Global China in Africa: Documenting Indian perspectives from Ghana

Table of contents

Introduction

Multifaceted partnerships, intricate interests: India and China in Africa

Chasing opportunities: India and China in Ghana

Coexisting and competing with China in Ghana

Key takeaways

Conclusion

Introduction

Today, a fragmented Global China1Ching Kwan Lee, “Global China at 20: Why, How and So What?,” The China Quarterly 250 (2022): 313–31, doi:10.1017/S0305741022000686. operates in African landscapes. The artisanal miners in Kumasi, Ghana, contractors in Dar es Salaam, Tanzania, entrepreneurs in Harare, Zimbabwe, managers in Nairobi, Kenya, agroscientists in Lusaka, Zambia, and officials from both provincial and national governments are the face of the “new type of international relations” that President Xi Jinping claimed China and countries in Africa are collectively crafting.2“China and Africa in the New Era:A Partnership of Equals,” Ministry of Foreign Affairs of the People’s Republic of China (PRC), 2021, https://www.fmprc.gov.cn/mfa_eng/wjdt_665385/2649_665393/202111/t20211126_10453904.html.

This is perhaps most evident in the infrastructure sector. The influx of capital vital to meeting Africa’s tremendous infrastructure needs is estimated to be between $130 billion to $170 billion a year, with a current financing gap of $68 billion to $108 billion.3“Africa’s Infrastructure: Great Potential but Little Impact on Inclusive Growth,” in African Economic Outlook 2018, African Development Bank, 2018, Chapter 3, https://www.afdb.org/fileadmin/uploads/afdb/Documents/Publications/2018AEO/African_Economic_Outlook_2018_-_EN_Chapter3.pdf. Today, Africa accounts for almost 25 percent of the global revenues of Chinese construction companies.4“Data: Chinese Contracts in Africa (1998-2020),” China Africa Research Initiative (website), Johns Hopkins School of Advanced International Studies, http://www.sais-cari.org/data-chinese-contracts-in-africa. To put this in context, in 1990, American and European companies had over 85 percent of the construction contracts in the continent. Now Chinese firms dominate with reports of market shares ranging between 31 percent to 62 percent, and in some cases—such as the Kenya National Highways Authority’s road projects—this number is even higher, with Chinese firms controlling 85 percent of all projects.5Gyude Moore, “Africa Must Learn to Compete with Dominant Chinese Firms,” African Business, 2022, https://african.business/2022/03/trade-investment/africa-must-learn-to-compete-with-dominant-chinese-firms/; and “How Chinese Firms Have Dominated African Infrastructure, Economist, February 19, 2022, https://www.economist.com/middle-east-and-africa/how-chinese-firms-have-dominated-african-infrastructure/21807721.

Chinese construction companies, with their unique advantages characterized by high speed, enormous scale, easy financing, and low costs enjoy a critical edge over other competitors.6Veda Vaidyanathan, China’s Infrastructure Development in Africa: An Examination of Projects in Tanzania and Kenya, Institute of Chinese Studies (ICS) Monograph no. 5, 2019, https://www.icsin.org/publications/chinas-infrastructure-development-in-africa-an-examination-of-projects-in-tanzania-and-kenya. Additionally, Chinese-built industrial parks and economic zones in Africa are attracting low-cost, labor-intensive manufacturing units that are relocating from China. Chinese tech companies are laying critical telecommunications infrastructure even as, venture capital funds are investing in African fintech firms, and other smaller enterprises are expanding across the region.

Partly due to the lack of alternative options, China is quickly becoming a partner of choice, and several African countries are keen to explore the many possibilities of working together. Some governments, like Zambia, are hiring Chinese citizens in investment promotion agencies to ease processes made complicated by the oft-quoted gaps in communication, with departments conducting road shows in China to attract potential investors.7Veda Vaidyanathan, China-Zambia Economic Relations: Perspectives from the Agricultural Sector, ICS Monograph no. 6, 2021, https://www.icsin.org/uploads/2021/05/31/6d702e36d280d186f36c66638001270e.pdf. Others, like Ethiopia, are making policy decisions to offer a slew of incentives to increase Chinese investments with the aim of diversifying the domestic industry, such as the pharmaceutical manufacturing sector.8Pippa Morgan, “Can China Help Build Africa’s Nascent Pharmaceutical Sector?,” China Global South Project, October 16, 2020, https://chinaglobalsouth.com/analysis/can-china-help-build-africas-nascent-pharmaceutical-sector/.

Beijing also gains tremendously from African countries’ collective political support in multilateral forums. According to late professor and author Ian Taylor,9Ian Taylor, “Mao Zedong’s China and Africa,” Twentieth Century Communism, no. 15 (2018): 47–72. China was always acutely aware of the collective power of the African states in multilateral organizations:

- African countries played a crucial role in the debate and final acceptance of the People’s Republic of China into the United Nations. The pro-Beijing resolution was supported by 76 votes, with 35 against and 17 abstentions. Over a third of the votes in favour of the PRC were from Africa, including from four countries which still had diplomatic relations with Taiwan; and of the 23 co-sponsors of the “important question,” 11 were African. It is certain that without the African votes, China would not have succeeded in being admitted to the UN at the time.

Contemporary discussions on Chinese great power aspirations, the promise of the Belt and Road Initiative (BRI), and the “win-win” concept, are often substantiated by illustrations of how Beijing has changed the status quo in Africa.

Examining China in Africa from India is unique on two main counts. First, African nations, particularly in eastern and southern Africa, have long been traditional partners for India, sharing ideological, political, economic, and sociocultural relations. The immense geopolitical and economic sway Beijing appears to have cultivated, requires New Delhi to reimagine its engagement with the region. This includes stepping up triangular cooperation with other democracies already active in the region, such as Japan and the United States, or practical cooperation through partnerships like the Quadrilateral Security Dialogue, or Quad,10“Fact Sheet: Quad Leaders’ Summit,” White House Briefing Room (website), September 24, 2021, https://www.whitehouse.gov/briefing-room/statements-releases/2021/09/24/fact-sheet-quad-leaders-summit/. a grouping of the United States, Australia, India, and Japan that works on a range of issues in the Indo-Pacific region including countries in Africa.11Hamish Sneyd, “Bringing Africa into the Indo-Pacific,” Perth USAsia Centre (website), April 2022, https://perthusasia.edu.au/our-work/bringing-africa-into-the-indo-pacific. Development projects already underway, such as the “Feed the Future India Africa Innovation Transfer Platform” where USAID partnered with a US NGO Technoserve to share and transfer innovative Indian soil and water management techniques known as Khadins and Taankas in Kenya and Malawi is a case in point.12U.S.-India Triangular Cooperation | India | Archive – U.S. Agency for International Development. usaid.gov. September 2022. A reimagination of engagement in the current context calls for a granular examination of Beijing’s instruments and approaches, and a better understanding of its grassroots impact.

