Retaliation and resistance: China’s economic statecraft in a Taiwan crisis

Table of contents

Chinese economic statecraft in a Taiwan crisis: Tools and applications

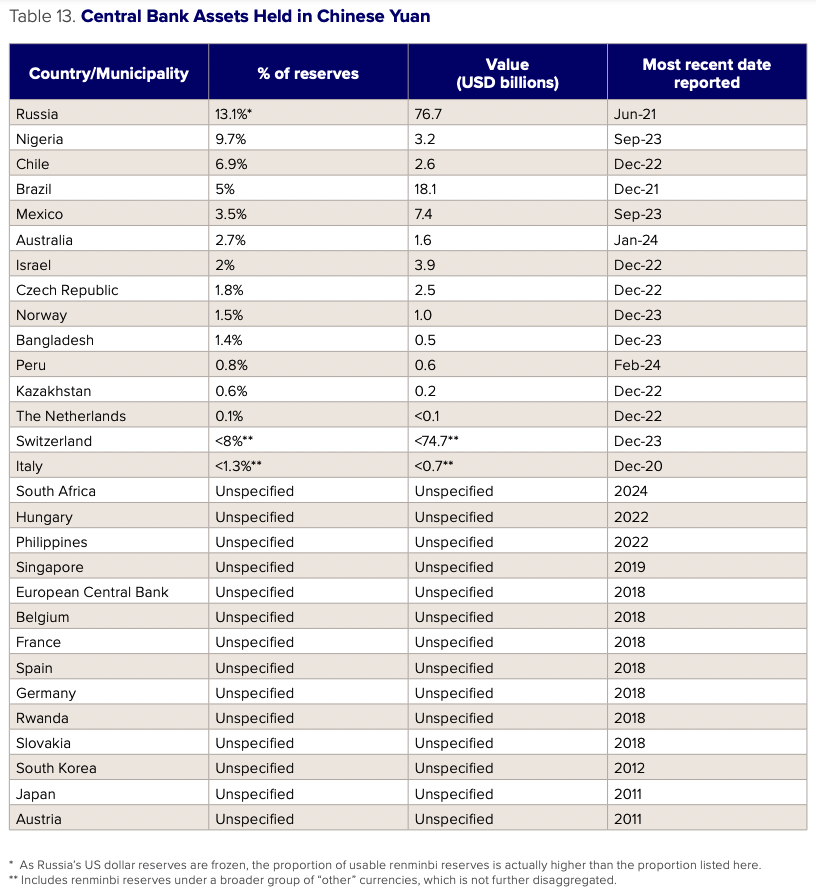

China’s capacity to circumvent financial sanctions and G7 economic statecraft

Using international Renminbi networks to circumvent sanctions

Current scope of Renminbi internationalization

Policy constraints on expansion of Renminbi financial networks

Responding to G7 economic statecraft in a crisis

Assessing China’s capacity to respond to G7 statecraft

Financial statecraft and consequences

Preventing escalation in economic warfare

Executive summary

Beijing has watched carefully as Western allies have deployed unprecedented economic statecraft against Russia over the past two years. Our report from June 2023 modeled scenarios and costs of Group of Seven (G7) sanctions in the event of a crisis in the Taiwan Strait. However, that report largely left unanswered a critical question: How would China respond?

This report examines China’s ability to address potential US and broader G7 sanctions, focusing on its possible retaliatory measures and its means of sanctions circumvention. We find that reciprocal economic statecraft measures would exact a heavy financial toll on the G7, China itself, and the global economy. Crucially, however, we also find that China is developing capacities that are making its economy more resilient to Western sanctions.

We consider the use of economic statecraft tools in two main scenarios: a moderate escalation over Taiwan limited to the United States and China that remains short of military confrontation, and a more severe scenario with G7-wide restrictions targeting Chinese firms and financial institutions. For each, we consider China’s potential responses to adversarial economic statecraft in terms of retaliatory action (including restrictions on economic activity within China and China’s potential actions abroad) and attempts to circumvent G7 sanctions.

We arrive at seven key findings:

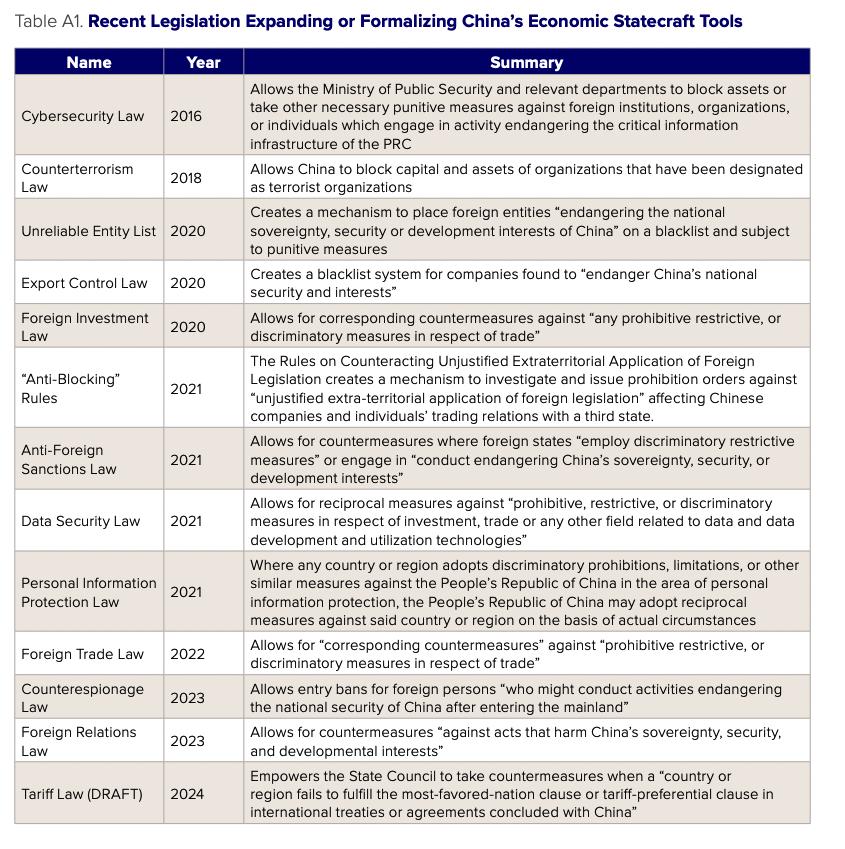

- China’s economic statecraft toolkit is quickly expanding. In the past five years, China has used a range of formal and informal statecraft tools, including tariffs, import bans, boycotts, and inspections, to punish firms and countries for their stances on Taiwan and other sensitive issues. In anticipation of the potential for more extensive foreign sanctions, China has also been legislating to equip itself with an expanded toolkit to respond. This scope of options distinguishes China from Russia, which had prepared for additional sanctions in a less organized fashion, and presents a significantly more difficult challenge for Western economic statecraft.

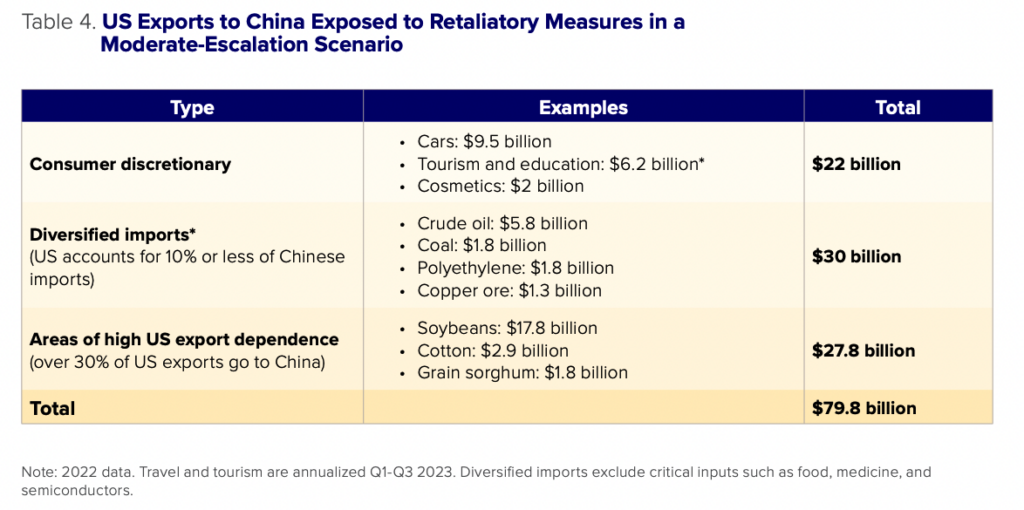

- China’s statecraft toolkit is heavily weighted toward trade and investment rather than financial statecraft. We assess that in a moderate scenario where US exports to China are curtailed, more than $79 billion worth of US goods and services exports (such as automobiles and tourism) would be at risk. In a higher-escalation scenario involving G7-wide sanctions against China, around $358 billion in G7 goods exports to China could be at risk from the combination of G7 sanctions and Chinese countermeasures. On the imports side, we estimate that the G7 depends on more than $477 billion in goods from China which could be made the target of Chinese export restrictions. Regarding investment, at least $460 billion in G7 direct investment assets would be at immediate risk from the combined impact of G7 sanctions and retaliatory measures by Beijing. By comparison, China has limited financial tools available to directly influence G7 economies. What restrictions China imposes on capital outflows are likely to be driven more by financial stability concerns rather than attempts to coerce.

- China will face steep short- and medium-term costs if Beijing deploys economic statecraft tools. China would face high economic and reputational costs from using economic statecraft tools, especially in a high-escalation scenario. While export restrictions would be one of China’s most impactful economic statecraft tools, it would also be among the costliest options for China. Over 100 million jobs in China depend on foreign final demand, and nearly 45 million of these jobs depend on final demand from G7 countries. In a high-escalation scenario, most of these jobs would at least temporarily be put at risk. Even in a moderate-escalation scenario, China’s viability as a destination for foreign investment would dramatically decline, with implications for China’s exchange rate and domestic financial stability.

- China may prefer to avoid tit-for-tat retaliation for strategic reasons. As a result of the major costs to its citizens, China is unlikely to follow a tit-for-tat approach but will target sectors where it can inflict asymmetric pain, particularly through the use of export controls or trade restrictions on critical goods such as rare earths, active pharmaceutical ingredients, and clean energy inputs (e.g., graphite). China’s political objectives in a Taiwan crisis are unlikely to be served with a completely reciprocal response to G7 sanctions.

- China will likely attempt to divide the G7 and thereby limit the impact of sanctions. In scenarios where the United States alone imposes sanctions on China, Beijing has more opportunities to circumvent sanctions using targeted retaliatory measures against the United States, but not other G7 countries. The G7 has varied relations with and commitments to Taiwan, and a significant proportion of firms, particularly in Europe, continue to see China as a critical export destination. In addition, China may use positive inducements to encourage countries across the Group of Twenty (G20) to stay neutral. Beijing may also leverage its large bilateral lending with a range of emerging and developing economies to attempt to circumvent or not implement G7 sanctions.

- China is seeking to create resiliency to sanctions by developing alternatives to the dollar-based financial system, including renminbi-denominated transaction networks. Renminbi-based networks are never likely to replace the US dollar-denominated global financial system. However, the gradual expansion of these networks can help Beijing find alternative mechanisms for maintaining access to financing and trade transactions even in the event of far reaching Western sanctions or trade restrictions. A rapidly growing number of domestic and cross border payment projects are being designed with the possibility of Western sanctions in mind.

- The timing of any crisis can significantly alter the impact of statecraft tools, for both the G7 and Beijing. Western efforts to de-risk and shift supply chains in the next five years may reduce Beijing’s “second strike” statecraft capacity over time. At the same time, China’s renminbi-based financial networks will expand in scope and liquidity, providing Beijing with more options to mitigate Western sanctions.

