The United States, Canada, and the minerals challenge

An energy mix enabled by clean technologies will be far more mineral-intensive than its hydrocarbon-based predecessor. Demand for minerals like lithium, nickel, and cobalt is projected to skyrocket over the coming years, with supply chains largely unprepared to scale up accordingly. And procurement of these minerals has been plagued by concerns over environmental impact, human rights violations, and state monopoly over specific parts of the value chain, posing both moral and strategic issues.

The onus now falls on policymakers in the United States and Canada to develop resilient, sustainable, and transparent mineral supply chains. As two of the world’s most advanced economies, the US and Canada have the opportunity to take the lead in preempting the emergence of some of the hazards that characterize the oil and gas-based system. It will not be easy; value chains are full of chokepoints, and mining operations have not always followed best practices. But to both enable a smooth energy transition and ensure that procurement does not negate minerals’ carbon-reducing benefits, the US and Canada must act now.

Executive Summary

Executive Summary

A net-zero energy system will be six times as mineral intensive as its hydrocarbon-based predecessor. But, the supply chains needed to deliver these mineral needs of the energy transition are woefully underdeveloped and undercapitalized; there is a projected $2-trillion investment gap over the next fifteen years for the minerals needed to limit climate change below two degrees Celsius. The world is underprepared for surging transition-related mineral demand. Supply chain underdevelopment, therefore, presents a potent risk to clean energy deployment in terms of the total amount of supplies available, while significant concentration across the existing mineral supply chain threatens to disrupt the ability of countries to manufacture and deploy clean energy technologies as part of a pivot to a low-carbon energy future.

The risks of this status quo to the United States and Canada are particularly acute. Demand in these two Group of Seven (G7) economies is forecasted to grow significantly, as Washington and Ottawa advance rapid plans to achieve net-zero emissions by 2050. Yet, the vast majority of transition mineral supply chains are concentrated outside of the United States and Canada, rendering them vulnerable to disruption or geopolitical gamesmanship, and risking the opportunity for both countries to realize the economic opportunities of a net-zero world. Mineral supply chains as they now exist are also poorly governed and have significant sustainability concerns, which may undermine US-Canadian leadership on the world stage as they deploy clean energy technologies, while cheapening the environmental and humanitarian impact of the energy transition around the world.

For the United States and Canada to deliver on their ambitious decarbonization agenda while securing their low-carbon energy system against supply shocks, they should mobilize their own long-standing history of friendship and collaboration to meet the mineral challenge. Both countries share common interests in securing a supply chain that can meet growing mineral needs and is governed transparently, sustainably, and free of disruption. Such a partnership can diversify the global supply chain through localization, use the demand side power of the integrated US-Canadian consumer market to set global resource-governance standards, and create a starting point for collaboration with likeminded countries to strengthen mineral value chains around the world.

The opportunity for the United States and Canada to lead is vast, and the potential tools at the two partners’ disposal are powerful. For Washington and Ottawa to bring these forces to bear, however, they must proceed with a set of principles in mind.

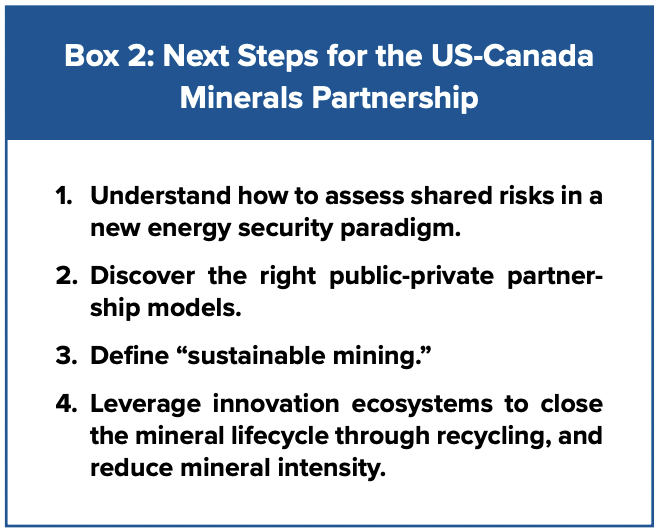

- First, the United States and Canada must understand how to assess shared risks in the new energy security paradigm brought about by the transition, which differs greatly from energy security considerations in a hydrocarbon-based system.

- Second, the two countries must discover the right public-private partnership models to bolster the incipient supply chains that have come to underlie the energy transition, devising models in which the sector can achieve both marketability and resiliency.

- Third, Washington and Ottawa must define “sustainable mining” to ensure that the extraction and production of energy transition minerals do not negate their carbon-reducing benefits, and that standards are set for the industry at a global scale.

- Finally, the United States and Canada should leverage their robust innovation ecosystems to close the mineral lifecycle through recycling, and reduce mineral intensity to ease the pressure on developing supply chains.

By undertaking these initiatives, the United States and Canada can safeguard their competitiveness in a net-zero global economy and set the stage for international action to ensure that mineral supply chains enable, rather than hinder, the global sustainable energy transition.

Introduction

Introduction

Elevated climate ambitions pledged by countries gathered at COP26 in Glasgow—if carried out fully and on time—would limit global temperature rise to 1.8 degrees by 2100.1 The clean energy technologies necessary to meet these goals, such as electric vehicles (EVs), solar photovoltaics, wind power, and others, are highly mineral intensive, auguring tremendous future demand for battery metals like lithium, cobalt, nickel, and graphite, wiring metals like copper and aluminum, solar cell metals like tellurium and indium, and the rare earth elements needed for wind turbines and EV motors.

