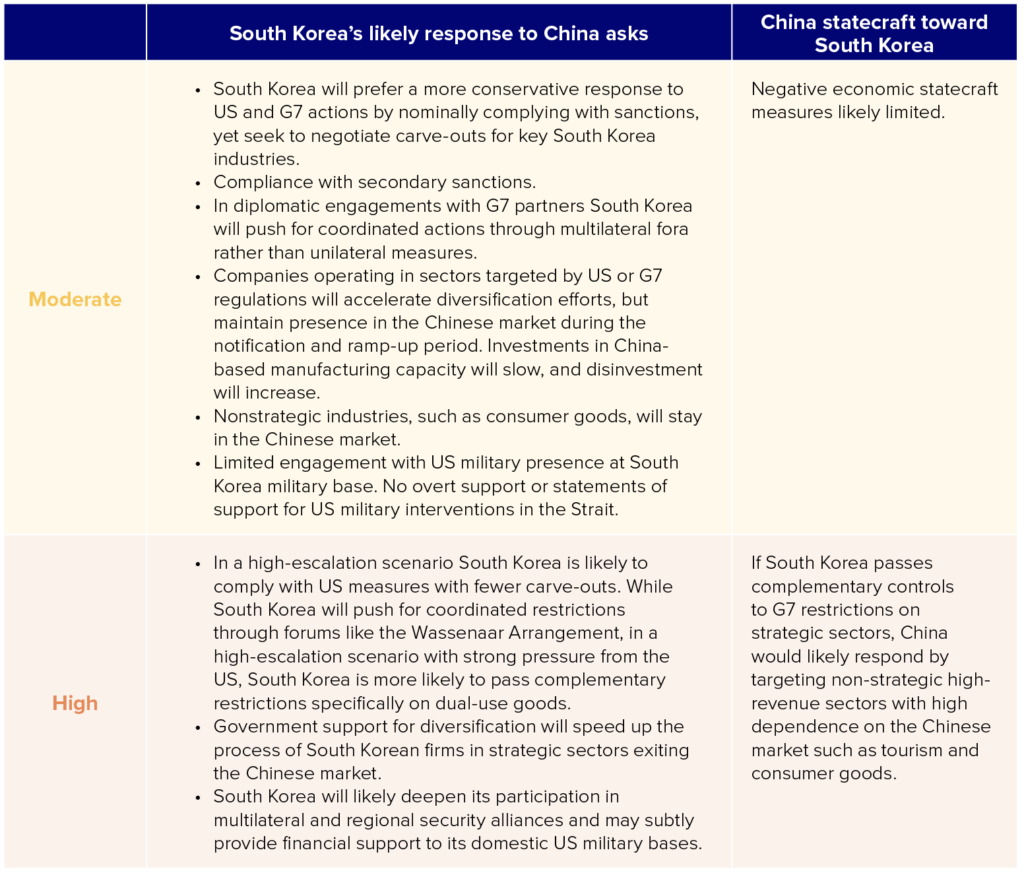

South Korean in a Taiwan escalation scenario

South Korea’s significant economic ties to China in strategic and nonstrategic, high-revenue industries pose high costs and constraints for compliance with G7 actions. However, South Korea’s proximity to the escalation zone and exposure to Chinese economic coercion necessitate safeguards against the risks of a retaliatory and economically weakened China. Anxieties over an opportunistic North Korea and widespread regional supply chain disruptions are also likely to push South Korea closer to G7 alignment than other G20 members, yet South Korea will likely resist partner requests for complementary national restrictions.

Table 7. South Korea’s anticipated activity by escalation level

In a moderate- to high-escalation scenario, South Korea will prioritize mitigating national security risks posed by North Korea and preventing cross-strait tensions from spilling over into regional conflict. South Korea would seek to limit the risks of China mobilizing North Korea and be wary of passing its own economic restrictions that directly target China or conveying direct support for US military mobilization. South Korea’s official position is that it does not maintain a security dialogue with the United States on cross-strait relations. Under a scenario in which the US deploys troops from South Korea, Seoul may quietly provide support services and funding and may seek to expand its technology and security alliances, such as by joining AUKUS, the alliance of Australia, the United Kingdom, and the United States.