Second, India-China relations are currently at an all-time low. The border standoff and loss of life from clashes, inherent lack of trust, a steep trade deficit, the BRI’s China-Pakistan Economic Corridor, have resulted in a decline in India-China relations, with many in the strategic community stating that it has reached the lowest point since the 1962 Sino-Indian War.13Vijay Gokhale. The Road from Galwan: The Future of India-China Relations, Carnegie Endowment for International Peace, Working Paper, 2021, https://carnegieendowment.org/files/Gokhale_Galwan.pdf. While the implications of India-China competition if not rivalry—in the Indian Ocean region, South Asia, and the Asia-Pacific region—are being studied closely, it is crucial to examine this in Africa: a region where India has tremendous interests and where pursuing them is becoming increasingly complex.

A 2021 report titled India’s Path to Power, crafted by some of the New Delhi’s leading intellectuals, stated that India’s relations with developing countries “have atrophied” and a fraying of ties within the subcontinent is also reflected in India’s relationships with countries in Africa. The authors argue that:14Yamini Aiyar, Sunil Khilnani, Prakash Menon, Shivshankar Menon, Nitin Pai, Srinath Raghavan, Ajit Ranade, and Shyam Saran, India’s Path to Power: Strategy in a World Adrift, posted at the Centre for Policy Research and the Takshashila Institution, October 2021.

- The great powers are facing internal stresses and challenges, having been diminished by the pandemic and the economic crash of 2020. China, which is perhaps an exception, has turned increasingly adversarial and is attempting to mould the multilateral system to its own purposes. We believe that a discombobulated world requires flexibility and broad coalitions, both to produce acceptable outcomes and to avoid conflict. This requires a new outreach by India to our traditional partners in the developing world. They are significant today as the locus of economic opportunities, as sources of support and commodities essential for India, and as necessary allies in reviving those parts of the multilateral system as would be useful in the decade ahead.

For New Delhi to craft “a new outreach” to its traditional partners, especially those in Africa, examining China’s active engagement and increasing footprint in the region will be key. The extent of this footprint can be analyzed by putting together the picture emerging from many growing African countries with significant Chinese presence. Ghana is an interesting case in point, and the focus of this study.

One of the fastest growing economies in West Africa, Ghana has shared deep historical, ideological, economic, and political relations with both Asian powers. The West African country also houses a significant Indian diaspora,15“About Us,” Indian Association of Ghana (website), accessed June 2022, http://iaghana.com/Home/GhanaDetails/About%20IAGhana. and has become a popular destination for Chinese migrants,16Jinpu Wang, “What Drives Chinese Migrants to Ghana: It’s Not Just an Economic Decision, Conversation, 2022, https://theconversation.com/what-drives-chinese-migrants-to-ghana-its-not-just-an-economic-decision-177580. providing an interesting canvas to evaluate perceptions.

To learn about the experiences of coexisting and competing with Chinese actors, the extent of backward and forward linkages, and to collect impressions of the growing Chinese community in the country, the methodology followed for this study included two steps: desktop research and key stakeholder interviews. From a list of twenty-three prominent Indian businesses in Ghana received from the High Commission of India in Accra, the researchers were able to interview representatives of twelve companies in Accra as well as in Tema in August 2022. Additionally, they conducted interviews with local Ghanian businesses, academics, tribal chiefs, and trade union representatives.

In examining Chinese impact, the research team built on the analytical work of Xiaoyang Tang, a professor in the Department of International Relations at Tsinghua University, on Chinese investments in Ghana from 2000 to 2014,17Xiaoyang Tang, Chinese Investment in Ghana’s Manufacturing Sector, IFPRI Discussion Paper No. 1628, 2017, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2946203. using data from the Ghana Investment Promotion Center (GIPC). The team asked GIPC for information on Chinese investments in Ghana from 2014 to 2021. Of the 261 Chinese companies listed in the data set, the researchers were able to establish contact with eighty-three, and thirty-three companies agreed to a telephonic interview. To fill the gap that this lack of in-person access presented, scholars who have been examining China in Africa and had recently interviewed small and medium-scale Chinese companies in Ghana were interviewed to learn from their findings.

Multifaceted partnerships, intricate interests: China and India in Africa

A brief overview of China in Africa

China’s engagement with Africa is not of recent origin. Chinese contacts with Africa date back to the early Han dynasty, while it was sea ventures under the command of Admiral Zheng He during the Ming dynasty when relations peaked.18Gao Jinyuan, “China and Africa: The Development of Relations Over Many Centuries,” African Affairs 83, no. 331 (1984); and Chris Alden and Cristina Alves, “History & Identity in the Construction of China’s Africa Policy,” Review of African Political Economy 35, no. 115 (2008): 43–58. In more recent history however—Ethiopia, Egypt, Liberia, and apartheid South Africa were among the few independent African countries —when the PRC was established in 1949.

Today, with a two-way trade of $254 billion and investments exceeding $2.07 billion in the first seven months of 2021 alone,19“Chinese Investment in Africa Rises as Project Values and Bilateral Trade Decline,” International Institute for Sustainable Development (website), October 25, 2021, https://www.iisd.org/articles/chinese-investment-africa-bilateral-trade-decline#:~:text=News-,Chinese%20Investment%20in%20Africa%20Rises%20as%20Project%20Values%20and%20Bilateral,scrutinizing%20contracts%20with%20Chinese%20firms. China is the largest trading partner, biggest investor, and creditor for most African countries. Four Chinese lenders—The Export-Import Bank of China, China Development Bank, Industrial and Commercial Bank of China, and the China International Development Cooperation Agency—have participated in debt restructuring, leveraging multilateral institutions like the Group of Twenty’s Debt Service Suspension Initiative, the International Monetary Fund’s Catastrophe Containment Relief Trust, and the debt cancellation programs of the Forum on China-Africa Cooperation (FOCAC).20“Global Debt Relief Dashboard,” The China Africa Research Initiative (CARI) (website), October 2022, http://www.sais-cari.org/debt-relief.