An International Energy Agency (IEA) study suggests that, to reach the Paris Agreement’s “well below 2°C” climate target, demands for such minerals and metals (referred to broadly in this paper as “transition minerals”) will increase fourfold by 2040; under a more ambitious global net-zero by 2050 agenda, mineral demand would increase sixfold by 2040.2 A World Bank model concurs, predicting that to supply the technology required under the IEA’s two-degree scenario, demand for minerals such as indium, nickel, and vanadium in 2050 will be twice that in 2018, while demand for graphite, lithium, and cobalt will grow by five and a half times in that same period.3 Coupled with other mineral-intensive advancements in pharmaceutical, defense, and telecommunication technology, transition minerals will increasingly inform the contours of the transition to a net-zero energy system, and global trade more broadly.

The United States and Canada have a major role to play in this evolution. Both Ottawa and Washington have set ambitious net-zero targets that will require rapid deployment of clean energy technologies. The Biden-Harris administration aims to decarbonize the US grid by 2035, fully electrify a federal fleet of 645,000 vehicles, and ensure that half of new US consumer vehicle sales are all electric by 2030, complementing private sector plans like Ford’s target of 40-percent electrification by 2030 and the goal of General Motors (GM) to become all electric by 2035.4 Canada’s federal government has mandated that 100 percent of light-duty vehicles and passenger trucks must be emissions free by 2035, and the country has set a target of 90 percent of its power coming from zero-emission sources by 2030, having already achieved 80 percent in 2016.5 The United States and Canada have considerable assets to achieve these goals. In addition to being significant future centers of clean energy demand (and the corresponding market-shaping opportunities), each country has a long-standing history of mining, and can bring both mineral resources and human capital to bear. Likewise, ambitions to establish leadership in the manufacturing of key clean energy technologies signals a need to leverage mineral supply chains within economies of scale, with concerns around economic growth and job creation also playing a role.

Such advantages aside, significant challenges are on the horizon. In contrast to the enormous global projections for transition mineral demand, mineral supply is currently on track to grow only modestly, with complex supply chains facing numerous obstacles, including insufficient financing for new resources, poor resource governance, and vulnerability to disruption. This reality is further complicated in an era of intensified geopolitical competition. Governments worldwide are recognizing mineral access as a key priority with broad implications for energy security, decarbonization, and economic competitiveness. Influence over mineral supply chains now reflects economic leadership in renewable energy, defense, and telecommunications.

The United States and Canada have considerable reasons to address these challenges through collaboration, and this paper offers several principles and next steps that should underpin such a partnership and leverage the unique proposition of the United States and Canada. While collaboration between Washington and Ottawa will add value by filling concerning gaps in the current mineral supply chain, the principles outlined within this paper are focused, by design, on the shared commitment within both countries to foster a secure, sustainable, and well-governed transition mineral supply chain, and with the intent that—by leveraging the unique geographic and economic proposition offered by the United States and Canada—such a partnership can act as a locus of broader multilateral action to ensure mineral supply chains effectively contribute to net-zero goals.

1 Fatih Birol, “COP26 Climate Pledges Could Help Limit Global Warming to 1.8°C, but Implementing Them Will Be the Key,” International Energy Agency, November 4, 2021, https://www.iea.org/commentaries/cop26-climate-pledges-could-help-limit-global-warming-to-1-8-c-but-implementing-them-will-be-the-key.

2 “The Role of Critical Minerals in Clean Energy Transitions,” International Energy Agency, May 2021, https://www.iea.org/reports/the-role-of-criticalminerals-in-clean-energy-transitions.

3 Kirsten Hund, et al., “Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition,” World Bank, 2020, https://pubdocs. worldbank.org/en/961711588875536384/Minerals-for-Climate-Action-The-Mineral-Intensity-of-the-Clean-Energy-Transition.pdf.

4 “Fact sheet: President Biden Sets 2030 Greenhouse Gas Pollution Reduction Target Aimed at Creating Good-Paying Union Jobs and Securing U.S. Leadership on Clean Energy Technologies,” White House, April 22, 2021, https://www.whitehouse.gov/briefing-room/statements-releases/2021/04/22/ fact-sheet-president-biden-sets-2030-greenhouse-gas-pollution-reduction-target-aimed-at-creating-good-paying-union-jobs-and-securing-u-sleadership-on-clean-energy-technologies/; Michael Wayland, “Biden Pushes for Electric Vehicles to Make Up Half of U.S. Auto Sales by 2030,” CNBC, August 5, 2021, https://www.cnbc.com/2021/08/05/biden-pushes-for-evs-to-make-up-40percent-or-more-of-us-auto-sales-by-2030.html; Sarah Kaplan, “Biden Wants an All-Electric Federal Fleet. The Question is: How Will He Achieve It?” Washington Post, January 28, 2021, https://www.washingtonpost. com/climate-solutions/2021/01/28/biden-federal-fleet-electric; Bob Woods, “GM, Ford Are All-in on EVs. Here’s How Their Dealers Feel About It,” CNBC, June 13, 2021, https://www.cnbc.com/2021/06/13/gm-ford-are-all-in-on-evs-heres-how-dealers-feel-about-it-.html.

5 “Zero Emission Vehicle Infrastructure Program,” Natural Resources Canada, February 4, 2022, https://www.nrcan.gc.ca/energy-efficiency/ transportation-alternative-fuels/zero-emission-vehicle-infrastructure-program/21876; “Powering Our Future with Clean Electricity,” Government of Canada, September 1, 2020, https://www.c2es.org/document/canadian-provincial-renewable-energy-standards.

I. Challenges Posed by the Transition Mineral Status Quo and the Role of the United States and Canada

Challenges Posed by the Transition Mineral Status Quo and the Role of the United States and Canada

The energy system of a net-zero world is far more mineral intensive than the previous energy system, yet it currently faces several obstacles, which are of significant concern. The growing mismatch between global supply and demand for minerals is already becoming apparent; for example, as of February 15, 2022, battery-grade lithium carbonate was trading on the Chinese market at a spot price nearly 50 percent higher than at the beginning of 2022, and eight times the price the year before.6 As Canada and the United States are participants in both the supply and demand sides of the mineral supply chain, these concerns will bear strongly on their relationship with the mineral supply chain.