Introduction

The prospect of a crisis over Taiwan has generated intense discussion in recent years, as other unthinkable scenarios in global affairs have become depressingly manifest. Russia’s invasion of Ukraine presented the United States and its allies with a need to quickly escalate economic sanctions and other tools of statecraft against Russia as part of a broader political response. As tensions in the Taiwan Strait have risen, the policy community began asking whether similar tools could be used to deter China in a Taiwan crisis scenario. Senior leaders in China increasingly reference risks from Western sanctions in policy remarks, and Beijing has reportedly conducted its own assessments of China’s vulnerabilities to Western economic sanctions.1Zongyuan Zoe Liu, “China’s Attempts to Reduce Its Strategic Vulnerabilities to Financial Sanctions,” China Leadership Monitor, March 1, 2024, https://www.prcleader.org/post/china-s-attempts-to-reduce-its-strategic-vulnerabilities-to-financial-sanctions; Reuters, “$2.6tn could evaporate from global economy in Taiwan emergency,” August 22, 2022, https://asia.nikkei.com/static/vdata/infographics/2-dot-6tn-dollars-could-evaporate-from-global-economy-in-taiwan-emergency/.

As tensions have risen within the US-China bilateral relationship, policymakers and analysts have started to actively discuss the potential use of sanctions, export controls on critical technologies, and China’s retaliatory responses. These economic statecraft tools are now being considered as options within a broader multilateral strategy toward China, without fully considering the consequences for cross-strait stability or the global economy. Over the last two years, economic warfare has become more plausible, even if military engagement still seems remote.

In June 2023, Rhodium Group and the Atlantic Council GeoEconomics Center published a report that found that the Group of Seven (G7) would likely consider a wide range of economic measures to deter or punish China in a Taiwan-related crisis scenario.2Vest and Kratz, Sanctioning China in a Taiwan Crisis. While that report highlighted what tools might be considered and their direct costs to the global economy, it largely set aside questions about China’s own economic statecraft tools and responses. This report aims to fill that gap and discuss China’s potential responses to G7 sanctions or other tools of statecraft.

While still extremely costly in economic terms, these tools are nonetheless likely to be considered in a crisis since the costs of war are far higher. But unless the US-China political tensions over Taiwan can be managed, these lines between economic and military warfare will be blurred in any crisis scenario, with economic statecraft tools appearing as plausible and manageable responses.

This is exactly why understanding China’s potential responses to US and allied statecraft is so important. Understanding China’s capacity for economic coercion and circumvention can help refocus policy debate around credible and effective deterrence of both broader military conflict and the steady escalation of tensions from more limited crisis scenarios. Just as theories of nuclear deterrence account for the concept of second-strike capabilities, so too must we consider economic retaliatory measures in assessing the deterrence character of sanctions.3See also the discussion of sanctions and deterrence theory in Chapter 6 of Henry Farrell and Abraham Newman, Underground Empire: How America Weaponized the World Economy (New York: Henry Holt and Co., 2023). Recent actions by Beijing to establish export controls on critical raw materials and other critical inputs reveal that Beijing is practicing and refining its use of economic leverage, but the contours of China’s ability, willingness, and channels for action are not well understood.

A February 2024 Atlantic Council policy brief by a senior US official (at the time out of government) with deep experience in this domain outlined seven principles for the effective use of economic statecraft.4Daleep Singh, “Forging a positive vision of economic statecraft,” New Atlanticist, Atlantic Council, February 22, 2024, https://www.atlanticcouncil.org/blogs/new-atlanticist/forging-a-positive-vision-of-economic-statecraft/. While these principles focus on US options, the framework can also be used to evaluate the effectiveness of China’s policy instruments.

Designing and implementing a set of economic statecraft instruments in a Taiwan crisis scenario to achieve political objectives requires clarity on the trade-offs involved among these principles, and where benefits will outweigh costs. In a Taiwan crisis, decisions will need to be made quickly, making it critical to understand China’s potential response. While China’s retaliatory tools can inflict significant short-term economic pain, and China’s leaders may not be considering the same principles as outlined in the table below, Beijing will also struggle to mount an economic statecraft strategy that is both sustainable and effective in limiting G7 policy choices toward China. This study aims to improve understanding of the uses and limits of China’s statecraft tools, as well as the potential costs of escalation, in order to make the commitments from both sides to deescalate in a crisis far more credible.

For the purposes of this report, we are limiting the measures discussed to explicitly economic tools and sources of economic power, even as we are aware that any crisis scenario would also include consideration of other nonmilitary options such as cybersecurity-related measures or disinformation campaigns, as well as military coercion below the threshold of war. Conventional wisdom assumes that China’s response would be coordinated and centralized, free from the democratic factors that constrain US and G7 action, including rule of law and separation of authorities across different branches of government and agencies. This study questions some of those assumptions, as Chinese bureaucratic interests are likely to clash on the question of the country’s need for US dollar inflows in the event of economic sanctions, as well as China’s economic interests in imposing restrictions on trade.

In chapter one, we build a framework to categorize the channels of economic interaction at risk from Chinese economic statecraft. In chapter two, we explore how each of these tools might be used at different levels of escalation, up to the level of retaliation against a major G7 sanctions program. In chapter three, we review China’s capacity to circumvent sanctions and statecraft using financial networks outside of the US dollar system.

This paper, and our prior work on sanctions options in a Taiwan crisis, focuses primarily on China and the G7. A forthcoming paper will explore the role of the G20 in a Taiwan contingency.

Chinese economic statecraft in a Taiwan crisis: Tools and applications

No country has ever tried to sanction an economy of China’s size and importance to the global economy. The use of economic statecraft against Russia following its invasion of Ukraine was exceptional in its breadth and its level of international coordination, but Russia was only the world’s eleventh-largest economy before the war began and had few economic countermeasures available aside from energy export denial.

As the world’s second-largest economy and premier manufacturing powerhouse, China has a far larger toolkit of economic policy instruments. It also has a history of using economic leverage assertively to achieve foreign policy objectives, though with mixed success. That experience means retaliatory efforts are nearly certain in ways the Western powers did not experience after imposing sanctions on Russia in 2014 and 2022 onward. In past work we took stock of economic statecraft tools available to the G7 and the costs and limitations of their use. In this chapter we catalogue China’s economic statecraft tools and applications, and assess the likeliness of their use in moderate or high Taiwan scenario escalations.

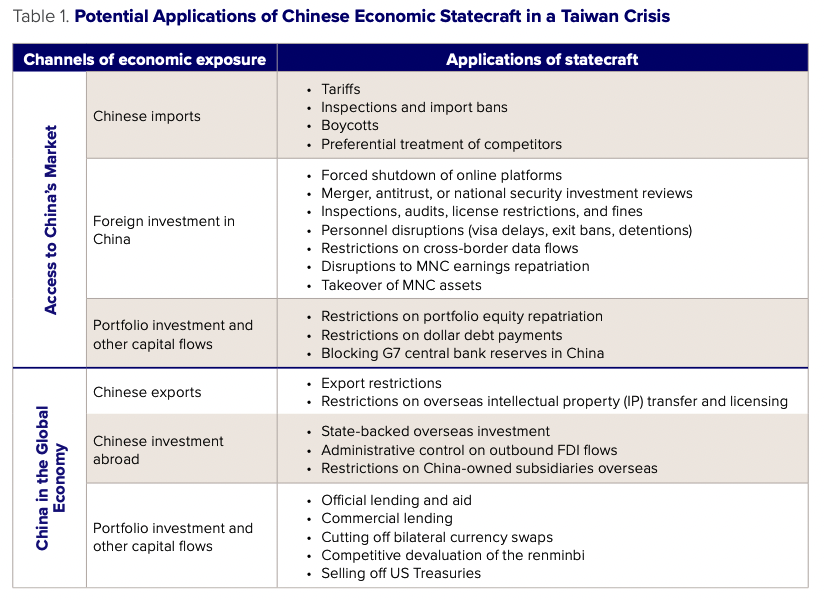

Drawing on past case studies and China’s growing legal and regulatory toolkit, we identify a range of economic statecraft actions that China could use in a Taiwan Strait escalation scenario. Scholars of economic statecraft typically subdivide statecraft tools into categories based on their direction (i.e., inbound or outbound flows) and on their channel (i.e., trade or capital flows).5David A. Baldwin, Economic Statecraft (Princeton: Princeton University Press, 1985); China Center, Understanding U.S.-China Decoupling: Macro Trends and Industry Impacts, U.S. Chamber of Commerce and Rhodium Group, 2021, https://www.uschamber.com/assets/archived/ images/024001_us_china_decoupling_report_fin.pdf. In the first section of this chapter, we look at access to China’s markets—i.e., the potential use of statecraft tools against economic flows into China, looking respectively at trade, foreign direct investment (FDI), and portfolio flows. In the second section, “China in the Global Economy,” we look at the use of statecraft tools aimed at these flows from an outbound perspective.

There is substantial debate within Chinese expert circles on the use of these tools. Academics and experts affiliated with China’s financial and economic bureaucracy often argue that defending against economic sanctions starts by building a strong financial system to improve domestic resilience and by deepening China’s global economic ties to increase the economic and diplomatic costs on the sanctioning economy. Zhang Bei, an economist at the People’s Bank of China’s (PBOC) Financial Research Institute, has argued that although China needs to strengthen countersanctions tools such as the Unreliable Entity List and Anti-Foreign Sanctions Law, it also needs to strengthen management of domestic financial risks and deepen global economic engagement through renminbi internationalization and international financial cooperation.6Zhang Bei, “Impact of Financial Sanctions on National Financial Security and Countermeasures,” China Security Studies (October 30, 2022), accessed via CSIS Interpret: China, https://interpret.csis.org/translations/impact-of-financial-sanctions-on-national-financial-security-and-countermeasures/. Chen Hongxiang, another PBOC-affiliated researcher, describes the anti-sanctions policy toolbox as a “last resort strategy.”7Chen Hongxiang, “Logical Analysis of U.S. Financial Sanctions and China’s Contingency Plans,” Contemporary Finance (October 10, 2022), accessed via CSIS Interpret: China, https://interpret.csis.org/translations/logical-analysis-of-u-s-financial-sanctions-and-chinas-contingency-plans/. Chen notes that the United States faces limitations in the use of financial sanctions given the risks to the attractiveness of the US dollar as a global currency and the diplomatic and economic costs of sanctions.

Other scholars have discussed China’s use of retaliatory measures and the legal foundations for responses in the future. For example, Yan Liang of Nankai University has described trade controls on strategic resources as having played an important role in China’s sanctions toolkit in the past, noting the 2010 export controls on rare earths.8Yan Liang, “China’s Economic Sanctions: Goals and Policy Objectives,” Foreign Affairs Review 6 (2012), China Foreign Affairs University. Cai Kaiming, a Chinese cross-border compliance lawyer, has written about the newly developed legal foundations of Chinese economic statecraft tools, including the Anti Foreign Sanctions Law, the 2021 blocking statute, the Unreliable Entity List, and the reciprocal measures of China’s Export Control Law, Data Security Law, and Personal Information Protection Law (see Appendix 1).9Cai Kaiming, “Research on American Legal Polices Against China and China’s Countermeasures,” Dentons China, 2022, http://dacheng.com/ file/upload/20230105/file/20230105164302_762feab8ea3a4756b88f12397470f0e5.pdf. “Blocking statute” refers to the Ministry of Commerce Order No. 1 of 2021 on Rules on Counteracting Unjustified Extraterritorial Application of Foreign Legislation and Other Measures. Throughout this paper, we consider the use of these new formal tools in a Taiwan crisis scenario, as well as the range of informal tools available, such as phytosanitary inspections and administrative orders, to China’s customs department. Given the range of both formal and informal tools available for the purpose of statecraft, the focus of this paper is on the ends, rather than the means. These tools span many different bureaucratic jurisdictions, but it is likely that, as in past instances of major statecraft actions where major costs to China’s economy are involved (such as China’s retaliatory tariffs against the United States in 2018), the decision to use these tools will come from China’s senior-most leadership.