South Korea’s calculus for coordinated economic restrictions against China will place greater weight on commercial outcomes in a moderate-escalation scenario in which national security risks are marginally less severe. Yet even in a moderate scenario, under unilateral US actions, South Korean trade with China and affiliate firms in consumer goods industries are likely to face significant disruptions. Financial restrictions will cause a drop in China’s consumption and restrict a large portion of China’s trade finance, shrinking Chinese demand for South Korean industrial output. The declining prospects of the Chinese market will eventually reduce the opportunity costs of decoupling and risks of retaliatory statecraft, but these costs are still likely to remain at levels high enough to require any South Korean government to balance these economic and security risks.

Indonesia

| Overview |

| China’s existing economic influence and engagement in Indonesia—especially its investments in infrastructure and mineral mining and processing—provide strong incentives for Indonesia to avoid alignment with the G7 in any scenario in which sanctions were imposed on China. Indonesia’s long-standing principle of foreign policy neutrality is also determinative. Indonesia is unlikely to execute complementary restrictions on China. Indonesia’s derisking efforts are burgeoning and cooperation with the United States and other G7 partners is increasing, signaling a desire to rely more on the G7 for economic relations. Indonesia is likely to accelerate derisking from China to reduce entanglement in US/G7 sanctions networks, as well as quietly comply with secondary sanctions. However, Indonesia’s derisking efforts are more limited than other G20 partners, and co-investments with China and G7 countries in critical energy and infrastructure sectors would be directly exposed to G7 sanctions. Indonesia is unlikely to face substantial punitive economic statecraft from China in the wake of a scenario in which tensions over Taiwan escalate. |

Indonesia’s stated positions on Taiwan

Indonesia has consistently advocated for the maintenance of the status quo in the Taiwan Strait, for both practical and principled reasons. As China-Indonesia economic relations have deepened, Indonesia has consistently reiterated support for the PRC’s One China principle in public comments and diplomatic agreements.38For example, during the visit by then-Speaker Nancy Pelosi to Taiwan in 2022, Foreign Ministry officials issued a statement calling on “all parties” to avoid escalation, while reaffirming Indonesia’s support for China’s One China principle. See Yvette Tanamal, “Indonesia calls for de-escalation after Pelosi’s Taiwan visit,” Jakarta Post, August 4, 2022, https://www.thejakartapost.com/world/2022/08/03/indonesia-calls-for-de-escalation-after-pelosis-taiwan-visit.html. Though Indonesia’s diplomatic and strategic priorities remain in Southeast Asia and within the Association of Southeast Asian Nations (ASEAN), Taiwan’s status has indirect implications for Indonesia’s own territorial claims against China in the South China Sea, as well as for other ASEAN claims.39Yvette Tanamal, “Taiwan Tensions Cloud ASEAN Meetings,” Jakarta Post, August 5, 2022, https://www.thejakartapost.com/paper/2022/08/04/taiwan-tensions-cloud-asean-meetings.html. As cross-strait tensions have increased since the Democratic People’s Party (DPP) took power in Taiwan in 2016, according to domestic media reports, Indonesian policymakers have begun developing contingency plans for a potential armed conflict.40Kris Mada, “Indonesia Siapkan Rencana Darurat Terkait Taiwan,” Kompas, April 14, 2023, https://www.kompas.id/baca/internasional/2023/04/14/indonesia-siapkan-rencana-darurat-terkait-taiwan. Around 300,000 Indonesian nationals reside in Taiwan, primarily domestic workers;41Taiwan Workforce Development Agency and Ministry of Labor, “Foreign Workers in Productive Industries and Social Welfare by Nationality,” September 2024, https://statdb.mol.gov.tw/html/mon/212030.htm. depending on the scenario, these nationals might require evacuation from Taiwan. At the same time, Indonesia’s foreign policy, like Brazil’s, follows principles of nonalignment.42In current terminology, it is known as “independent and active” foreign policy, which eschews alignment with “super powers” and “military pact[s].” See Retno Marsudi, “Indonesia’s Non-Aligned Foreign Policy Is Not Neutral,” Diplomat, November 28, 2023, https://thediplomat.com/2023/11/indonesias-non-aligned-foreign-policy-is-not-neutral/. As a practical matter, Indonesia seeks to balance its relationship between China and the United States, pursuing close US defense cooperation and a strategic counterbalance to China in the Indo-Pacific region.

Economic interaction with China

Against this diplomatic backdrop, China’s economic influence in Indonesia is substantial, with China serving as Indonesia’s largest trading partner—by both imports and exports (figure 5)—and as a major source of foreign investment.