Meeting the scale of transition mineral demand growth, and quickly: At present, mineral supply chains are unprepared for such an acceleration of demand as a result of energy transition. According to IEA projections, by 2030, primary demand for copper will outpace production by more than one-fourth, and the same will be true of cobalt by a factor of two and lithium by a factor of three.7 Supply-demand dislocation is already here, with Benchmark Mineral Intelligence projecting a twenty-thousand-metric-ton supply deficit in graphite for 2022, the equivalent necessary for a quarter-million EV batteries.8 A $2-trillion gap exists between current and planned capital expenditure over the next fifteen years and what would be needed to realize a two-degree pathway.9 A lack of liquidity and considerable price volatility in minerals markets further add to the headwinds for supply chain investment across the upstream and midstream supply chains, which—when combined with large lead times—makes it difficult for new market entrants.10

Supply chain concentration: Concentration exacerbates mineral supply difficulties. Clean energy minerals are far more concentrated than their fossil fuel predecessors. The IEA notes that half of cobalt production is confined to the Democratic Republic of Congo (DRC), while China produces half of rare earth elements. The top three producers of lithium are responsible for nearly four-fifths of the world’s supply. The majority of midstream transit mineral production is further concentrated to a single country, again, China.11 Geographic concentration not only creates political risks—a country that dominates a strategic mineral could withhold supply to achieve certain political aims—but also increases the risk of other disruptions, caused by bottlenecks downstream or by events like pandemics, natural disasters, and war. The Russian invasion of Ukraine, for example, has surged global nickel and aluminum prices 7 percent on the month, due to financial sanctions affecting around 6 percent of global supply.12

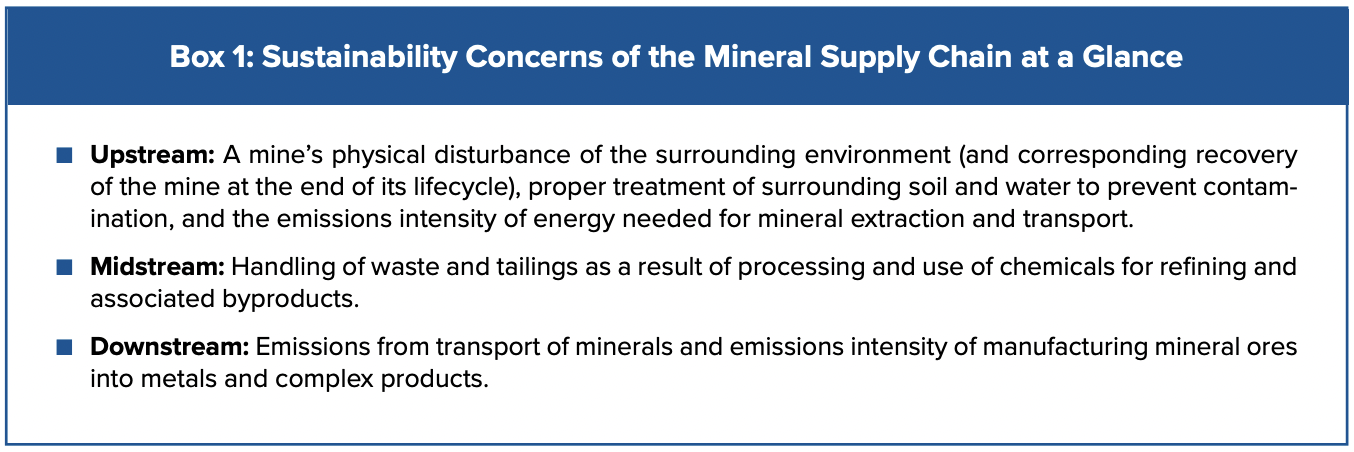

The urgent need for sustainability: The social and environmental toll of mineral extraction and processing must be minimized to guarantee that demand for the minerals necessary to power the energy transition does not come at the expense of the environment or fair labor practices. These issues are present throughout the supply chain (see Box 1). Although the emissions reductions associated with clean technologies are clear—the lifecycle emissions of an EV are half those of a traditional car, and up to a quarter lower with low-emission electricity—the overall carbon impact of mineral production remains substantial.13

Current critical mineral mining also carries a heavy human toll. In China, villagers located near rare earth extraction and processing sites have suffered myriad negative health consequences linked to acid runoff from beneficiation leaching into drinking water. Moreover, rare earth mines can also damage livelihoods, rendering nearby soils incapable of supporting crops.14 All the while, labor practices and treatment of local communities remain consistent threads in the sustainability concerns associated with mineral supply chains, with mining activity in the Democratic Republic of the Congo being an oft-referenced example.

The role of the United States and Canada

The United States and Canada are participants throughout the mineral supply chain. Canada is a leading global producer of nickel, with a well-developed downstream and midstream supply chain from extraction to smelting and refining. Canada’s nickel supply chain also makes it a significant producer of cobalt, which is recovered from nickel at various stages in that supply chain, for processing in Canada. Yet, Canada is not a producer of “battery-grade” minerals, which need to be converted into various sulphate, carbonate, and hydroxide forms before being suitable inputs for battery production.15 In general, Canada is an early-stage player in the global mineral supply chain, with trade surpluses of $22 billion for ores and concentrates and $19 billion for smelted and refined minerals and alloys. However, the country runs significant deficits downstream: $20 billion for final metal goods and $7 billion for semi-finished industrial metals like metal wiring, sheets, and tubes.16

The United States, on the other hand, is a major player in EV manufacturing, but not EV-input production. The United States was the world’s largest EV exporter in 2020, a year in which the country produced nearly half a million EVs for foreign and domestic consumption.17

Between 2010 and 2020, the country assembled 65,813-megawatt hours (MWh) worth of lithium-ion battery-powered EVs, but produced only an equivalent of 39,060 MWh of battery cells in that same period, less than 60 percent the end-stage manufacturing output. The United States is highly import dependent on the minerals needed for EVs, importing nearly 50 percent of its nickel demand, more than three-quarters of its cobalt, more than 90 percent of its rare earth elements, and all of its manganese and graphite in 2021.18

These features of the current mineral supply chain pose several risks that should concern both Ottawa and Washington as they enter a mineral-intensive future.

