The India-Middle East-Europe Economic Corridor: Connectivity in an era of geopolitical uncertainty

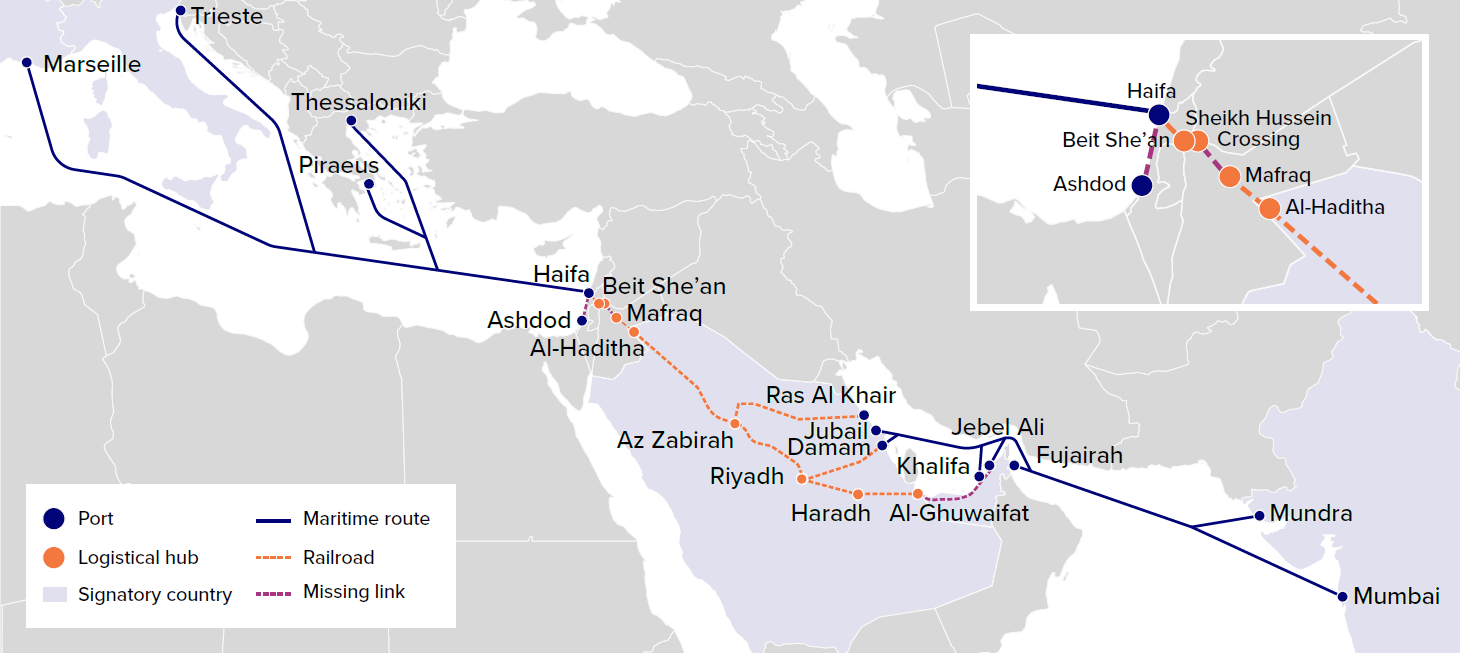

Launched at the 2023 Group of Twenty (G20) summit in New Delhi, the India-Middle East-Europe Economic Corridor (IMEC) features three pillars that integrate existing and future infrastructure: a transportation pillar—the corridor’s backbone—integrating rail and maritime networks, an energy pillar with interconnected energy and electricity infrastructure across continents, and a digital pillar providing new fiber-optic cables and cross-border digital infrastructure.

- The corridor is well placed to be a consequential regional integration and infrastructure initiative in the coming decades, reinforcing supply chain security and aligning Eurasian policy around open, rules-based connectivity, supported by market-driven, locally funded investment from a diverse set of countries. IMEC also provides an alternative to existing corridors dominated by a single government, particularly the Belt and Road Initiative.

- The transportation corridor plan has a financing gap of approximately $5 billion to become minimally operational, linking Gulf ports to Haifa, Israel. Most of the unmet costs are in Jordan, Israel, and logistics hubs likely at Haradh, in the Kingdom of Saudi Arabia (linking KSA-United Arab Emirates); al-Haditha, KSA (KSA-Jordan); Mafraq, the Jordan logistics hub, and near Beit She’an in Israel (Jordan-Israel).