Figure 5. China-Indonesia trade ties

China’s FDI to Indonesia began with investment in low-skilled manufacturing sectors and raw materials in the 2000s and early 2010s, and shifted to tap Indonesia as an ASEAN production base, a valuable consumer market for Chinese automotives and tech firms, and expanded investments related to batteries and EV supply chains.43Matthew Mingey et al., ESG Impacts of China’s Next-Generation Outbound Investments: Indonesia and Cambodia, Rhodium Group, August 24, 2023, https://rhg.com/research/esg-impacts-of-chinas-next-generation-outbound-investments-indonesia-and-cambodia/. China’s firms have made major investments in coal, critical minerals, and infrastructure, such as Indonesia’s first high-speed railway and hydropower and geothermal generation projects. The most strategically important investments are likely those in aluminum and nickel supply chains, where Chinese firms have complied with Indonesian policy to use downstream processing in Indonesia (figure 6). Competition from cheap Chinese imports has prompted officials to moot heavy tariffs on certain products, including textiles, though the tariffs have not been implemented since they were first announced in July 2024.

Figure 6. The predominance of Chinese investment and processing in Indonesia

These economic ties are durable, as China’s investment base in Indonesia also relies on technical experts and skilled labor from China, especially related to mineral and metal processing.44Angela Tritto, How Indonesia Used Chinese Industrial Investments to Turn Nickel into the New Gold, Carnegie Endowment for International Peace, April 11, 2023, https://carnegieendowment.org/research/2023/04/how-indonesia-used-chinese-industrial-investments-to-turn-nickel-into-the-new-gold?lang=en. Foreign labor and allegations of double standards in workplace safety and pay have been politically controversial in Indonesia.45Former Chinese workers and media reports also allege poor working conditions for and abuse of Chinese workers in Indonesia. See Xu Zhenhua, “For Chinese Workers in Indonesia, No Pay, No Passports, No Way Home,” Sixth Tone, January 9, 2022, https://www.sixthtone.com/news/1009399. Nevertheless, these workers play critical roles in metal mining and processing that may be affected in a Taiwan scenario.

Indonesia in a Taiwan escalation scenario

China’s outsized economic influence would likely limit Indonesia’s capacity and willingness to align with the most expansive G7 sanctions in a moderate- or high-escalation scenario, prioritizing trade continuity and minimizing economic disruption and spillovers elsewhere in the Indo-Pacific area. Yet Indonesia would also be reluctant to accede to China’s most significant consequential asks, especially if China requests that Indonesia fully ignore the potential impact of G7 or US secondary sanctions.

Table 8. Indonesia’s anticipated activity by escalation level

Indonesia’s past practice in response to political developments in Taiwan—such as high-level US legislative visits—has been to call for neutrality and de-escalation while nominally professing adherence to China’s concept of the One China principle. In a moderate-escalation scenario, this is the most likely outcome. Indonesia’s sanctions compliance is far from certain in this scenario, given the scope of trade finance and other two-way trade ties—especially if China’s state-owned mineral companies are placed on the sanctions list. Complicating the picture is Japan’s close economic relationship with Indonesia; Japan ranks second in FDI stock within the country, and Japanese firms are active in Indonesia’s infrastructure funding and the automotive industry. Japanese firms are also significant co-investors—with Indonesian and Chinese partners—in large nickel and critical mineral joint ventures in Indonesia, including investments in one of the country’s largest industrial parks, Indonesia Morowali Industrial Park (IMIP). If Japan and the rest of the G7 decide to comply with or directly implement complementary sanctions, this could directly strike Indonesia’s next-generation investments.

Despite Taiwan’s attempts to build closer ties with Indonesia and Southeast Asia as part of its New Southbound Policy, Taiwan simply does not have as much economic or political heft as China in Indonesia.46See Bonnie Glaser et al., The New Southbound Policy: Deepening Taiwan’s Regional Integration, CSIS, January 2018, https://csis-website-prod.s3.amazonaws.com/s3fs-public/event/180113_Glaser_NewSouthboundPolicy_Web.pdf. Any bilateral engagement with Taiwan thus would likely be done discreetly to avoid inflaming tensions with China, especially in a high-escalation scenario.