The consequences of a tightening mineral supply chain on clean energy deployment goals: Many decarbonization goals, including those of the Biden-Harris and Trudeau administrations, currently outpace the ability of new mineral supplies to come online. Supply and price instability threaten to derail clean energy deployment by displacing costs onto clean energy consumers. The IEA warns price spikes for copper and aluminum—which now comprise 20 percent of grid investment costs—could derail the infrastructure investments necessary to decarbonize global electricity systems.19 According to the IEA’s “World Energy Outlook 2021,” clean energy investments under a net-zero by 2050 scenario would increase in cost by three-quarters of a trillion dollars if current elevated spot prices were to persist.20

Price factors will determine the ability for clean technologies to be deployed and adopted at scale. For example, overall production costs for lithium-ion batteries are down an astonishing 90 percent from only five years ago. Consequently, a progressively higher proportion of costs come from raw materials, which can now account for 70 percent of lithium-ion battery production, compared to less than fifty percent only five years ago. For EVs, the battery pack now constitutes the single most expensive part of the EV to produce, accounting for a third the consumer price.21 These trends pose significant risks to Washington in particular, given the continued rollout of new domestic EV and EV-battery manufacturing facilities by the US auto industry in the past year.

Such risks cut across clean energy technologies. Many minerals are as critical to EVs as they are to wind turbines or grid modernization. Rare earth-enabled permanent magnets are another example, needed for both wind turbines and EV motors. Left unchecked, Washington and Ottawa run the risk of their net-zero goals increasing in cost, or worse, cannibalizing each other as clean energy technologies increasingly vie in a zero-sum competition for transition minerals.

Geopolitics, energy security, and economic competitiveness: Tight, concentrated mineral supply chains add further risks to the United States and Canada’s precarious position in a more mineral-intensive world. The COVID-19 pandemic has caused many supply chain dislocations due to overconcentration, including the shortage of computer chips brought about by lockdowns in Malaysia, a leading semiconductor manufacturer.

The geopolitical risks associated with mineral dependency have clear precedent. In 2010, tensions between China and Japan over the disputed Senkaku Islands, also known as the Diaoyu Islands in Chinese, motivated Beijing to embargo tungsten, molybdenum, and rare earth elements, of which China then controlled 97 percent of global supply.22 These minerals, all of which are used in permanent magnets, form an integral part of the value chain for Japan’s all-important electronics industry, providing potent leverage for an adversary. Current considerations related to sanctioning Russian nickel production as a result of its invasion of Ukraine and the risks of upsetting the nickel industry (of which it is the second largest global producer) further add to the relationship between geopolitics and mineral dependency.

Meanwhile, as a dominant force in the supply chain status quo, China will factor heavily in US and Canadian consideration of supply chain concentration, particularly given the tensions between China and the West on a host of other geopolitical issues. Here, the case study of the Japan embargo provides an ominous signpost for the broader trend of transition minerals playing a role in the geopolitics of the energy transition, one in which some policymakers fear that China’s outsized role in the mineral supply chain may pose an energy security risk or prevent Washington and Ottawa seizing the leadership opportunities of the net-zero transition.23

The role of China in global mineral markets must not be overdramatized, however, particularly given the anti-China rhetoric permeating Western capitals. China will continue to be a key component of the clean energy value chain well into the foreseeable future, and it is vital for the energy transition that minerals continue to flow out of China at the scale needed to meet the world’s minerals challenges. In addition, as China is the world leader in low-cost mineral supply chains, its minerals may be critical for delivering a cost-efficient, rapidly scalable energy transition that can outcompete hydrocarbon alternatives throughout the world, including the United States and Canada.

Whether the possibility of disruption implied by supply chain concentration is an energy security risk is another question. Destroyed gas pipelines or oil price volatility have immediate ramifications for power and gasoline access. However, disruptions to mineral supplies do not have a similar impact on EV-, solar-, or wind-power production, or electricity and heating. Instead, an interruption of supply is more likely to disrupt end-product manufacturing, increasing costs or the availability of that product over a longer term.

A better lens through which to interpret the risks of concentration, in that case, is how the impact of mineral access—or the lack thereof—will determine future economic competitiveness for countries seeking to lead in the manufacturing of new energy technologies; consequently, control of the supply chain may allow established mineral producers to leverage market share to influence the growth of new manufacturing centers. The availability and price stability of mineral inputs will be a key determinant of the success and speed of the electrification of the automotive industry in the United States. Similarly, the projected supply gap in available mineral supplies suggests that choosing not to develop mineral resources represents a missed economic opportunity in the energy transition, just as much as it introduces manufacturing risk.

For the Biden administration, in particular, the intersection of supply chain risk for minerals-dependent technologies and economic competitiveness bears strongly on employment goals in a net-zero-oriented future. As the Biden administration looks to accelerate the post-pandemic economic recovery, bolstering green industry is crucial for a just transition that can provide domestic jobs in the clean energy sector and replace the employment opportunities previously offered by the fossil fuel industry. The hydrocarbon sector directly employed nearly one million Americans in 2020, in jobs that must be replaced for a socially responsible and politically durable energy transition in the United States. Employment growth in EVs and renewable power can ease this transition, but only if supportive supply chains can adequately enable the manufacturing of the future. The same is true in Canada, where six hundred thousand people, or 3.2 percent of the population, are employed by the nation’s oil and gas sector, in jobs that analysts believe could decline by three-quarters by 2050.