The 2022 African Youth Survey conducted by the Ichikowitz Family Foundation across fifteen countries and based on 4,507 interviews found that:

- Of all the foreign actors seen to have an influence on the continent, youth see China as having by far the biggest impact, with more than half (54 percent) of African youth saying that China has a lot of influence on their country and almost a further quarter (23 percent) saying it has some influence. The United States is seen as the second most influential foreign power, with four-in-ten (41 percent) youth saying it has a lot of influence on their country and another quarter (26 percent) saying it has some influence.

Respondents who mentioned China’s positive influence pointed to the affordability of Chinese products (44 percent), assistance in developing infrastructure (41 percent), and its creation of employment opportunities (35 percent). Meanwhile, those who viewed it as a negative appear concerned about Chinese companies exporting resources without fair compensation (36 percent), Chinese workers taking job opportunities away from locals (24 percent), and a lack of respect for the country’s values and traditions (21 percent), among others.21African Youth Survey 2022, Ichikowitz Family Foundation, 2022, https://ichikowitzfoundation.com/wp-content/uploads/2022/06/AfricanYS_21_H_TXT_001g1.pdf.

Similarly, Afrobarometer, a pan-African, nonpartisan survey research network, found that 63 percent of Africans surveyed in 2019-21 across thirty-four countries “hold positive views of China’s assistance and influence”—attributed largely to China’s projects in infrastructure, development, and investment in Africa. However, the survey also said that:

- Positive views of China’s influence do not appear to affect Africans’ attitudes toward democracy. China remains second to the United States as the preferred development model for Africans. And majorities of those who are aware of Chinese loans and development assistance to their countries are concerned about being heavily indebted to China.22Josephine Sanny and Edem Selormey, “AD489: Africans Welcome China’s Influence but Maintain Democratic Aspirations,” Afrobarometer, November 2021, https://www.afrobarometer.org/publication/ad489-africans-welcome-chinas-influence-maintain-democratic-aspirations/.

While China’s growing engagement with Africa is said to have had a positive, albeit uneven, effect on Africa’s economic growth, economic diversification, job creation, and connectivity,23Folashade Soule and Edem E. Selormey, “How Popular Is China in Africa? New Survey Sheds Light on What Ordinary People Think,” Conversation, November 17, 2020, https://theconversation.com/how-popular-is-china-in-africa-new-survey-sheds-light-on-what-ordinary-people-think-149552. it also has received sufficient pushback—with allegations of unfair business practices, violation of local laws, and poor compliance with safety and environmental standards.24Eleanor Albert, “China in Africa,” Backgrounder, Council of Foreign Relations, updated July 12, 2017, https://www.cfr.org/backgrounder/china-africa. The current discourse on China’s engagement in Africa has led to the creation of an entire subfield of study, with writers, journalists, and artists weighing in.

A brief overview of India in Africa

Historically, it was proximity to African shores and the promise of fortunes to be made that enabled early migration from the Western coast of India to the Eastern coast of Africa. According to the historian Savita Nair, records of these movements of people can be found in travellers’ notes at the time of The Periplus of the Erythraean Sea, a first century CE account at a time when Indian traders had agents in areas of East Africa.25Savita Nair, “Moving Life Histories: Gujarat, East Africa, and the Indian Diaspora, 1880–2000,” (PhD diss., University of Pennsylvania, 2001), https://repository.upenn.edu/dissertations/AAI3015348/. Later, while many Indians were brought to Africa by the British Government as indentured labourers, others referred to as ‘Passenger Indians’, traders, artisans, teachers and shop assistants, mainly from the western coast, came in search of opportunities.

Today, descendants and members of the Indian diaspora are deeply integrated in many African societies, raising families, running businesses, and often becoming citizens in the host country. Official estimates suggest there are over three million people, spread over forty-six African countries, with the largest concentration in South Africa, Mauritius, Kenya, Uganda, Tanzania, Malawi, and Mozambique.26“Address by External Affairs Minister, Dr. S. Jaishankar, at the Launch of Book: India-Africa Relations: Changing Horizons,” Ministry of External Affairs, Government of India, May 17, 2022, https://mea.gov.in/Speeches-Statements.htm?dtl/35322/. Given the many waves of migrants and entrepreneurs who have reached Africa, presently there are people of Indian origin who have varying degrees of familiarity with the motherland.

African nations are also crucial economic partners for India. Total trade with the region for 2020-21 was valued at $55 billion, and India is the fifth-largest investor in Africa, with cumulative investments of $54 billion. The acquisition of critical assets by Indian SOEs to diversify the energy basket away from West Asia, commercial ventures by Indian corporations looking to expand into untapped markets, and small and medium-scale Indian entrepreneurs operating across countries and sectors, the economic cooperation between these regions takes on multiple forms.

While state-level interactions are driven under the auspices of the India Africa Forum Summit (IAFS), there are also a plethora of development cooperation mechanisms that make Delhi a key developmental partner for many countries in the continent. Indian sub-national actors, including civil society and voluntary organizations are also setting up linkages across these geographies, scaling up innovative development solutions and sharing knowledge. From agriculture and health, to education, existing frameworks prioritize individual and institutional capacity building and are driven by priorities set by partner countries in Africa.

What makes this seemingly straightforward geopolitical development – of Asian powers reengaging Africa – complex to document is the fact that many different Indias exist in Africa: i.e., the third-generation, Indian-origin industrialist, the successful first-generation entrepreneur, the contractor of an Indian multinational corporation looking to win bids. They have all have felt the change in status quo brought on by the multitude of Chinas that are operating in these geographies: whether it is the contractor in a Chinese state-owned enterprise (SOE) that seems to have access to virtually unlimited funding, the small-scale manufacturer with an entire supply chain in China, or the artisanal miner working in the gold mines. The range of Indian actors, despite their differences, have all felt the impact and have something to say. Their perspective offers a unique vantage point to examine nuances of the phenomenon that is Global China.

Chasing opportunities: India and China in Ghana

The 1955 Asian-African Conference (also called the Bandung Conference), involving representatives from twenty-nine newly independent nations from the developing world during the Cold War, was a watershed moment that shaped both India’s and China’s early relations with countries on the continent. Their shared ideological fight against colonialism and imperialism strengthened the idea of Afro-Asian solidarity. The foundation of Ghana’s relations with both India and China were laid by the close friendship and political exchanges of Ghana’s first president, Kwame Nkrumah, with Indian Prime Minister Jawaharlal Nehru and Chinese Premier Zhou Enlai.