Scenarios

While China’s past use of economic statecraft is instructive, Beijing may not necessarily respond to future escalations with the same old tools, or with the same intensity. In recent years, China showed a willingness to use economic statecraft more explicitly and intensely than in the past, albeit in a concentrated fashion (e.g., trade bans against Lithuania). China has also created new legal frameworks to justify future retaliatory or punitive actions.10Emily Kilcrease, No Winners in This Game Assessing the U.S. Playbook for Sanctioning China, Center for a New American Security, December 2023, https://www.cnas.org/publications/reports/no-winners-in-this-game. In short, we need to make predictions of future use cases beyond the range of China’s past actions.

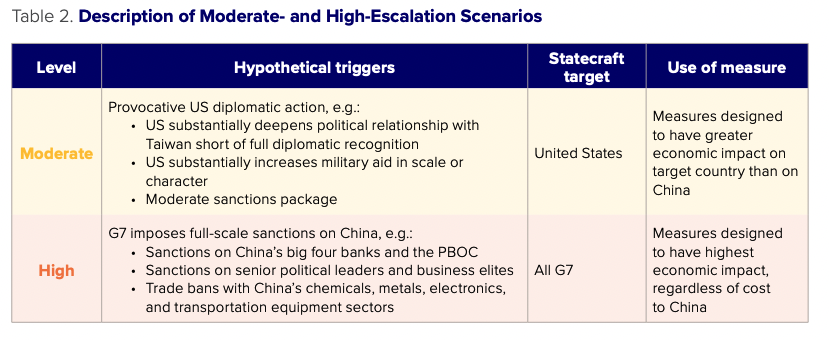

To explore how China might use economic statecraft tools in the future, we consider two scenarios:

Moderate-escalation scenario: China responds to the United States taking an escalatory diplomatic action in the Taiwan Strait, such as a substantial deepening of the political relationship with Taiwan, a step-change in military aid, or a limited sanctions package in response to Chinese aggression toward Taiwan. In this scenario, China reacts with economic statecraft measures targeting the United States designed to impose relatively higher costs on the United States than China. In this scenario, China’s willingness to use statecraft is constrained by the necessity to maintain a strong business environment amid high geopolitical tensions.

High-escalation scenario: China retaliates to a maximalist G7 sanctions package that includes full blocking sanctions on China’s major banks and the PBOC, sanctions on senior political figures and business elites, and trade bans with relevance for China’s military.11Vest and Kratz, Sanctioning China in a Taiwan Crisis China adopts a much stronger and broader set of economic statecraft measures against the entire G7, with an intent to impose costs as high as possible on the sanctioning economies.

Both scenarios stop short of war between China and the United States or other G7 countries, and are meant to provide a context to evaluate the potential use of China’s statecraft tools. We consider only economic statecraft responses in a Taiwan escalation scenario, although China is also likely to consider military and quasi-military actions that are outside the scope of this paper, such as undersea cable cuttings, cyberattacks, or blockades. Where we highlight costs in dollar terms, they should be understood as the assets and annualized economic flows at risk of disruption unless otherwise specified.

Access to Chinese markets

One of China’s primary methods of exercising economic statecraft in the past has been to restrict access to its markets, either through trade barriers or disruptions to the operations of foreign companies and investors in China. In this section we consider the use of these tools in the past and in moderate- and high-escalation future scenarios.

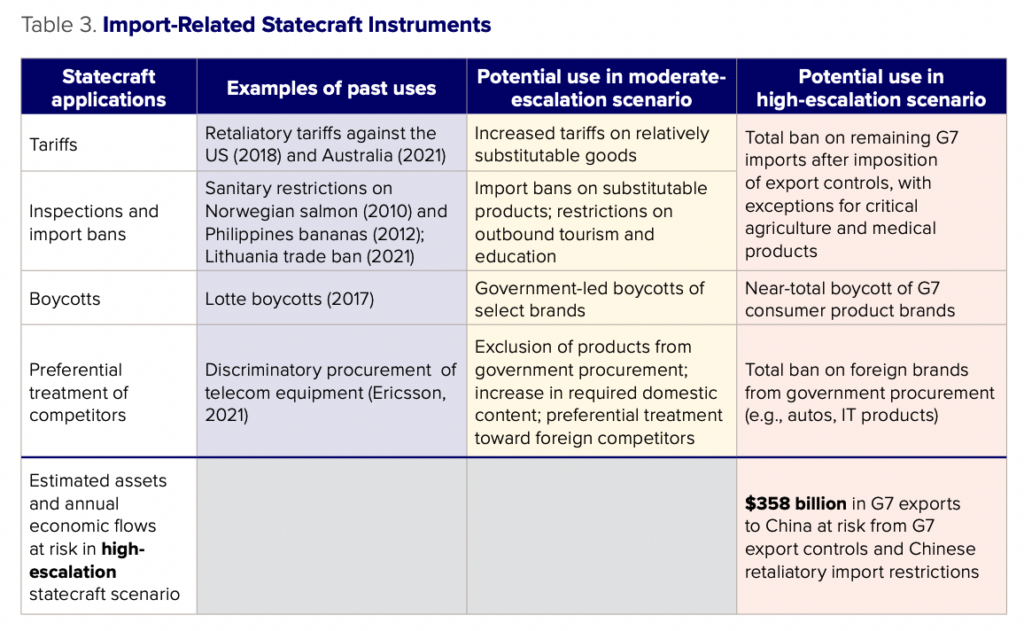

Chinese imports

One of China’s primary methods of exercising economic statecraft in the past has been to restrict access to its markets through tariffs and nontariff barriers. In a moderate escalation with the United States over Taiwan, China could scale up these tools to restrict imports across a range of noncritical goods such as consumer products, easily substitutable goods, and goods where the United States is heavily dependent on China as an export market. In a higher-escalation scenario involving a maximalist G7 sanctions program, China could impose import bans on a broader range of goods, although the main initial disruptions to imports would likely come from sanctions against Chinese banks and importers. A total ban on G7 imports, with exceptions for critical agricultural and medical imports, would put $358 billion in exports to China at risk.

Past uses of statecraft

Restrictions on market access have been one of China’s most common forms of coercion in past geopolitical incidents. In most cases, these tools have been narrowly targeted—either against single companies or narrow product categories—to minimize the impacts on China’s economy and to act as a warning rather than full-blown punishment mechanism. Yet they have the potential to be scaled up in response to higher levels of escalation, especially as many G7 companies depend heavily on the Chinese market for revenue and growth.

- Tariffs – In numerous past cases, China has increased tariff rates on imported products in an apparent response to political actions taken by other countries. China retaliated against the Trump administration’s imposition of across-the-board tariffs on Chinese exports to the United States, resulting in a 21% average tariff rate on goods imported from the United States.12Chad P. Brown, “US-China Trade War Tariffs: An Up-to-Date Chart,” Peterson Institute for International Economics, April 6, 2023, https://www.piie.com/research/piie-charts/2019/us-china-trade-war-tariffs-date-chart. After members of Australia’s cabinet called for independentinvestigations into the origins of COVID-19 in April 2020, China imposed economic restrictions on a range of Australian products. China’s Ministry of Commerce (MOFCOM) announced tariffs as high as 218 percent on Australian wine and 80.5 percent tariffs on barley.13Richard McGregor, “Chinese Coercion, Australian Resilience,” Lowy Institute, October 2022, https://www.lowyinstitute.org/publications/ chinese-coercion-australian-resilience; Ministry of Commerce of the People’s Republic of China, “Announcement on the Final Ruling on the Anti-dumping Investigation into Imported Wine Originating from Australia,” 2021, http://www.mofcom.gov.cn/article/zcfb/zcblgg/202103/20210303047613.shtml; Ministry of Commerce of the People’s Republic of China, “Announcement on the Final Ruling of the Anti-dumping Investigation into Imported Barley Originating from Australia,” 2020, http://gpj.mofcom.gov.cn/article/cs/202005/20200502965862.shtml. In these cases, China provided the justification for higher tariffs on the basis of anti-dumping action against Australian exporters, but the timing and character of the tariffs led to speculation that the tariffs were retaliatory action by the Chinese government.14McGregor, “Chinese Coercion. Notably, China targeted goods where the costs to China’s economy would be lower than products like natural gas and iron, for which Australia also depends on China as an export market. In the Australia case, MOFCOM was responsible for raising tariffs, but the State Council itself also has powers to increase tariffs, as it did in imposing retaliatory tariffs against the Trump administration’s June 15, 2018, Section 301 tariff announcement.15Chad P. Bown, Euijin Jung, and Zhiyao (Lucy) Lu, “China’s Retaliation to Trump’s Tariffs,” Trade and Investment Policy Watch, Peterson Institute for International Economics, June 22, 2018, https://www.piie.com/blogs/trade-and-investment-policy-watch/chinas-retaliation-trumps-tariffs; State Council of the People’s Republic of China, “Announcement of the Tariff Commission of the State Council on Imposing Additional Tariffs on $50 Billion of Imported Goods Originating in the United States,” June 2018, https://finance.sina.com.cn/roll/2018-06-16/doc-ihcyszsa0555207.shtml.

- Inspections and import bans – China also exerts economic pressure through inspections and informal bans on imported goods. In 2010, China effectively banned salmon imports from Norway on the pretense of a violation of sanitary regulations after the Norwegian Nobel Committee awarded the Nobel Peace Prize to dissident Liu Xiaobo.16Richard Milne, “Norway sees Liu Xiaobo’s Nobel Prize hurt salmon exports to China,” Financial Times, August 15, 2013, https://www.ft.com/content/ab456776-05b0-11e3-8ed5-00144feab7de. China banned banana imports from the Philippines on health grounds in 2012 amid tensions in the South China Sea.17Andrew Higgins, “In Philippines, banana growers feel effect of South China Sea dispute,” Washington Post, June 10, 2012, https://www.washingtonpost.com/world/asia_pacific/in-philippines-banana-growers-feel-effect-of-south-china-sea-dispute/2012/06/10/gJQA47WVTV_story.html The most recent major case followed the opening of a Taiwanese Representative Office in Lithuania in 2021.18Reuters, “Taiwan opens office in Lithuania, brushing aside China opposition,” November 18, 2021, https://www.reuters.com/world/china/taiwan-opens-office-lithuania-brushing-aside-china-opposition-2021-11-18/. China imposed a de facto ban on imports from Lithuania through a range of measures, including denials of trade finance, revocation of import permits, the removal of Lithuania from China’s customs system, and cancelation of freight shipping to Lithuania by a Chinese rail shipping operator. Given that Lithuania only accounts for 0.003 percent of Chinese imports and its goods are primarily agricultural, the immediate cost to the Chinese economy from the import bans was limited. However, the diplomatic blowback from targeting a European Union (EU) member state with a full trade ban was arguably quite high. Coercion against Lithuania led the EU to raise a trade case in the World Trade Organization against China, and it likely strengthened support for the creation of the Anti-Coercion Instrument. It is a matter of debate whether China took these actions against Lithuania accepting these costs, or whether it underestimated the harshness of the EU’s reaction.