Sustainability, transparency, and governance: The issues of environmental and labor sustainability will continue to shape how the United States and Canada interact throughout the mineral supply chain. At the core of this is a shared commitment to ensuring sustainability is central to net-zero goals all the way down to the mine itself. For the United States in particular, given the clean energy manufacturing ambitions stated by the Biden administration, sustainability will have a tangible impact, as clean energy companies are increasingly held to account for the sustainability of their supply chains.

Given the exposure of the United States and Canada across the minerals supply chain, there are increased incentives to ensure that these supply chains are transparent and well-governed to limit the impact of volatility and supply chain risk. Greater sustainability and transparency can unlock powerful environmental, social, and governance (ESG) financing flows necessary to catalyze investment in mineral production, which is desperately needed to enable other ESG-aligned investments in the upstream of the clean energy value chain. By promoting governance standards as a prerequisite for cheaper capital, this investment can also raise the barriers to entry into the supply chain, allowing sustainability-oriented operations to compete with low-cost—often informal— dirty mining elsewhere. Finally, increased transparency can strengthen demand side confidence in mineral supply chains, allowing for price-stabilizing vertical integration by consumer-facing manufacturers, making them less wary of the reputational risks associated with the downstream.

6 Andy Home, “Lithium Supply Crunch Part II—This Time It’s for Real,” Reuters, February 15, 2022, https://www.reuters.com/markets/commodities/ lithium-supply-crunch-part-ii-this-time-its-real-2022-02-15.

7 “The Role of Critical Minerals in Clean Energy Transitions.”

8 Zhang Yan and Tom Daly, “China EV, Battery Makers Grapple with Graphite Squeeze,” Reuters, December 15, 2021, https://www.reuters.com/ business/autos-transportation/china-ev-battery-makers-grapple-with-graphite-squeeze-2021-12-15/.

9 Julian Kettle, “Mining Risk: Will Fortune Favour the Brave?” Wood Mackenzie, May 4, 2021, https://www.woodmac.com/news/opinion/mining-risk-willfortune-favour-the-brave.

10 For cobalt—an anomaly insofar as reliable price data exist—a late-2017, early-2018 price peak nearing $100,000 per metric ton collapsed to about $25,000 by mid-2019, and recovered only partially to $70,000 by December 2021. Similar metals have value chains too opaque for such numbers to be tracked. “LME Cobalt,” London Metals Exchange, December 2021, https://www.lme.com/Metals/EV/LME-Cobalt.

11 “The Role of Critical Minerals in Clean Energy Transitions.”

12 Diana Kinch, Charles Thompson, and Annalisa Villa, “Aluminum, Nickel Lead Metals Rally as Market Seeks Clarity on SWIFT Rules for Russia,” S&P Global, March 1, 2022, https://www.spglobal.com/commodity-insights/en/market-insights/latest-news/metals/030122-aluminum-nickel-lead-metalsrally-as-market-seeks-clarity-on-swift-rules-for-russia.

13 “The Role of Critical Minerals in Clean Energy Transitions.”

14 “How Rare-Earth Mining has Devastated China’s Environment,” Earth.org, July 14, 2020, https://earth.org/rare-earth-mining-has-devastated-chinasenvironment/.

15 Brendan Marshall, “Building Supply Chain Resiliency of Critical Minerals,” Canadian Global Affairs Institute, November 2021, https://www.cgai.ca/ building_supply_chain_resiliency_of_critical_minerals.

16 “Mineral Trade,” Natural Resources Canada, July 2021, https://www.nrcan.gc.ca/maps-tools-and-publications/publications/minerals-miningpublications/mineral-trade/19310.

17 Lora Kolodny, “The U.S. is Falling Further Behind China and Europe in Electric-Vehicle Production,” CNBC, June 29, 2021, https://www.cnbc. com/2021/06/29/the-us-is-falling-further-behind-china-and-europe-in-ev-production.html.

18 “Mineral Commodity Summaries 2022,” United States Geological Survey, January 2022, https://pubs.usgs.gov/periodicals/mcs2022/mcs2022.pdf.

19 “How Rare-Earth Mining has Devastated China’s Environment.”

20 “World Energy Outlook 2021,” International Energy Agency, October 2021, https://prod.iea.org/reports/world-energy-outlook-2021.

21 “The Role of Critical Minerals in Energy Transitions.”

22 “Loosening China’s Grip on Rare-Earth Metals,” Washington Post, March 15, 2021, https://www.washingtonpost.com/opinions/loosening-chinas-gripon-rare-earth-metals/2012/03/15/gIQAQ5g2ES_story.html.

23 Given China’s existing supply-chain monopolization, new projects outside of China—already burdened by significant lead times and capital risk— enter markets where low-cost, subsidized projects have a significant advantage. Without direct support for financing or organizing offtake—which is far less common in market economies than in China’s state-capitalist model—new projects struggle to compete.

II. The United States, Canada, and the Opportunity to Manage Shared Risks Through Collaboration

The United States, Canada, and the Opportunity to Manage Shared Risks Through Collaboration

The United States and Canada also have the opportunity to assume shared responsibility in confronting the aforementioned challenges posed by a more mineral-intensive world.

Economic Competitiveness and the Lure of Localization

Concerns about the energy transition and economic competitiveness are finding ground in the United States given the bipartisan nature of pro-competitiveness, jobs-oriented narratives around the new energy technologies, and the continued risks of insufficient mineral supply for US manufacturing.