China-Ghana relations

Among the many diverse countries on the African continent, Ghana presents an interesting case study. It is one of the earliest countries in Africa to establish diplomatic ties with China, and it has been central to China’s Africa Policy. Taylor states: “The overthrow of Kwame Nkrumah of Ghana in 1966 was a major setback for Chinese policy in Africa, particularly since it happened when Nkrumah was in Beijing on an official visit. Almost immediately, the new Ghanaian military government ordered the expulsion of Chinese ‘experts.’ The military training camp headed by Chinese instructors was also closed, and its instructors expelled. On 20 October 1966, after Sino-Ghanaian relations had deteriorated further, diplomatic relations were suspended.”27Taylor, “Mao Zedong’s China and Africa”, 53 and Ian Taylor. Review of Chau, Donovan C., Exploiting Africa: The Influence of Maoist China in Algeria, Ghana, and Tanzania . H-Asia, H-Net Reviews. April, 2015. URL: http://www.h-net.org/reviews/showrev.php?id=41770.

Today, China is Ghana’s biggest trading partner. Ghana’s imports from China between 1995 and 2020 have increased at an annual rate of 20 percent, $71.3 million to $6.75 billion (and the top import, at $232 million, was coated flat-rolled iron); its exports to China have increased at an annual rate of 26.5 percent, rising from $4.23 million to $1.52 billion (and the top export, at $1.24 billion, was crude petroleum).28“China/Ghana,” Observatory of Economic Complexity (OEC) (data visualization platform), 2020 data and July 2022 trade trends, https://oec.world/en/profile/bilateral-country/chn/partner/gha#:~:text=Ghana%2DChina%20In%202020%2C%20Ghana,to%20%241.52B%20in%202020. The humongous trade imbalance notwithstanding, the increasing economic incentives and opportunities for social mobility have made Ghana a destination for Chinese migration, housing between ten and thirty thousand Chinese today.29Joseph Teye and Jixia Lu, “China-Ghana Migration Corridor Brief,” Migration for Development and Equality (MIDEQ), Global Challenge Research Fund, and UK Research and Innovation, accessed August 2022, https://www.mideq.org/en/resources-index-page/china-ghana-migration-corridor-brief/. However, these estimates vary, with the Chinese government placing the number at between thirty thousand and fifty thousand Chinese expats and diaspora in Ghana.30Angeli Datt and Aurelia Ayisi, “Beijing’s Global Media Influence 2022: Country Report, Ghana,” Freedom House, https://freedomhouse.org/country/ghana/beijings-global-media-influence/2022#footnoteref10_sw3bso0. Conversely, there has also been an uptick in the number of Ghanaian youth choosing to study in China, with over eight hundred students registering in doctoral programmes in China in 2018.31Natasha Robinson and David Mills, “Why China Is Becoming a Top Choice for Ghanian PhD Students,” Quartz Africa, last updated July 2022, https://qz.com/africa/2102664/why-china-is-becoming-a-top-choice-for-ghanaian-phd-students/. The current president, Nana Akufo-Addo, stated that Ghana is aiming to replicate China’s development model with the industrialisation policy of ‘1-District-1-Factory’, during a FOCAC roundtable in 2018.32“Ghana aiming to Replicate China’s Success Story”, The Presidency Republic of Ghana, 04 September 2018, https://presidency.gov.gh/index.php/briefing-room/news-style-2/809-ghana-aiming-to-replicate-china-s-success-story-president-akufo-addo.

According to the latest data received from the Ghana Investment Promotion Center, 261 Chinese firms were registered in eight sectors of the Ghanaian economy. A majority of these firms are wholly owned by Chinese shareholders. The Chinese enterprises operating in Ghana that were interviewed for this study in August 2022 ranged from companies engaged in the production and export of cashew nuts, agrochemicals, roofing sheets, fiber-artificial hair, and security doors; recycling of plastic bottles; traders of electrical appliances; and those engaged in construction and agriculture. A few common threads from their responses include:

- No previous experience in Africa: Several companies interviewed stated that Ghana was the first country in Africa where they had established businesses. Broadly, respondents said that they had two to ten years of experience in Ghana. Three companies had no experience operating in any other part of the continent. Though Ghana was their first foray into Africa, they declined to explain what brought them there.

- Job creation: It appears that most enterprises employ local staff. Though a crude oil refining company employed 1,600 workers and a company running a mall employed 1,000 people, the number of jobs generated by other companies ranged from four to one hundred. The breakdown of employees by nationality was not available. This notwithstanding, the majority of the Chinese firms claimed to have employed more local staff than Chinese workers.

- Challenging business environment: Respondents described business as “currently very difficult.” This was attributed to a weak cedi/low dollar rate. Several representatives indicated their company was no longer in operation—either “shut down due to large electricity bills” or because they were “temporarily closed.”

- Government as resource: While one enterprise mentioned receiving help from the government, most stated that they did not receive financial assistance from their government- but had its support if they faced any difficulty.