- The corridor would have the capacity to move about forty-six trains daily carrying 1.5 million storage containers (TEUs) annually on single-stack cargo rail, with the ability to scale up to 3 million TEUs in the future, with both double-stack cargo rail and the additional integration of Ashdod Port enabling greater throughput into the Eastern Mediterranean. The upper ceiling of trade volume carried on IMEC could reach even higher, as it is only constrained by the laying of additional rail lines and port capacity, which could be expanded both by additional rail investments and integrating additional countries into IMEC.

- Transshipment times via the transportation corridor could be reduced by about 40 percent (to twelve-plus days) relative to maritime routes, generating approximately $5.4 billion in annual savings on Asia-Europe trade traveling the route. The corridor also would provide stronger access to international markets for countries along the route and increase export competitiveness. For India alone, IMEC could generate an overall increase of between 5 percent and 8 percent in Indian export valuation, returning $21.85 billion of additional Indian exports annually.

- The energy and digital pillars of the corridor will likely reinforce energy security and global data transmission. High-potential projects include deeper electricity grid integration among portions of the corridor and new subsea and terrestrial fiber-optic cables linking emerging data centers in the Middle East with Europe and India. The economic potential and feasibility of other components identified in the 2023 IMEC statement, namely a trans-Arabian gas pipeline linking Saudi Arabia to the Eastern Mediterranean and leveraging green hydrogen along the IMEC, remains unclear. The corridor has the potential to provide an effective platform for critical mineral refining and supply chains, advanced manufacturing zones, AI data centers, and other strategic components.

- The IMEC offers strategic and economic opportunity for the United States and its partners. Washington should leverage its convening power and risk-mitigation tools to renew momentum on IMEC in 2025, and leverage US leadership in the 2026 G20 process to establish and shape an IMEC coordinating structure. IMEC’s completion would demonstrate the staying power of US diplomacy in the Middle East; provide a clear alternative to China’s Belt and Road Initiative; create additional incentives for states to normalize relations with Israel; open new markets for US companies; shape regional coordination in strategic sectors; and deepen US-Gulf alignment. To ensure IMEC’s success, the initiative needs senior US engagement and a central coordinating mechanism.

- While IMEC represents an opportunity to reshape Eurasia’s economic and political landscape, success is not guaranteed. Regulatory uncertainty and political risk make small but critical components of the IMEC a difficult proposition for private capital absent risk-mitigation measures from governments. Further, realizing the full potential of IMEC requires additional steps from IMEC signatory governments to ensure full corridor interoperability, develop common digital platforms, remove nontariff barriers, harmonize trade and customs standards, and sustain public investments in transportation, energy, and digital systems.

- An IMEC central coordinating body is essential to overcoming these challenges and maximizing the corridor’s potential. This body should include a ministerial-level component to secure the necessary political support, a secretariat to manage day-to-day coordination, and technical working groups that incorporate private-sector stakeholders and experts. Further, the coordinating body should embrace IMEC not as a single corridor, but a web of interconnected routes uniting regional policies on open, transparent, and free trade.

- To advance IMEC this year, the United States should consider launching a high-level public meeting in 2025 before assuming the G20 chairmanship on December 1. The French, Italian, and German governments should consider pushing for IMEC as a deliverable in the G7, particularly through the Partnership for Global Infrastructure and Investment. Key deliverables could include a communiqué that outlines a road map for IMEC through 2026; announces intent to form a coordinating body through the G20/G7 sherpa processes; and includes formal entry of regional partners in the IMEC as well as nonsignatory observer countries.

About the authors

Afaq Hussain is a nonresident senior fellow at the N7 Initiative within the Atlantic Council’s Middle East Programs. In this role, much of his work focuses on the economic aspects of India-Middle East-Europe Corridor. A policy researcher with over twenty years of experience, Hussain’s expertise spans logistics infrastructure, trade facilitation, regional connectivity, and related regulatory policy.

He is the co-founder and director of the Bureau of Research on Industry and Economic Fundamentals (BRIEF) in New Delhi.

Nicholas Shafer is a project lead with the Atlantic Council’s N7 Initiative where he leads the program’s work related to India and the Middle East, particularly on IMEC and the I2U2 Group. He has worked closely on IMEC since the initiative launched in September 2023.

Related content

Explore the program

Through our Rafik Hariri Center for the Middle East, the Atlantic Council works with allies and partners in Europe and the wider Middle East to protect US interests, build peace and security, and unlock the human potential of the region.

Image: Evannovostro/Shutterstock