In a high-escalation scenario, where the G7 might sanction China’s major private banks and policy, stress on Indonesia’s stock of external debt to Chinese creditors—private and official—would become more acute. Indonesia’s external debt to Chinese creditors stood at $21.2 billion as of July 2024, with an additional $17.4 billion to Hong Kong-based entities.47Bank Indonesia and Ministry of Finance, External Debt Statistics of Indonesia, September 2024, https://api-djppr.kemenkeu.go.id/web/api/v1/media/2DCFE7B5-51AE-417D-9505-67971C9A97F1. This debt is not likely to be an effective tool of coercive statecraft for Beijing. There are no known cases where China has used the threat of debt acceleration effectively to force countries to adopt its preferred foreign policy positions. Moreover, China’s loan agreements allow for default to be declared only under certain circumstances, and even if successful, such efforts would likely do nothing but saddle the lending bank with sizable nonperforming loans that it would be unable to collect. These debts are more relevant as a source of G7 or unilateral US pressure. If G7 sanctions targeted major Chinese banks, Indonesia may not be legally permitted to service Chinese debt, which could have implications for its global creditworthiness and its relationship with China’s financial system.

Transit through Indonesian territorial waters could also become more crucial for international shipping—if ships needed to be routed well around Taiwan. The question of transshipment is also an open one. Indonesia is within reasonable sailing range of China, and its ports could, in theory, be used for sanctions evasion in the event of G7 measures against China. However, direct cargo routes between Indonesia and ports in mainland China are few, with most shipments routed through Singapore. Recently, China’s purchases of Russian crude oil in evasion of G7 sanctions were routed mostly through Malaysia, rather than Indonesia.48Rogan Quinn and Logan Wright, “Discounts and Teapots Alter China’s Oil Trade,” Rhodium Group, May 18, 2023.

Table 9. Indonesia’s alignment with domestic and international sanctions (select cases)

Indonesia has approached past international sanctions efforts gingerly, particularly when dealing with unilateral US sanctions. As Indonesian officials were themselves targeted by US sanctions and travel bans during the Suharto era until 1998—including current President Prabowo Subianto—the use of sanctions remains controversial.49Prabowo Subianto—known mononymously as Prabowo—was denied entry to the United States until 2020 as part of US restrictions on Indonesian military officials. The de facto travel ban relates to Indonesia’s violent crackdown on pro-independence protestors in East Timor in 1992, as well as Prabowo’s connection to alleged human rights abuses by Indonesian military units. Indonesia was banned from US military training programs and arms sales until 2005. See Phil Stewart and Idrees Ali, “Pentagon Prepares to Welcome Once-banned Indonesian Minister, despite Rights Concerns,” Reuters, October 15, 2020, https://www.reuters.com/article/world/pentagon-prepares-to-welcome-once-banned-indonesian-minister-despite-rights-con-idUSKBN2700HR/; and Frega Wenas Inkiriwang, The Dynamic of the US-Indonesia Defence Relations: The “IMET Ban” Period, 2020, https://eprints.lse.ac.uk/103107/1/AJIA202_IMET_forfinalisation_FWI02012020.pdf. Indonesia has not been an unswerving supporter of G7 sanctions efforts. Indonesian entities have been placed on the US SDN list for allegedly transacting with Iran in drone parts.50BBC Indonesia, “AS jatuhkan sanksi ke pengusaha Surabaya, dituduh pasok komponen pesawat nirawak Iran-‘Saya tak pernah kirim ke Iran,’ kata Agung Surya Dewanto [US Imposes Sanctions on Surabaya Businessman Accused of Supplying Iranian Drone Components—‘I Never Sent to Iran,’ ” says Agung Surya Dewanto], January 17, 2024, https://www.bbc.com/indonesia/articles/c29y6ey701eo/. Moreover, Indonesian officials have occasionally adopted a neutral and entrepreneurial approach to international sanctions against Russia. A circular from Indonesia’s trade ministry in 2014, following Russia’s invasion of Crimea, identified “opportunities to increase exports” and argued the country should take advantage of foreign trade bans to fill Russian trade needs.51Septika Tri Ardiyanti, Badan Pengkajian dan Pengembangan Perdagangan [Trade Analysis and Development Agency], “Peluang Ekspor Indonesia Di Tengah Sanksi Ekonomi Rusia [Indonesia Export Opportunities amid Russian Economic Sanctions],” 2017, https://bkperdag.kemendag.go.id/media_content/2017/08/Peluang_Ekspor_Indonesia_di_Tengah_Sanksi_Ekonomi_Rusia.pdf. After Indonesia increased trade credit and export insurance, Indonesia achieved a trade surplus with Russia in 2020 for the first time since 2016 though the benefits were short-lived after a crash in global palm oil prices in the second half of 2022. Indonesia also did not support the expansion of sanctions against Russia as host of the G20 summit in Bali in 2022, instead calling merely for G20 “unity.” On China, however, media reports suggest Indonesia has complied, albeit in a limited fashion, with US economic statecraft threats to restrict trade if Indonesia’s navy followed through on plans to source patrol boats from a Chinese supplier in 2020.