- Boycotts – China uses its state media to foment and support boycotts of foreign brands during crises. In 2022, Chinese consumers boycotted H&M for its refusal to use cotton from Xinjiang with backing from state media and party organizations.19Tu Lei, “H&M boycotted for ‘suicidal’ remarks on Xinjiang affairs,” Global Times, March 24, 2021, https://www.globaltimes.cn/page/202103/1219362.shtml. In February 2017, the Lotte Group approved a land swap with the South Korean government to place a Terminal High Altitude Area Defense (THAAD) missile defense system on its former property. In response, China forced the closure of 74 Lotte supermarkets for supposed fire safety violations and published news articles urging consumers to punish South Korea “through the power of the market.”20Darren J. Lim and Victor A. Ferguson, “Informal economic sanctions: the political economy of Chinese coercion during the THAAD dispute,” Review of International Political Economy 29 (5) (2002): 1525–1548, https://doi.org/10.1080/09692290.2021.1918746. In both cases, China focused on companies that had ample local competition and low import dependence to mitigate the costs to China’s economy. South Korean companies in petrochemicals and semiconductors, by contrast, saw limited or no effect on their performance during the THAAD incident.21Ibid.

- Preferential treatment of competitors – Beijing’s direct and indirect control of state-run procurement provides leverage over foreign firms hoping to capture a slice of China’s market. Companies fear that officials can manipulate the bidding process to hurt their sales and exert influence on their home countries. One example came in 2021 after Swedish authorities implemented a ban on Huawei and ZTE 5G technology in late 2020. In subsequent bidding for state-owned China Mobile in June 2021, Ericsson’s share of 5G equipment awards dropped by nearly 80 percent. Ericsson had previously lobbied against the ban in Sweden, fearing it would be targeted for retaliation in China,22Stu Woo, “Ericsson Warns China Backlash Threatens Its Market Share,” Wall Street Journal, July 16, 2021, https://www.wsj.com/articles/ericssonwarns-china-backlash-threatens-its-market-share-11626440735; Jonas Froberg and Linus Larsson, “Ericssons vd Börje Ekholm bekräftar påtryckningar från Kina” [Ericsson CEO Börje Ekholm Confirms Pressure from China], Dagens Nyheter, January 4, 2021, https://web.archive.org/web/20210106070006/https://www.dn.se/ekonomi/ericssons-vd-borje-ekholm-bekraftar-patryckningar-fran-kina/. and an editorial in the state-run Global Times later tied the bidding results to Sweden’s policy decision.23Li Qiaoyi and Shen Weiduo, “Ericsson’s setback in China linked to Sweden’s crackdown on Chinese firms: source,” Global Times, July 22, 2021, https://www.globaltimes.cn/page/202107/1229399.shtml.

Potential use in moderate-escalation scenario

How countries choose which imports to restrict is a central question of economic statecraft. In China’s retaliation against US tariffs in 2018, China’s tariffs tended to target US exports produced disproportionately in counties that leaned Republican and voted for then president Donald Trump in 2016, suggesting a political influence logic to China’s tariff targets.24Thiemo Fetzer and Carlo Schwarz, “Tariffs and Politics: Evidence from Trump’s Trade Wars,” Economic Journal 131 (636) (May 2021): 1717–1741, https://doi.org/10.1093/ej/ueaa122. More broadly, policymakers are likely to think about the effectiveness of tariffs: Is the sender country able to bear the cost of sanctions while imposing enough damage to compel the other side to make concessions?25Kerim Can Kavakli, J. Tyson Chatagnier, and Emre Hatipoğlu, “The Power to Hurt and the Effectiveness of International Sanctions,” Journal of Politics 82 (3) (July 2020), https://doi.org/10.1086/707398.

Past instances of China’s restrictions on imports have typically been targeted in ways that limit costs to China’s economy: single firms, narrow sectors, or smaller economies. In a scenario involving the United States in a moderate escalation over Taiwan, China might accept elevated costs if it felt that sanctions on the United States were necessary to signal resolve, punish US behavior, or deter further action. In such a circumstance, China could target a range of sectors where costs to the US economy are high and costs to the Chinese economy, though elevated, are still relatively low. The tools used are likely to be the same as in the past: some combination of higher tariffs and both formal and informal import restrictions. The key question facing Chinese policymakers would be which sectors and goods to target.

First, China could target consumer discretionary products such as imported cars and cosmetics. While consumers would face higher costs and fewer choices, a ban on these products would have a far lower impact on the Chinese economy than a ban on intermediate goods or capital goods that China depends on for industrial production. If restrictions were expanded to US-branded products made in China (Tesla cars made in Shanghai, for instance), China would face some employment impacts, but in general these would likely be the easiest goods to target.

Second, China could target products where it has diversified imports and the United States has limited market power. China imports commodities such as crude oil, coal, polyethylene, and copper ore from the United States, but in small quantities relative to other exporters. China could likely impose high tariffs or bans on such goods from the United States, and procure them from other countries (albeit at higher costs). While not included in the table below, China might also include products where import dependence is still high but where China is actively pursuing self-sufficiency and strong local players are emerging, such as medical devices. China would likely avoid targeting critical inputs to its supply chains that would be difficult or costly to replace quickly, such as integrated circuits.

Finally, China could target areas based on how much the United States depends on China as an export market. In 2022, over half of US exported soybeans went to China, as did 83 percent of its exported sorghum. US dependence on China for its agricultural goods informed China’s decision to target these goods in response to the Section 301 tariffs. Yet the costs to China for imposing tariffs on these products would also be high: the United States supplied 31 percent of China’s imported soybeans and 64 percent of its imported sorghum. China would likely tailor the strength of its import restrictions depending on global agricultural conditions and whether alternative supply could be found elsewhere.

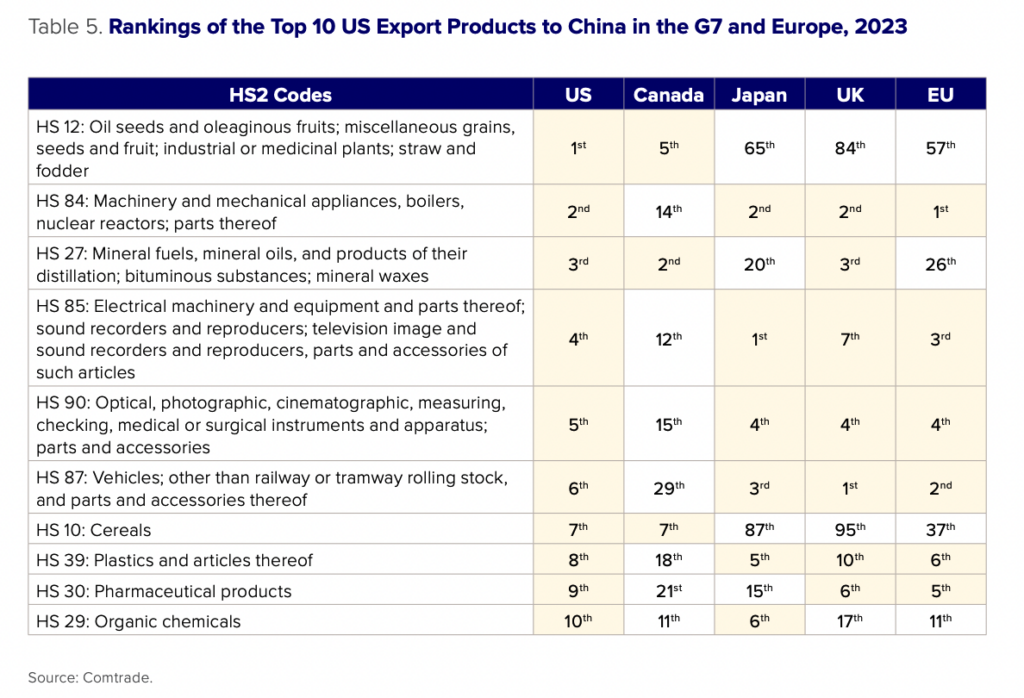

Tariffs or bans on US imports could also provide China with an opportunity to drive wedges between the United States and other countries. Sustained demand from Chinese consumers amid higher restrictions on US imports would increase demand for imported goods elsewhere. As a group of advanced industrial economies, the G7’s exports overlap substantially with US exports that could be at risk from Chinese trade barriers. Table 5 shows the top ten exports from the United States to China by value, and the export rank of those products from other G7 countries and Europe to China. For every product that ranks among the United States’ top ten exports to China, at least one other G7 country (and often multiple countries) also have that product ranked in their top exports to China. While these products are often diverse and not completely substitutable, the overlap in the export baskets of G7 countries to China points to the potential for China to exploit competitive dynamics between the United States and other G7 countries.

Potential use in high-escalation scenario

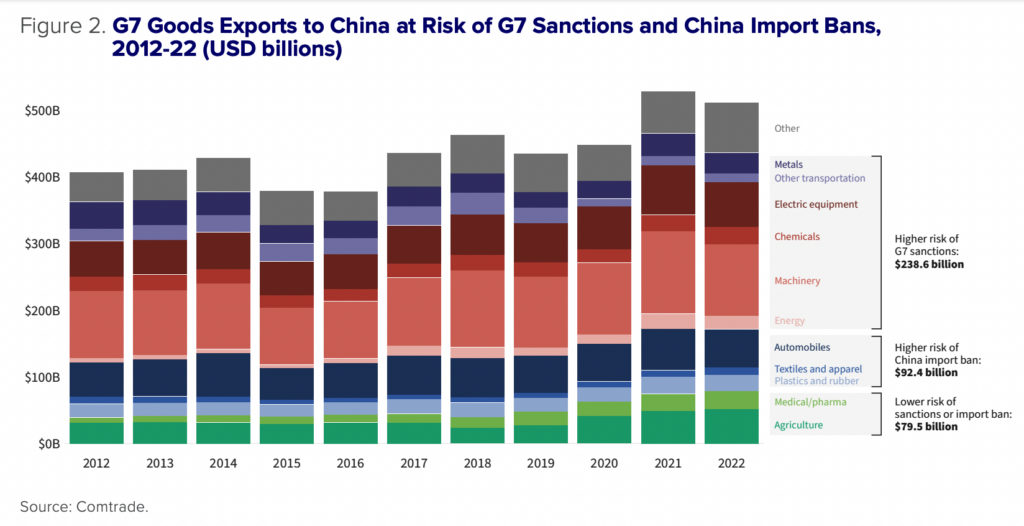

In a maximalist-escalation scenario, the initial disruptions to foreign exports to China would stem from G7 sanctions themselves rather than Chinese retaliation. As we argued in our June 2023 study on G7 sanctions toward China in a Taiwan crisis, many goods such as chemicals, energy, and electrical equipment would likely fall under a strengthened G7 export control regime, putting hundreds of billions of dollars of trade at risk.26Vest and Kratz, Sanctioning China in a Taiwan Crisis Sanctions on China’s banking system would limit exporters’ ability to settle transactions with importers.

Over time, however, foreign businesses could shift their transactions to unsanctioned importers and banks. Despite sanctions on much of Russia’s economy, at least 101 multinational companies from G7 countries are continuing operations in Russia as of January 2024, according to Yale researchers.27Chief Executive Leadership Institute, “Yale CELI List of Companies Leaving and Staying in Russia,” Yale School of Management, accessed February 29, 2024, https://www.yalerussianbusinessretreat.com/. While some of these firms are operating in sectors that may be considered humanitarian exceptions— such as agriculture and healthcare—most are not.