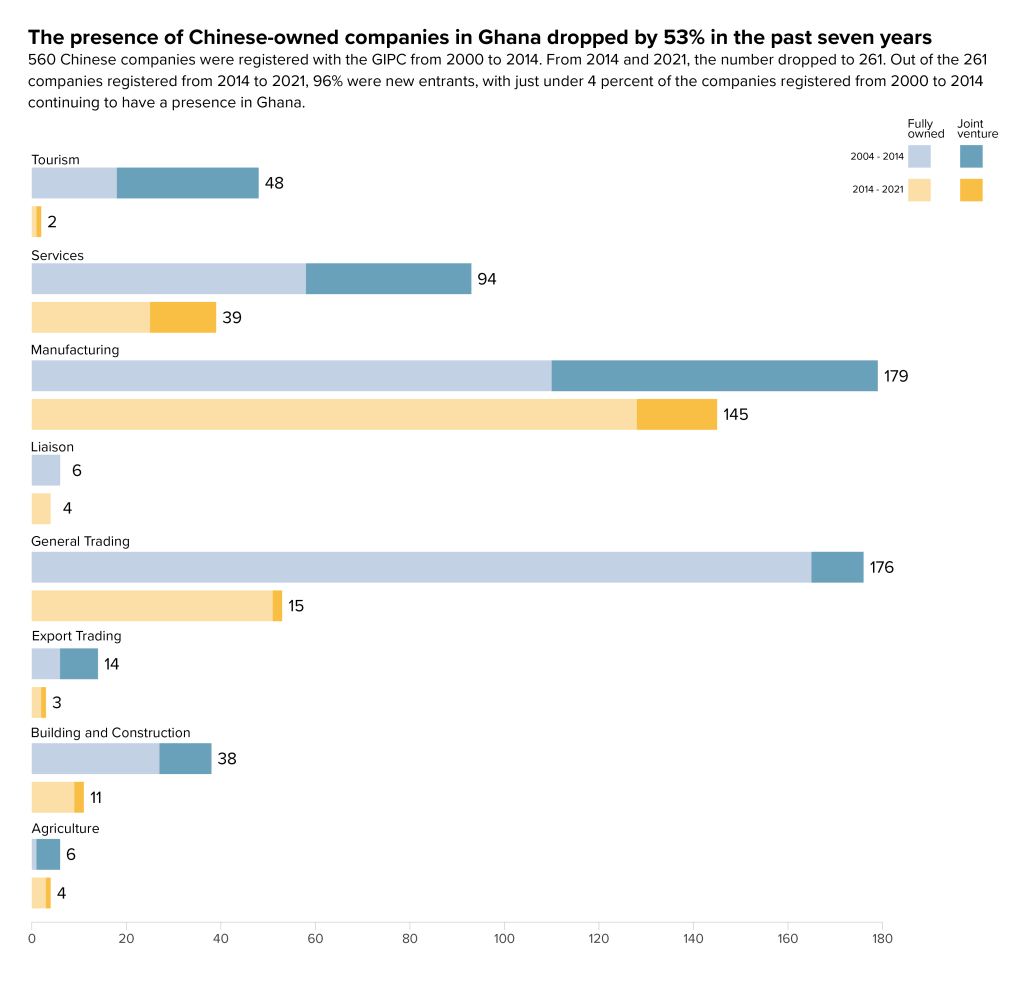

A comparative analysis of GIPC data sets from 2000 to 2014 and from 2014 to 2021 presents some interesting trends:

- Manufacturing sector leads FDI: Chinese firms injected $2.8 billion into the Ghanaian economy from 2014 to 2021. The manufacturing sector accounted for the largest number of companies (145) and contributed the highest foreign direct investment ($2.3 billion). The tourism industry had the least projects (two) and contributed the least FDI ($184,800).

- Short-lived businesses: While 560 Chinese companies were registered with the GIPC from 2000 to 2014, 261 Chinese companies were registered under GIPC from 2014 to 2021. Of the 261 companies registered from 2014 to 2021, 251 were new entrants (96.17 percent). In essence, only 3.83 percent of the companies registered from 2000 to 2014 continued to exist over the 2014-2021 period. All the companies that remained, operated within their original sectors, and some of them had made slight alterations to their original company names.

- Decrease in joint ventures: Out of the 560 (30.2 percent) registered from 2000 to 2014, 169 were jointly owned by Ghanaian and Chinese partners, while only 38 out of the 261 (14.5 percent) companies registered from 2014 to 2021 were joint ventures.

- Change in geographical distribution: From 2000 to 2014, Chinese companies operated in nine out of ten regions in Ghana, with the Upper West region recording zero registered Chinese companies. From 2014 to 2021, Chinese companies were operating in seven out of the ten regions (sixteen in 2018), with none operating in the Bono Ahafo, Upper East, and Upper West regions.

India-Ghana relations

India and Ghana, with their postcolonial legacies, have historically enjoyed good bilateral relations and were the founding members of the Non Aligned Movement. India opened its consulate in Accra in 1953 and full-fledged relations were established immediately after Ghana’s independence in 1957. The country also has a traditional Indian diaspora, with official estimates of ten thousand nonresident Indians and persons of Indian origin,33“Brief on India: Ghana Bilateral Relations,” Ministry of External Affairs (MEA), Government of India, December 2021, https://mea.gov.in/Portal/ForeignRelation/Brief_on_India_Ghana_Relations.pdf. and unofficial estimates suggesting close to twenty thousand persons. There have been frequent and regular ministerial exchanges: the Indian president, Pranab Mukherjee, visited Ghana in 2016, and President Afuko-Addo participated in the founding conference of the International Solar Alliance on March 11, 2018, in New Delhi.

The two countries also are key developmental partners. Since the establishment of relations in the late 1950s until now, India has extended around $450 million for various projects like rural electrification, establishment of the Ghana-India Kofi Annan Centre of Excellence in Information and Communication Technology (ICT), construction of the presidential palace, agriculture mechanization, upgrades to the water supply systems, and establishment of a foreign services training institute.34“Brief on India: Ghana Bilateral Relations,” MEA. During the COVID-19 pandemic, India delivered 650,000 doses of vaccine under the COVAX initiative.35India-Africa Healthcare: Prospects and Opportunities, Export-Import Bank of India, Working Paper No. 102, March 2021, https://www.eximbankindia.in/Assets/Dynamic/PDF/Publication-Resources/ResearchPapers/OP/142file.pdf. In the education sector, Ghana is part of the pilot broadband technology project in tele-education and telemedicine (known by the acronym e-VBAB ), and six hundred Ghanian students enrolled in various Indian universities in 2021-22. The 2022 African Youth Survey (cited earlier in the report) stated that 68 percent of respondents viewed India as a positive influence.36African Youth Survey 2022, Ichikowitz Family Foundation.

India is among the top trading partners of Ghana, with total trade in 2021-2022 amounting to $2.6 billion, with India exporting $1.1 billion to Ghana in 2020-21 and importing $1.49 billion, with gold accounting for almost 80 percent of all Indian imports, valued at $853 million.37“Economic and Commercial Brief,” High Commission of India, Accra, Ghana and “India/Ghana,” OEC, 2020 data, https://oec.world/en/profile/bilateral-country/ind/partner/gha. Ghana also exports cocoa, cashew nuts, and timber, and imports from India include pharmaceuticals, packaging material, rice, electrical equipment, transport vehicles, and agricultural machinery, among others.