Consequently, the political winds in the United States are aligning for greater localization of critical supply chains. A long-standing desire to onshore industry and “buy American”—including through the Biden administration’s mandate that an all-electric federal vehicle fleet be entirely US-made—suggest federal policy will head toward a comprehensive reshoring agenda.24 The administration’s hundred-day review, which calls for an “end-to-end” US battery supply chain, lays a starting point for such efforts, while the recently passed Infrastructure Investment and Jobs Act provides $6 billion for midstream and upstream battery activities.25 The Biden administration recently announced an investment partnership with MP Materials to improve domestic processing of rare earth elements and sectoral job creation.26

Localization can offer secure means of bolstering supply chain resiliency and improving competitiveness, the economics of which are particularly salient for the EV industry. For example, Ford’s electric F-150 Lightning weighs 1,600 pounds (725 kilograms) more than the standard F-150, with the difference accounted for by the vehicle’s lithium-ion battery.27 That complicates the transportation of key vehicle inputs, one of several motivating factors for the localization of battery production by US automakers like Tesla and GM.28

A question remains, however, of how far such retrenchment should go, especially when it includes the midstream and upstream of the mineral supply chain. To this end, Ottawa and Washington are ideal partners, thanks to the substantial resource endowments already shared between the United States and Canada. Canada served as the primary import source from 2017 to 2020 for the United States’ supply of four critical minerals: potash (75 percent), tellurium, (57 percent), vanadium (33 percent), and aluminum (50 percent). For batteries, Canada’s natural reserves of raw materials like nickel, cobalt, lithium, and graphite are beginning to be paired with US manufacturing as part of a cross-border supply chain. In March 2022, GM announced a partnership with the governments of Canada and Quebec to build a Canadabased facility designed to produce cathode active material (a sub-component of GM’s Ultium battery) using Canada’s mineral resources.29 United Kingdom-based Britishvolt and Ontario-based Stromvolt are, respectively, building sixty- and ten-gigawatt-hour plants in central Canada to supply EV manufacturing across the border.30 US-Canada private sector mineral partnership is evident via the Battery Materials & Technology Coalition (BMTC), established in 2021 by US and Canadian mineral and battery manufacturing companies to improve the viability of North American supply chain networks.31

Eager to enhance its role as a mineral supplier to the United States, Ottawa has been proactive in its mineral policy agenda. In March 2021, the government published a critical minerals list to complement the official lists of critical minerals drafted by the governments of the United States, Japan, European Union, and Australia. Canada only defined a mineral as “critical” if it appeared on at least one ally’s list.32 Following that, Natural Resources Canada promulgated the Canadian Minerals and Metals Plan to harmonize federal, provincial, and territorial actions on developing resources, innovation, and ESG standards to make Canada a leading minerals player.33 In December 2021, Prime Minister Trudeau tasked Innovation Minster François-Philippe Champagne with reviewing legislation to “mitigate economic security threats from foreign investment” in Canada’s critical minerals sector, in a move subtly targeted toward Chinese state-owned enterprises.34

Canada has also engaged both the current and previous US administrations for bilateral cooperation on the minerals challenge. The US-Canada Critical Minerals Working Group—first convened in 2019, paving the path for deeper mineral supply integration, and leading later to the establishment of the US-Canadian Joint Action Plan on Critical Minerals Collaboration, which was announced in January 2020—pledges Washington and Ottawa to coordinate on securing strategic supply chains and engaging industry through joint initiatives on research and development, supply chain planning, and industrial policy.35 The third meeting of the Working Group, held in July 2021, underlined cooperation on critical minerals as an important component of the Biden administration’s Roadmap for a Renewed US-Canada Partnership.36

Using Localization as a Platform for Broader Mineral Supply Chain Leadership

A more mineral-intensive future poses challenges that are too immense to be met adequately by only one country. A US-Canadian supply chain can play a modest role in growing and diversifying the global mineral economy, but the reality remains that a US-Canada partnership will occur as global demands on mineral supply chains increase drastically. This illustrates the need to use both supply side and demand side strength to enable an agenda of creating sustainable and well-governed mineral supply chains elsewhere in the world.

Such an effort begins with the vibrant automotive, energy, and high-tech manufacturing sectors that give the United States and Canada enormous leverage to demand greater governance standards in the upstream supply chain originating abroad. The vast consumer heft of these two G7 economies—integrated under the United States-Mexico-Canada Agreement (USMCA) free trade area—can set the market and enforce standards on the global mineral industry. The scale of imports that would be necessary to achieve US and Canadian electrification goals, therefore, would contribute a significant share of global demand; according to the Biden administration’s hundred-day supply chain review, electrifying only 20 percent of US light-duty automobiles would require nearly half the amount of lithium mined worldwide in 2019, and nearly a quarter of the nickel.37 That gives US purchasers significant leverage in demanding improved labor and sustainability practices, and Washington and Ottawa have a record of making such regulations conditions for reduced tariff trade. Along with Mexico, the United States and Canada under the USMCA mandated that at least 40 percent of automobile components had to be made by workers making more than $16 an hour in order to qualify for duty-free export, which compelled manufacturers like Honda and Toyota to raise wages in Mexico to avoid tariffs.38 By placing similar tariff conditions on minerals, the United States and Canada could enforce governance standards outside of North America.

Such efforts will be bolstered by using collaboration as an opportunity to reinforce the best-in-class ESG components of a prospective US-Canada mineral supply chain. Private sector actors in both countries have pushed forward the sustainable mining agenda in practice. Due to a largely carbon-free grid that can be used to power extraction, Canada’s nickel production has the second-lowest carbon intensity in the world, and Canada Nickel’s Crawford project was found to have a per-unit carbon footprint that was 93 percent smaller than the industry-wide average.39 In California, GM-backed mineral developer Controlled Thermal Resources extracts lithium for EV batteries powered by co-located geothermal power, resulting in near-zero-emission mining.40 In addition to the examples set by these projects for what an ESG-compliant downstream mineral sector may look like, US and Canadian shared values and interests can shape a competitive, sustainable, and humane mineral sector through enlightened and harmonized regulations.