G7 trade with Russia fell by more than half in 2022. One quarter of the remaining trade is in agricultural commodities, medicine, and medical devices, which are explicitly authorized under a general license from the US Office of Foreign Assets Control.28Office of Foreign Assets Control, “Russia-related General License 6C – Transactions Related to Agricultural Commodities, Medicine, Medical Devices, Replacement Parts and Components, or Software Updates, the Coronavirus Disease 2019 (COVID-19) Pandemic, or Clinical Trials (January 17, 2023),” US Department of the Treasury, accessed March 15, 2024, https://ofac.treasury.gov/sanctions-programs-and-country-information/russian-harmful-foreign-activities-sanctions. But despite sanctions on many major Russian firms and banks, G7 countries exported almost $25 billion in non-agriculture and non-medical products to Russia in 2022, regardless of the reputational and logistical challenges of exporting even permitted goods to Russia.

The resilience of G7 exports to Russia after sanctions suggests that trade with China, though diminished, could continue even in a maximalist sanctions regime. Broadly speaking, there are three groups of exports in a maximalist sanctions program: (1) goods at higher risk of G7 export restrictions, (2) goods at higher risk of Chinese import restrictions as retaliation, and (3) goods at lower risk of either G7 or Chinese restrictions.

It is impossible to know a priori what sectors G7 countries would agree to impose strict export controls upon, given the substantial costs to their own economies from these sanctions. But for the sake of this analysis, we assume that energy, machinery, chemicals, electrical equipment, trains, planes, and metals are at higher risk of G7 sanctions, making Chinese import restrictions in these sectors less relevant.

What’s left? China imported $92.4 billion in automobiles, plastics, textiles, and rubber from G7 countries in 2022. Losing these imports would certainly be costly to the Chinese economy, but not fatal, making them possible candidates for Chinese retaliation in a maximalist scenario.

Finally, China imported $79.5 billion in agricultural goods, pharmaceuticals, and medical devices from G7 countries in 2022. Agricultural and medical goods were exempt from G7 sanctions in the Russia case as part of humanitarian carveouts present in all sanction regimes. It is likely they would be exempt from G7 sanctions against China as well. While China is likely to impose some restrictions on agricultural products (as it has in the past against French wine and US soybeans), a total ban on agricultural products from the G7 would be extremely costly to the Chinese economy, even if some of those imports could be backfilled by greater imports from non-G7 countries like Brazil. Medicine and pharmaceuticals would be even more so. In this instance, it seems likely that agricultural and medical goods would face lower risks of a total trade ban from either China or the G7.

Import-related statecraft tools have been a part of China’s economic statecraft toolkit in the past and would likely be featured in a moderate- and high-escalation scenario in the future. In a moderate-escalation scenario, the tools would remain more or less the same, but could target a broader range of sectors where Chinese dependence is low (consumer discretionary goods and substitutable goods) or where US dependence on China as an export market is high. Targeted import restrictions against the United States would also create opportunities for China to weaken G7 unity by importing more from other G7 countries.

In a high-escalation scenario, the initial disruption to foreign market access in China would stem primarily from G7 sanctions and market turbulence more broadly, rather than Chinese countersanctions. China is more likely to be judicious in imposing import bans on agricultural goods and pharmaceuticals against the full G7. Excluding those products, the full range of G7 exports to China at risk from G7 sanctions and Chinese countersanctions is around $358 billion.

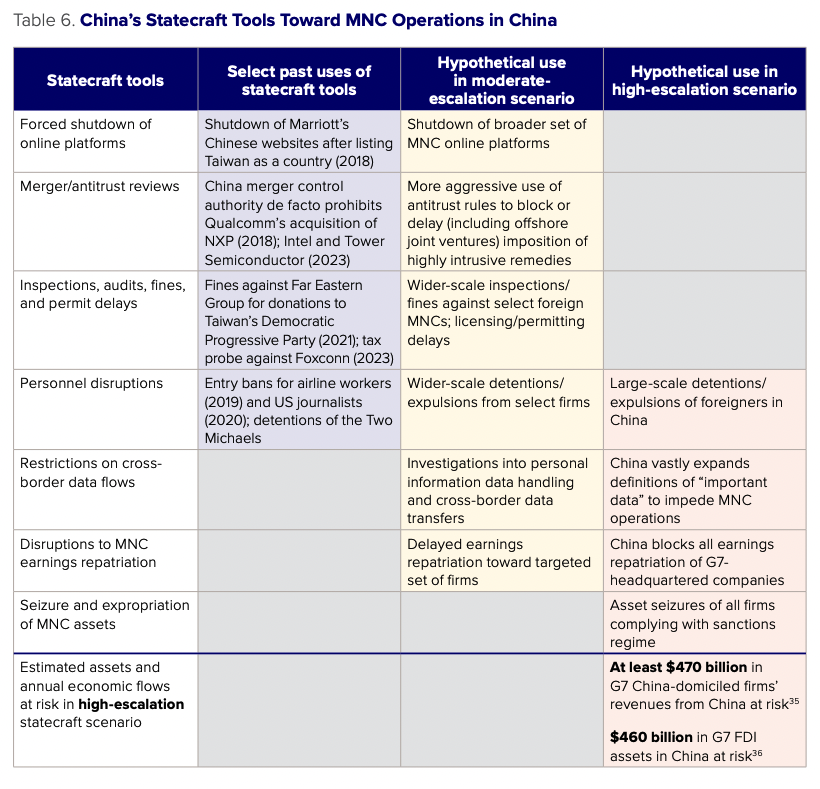

Foreign direct investment in China

During past geopolitical crises, China has used investment-related tools such as audits, inspections, and antitrust rules, typically either to punish a specific firm for its own actions (such as perceived support for Taiwanese independence) or to pressure firms to lobby their home governments. In a Taiwan escalation scenario, these tools could be used more expansively, potentially affecting up to $460 billion in G7 investment in China and an estimated $470 billion in annual revenue, but at the cost of undermining investor sentiment and accelerating capital flight from China.

Past uses of statecraft

China’s past use of statecraft against foreign firms domiciled in China indicates the wide range of tools available:

- Forced shutdown of online platforms – China’s cyberspace regulator has in the past used its authorities to force companies to adhere to China’s conception of “One China” on their websites and branding materials. In 2018, the Cyberspace Administration of China (CAC) forced Marriott to temporarily shut down its website in China due to an email questionnaire that listed Hong Kong, Macau, Tibet, and Taiwan as separate countries.29Abha Bhattarai, “China asked Marriott to shut down its website. The company complied.” Washington Post, January 18, 2018, https://www.washingtonpost.com/news/business/wp/2018/01/18/china-demanded-marriott-change-its-website-the-company-complied/.

- Merger/antitrust reviews – China has used its antitrust authority, the State Administration for Market Regulation (SAMR), as a powerful extraterritorial tool to block mergers between foreign companies during times of geopolitical tension. It is widely believed that China blocked the $44 billion merger of Qualcomm and NXP in 2018 in retaliation for US Section 301 tariffs on Chinese goods.30Don Clark, “Qualcomm Scraps $44 Billion NXP Deal After China Inaction,” New York Times, January 25, 2018, https://www.nytimes.com/2018/07/25/technology/qualcomm-nxp-china-deadline.html. The deal had been approved by eight other jurisdictions but was ultimately called off, as China’s refusal to approve the deal would have prevented the merged companies from operating in China. SAMR refused to approve the merger of Intel and Israeli firm Tower Semiconductor in 2023 amid escalating US tech controls on Chinese semiconductor firms.31Anirban Sen, “Intel scraps $5.4 bln Tower deal after China review delay,” Reuters, August 16, 2023, https://www.reuters.com/technology/intel-walk-away-54-bln-acquisition-tower-semiconductor-sources-2023-08-16/.

- Inspections, audits, fines, and permit delays – China has often used health, safety, environmental, and quality inspections, tax audits, and other routine regulatory actions to punish firms (or the firm’s home country) for their stances on crossstrait issues. In 2021, the Chinese subsidiaries of Taiwan-owned conglomerate Far Eastern Group were fined $13.9 million for a range of violations, including breaches of environmental protection rules. Far Eastern had been a major donor to Taiwan’s Democratic Progressive Party (DPP), a party that Beijing views as advocating for Taiwan’s independence. In the leadup to the 2024 Taiwan general election, Foxconn’s Chinese subsidies became the subject of tax audits and land-use investigations. The investigations were believed by some to be meant to force Foxconn’s founder, Terry Gou, out of the presidential race to avoid splitting votes away from Beijing’s favored party, the Kuomintang.32Reuters, “Foxconn faces tax audit, land use probe, Chinese state media reports,” October 22, 2023, https://www.reuters.com/technology/foxconn-faces-tax-audit-land-use-probe-chinese-state-media-2023-10-22/. And in 2017, China used fire safety and health code inspections to force the closure of Lotte supermarkets during the THAAD incident.33Cynthia Kim and Hyunjoo Jin, “With China dream shattered over missile land deal, Lotte faces costly overhaul,” Reuters, October 24, 2017, https://www.reuters.com/article/idUSKBN1CT35Y/.

- Personnel disruptions – In some cases, China has imposed restrictions on personnel traveling in or out of China for geopolitical reasons. 34Jennifer Creery, “Buzzfeed journalist denied new China visa following award-winning coverage of Xinjiang crackdown,” Hong Kong Free Press, March 31, 2020, https://hongkongfp.com/2018/08/22/buzzfeed-journalist-denied-new-china-visa-following-award-winning-coverage-xinjiang-crackdown/. China’s aviation regulator in 2019 ordered Hong Kong carrier Cathay Pacific to ban airline staff who supported the Hong Kong protests from traveling to China.35Blake Schmidt, “China Cracks Down on Cathay After Staff Join Hong Kong Protests,” Bloomberg, August 9, 2019, https://www.bloomberg.com/news/articles/2019-08-09/china-bars-cathay-pacific-staff-who-took-part-in-protests. In March 2023, China detained five local staff of Mintz Group, a corporate due diligence firm.36Michael Martina and Yew Lun Tian, “China detains staff, raids office of US due diligence firm Mintz Group,” Reuters, March 24, 2023, https://www.reuters.com/world/us-due-diligence-firm-mintz-groups-beijing-office-raided-five-staff-detained-2023-03-24/. In October 2023, China detained and then arrested a Japanese employee of Astellas Pharma on suspicion of espionage.37Kiyoshi Takenaka and Kaori Kaneko, “China formally arrests Astellas employee suspected of spying, Japan urges release,” Reuters, October 19, 2023, https://www.reuters.com/world/china/china-formally-arrests-astellas-employee-suspected-spying-japan-urges-release-2023-10-19/.

Table footnotes38International Monetary Fund, “Coordinated Direct Investment Survey,” accessed March 15, 2024, https://data.imf.org/?sk=40313609-f037-48c1- 84b1-e1f1ce54d6d5. 39Ministry of Commerce of the PRC, “中国外资统计公报2023年 [Statistical Bulletin of FDI in China 2023],” 2023, https://fdi.mofcom.gov.cn/resource/pdf/2023/12/19/7a6da9c9fb4b45d69c4dfde4236c3fd9.pdf.

Potential use in moderate-escalation scenario

Past methods of disrupting multinational corporation (MNC) activities in China could be scaled up in a moderate-escalation scenario, but the use of these tools runs the risk of accelerating MNC diversification away from China and impairing China’s economy. These tools are more effective when firms believe that, despite short-term tensions, China still holds promise for their business operations and sales.