Conclusion

Scenarios of escalating military tensions over Taiwan are already difficult to contemplate, given the enormous economic costs that would result for virtually every national economy. Political positioning for G20 governments is complex. Most have assiduously tried to avoid the perception that they are deliberately choosing sides between the United States and China in a Taiwan crisis scenario. Given China’s central position within global manufacturing supply chains, most G20 economies have significant economic ties with China that their governments will be loath to sever over early signs of rising tensions. Nonetheless, both the G7 and Beijing will have their own diplomatic interests at stake during any conflict scenario and will be actively soliciting cooperation and political support.

This report has outlined some of the economic and political factors that would inform those choices in three countries: Brazil, South Korea, and Indonesia. These three countries were selected because they all have different types of distinct economic linkages to China and are potentially vulnerable to different economic statecraft tools from Beijing. Importantly, their relations with G7 countries are also distinct. South Korea is a political and military ally of the United States. Indonesia is strengthening political and military cooperation with the United States and the G7. Brazil’s financial system and its access to US dollars remain vitally important for both Brazilian and other Latin American economies.

In contemplating scenarios of potential escalation over Taiwan, ambiguity about the economic costs and the eventual scale of escalation will likely introduce caution among G20 governments, including our examined case studies. But as that ambiguity fades and escalation continues, conditions become clearer that aggregate economic costs will rise, and demands from Beijing and the G7 for more concrete alignment will increase. A moderate escalation scenario naturally imposes fewer hard choices upon G20 governments and permits them to avoid conflicting entanglements.

However, in a scenario of significant military escalation over Taiwan and extensive financial sanctions on China, economic actors in all three countries would likely comply with US sanctions or reductions of trade to China to some extent, due to concerns about secondary sanctions risks. In a moderate escalation scenario, the scope of any compliance would likely be more limited, given that all of these economies maintain significant trade relationships with China subject to potential disruption from Beijing. All three countries will experience some immediate economic consequences from disruptions to China’s economy and capacity to maintain international payments. None would likely offer public expressions of support for economic sanctions, but rather defer to previous diplomatic statements related to Taiwan’s political status. South Korea would likely provide the highest level of cooperation or support for any US actions, given the countries’ military alliance.

Given the three countries’ economic relationships with China, this report argues that Beijing would have a limited interest in pursuing punitive or negative economic statecraft tools against Brazil, South Korea, or Indonesia. In the event of US or G7 sanctions, Beijing would have an incentive to maintain regular trade and financial transactions wherever possible, encouraging third countries to continue current levels of economic engagement with China despite their potential exposure to secondary sanctions risks. Beijing could also offer additional economic carrots or incentives to G20 countries to maintain economic engagement, such as additional concessions on market access, new investment, or credit via bilateral swap lines.

Nonetheless, the intersection of these two sets of competing forces in the event of escalating tension over Taiwan will create significant political pressures for all G20 governments. China’s economic statecraft tools have been deployed in the past against South Korea, Lithuania, Australia, and other economies, and any restraint from Beijing could be viewed as temporary or contingent based on cross-strait developments, given the centrality of Taiwan to Beijing’s political interests. The uncertainty of China’s response may have a chilling effect on G20 willingness to act or align with US consensus-building measures as they wait for China’s response or for more significant decoupling progress in key industries to manifest.

Similarly, no trade-oriented G20 economy could afford to see any major bank lose access to US dollar clearing facilities in the event of secondary sanctions from the United States, even if there are clear limits to the American usage of these tools. Access to US financial markets, financial market infrastructure, and transactions in US dollars are important gateways to the global economic system, and access to them is important enough to secure at least nominal compliance on US actions.

Yet as scenarios of military tensions over Taiwan have passed from the realm of the unthinkable to the potentially imaginable, G20 governments will be forced to weigh the significant economic costs of choosing between competing demands from Washington and Beijing. Publicly highlighting these costs and the political dilemmas they will inevitably create may help to reinforce a multilateral consensus to prevent escalation before it occurs, as well as develop pathways to ease tensions in the event an unfortunate scenario materializes.

About the authors

Matthew Mingey is an Associate Director with Rhodium Group, focusing on China’s economic diplomacy and outward investment, including development finance. Matthew is based in Washington, DC. Previously, he worked on global governance issues at the World Bank. Matthew received a Master’s degree in Global Business and Finance from Georgetown University’s Walsh School of Foreign Service and a Bachelor’s degree from the University of Pennsylvania.