Each of these elements provides a launchpad for the United States and Canada to catalyze broader networks of partners to safeguard the supply chains needed to support decarbonization, while enforcing normative standards on an industry fast becoming a cornerstone of the net-zero world. Through demand side incentives, courtesy of the strength of North America’s consumer market, Ottawa and Washington can deliver on their shared commitment to set global standards in critical supply chains, in concert with other likeminded major consumer markets like the European Union and Japan. Again, localization may offer a chance to set standards in the upstream and midstream and, in doing so, enforce greater social and environmental standards on the industry at large.

To this end, both Washington and Ottawa have been proactive on the multilateral front, being partners in the Energy Resource Governance Initiative (ERGI), a US State Department vehicle to help resource-endowed countries strengthen governance and production to bolster global mineral supply. ERGI—which also includes Australia, Botswana, Peru, Argentina, Brazil, the DRC, Namibia, the Philippines, and Zambia—promises to provide a solid foundation for dialogue between established mineral economies like the United States and Canada and developing countries seeking to grow their minerals sectors in line with best-in-class governance standards; US-Canadian leadership in developing this forum will be critical to their greater mineral supply chain objectives. Through ERGI and other multilateral initiatives, Washington and Ottawa can establish multilateral collaboration with allies to deliver critical clean technology inputs at a scale commensurate with demand as the energy transition gathers pace. Such multilateral partnerships should be expanding to facilitate as sustainable, liquid, and diversified a global mineral market as possible. Canada also announced a critical minerals alliance with the European Union to integrate Canadian mineral supply chains into the European Single Market and foster collaboration with a likeminded partner on innovation and ESG standards.41 Another easy win the United States and Canada could achieve on the multilateral front would be to engage Mexico, which currently runs a $12.25-billion mineral trade surplus with the United States, despite pandemic-related disruptions to both mining and refining.42 The USMCA agreement obligates Mexico’s mining sector to adhere to enhanced labor and environmental requirements, and environmental permitting has become less permissive than in previous decades.43 Mexico also offers substantial potential for low-cost lithium production, given the country’s 1.7-million-metric-ton reserves.44

Security, environmental, and governance challenges pervasive in the mineral sector pose significant—but not insurmountable—risks to the United States and Canada. As the two countries boast robust mining and human capital resources, shared values, interest in building a sustainable, transparent, and robust mineral supply chain in the pursuit of net-zero goals, and already-significant economic integration, such risks may present opportunities through close collaboration. Localization through shared supply chain activity can alleviate supply security concerns with guaranteed sourcing secured domestically or through a trusted partner, and shorter supply chains that offer fewer points of failure, and better position both countries to seize the economic potential of an economic transition to a net-zero world. It further adds leverage for Washington and Ottawa to ensure that the supply chains that support the energy transition are sufficiently developed and adhere to the highest environmental, social, and governance standards, by establishing a tangible foundation for multilateral partnership.

24 Nick Yekikian, “President Biden Pledges to Replace Every Federal Vehicle with an American-Made EV,” Motortrend, January 25, 2021, https://www. motortrend.com/news/president-biden-federal-vehicles-ev-buy-american/.

25 “Fact sheet: Biden-Harris Administration Announces Supply Chain Disruptions Task Force to Address Short-Term Supply Chain Discontinuities,” White House, June 8, 2021, https://www.whitehouse.gov/briefing-room/statements-releases/2021/06/08/fact-sheet-biden-harris-administrationannounces-supply-chain-disruptions-task-force-to-address-short-term-supply-chain-discontinuities/. Andy Home, “U.S. Infrastructure Bill Targets Critical Minerals Supply,” Reuters, August 12, 2021, https://www.reuters.com/article/us-critical-minerals-ahome/column-u-s-infrastructure-bill-targetscritical-minerals-supply-idUSKBN2FD1GU.

26 “Fact Sheet: Securing a Made in America Supply Chain for Critical Minerals,” White House, February 22, 2022, https://www.whitehouse.gov/briefingroom/statements-releases/2022/02/22/fact-sheet-securing-a-made-in-america-supply-chain-for-critical-minerals/.

27 Peter Valdes-Dapena, “Why Electric Cars Are so Much Heavier Than Regular Cars,” CNN, June 7, 2021, https://www.cnn.com/2021/06/07/business/ electric-vehicles-weight/index.html.

28 “Global Battery Arms Race: The USA’s Three EV to Battery Hubs to Watch,” Benchmark Mineral Intelligence, February 1, 2021, https://www. benchmarkminerals.com/membership/global-battery-arms-race-the-usas-three-ev-to-battery-hubs-to-watch/.

29 “GM Expands Its North America-Focused EV Supply Chain with POSCO Chemical in Canada,” GM Corporate Newsroom, March 7, 2022, https:// media.gm.com/media/us/en/gm/home.detail.html/content/Pages/news/us/en/2022/mar/0307-posco.html.

30 James Frith, “Canada Emerges as Cornerstone of North American Battery Supply Chain,” Bloomberg, October 19, 2021, https://www.bloomberg.com/ news/newsletters/2021-10-19/canada-poised-to-become-battery-leader-in-north-america.

31 “Announcing the Formation of the Battery Materials & Technology Coalition,” State of West Virginia, July 19, 2021, https://www.wv.gov/daily304/ archives/Pages/Announcing-the-Formation-of-the-Battery-Materials-&-Technology-Coalition-.aspx.

32 “Critical Minerals,” Natural Resources Canada, March 29, 2021, https://www.nrcan.gc.ca/our-natural-resources/minerals-mining/criticalminerals/23414.

33 “Canada’s Mines Ministers Unveil the Canadian Minerals and Metals Plan, a Visionary Plan to Inspire and Shape the Future of Canadian Mining,” Government of Canada, March 3, 2019, https://www.canada.ca/en/natural-resources-canada/news/2019/03/canadas-mines-ministers-unveil-thecanadian-minerals-and-metals-plan-a-visionary-plan-to-inspire-and-shape-the-future-of-canadian-mining.html.