The CAC could use its powers to shut down US companies’ websites in China, disable their apps, or close their app stores. China could impose these restrictions through a variety of legal and regulatory tools, including revoking a firm’s Internet Content Provider (ICP) filing license or by blocking their Internet Protocol (IP) address within China’s Great Firewall.40Tim Hardwick, “Apple Adopts Tighter Chinese App Store Rules, Closing Foreign App Loophole,” Mac Rumors, October 3, 2023, https://www.macrumors.com/2023/10/03/apple-adopts-tighter-china-app-store-rules/. Through merger reviews, authorities can force companies to choose between abandoning the Chinese market or what can be years-long, multibillion-dollar deals. Inspections, audits, and fines could be scaled up against US firms in a crisis. Personnel disruptions, including tacit hostage-taking as in the cases of Michael Kovrig and Michael Spavor, is extremely worrisome for firms. Put together, these instruments may create a strong incentive for businesses to lobby their home governments for more amicable relations that would allow a deal to go through, but they would also accelerate plans to move operations from China, particularly if it looks like relations will be tense for the long term. Previously unused tools could also be used at higher levels of escalation. China could initiate investigations into a firm’s handling of data or revoke certifications for cross-border data handling. Rules around data, personal information, and cybersecurity ranked second on the list of US companies’ top 10 challenges in China in 2023.41US-China Business Council, Member Survey, 2023, https://www.uschina.org/sites/default/files/en-2023_member_survey.pdf. Already many companies are working to minimize their regulatory risk by partially or completely localizing their data storage, information technology, human resources, and software solutions in China.42Ibid. Data issues are particularly acute in the automotive, healthcare, and financial services sectors, making retaliatory data audits and investigations a possibility in a moderate escalation scenario.43Antonio Douglas and Hannah Feldshuh, How American Companies are Approaching China’s Data, Privacy, and Cybersecurity Regimes, US-China Business Council, April 2022, https://www.uschina.org/sites/default/files/how_american_companies_are_approaching_chinas_data_ privacy_and_cybersecurity_regimes.pdf. Chinese authorities could also restrict how firms repatriate earnings. In past times of macroeconomic stress, China has restricted remittances for MNCs moving money abroad, although there is no evidence suggesting these restrictions were geopolitically motivated.44Erin Ennis and Jake Laband, “China’s Capital Controls Choke Cross-Border Payments,” US-China Business Council, n.d., https://www.uschina.org/china%E2%80%99s-capital-controls-choke-cross-border-payments. Foreign companies in China often repatriate income by issuing dividend payments to their overseas parent companies, which requires certain tax documents and processing by a Chinese bank. Chinese authorities could initiate tax audits targeting US companies to delay repatriation, or order banks to delay or reject processing requests. However, even in a moderate-escalation scenario, China would face macroeconomic pressures that would constrain how aggressively it targeted foreign companies. High geopolitical tensions would likely increase capital outflows and put depreciation pressure on the Chinese currency. Although China has substantial foreign reserves and strong capital controls, China’s reserves are finite and its capital controls are imperfect. Aggressive moves against foreign companies in China could exacerbate capital outflows in ways that Beijing would want to avoid.

Beijing would also seek to avoid moves that make it appear “uninvestable” to foreign firms more broadly. China’s long-term economic and financial stability depends in part on the willingness of foreign investors to continue investing in China, both to offset inherent outflow pressures and to drive productivity through partnerships with world-leading MNCs. Actions taken against MNCs, even if targeted against only one country, could undermine China’s narrative that it is a safe and attractive place for foreign investors to do business.

Potential use in high-escalation scenario

In a high-escalation scenario, China’s willingness to use aggressive economic statecraft actions against MNCs would likely be much higher. G7 sanctions on China’s major banks would immediately make China appear “uninvestable” for many investors, and many MNCs would be executing plans to exit the market even before considering Chinese retaliatory action. At this point, China would have little to gain from holding back on retaliatory actions on a pretense of maintaining “investability.”

Firms selling their assets in China would likely do so at a steep discount given a limited number of buyers and intense pressure to move quickly. Even once assets are sold, it would not be guaranteed that sellers could repatriate the proceeds of the sales to their home countries given strict capital controls on foreign reserves.

Tools used at lower levels of escalation could be used at greater scale. Local staff and visiting executives would likely face higher risks of travel delays and, potentially, exit bans or detentions amid heightened concerns over espionage. Restrictions on personal information protection and cross-border data transfers would likely be tightened considerably, adding to the logistical challenges of operating a Chinese subsidiary. Strict capital controls would likely prevent MNCs from repatriating any earnings in dollars whatsoever.

Companies would also be exposed to risks of asset seizure. G7 companies in strategic sectors such as chemicals and pharmaceuticals could face the risk of immediate expropriation. Within months of Russia’s invasion of Ukraine, for instance, Russia took control of German and Finnish utility assets in Russia.45Bloomberg News, “Russia Seizes Foreign-Owned Utilities After EU Asset Moves,” Bloomberg, April 26, 2023, https://www.bloomberg.com/news/articles/2023-04-26/russia-seizes-fortum-uniper-plants-in-response-to-asset-freezes?sref=H0KmZ7Wk. In China, companies that stayed, even in nonstrategic sectors, would face the risk of seizure as retribution in kind for G7 asset seizures or freezes or to ensure continued employment at firms that suspended their operations due to G7 sanctions.46Sarah Anne Aarup, “Russian roulette for Western companies that stayed,” Politico, August 8, 2023, https://www.politico.eu/article/western-companies-stayed-russia-war-face-consequences/; Andrew Osborn, “West stands to lose at least $288 bln in assets if Russian assets seized -RIA,” Reuters, January 21, 2024, https://www.reuters.com/business/west-stands-lose-least-288-bln-assets-if-russian-assets-seized-ria-2024-01-21/.

Estimating the FDI stock and revenues of G7 firms in China is hamstrung by a number of methodological challenges. China’s total inward FDI stock in 2022 was $3.6 trillion, according to the International Monetary Fund’s (IMF’s) Coordinated Direct Investment Survey.47International Monetary Fund, “Coordinated Direct Investment Survey.” However, because the IMF compiles data based on the immediate investing country, rather than the ultimate beneficial owner of the investing firm, it is difficult to identify what FDI ultimately comes from G7 countries. For instance, only $460 billion of China’s FDI stock comes directly from G7 countries, according to Chinese reporting to the IMF as of 2022, while $2.5 trillion (70 percent of the total) is attributed to Hong Kong, the Cayman Islands, and the British Virgin Islands, some of which is G7 investment channeled through these intermediaries. Complicating matters further, a substantial portion of China’s inward FDI stock is actually China-origin investment that is routed back through Hong Kong or other tax havens. Here we use the most conservative estimate of G7 FDI—that which is directly attributable to G7 countries. The full value of the G7 FDI stock in China is likely much larger.

Similarly, it is difficult to assess the total revenue and profit exposure from MNCs in China. Annual filings of listed companies do not systematically break out revenue by region. Data from China’s MOFCOM estimate that the total revenue of foreign-invested enterprises above designated size in China in 2022 was $3.9 trillion.48“Above designated size” refers to businesses with annual main business revenues of 20 million yuan or greater. “Foreign-invested enterprise” includes a range of entities, including wholly foreign-owned enterprises, Sino-foreign equity joint ventures, and other corporate structures. China does not individually report business revenues from foreign-invested enterprises by country, although MOFCOM does report the amount of realized inward FDI by country. Assuming that business revenues are proportional to overall business revenue, we estimate that G7 foreigninvested enterprises earned $470 billion in revenues in China in 2022 and $33 billion in profits—all of which would be put at risk from the combined impact of G7 sanctions and Chinese countersanctions in a high-escalation Taiwan crisis scenario.

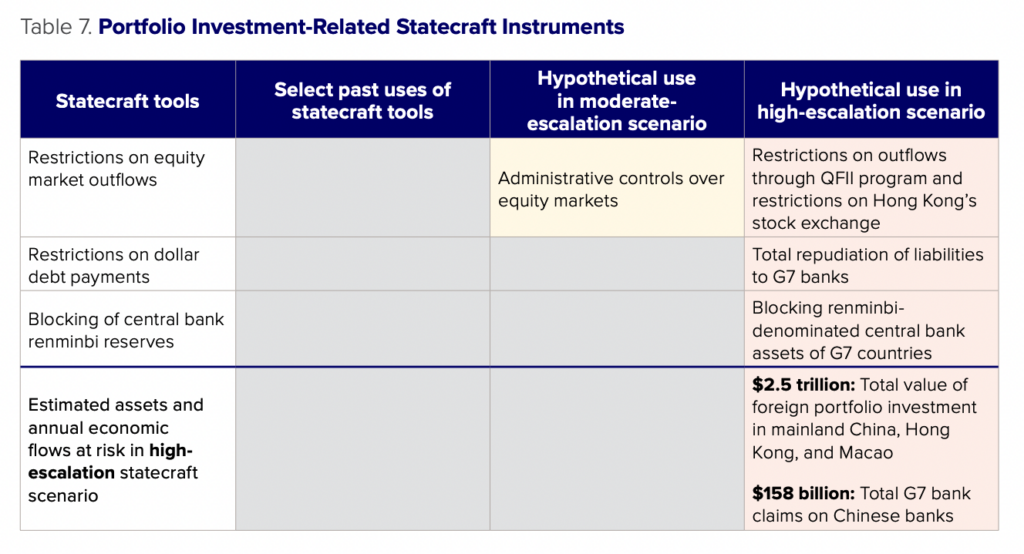

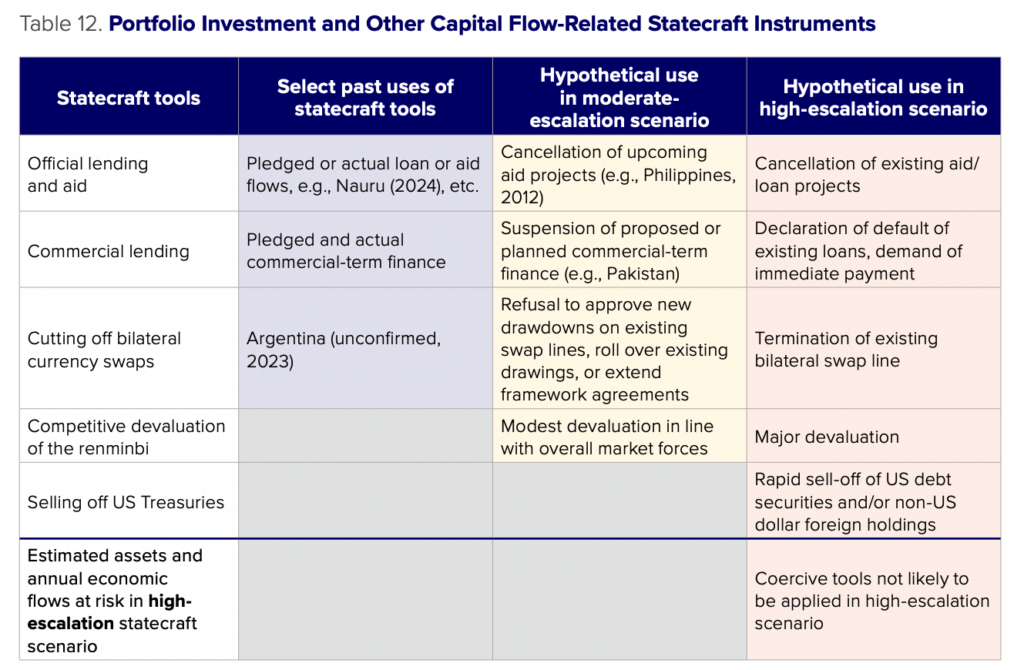

Portfolio investment and other capital flows

China could use restrictions on its equity markets to limit outflows of foreign portfolio capital from China. While these tools have not been used in the context of economic coercion in the past, China has restricted activity in its equity markets in an attempt to stabilize market conditions. In a moderate- or high-escalation scenario, China will likely consider imposing restrictions on market activity or outbound portfolio flows.