In terms of investments, India’s FDI accounted for 7.61 percent of the total FDI of 1.29 billion in Ghanain 2021. Between 1994 and 2021, Indian wholly-owned companies and Joint Ventures invested $2.2 billion in 870 projects and generated thousands of jobs.38According to GIPC, Indian companies have invested $1.73 billion in more than seven hundred projects between 1994 and 2019. See “Economic and Commercial Brief,” High Commission of India, Accra, Ghana, accessed December 2022, https://www.hciaccra.gov.in/page/commerce/. In 2021, India was the second largest investor by number of projects (25), after China and the third largest by value with FDI aggregating to $98.84 million.39“Economic and Commercial Brief,” High Commission of India. The major sectors receiving Indian investments were General Trading (170 projects, $149.72 million), Export Trading (126 projects, $49.73 million), Agriculture (45 projects, $377.04 million), Building and Construction (54 projects, $74.18 million). In terms of business activities, manufacturing accounted for the greatest most number of projects with an investment value of $1.1 billion with 275 projects.40“Economic and Commercial Brief,” High Commission of India, Accra, Ghana. Other major business activities receiving Indian investment in Ghana are ICT and Internet infrastructure ($148.6 million), followed by extraction ($98.3 million), business services ($47.7 million), and technical support centers ($17 million).41Indian Investments in West Africa: Recent Trends and Prospects, Export-Import Bank of India, Working Paper No. 82, 2018, https://www.eximbankindia.in/Assets/Dynamic/PDF/Publication-Resources/ResearchPapers/103file.pdf.

The forces that have drawn the Indian entrepreneur to various geographies in Africa are as diverse as the three million strong Indian diaspora in the region. However, a commonly shared sentiment among Chinese and Indian businesses appears to be belief in the African growth story.

One respondent of Indian origin stated that his grandfather came to Ghana in 1937 believing “where there’s gold, there’s money” and started a trading business that has now diversified and is run by his descendants. Decades later, drawn to this promise of opportunity was Gopal Vasu, who after graduating from Indore Christian College in 1969, was excited to join his elder brother working in Lagos. Decades later, in 1989, Kingsway Chemist Ghana Ltd., a division of a company now known as Unilever (Ghana) Ltd., decided to halt its pharmaceutical production lines in Ghana and sell its production equipment to a pharmacist who worked for them. The pharmacist then joined forces with a local partner to start M&G Pharmaceuticals. In 1993, Gopal and his associates (under the Ghana Investment Promotion Centre Act) took over the company and started manufacturing four products. Today, they produce more than eighty generic drugs. This is indicative of the multigenerational Indian business families who have been operating and growing in Ghana, which stands in strong contrast to Chinese businesses, who are not only relatively new entrants to the market, but also wind down their operations comparably faster.

Similarly, in 1988 another interviewee said he was visiting his wife’s family in Accra and was excited about opportunities in the West African country. Two weeks into his holiday, he registered a company; in 1991, he set up his first retail store. Today, his group leads the formal retail space in the country, with fifty-six shops and four more planned.

Managers of Indian corporations share that optimism about the potential of African markets. According to Kaushic Khanna, chief manager of KEC International Limited, a $1.8 billion engineering, procurement, and construction (EPC) company headquartered in Mumbai, “the next ten to fifteen years belong to Africa. If Indian companies can work closely with the government of India in identifying and delivering projects in Africa, there are tremendous opportunities for growth.” One of the successful projects KEC executed in Ghana is the 330 kilovolt transmission line built from the Volta region substation in Tema to Tornu, near Dzodze. This roughly $9 million order was secured from the Volta River Authority and completed in twenty months.

Rajesh Nair, regional manager of Shapoorji Pallonji (SP) echoes this sentiment: The market is so big, with several infrastructure opportunities. “While the competition with Chinese firms is rife, there is no need to compete among (sic) Indian companies,” he says. “Ghana is a $72 billion economy, SP’s growth in the last five years, despite increasing Chinese footprint, has been positive.” He adds that SP’s familiarity in Africa, with operations in Ghana for more than sixteen years, helps highlight the fact that “Indian companies can also pull off large scale projects.”

The Tema-Mpakadan line is one of Ghana’s biggest railway projects and a case in point. It is being built by Afcons, a subsidiary of SP, and is funded by the Export-Import Bank of India (EXIM Bank). The 100-kilometer, standard-gauge railway line, costing $447 million, is part of a multimodal transportation network designed to connect Tema port to the country’s northern regions and landlocked countries like Burkina Faso, Mali, and Niger, and is expected to bring in huge revenues for Ghana.

Coexisting and competing with China in Ghana

Enterprising—but “they don’t contribute to the local economy”

Several Indian entrepreneurs attest to the fact that the work culture of Chinese actors is unique. According to one, “small time traders in groups of ten and twenty, live and work out of warehouses, do everything themselves—from loading the truck, driving it to the market, selling products—operating on absolutely minimum overheads.” Adds another Indian businessman: “They are incredibly enterprising. Most of them do not speak a word of English, but they establish businesses with a local translator. Pretty gutsy, if you ask me.”

A scholar who recently interviewed several Chinese miners working in the gold mines of Kumasi and Obuasi pointed out that for many, Ghana was the first point of arrival. While a few had prior experience in the gold sector in China, others hoped to improve their financial situation and social mobility. Some others had moved due to the competition within China. It’s difficult to say if they have short- or long-term aspirations, according to the scholar; their move is more opportunistic, pragmatic, and there is a lot of pressure to be successful. “You lose face if you don’t send back money.” While there was one respondent who had familial ties to the business, with a father who was a gold miner and a sister with a gold-trading store, most of the interviewees were middle-aged married men who send money earned in Africa back to China.

However, larger Chinese companies entering markets that Indian businesses have dominated are being met with sufficient resistance. An Indian entrepreneur complained that Chinese counterparts often underprice their products, making it difficult for them to compete. Similarly, small-scale traders who sell Chinese wares right outside stores owned by Indian-origin Ghanian traders are also a source of competition “Customers who come to us must walk through a crowd of hawkers, selling cheaper Chinese products, to get in.” While the local authorities routinely act against complaints, there are usually no long-term consequences. Chinese businesses also don’t contribute to the local economy, says another respondent: “The effort is not to develop the economy, but grab small shares.”

The African agency and the “China option”

The president of Ghana Union of Traders Association (GUTA), Dr. Joseph Obeng, sees the Chinese presence in Ghana as quite worrying and calls for stricter oversight: “Ghana is a conduit for dumping goods manufactured in China.” In the imported goods market, he adds, locals have 15 percent, while the rest is dominated by expats, primarily the Chinese. “While some Indians could also be involved in problematic pursuits, they at least invest money in Ghana, buy houses, settle down, send their kids to school here, and get involved in the community, building health centers and schools.”