Past uses of statecraft

To our knowledge, China has not restricted trade orders or imposed capital controls in equity markets during disputes with other countries in an effort at coercion. However, China has intervened heavily in equity markets in the past in an attempt to steady markets during times of financial instability. In July 2015, a speculative bubble in China’s equity markets burst, with the Shanghai Composite Index falling by 32 percent from a peak the month prior. To stem the decline, China ordered brokerages not to process sell orders while using state funds to buy stocks.49Daniel H. Rosen and Logan Wright, “Credit and Credibility: Risks to China’s Economic Resilience,” Center for Strategic and International Studies, October 2018, https://www.csis.org/analysis/credit-and-credibility-risks-chinas-economic-resilience.

Potential use in moderate-escalation scenario

In a moderate-escalation scenario, it is probable that China would impose some capital controls and restrictions on equity markets to stanch capital flight stemming from a heightened sense of geopolitical risk among investors. Rather than a tool of economic statecraft per se, capital market controls should be seen as a likely response to financial instability during a crisis. In a more moderate scenario, where tensions with the United States and China trigger a stock market rout, for instance, China might turn to administrative controls on equity markets, as in 2015, that de facto restrict foreign investors selling Chinese stocks and repatriating funds. Given that the objective of such controls would be to ward off financial instability rather than impose costs on other countries, these restrictions would likely affect all financial investors in China rather than any one country.

Potential use in high-escalation scenario A higher-escalation scenario would likely see China impose capital controls across the board, including on capital flows through Hong Kong and Macao, to limit destabilizing outflows. Theoretically speaking, some of these tools could be targeted at G7 investors, but in practice, it would be difficult even for Chinese authorities to identify which portfolio assets belong to which investors. As with direct investment flows, portfolio investment is intermediated through tax havens, obfuscating the ultimate owners of capital. Efforts to estimate the holdings of Chinese securities on a nationality basis (rather than the typical residency basis) suggest that official data significantly understate holdings of Chinese securities.50Sergio Florez-Orrego et al., “Global Capital Allocation,” NBER Working Paper Series, Working Paper 31599, National Bureau of Economic Research, August 2023, https://www.nber.org/system/files/working_papers/w31599/w31599.pdf. Chinese authorities in a crisis would likely be hard-pressed to systematically identify G7 countries’ portfolio assets in China, let alone block them in a targeted fashion. If they did pursue this strategy, it is more likely that only a few high-profile investment firms would be targeted.

Instead, the more likely outcome is a comprehensive set of controls aimed at preventing a financial crisis. The IMF’s Coordinated Portfolio Investment Survey provides estimates of total portfolio assets and liabilities by economy.51International Monetary Fund, “Coordinated Portfolio Investment Survey,” https://data.imf.org/?sk=b981b4e34e58467e9b909de0c3367363. Based on this data, if full capital controls were put in place, an estimated $2.5 trillion worth of foreign equity assets in China, Hong Kong, and Macao would be at risk.

China in the global economy

China’s central place in global supply chains means that disruptions stemming from actions in a Taiwan escalation scenario would have far-reaching consequences. The previous section considers Chinese economic statecraft actions on flows and assets into China. This section considers the use of China’s statecraft toolbox on the global economy outside China: exports, outbound investment, and interactions with global financial markets.

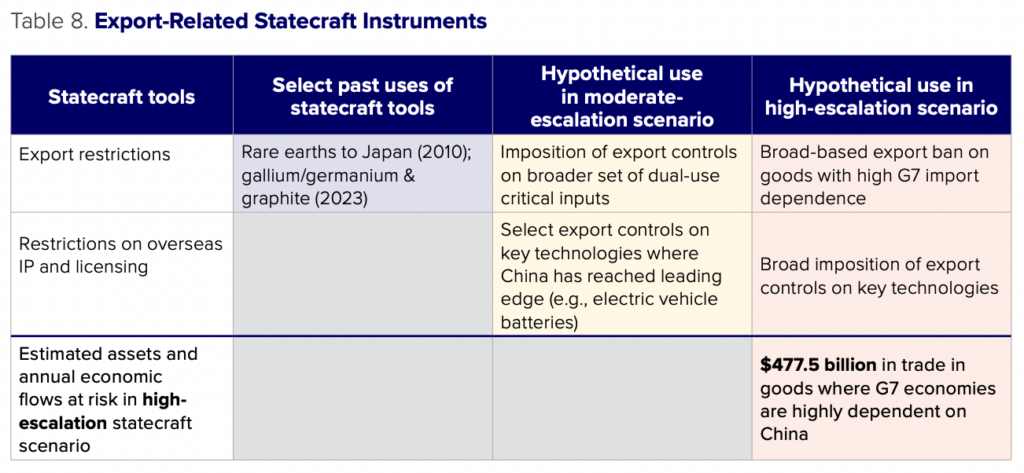

Chinese exports

In an escalation over Taiwan, China could use its central position in global supply chains to exercise leverage against other countries. Because weaponizing supply chains may accelerate diversification away from China, these tools have been used sparingly in the past. However, new legal and regulatory tools have created a pathway for their use in a future scenario where China is more willing to bear the economic and reputational costs of disrupting supply chains.

Past examples of statecraft

Export restrictions on critical goods – China has used export restrictions in past geopolitical incidents to exert leverage over other countries. In September 2010, after a collision between Japanese coast guard ships and a Chinese fishing vessel and Japan detained its captain, China imposed an informal export ban on rare earths to Japan.52Keith Bradsher, “Amid Tension, China Blocks Vital Exports to Japan,” New York Times, September 22, 2010, https://www.nytimes.com/2010/09/23/business/global/23rare.html. In October 2010, industry officials reported that China expanded the export restrictions to the United States and Europe amid a trade dispute. China resumed exports in November of that year.53Keith Bradsher, “China Restarts Rare Earth Shipments to Japan,” New York Times, November 19, 2010, https://www.nytimes.com/2010/11/20/business/global/20rare.html.

In July 2023, China announced it would require export permits for Chinese gallium and germanium, elements used in chip production and solar panels among other products.54Reuters, “China gallium, germanium export curbs kick in; wait for permits starts,” August 1, 2023, https://www.reuters.com/markets/commodities/chinas-controls-take-effect-wait-gallium-germanium-export-permits-begins-2023-08-01/ China’s announcement came as the United States imposed restrictions on high-end chip and chip equipment exports to China. China announced in October 2023 it would require licenses for export of graphite products used in electric vehicle batteries.55Ministry of Commerce and General Administration of Customs of the People’s Republic of China, “海关总署公告2023年第39号 关于优化调整石 墨物项临时出口管制措施的公告” [MOFCOM and GACC Announcement No. 39 of 2023 on Optimizing and Adjusting Temporary Export Control Measures for Graphite Items], October 2023, http://www.mofcom.gov.cn/article/zcfb/zcdwmy/202310/20231003447368.shtml. In both cases, demand for the products shot up immediately in advance of the license requirement, as importers stockpiled goods, and then fell, as the license regime was put in place. Gallium and germanium exports returned to pre-control levels by December. Rather than an export ban as in the past, the imposition of an export regime around gallium and germanium appeared to be an effort to formalize the legal foundation of export controls on a new set of critical goods. While Chinese authorities denied that the measures were retaliatory and aimed at any particular country, the announced measures did highlight China’s economic leverage in a period of heightened geopolitical tensions.

Potential use in moderate-escalation scenario

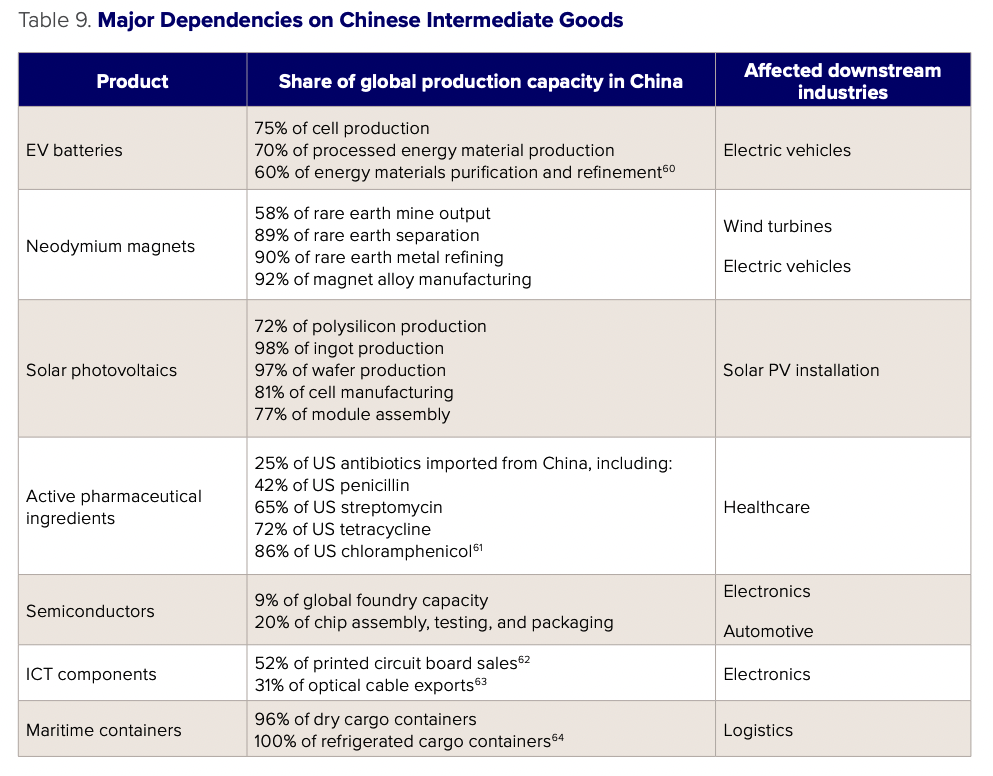

Export restrictions on critical goods – In a moderate-escalation scenario, China could limit exports to the United States across a range of products through export tariffs, informal restrictions, or full export bans. The United States is China’s largest export destination, with $583 billion in goods exported to the United States in 2022 (16 percent of China’s total exports).56United Nations Department of Economic and Social Affairs, “UN Comtrade Database,” accessed March 4, 2023, https://comtradeplus.un.org/. Export trade to the United States is an important source of employment, with an estimated 21.6 million jobs in China supported by exports to the United States.57OECD, “Trade in Employment Database,” accessed March 4, 2023, https://www.oecd.org/industry/ind/trade-in-employment.htm. China’s dependence on the United States as an export market suggests that Chinese policymakers will be cautious when imposing export restrictions, aiming to reduce the impacts on the Chinese economy while still imposing meaningful costs on the United States.

For this reason, initial export restrictions would likely focus on select intermediate goods where trade volumes and Chinese export-dependent employment is low, but the lack of which would have compounding effects on US industry. Past supply chain analyses have identified some of the main dependencies on imports from China (see Table 9).

Table footnotes58Aakash Arora et. al., Building a Robust and Resilient U.S. Lithium Battery Supply Chain, Li-Bridge, February 2023, https://netl.doe.gov/sites/ default/files/2023-03/Li-Bridge%20-%20Building%20a%20Robust%20and%20Resilient%20U.S.%20Lithium%20Battery%20Supply%20Chain.pdf. 59U.S.-China Economic and Security Review Commission, “Section 4: U.S. Supply Chain Vulnerabilities and Resilience,” accessed March 3, 2024, https://www.uscc.gov/sites/default/files/2022-11/Chapter_2_Section_4–U.S._Supply_Chain_Vulnerabilities_and_Resilience.pdf. 60U.S. Department of Commerce and U.S. Department of Homeland Security, Assessment of the Critical Supply Chains Supporting the U.S. Information and Communications Technology Industry, February 24, 2022, https://www.commerce.gov/sites/default/files/2022-02/Assessment-Critical-Supply-Chains-Supporting-US-ICT-Industry.pdf. 61Ibid. 62U.S. Department of Transportation, Supply Chain Assessment of the Transportation Industrial Base: Freight and Logistics, February 2022, https://www.transportation.gov/sites/dot.gov/files/2022-02/EO%2014017%20-%20DOT%20Sectoral%20Supply%20Chain%20Assessment%20 -%20Freight%20and%20Logistics_FINAL.pdf.