Isaac Odoom, an assistant professor of political science at Carleton College in Canada, argues that the Chinese are getting three things right in Africa that bear attention.42Dr. Isaac Odoom (assistant professor of political science at Carleton College in Canada, who specializes in international relations and the politics of development in the Global South with a focus on Africa), in conversation with the authors via Zoom, August 2022. First comes a courtship: “Ghanaians and the Africans seem to like Chinese economic courtship. They come to the table with the rhetoric of partnership and win-win for both parties, without necessarily the salvation discourse that comes from the West,” he says. Second, their unique focus has been on infrastructure development, meeting African deficits directly. Third, China is open to very innovative ways of financing projects that are critical to the long-term development of African countries in Ghana. “What these three factors essentially do is present a viable ‘China option,’ where engaging with Beijing offers African countries some leverage in its relations with other foreign actors,” Odoom says.

When asked if there is an African strategy for China, he says “in practice, the Chinese engagement across Africa has been very bilateral. It is very difficult to have all African countries converging in their political and economic objectives, even though they are all interested in reducing poverty and eradicating diseases. But because of [the] historical colonial nature of our countries, there is always a national interest as defined by the elite or history. Any talk of African strategy is bound to suffer these deficiencies or dysfunctions because of the nature of how China engages Africa and because of the makeup of African countries.”

Differences in corporate strategies

According to an Indian executive, “the question is not whether Indian and Chinese companies are competing in Africa. The fact is that the Indian and Chinese governments are vying for influence in the region, and they operate with different philosophies.” For one, information about Indian companies and details about specific projects are readily available; they show a degree of transparency that Chinese companies do not.

An Indian businessman who gets spare parts manufactured by both Indian and Chinese companies also referred to the differences in corporate approaches between the two. “There is no need to micromanage the Indian producer—we drop our orders and move on. However, with the Chinese, we have to monitor very closely, every step of the way. Although we have worked with the same manufacturer for almost ten years, there is a serious lack of trust as they have the ability to quickly change the terms of engagement.” Another interviewee underlines the fact that not everything Chinese is bad: “Large Chinese companies in the industrial sector, like ceramics, add value to the landscape, but smaller companies tend to flout rules.”

There have been situations when both Chinese and Indian contractors have continued work in the face of nonpayment of bills, which have, in the long run, resulted in generating goodwill. However, this is feasible only for the larger corporations, as the smaller players in the industry would be hard hit. One of the major criticisms facing Indian companies is implementation delays. This was attributed to a combination of factors including bureaucratic bottlenecks, issues with land acquisition, and delayed decision-making.

Advantage, China: Access to supply chains, finance, and government support

According to several Indian respondents, Chinese companies have demonstrated the ability “to buy companies along the entire supply chain.” In the pharmaceutical-manufacturing sector, this has meant purchasing companies that supply bulk drugs, intermediaries, and fill and finish operations. In infrastructure, it includes buying quarries that supply construction companies.

“We cannot compete with Chinese companies’ pricing or economies of scale. The costs for Indian companies are higher,” says an Indian manager. “Finance is king,” adds another, saying: “Whoever brings the funds gets the projects, and the Chinese are everywhere.” Moreover, he says, “people criticize the quality of Chinese projects, but what matters on the ground is who can execute, and the Chinese are often the fastest.” An Indian contractor explains, “some governments in Africa are closer to the Chinese government than others, and in these countries it’s near impossible to win projects. So, we are forced to explore other underexplored markets.”

According to them, one of the main advantages Chinese businesses enjoy in Ghana vis-à-vis their Indian counterparts is support from their government, which manifests in various forms. “When executives from Chinese companies go to visit [African] government clients, they are sometimes accompanied by someone from their embassy.” In some other instances, when a company runs into trouble or faces backlash, the issue is quickly “taken care of,” they say. “As an Indian business operating in Ghana for decades, I can tell you, they get away with so much,” says one Indian entrepreneur. The Indian government, respondents say, supports the Indian community, but not individual businesses. Indian contractors also pointed out that they are excessively scrutinized at airports, including their documents at ports and customs, in a way that the Chinese are not. “Why don’t they have tax officials regularly visiting their offices? Complaints to the Chinese embassy are quickly taken up at the governmental levels, affording them a degree of protection,” said one.

Key takeaways

In this context, the following section provides some key recommendations for Indian stakeholders to deepen economic engagement in African markets.

Need to urgently diversify from Chinese supply chains

Several Indian manufacturers operating in Ghana stated that more than 90 to 95 percent of their raw materials used to be sourced from China. However, the pandemic has forced them to reassess. Today, some procure material from new markets that include India, Brazil, Malaysia, Europe, the United States, and Dubai. A manufacturer that produces plastic injection molding has reduced imports from China and sources plastic pellets from India and countries in Europe instead, but many are still reliant on China for raw materials.

Opportunities in pharmaceutical manufacturing

There is tremendous potential for Indian companies to enter the pharmaceutical manufacturing sector across African nations.43Veda Vaidyanathan, “Indian Health Diplomacy in East Africa: Exploring the Potential in Pharmaceutical Manufacturing,” South African Journal of International Affairs 26, no. 1 (2019): 113–135. This study has identified that an efficient way to do this would be to extend support to and encourage Indian-origin businesses already operating in Ghana. For example, Atlantic Life Sciences, owned by a person of Indian origin, has recently set up the first pharmaceutical manufacturing plant in West Africa. Funded by the Ghana Export-Import Bank, the Standard Chartered PLC, and Pharmanova Ltd., the plant was inaugurated by President Akufo-Addo in 2022 and has partnered with Bosch machines for vaccine manufacturing. According to the founder and CEO, Atlantic Life Sciences has been looking for partners to start the fill and finish business for anti-rabies treatments, tetanus, and snake-bite vaccines, with a capacity to produce 70,000 vials a day, but during the time of interview in August 2022, the company had only been approached by a Chinese firm. While this would be an opportunity for Indian companies to tap into the West African markets, it also presents India an opportunity to work alongside its partners in the Quad to prioritize vaccine manufacturing in Africa.44Veda Vaidyanathan, “China Is Manufacturing Vaccines in Africa. The Quad Should Too,” Diplomat, October 5, 2021, https://thediplomat.com/2021/10/china-is-manufacturing-vaccines-in-africa-the-quad-should-too/.

Fast-tracking bureaucratic processes

An Indian company in the power-transmission sector stated that the firm’s technical acumen, familiarity of dealing with similar challenges in India, and success in finding localized solutions enable it to retain a competitive edge in Ghana. However, the Chinese have systems and institutions in place that allow seamless processes. “China realizes the power of tiny bureaucratic functions,” he says. The task of validating the authenticity of a report in a government-accredited lab in India, for instance, would take him much longer than his Chinese counterpart. It would be helpful if there was a channel through which Indian companies operating in competitive ecosystems abroad could fast-track select bureaucratic processes.

Encouraging private-sector investors

There appears to be tremendous opportunities for businesses looking for joint ventures or providing services, especially in the technology sector. A leading Indian entrepreneur in the tech space tells us how his company has conducted business with Indian and US firms for years and has recently begun working with a Chinese service provider. Attributing this to quick decision-making and prompt delivery, he says “I didn’t want to do business with the Chinese, but the American companies weren’t delivering on time. They probably have bigger clients to cater to whereas the Chinese persistently followed up with us for business.”

Creating innovative sources of funding

One of the challenges facing the Indian investor has been gaining access to funds. While nonconcessional funding in the form of a buyer’s credit provided by the Indian EXIM Bank directly pays contractors, the lines of credit it offers often take years to mature. “If an African government requests a power plant in 2015, for instance, the project is sometimes only realized in 2020,” explains an Indian contractor. Not only does the tendering process sometimes takes years to complete, but individual contractors who have identified and convinced potential clients, who then approach the Indian government, have to wait excessive amounts of time for a decision. This has meant that Indian companies that primarily worked on projects funded by the EXIM Bank have had to quickly diversify and find alternate, innovative modes of funding to grow their portfolio.

Focusing on technology, knowledge, and skills transfer

For investments to be truly sustainable, creating assets that improve livelihoods and develop economies, it is vital to ensure that technology and knowledge are transferred seamlessly. While India already has in place several frameworks of cooperation that focus on building individual and institutional capacity, there is room to expand on this work, with sector-specific courses. While studies have shown that Chinese investors do transfer technology,45Yoon Jung Park and Xiaoyang Tang, “Chinese FDI and Impacts on Technology Transfer, Linkages, and Learning in Africa: Evidence from the Field,” Journal of Chinese Economic and Business Studies 19, no. 4 (2021): 257–268. cultural factors sometimes impede its efficiency. For instance, an academic who has worked closely with Chinese firms as an interpreter in Accra noted that, despite some Chinese firms’ policy for skills and knowledge transfer, some Chinese managers tend to work on highly technical aspects of a project after working hours, after the Ghanaians have left, which undermines the process of skill transfer.

Creating viable alternatives: Leveraging Indian contractors

To compete with Chinese firms gaining traction in Africa in the long run, the government of India will need to support its large contractors with decades of experience operating in African markets. The Indian government can work with partners in Africa to identify strategic projects and support the major Indian infrastructure companies—with a track record of delivery and execution—to fulfil the mandates of the host governments. This will not only lead to several intangible benefits, but will work toward providing African governments with alternatives in their efforts to fill the continents’ massive infrastructure gap.

Enforcing local laws strictly

GUTA President Obeng says that if the aim is to industrialize Ghana, then enforcement of local laws needs to be stronger. “When you give Chinese traders looking to enter Ghana approvals to trade, send them some questions: How many containers will you buy this year? What will be the value of the container? Do you have the money here? If yes, then lodge it with the Bank of Ghana. They can’t come here to drain the forex of Ghana” he says. “We need to reduce dependence on the Chinese—I’m scared, I’m afraid of how things are going now. It’s our own folly. You have to enforce rules, laws, security.”

Conclusion

The broad spectrum of Indian perspectives, ranging from a quasi “insider” to a familiar “outsider” and an outright foreigner to the Ghanian landscape, provides a unique lens to observe China’s growing role in the country in all its complexity. While there are similarities in the approach, drivers, and instruments of these Asian powers, Beijing’s overtures have been distinct. Examining the impact this has had on Ghanian stakeholders and documenting Indian experiences alongside, contributes to the discourse on how other powers engaged in the region can create viable alternatives for African decision makers.

It is, after all, a global marketplace with myriad options for those open to engagement and new approaches. Perhaps Odoom has said it best:46Odoom, in conversation with the authors.

- What the pandemic has taught us is that we still live in a global society, a global village, but the norms that govern that global village are undergoing some disruption. The traditional gatekeepers have had control and dominance for a long time. What we are seeing is an emerging disruption of that structure. And China is a key part of that disruption, and China sees Africa as a companion in that enterprise. So, it will do everything to get African support, whether economically or politically. Engagement from China and India and other southern countries is going to rise. However, this rise does not automatically lead to benefit for the Africans. It boils down to how Africans engage their counterparts.

Lead researcher and writer

- Veda Vaidyanathan

Contributor, research

- Arhin Acheampong

Collaborating institutions

- Institute of Chinese Studies (ICS), New Delhi, India

- Afro-Sino Centre of International Relations (ASCIR), Accra, Ghana

With sincere thanks to

- Ashok K. Kantha, former director, ICS, New Delhi

- Aubrey Hruby, nonresident senior fellow, Africa Center, Atlantic Council

- Ewedanu Grace Selase Abla, research associate, ASCIR, Accra

- James Hildebrand, former associate director, Global China Hub, Atlantic Council

- Mark Kwaku Mensah Obeng, senior lecturer, Department of Sociology, University of Ghana

- Pamela Carslake, director, ASCIR, Accra

- S. Chinpau Ngaihte, first secretary, High Commission of India, Accra

- Shruti Jargad, research assistant, ICS, New Delhi

- Xiaoyang Tang, professor, Department of International Relations, Tsinghua University

- Cate Hansberry, Publications Editor, Engagement, Atlantic Council

- Nancy Messieh, Deputy Director, Digital Communications, Engagement, Atlantic Council

- Andrea Ratiu, Digital Production Assistant, Engagement, Atlantic Council

Related content

Watch the event

The Global China Hub researches and devises allied solutions to the global challenges posed by China’s rise, leveraging and amplifying the Atlantic Council’s work on China across its sixteen programs and centers.

Image:

Photo by Francisco Anzola on Flicker.