Restrictions on overseas IP and licensing – In addition to restricting goods exports, China may also change its posture on technology exports to the United States. Since 2008, China has maintained a technology catalogue that regulates what technologies may be exported from China.63Hogan Lovells, “China updates technology catalogue for export control, targeting emerging and cutting-edge sectors,” January 31, 2024, https://www.engage.hoganlovells.com/knowledgeservices/insights-and-analysis/china-updates-technology-catalogue-for-export-controltargeting-emerging-and-cutting-edge-sectors. The technology catalogue contains twenty-four technologies prohibited for export and 111 technologies requiring an export license. The latest revision issued in December 2023 added LiDAR systems, used in autonomous driving applications, to the list of technologies requiring a license. Other technologies covered requiring licenses under China’s technology control regime include advanced materials processing (e.g., chemical vapor deposition) and underwater autonomous robot manufacturing and control technology, among others. As China reaches the cutting edge in some of these technologies, the ability to grant or revoke export licenses to companies in the United States and elsewhere represents an additional statecraft tool.

Potential use in high-escalation scenario

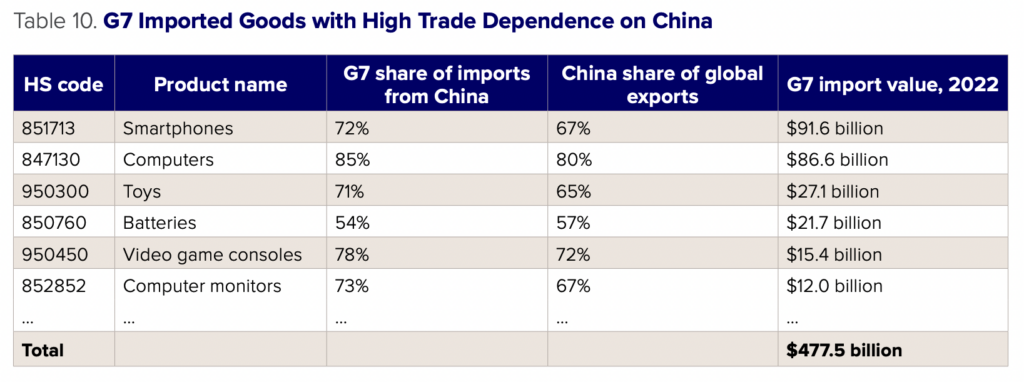

In a high-escalation scenario, Chinese policymakers may decide to impose as high costs as possible on the sanctioning G7 countries by imposing export restrictions on all goods where import dependence on China is high. Such an approach would cover a broad range of consumer and industrial goods, and would be aimed at disrupting the economies of the targeted countries and increasing costs for consumers. However, this would come at tremendous cost to the Chinese economy and its ability to withstand sanctions.

Import dependence is contingent on a range of factors, including not only how much a country depends on another for a particular good, but also how widely available that good is in the global market. While a true accounting of import dependence requires a sector-by-sector approach, we roughly estimate the value of goods where the G7 nations are highly dependent on China by summing up G7 imports at the HS 6-digit level where (1) over 50 percent of G7 imports come from China, and (2) China accounts for over 50 percent of global exports. This encompasses all products where both initial dependence on China is high and where substitutes from other countries may be expensive or hard to find given how dominant China is in that product category, at least in the short run. Based on this approach, the G7 is highly dependent on $477.5 billion in goods imported from China. This is a highly conservative measure, since losing access to intermediate goods would disrupt downstream manufacturing and incur costs much greater than their import value alone.

While export restrictions would be one of China’s most impactful economic statecraft tools, it would also be among the options costliest to China itself. First, an estimated 101.2 million jobs in China depend on foreign final demand, 44.8 million of which depend on final demand from G7 countries.64OECD, “Trade in Employment Database,” accessed March 4, 2023, https://www.oecd.org/industry/ind/trade-in-employment.htm. Any measures that disrupted these factories would exacerbate structural issues in employment and wages. Secondly, a major source of China’s resilience against sanctions is the fact that it runs a persistent trade surplus, which could be put at risk from export restrictions. Even under a full-scale G7 sanctions regime against Chinese banks, it would be very difficult to trigger a balance of payments crisis in China so long as the country continues to run a strong trade surplus. Trade restrictions from China that undermine its own trade surplus would work against China’s ultimate objective of maintaining macroeconomic stability in a moment of crisis. Finally, sanction regimes face the challenge of preventing transshipment of goods from third countries into the targeted economy. To effectively cut off the United States and other G7 economies from these products would require China’s non-sanctioned trading partners to agree not to transship controlled products to the G7, and for China to be willing to impose punishments on third countries that refuse to comply. China is unlikely to have the bureaucratic breadth even to monitor potential sanctions evasion on this scale, and may be loath to punish other countries in a moment where it is diplomatically isolated.

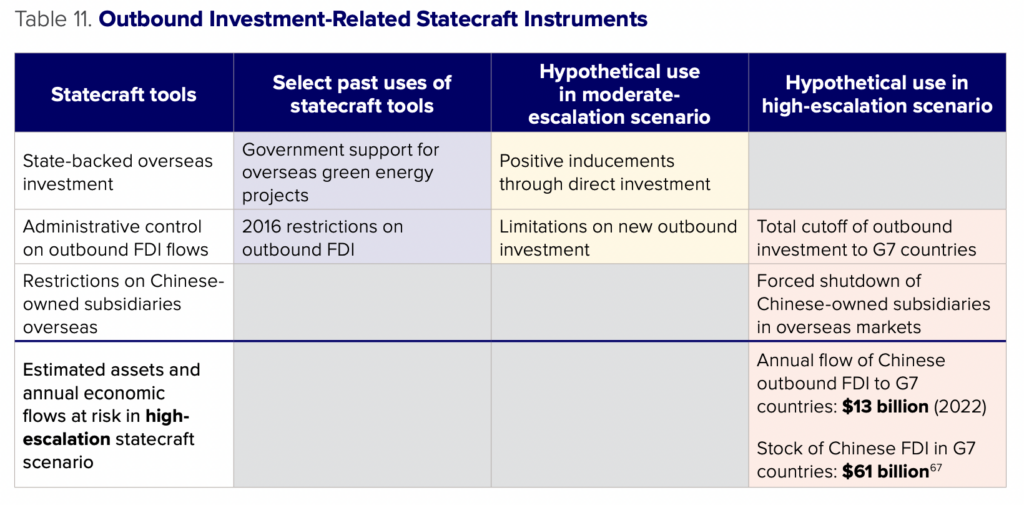

Chinese investment abroad

China has typically used overseas investment as a positive inducement rather than a coercive tool. In a moderate-escalation scenario, China could pair promises of outbound investment to friendlier countries with limitations on new outbound investment to other countries, although this would be likely driven less by a statecraft agenda and more by geopolitical realities in the host countries. In a highescalation scenario, China could potentially force the shutdown of Chinese-owned subsidiaries abroad, but this would be extremely costly and of limited effectiveness.

Past uses of statecraft

State-backed overseas investment – Overseas investment is a key part of China’s economic diplomacy.65Xinhua, “Full text of President Xi’s speech at opening of Belt and Road forum,” May 14, 2017, http://www.xinhuanet.com/english/2017-05/14/c_136282982.htm. Although it is debatable how much investment is driven by state versus commercial interests, major investment projects are often marked by both governments as opportunities to demonstrate a constructive relationship. In many cases these projects bring tangible economic benefits to the host country, making them an important part of China’s statecraft toolkit.66See, for example: Government of the Republic of Croatia, “Senj wind farm opened for trial run, the project will contribute to Croatia’s green transition,” December 7, 2021, https://vlada.gov.hr/news/senj-wind-farm-opened-for-trial-run-the-project-will-contribute-to-croatia-s-greentransition/33504; Wilhelmine Preussen, “Hungary’s Orbán courts China and wins a surge of clean car investments,” Politico, December 20, 2023, https://www.politico.eu/article/hungary-pm-viktor-oran-china-ties-ev-clean-car-investments-tensions-eu/.

Table footnote67International Monetary Fund, “Coordinated Direct Investment Survey.”

Administrative control on outbound FDI flows – China maintains administrative controls on outbound investment, limiting or approving investment when it meets political and economic goals. In the early 2010s, China began liberalizing its strict controls on outbound FDI to encourage Chinese firms to invest abroad.68Thilo Hanemann, “Testimony before the U.S.-China Economic and Security Review Commission,” U.S.-China Economic and Security Review Commission, Hearing on Chinese Investment in the United States, January 26, 2017, https://www.uscc.gov/sites/default/files/Hanemann_USCC%20Hearing%20Testimony012617.pdf. In 2016, a surge in capital outflows led Beijing to reimpose restrictions on outbound FDI in an attempt to mitigate balance of payments pressures. While this is not a direct application of statecraft, the tools exist for China to selectively restrict outbound investment in a future escalation scenario.

Potential use in moderate-escalation scenario

In a moderate-escalation scenario, Beijing could use promises of investment as positive inducements to align with China diplomatically, or use threats to cut off ongoing or future investments as a form of coercion.

The perceptions of China and its role in a moderate-escalation scenario would matter significantly to the effectiveness of these tools. Where the escalation exacerbates national security concerns toward China, Chinese promises of outbound investment or threats to cut off ongoing or new projects will likely have little effect. Similarly, if the geopolitical environment contributes to capital outflow pressure, China will be less likely to greenlight much new outbound investment.

Potential use in high-escalation scenario

In an escalation over Taiwan, China could theoretically halt all outbound investment to G7 countries as a form of coercion, although geopolitical conditions would likely make the point moot. G7 countries would be unlikely to welcome new investment from China in a major Taiwan escalation. The wave of new and updated inbound investment screening regimes across the G7 over the past decade give G7 governments the capacity to block many types of investments on national security grounds.69OECD, “Investment policy developments in 61 economies between 16 October 2021 and 15 March 2023,” April 2023, https://www.oecd.org/daf/inv/investment-policy/Investment-policy-monitoring-April-2023.pdf; Gabriel Rinaldi and Peter Wilke, “Germany rethinks China’s Hamburg port deal as further doubts raised,” Politico, April 19, 2023, https://www.politico.eu/article/germany-to-revisit-chinas-hamburg-port-deal-over-inconsistencies-on-critical-infrastructure-classification/. China would likely limit outbound investment regardless to stem capital outflows, and Chinese project developers would likely struggle to find overseas lenders willing to finance their projects at the risk of getting caught up in G7 sanctions.

China could hypothetically impose restrictions on the activities of Chinese-owned businesses abroad, with the aim of disrupting the domestic economy of the sanctioning countries. Chinese authorities could theoretically pressure Chinese firms in the United States to slow down operations or lay off workers. Chinese ownership of critical infrastructure — including State Grid Corporation of China’s 40 percent stake in the Philippines’ national grid and COSCO’s proposed 24.99 percent stake purchase in a port terminal in Hamburg — has raised concerns among policymakers over the national security risks of Chinese ownership of critical infrastructure in a crisis.70James Griffiths, “China can shut off the Philippines’ power grid at any time, leaked report warns,” CNN, November 26, 2019, https://www.cnn.com/2019/11/25/asia/philippines-china-power-grid-intl-hnk/index.html. To our knowledge, there have been no documented cases of Chinese firms shutting down their operations in other countries amid a geopolitical dispute with the intent to disrupt the local economy.