34 Robert Fife and Bill Curry, “Trudeau Presses for Canada to Become a Critical Mineral Powerhouse,” Globe and Mail, December 16, 2021, https://www. theglobeandmail.com/politics/article-trudeau-wants-action-on-critical-minerals-and-renewal-of-investment/.

35 “First Meeting of the U.S.-Canada Critical Minerals Working Group,” US Embassy and Consulates in Canada, October 4, 2019, https://ca.usembassy. gov/first-meeting-of-the-u-s-canada-critical-minerals-working-group; “Canada and U.S. Finalize Joint Action Plan on Critical Minerals Collaboration,” Government of Canada, January 9, 2020, https://www.canada.ca/en/natural-resources-canada/news/2020/01/canada-and-us-finalize-joint-actionplan-on-critical-minerals-collaboration.html.

36 “United States and Canada Forge Ahead on Critical Minerals Cooperation,” US Department of State, July 31, 2021, https://www.state.gov/unitedstates-and-canada-forge-ahead-on-critical-minerals-cooperation/.

37 “Building Resilient Supply Chains, Revitalizing American Manufacturing, and Fostering Broad-Based Growth: 100-Day Reviews under Executive Order 14017,” White House, June 2021, https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf.

38 Shuji Nakayama and Ryo Asayama, “Japan Auto Companies Triple Mexican Pay Rather than Move to US,” Nikkei Asia, June 28, 2020, https://asia. nikkei.com/Business/Automobiles/Japan-auto-companies-triple-Mexican-pay-rather-than-move-to-US.

39 “Mineral Trade,” Jessica Casey, “Canada Nickel Announce Low Carbon Footprint,” Global Mining Review, June 1, 2021, https://www. globalminingreview.com/environment-sustainability/01062021/canada-nickel-announce-low-carbon-footprint/.

40 Sam Abuelsamid, “GM Invests in Controlled Thermal Resources for U.S. Lithium Production,” Forbes, July 2, 2021, https://www.forbes.com/sites/ samabuelsamid/2021/07/02/gm-invests-in-controlled-thermal-resources-for-us-lithium-production/?sh=3878e3fd2fac.

41 “Policy and Strategy for Raw Materials,” European Commission, https://ec.europa.eu/growth/sectors/raw-materials/policy-and-strategy-rawmaterials_en.

42 “Mexico—Country Commercial Guide: Mining and Minerals,” US Department of Commerce International Trade Administration, September 2, 2021, https://www.trade.gov/country-commercial-guides/mexico-mining-and-minerals.

43 David Alire Garcia, “Mining Firms in Mexico Must Face ‘Strict’ Scrutiny, Says Senior Official,” Reuters, September 17, 2021, https://www.reuters.com/ business/sustainable-business/mining-firms-mexico-must-face-strict-scrutiny-says-senior-official-2021-09-17/.

44 “Mexico—Country Commercial Guide: Mining and Minerals.”

III. The Path Ahead

The Path Ahead

The question at hand is to identify the path forward to build upon this nascent partnership, with an eye to the challenges posed by an ever-more mineral-intensive world. With vast indigenous supply potential, a massive and combined consumer market, and available public and private financing at their disposal, the United States and Canada are well placed to embark on a strategy to scale extraction and processing capacity at home and abroad to meet climate goals, safeguard North American job creation, and enforce environmental and social governance standards on an opaque, but vital, global industry. As Washington and Ottawa look to the future of their sustainability and resiliency-minded supply chain cooperation, the two capitals should consider some key next steps.

Understand and Assess Shared Risk

First, the United States and Canada must understand how to appropriately assess the risks brought by the mineral intensity of the energy transition. The most common tool currently is the criticality index, whereby governments list a set of minerals considered “critical” by virtue of strategic importance and supply challenges. The United States, European Union, and Japan each have their own bespoke lists and criteria, while those of Canada and Australia incorporate the criticality assessments of allies to harmonize cross-national assessments.45

Such efforts should be expanded through multilateral initiatives to prioritize transnational action with trusted partners on certain highly critical minerals. This can be done through new ad hoc forums, such as a North American minerals commission, or through older organizations like the Organisation for Economic Co-operation and Development or the International Energy Agency, which can assess supply risk and criticality through a less politicized lens. Such efforts can concert even greater demand power to enforce minimum environmental and labor rights standards than the United States and Canada can exert alone, while trade between trusted partners can provide a politically secure complement to a localized US-Canada supply chain. Of course, Washington and Ottawa should nevertheless complement these efforts through a bilateral or multilateral critical supply chain review like the Biden administration’s hundred-day study conducted in 2021.

Redefining risk also includes rethinking increasingly outdated notions of energy security. Disruption of mineral supply chains differs from traditional energy security concerns. While destroyed gas pipelines or dramatic spikes in oil prices have immediate ramifications for electricity supply or access to gasoline, mineral disruptions impact the ability to drive an EV, or for solar panels or wind turbines to continue working differently. Instead, they simply disrupt production further up the supply chain. While such risks are less acute, they are also less apparent to the voting public, particularly compared to gas station pump prices, which are always a volatile political issue in North America. In that way, the risks may be even more insidious, potentially derailing North America’s clean transition by limiting the development of adequate transition mineral supplies to ensure low-cost clean energy deployment and inhibiting economic competitiveness in the clean energy transition through insufficient access to the supply chains needed to manufacture those technologies in the first place.

Mitigating such shared risk should move beyond ideas surrounding mineral and material stockpiling (which frequently fail to take the full supply chain into account) and incentivize shared “last resort” supply chains capable of alleviating disruption. Here the steady transition in other consumer products from a “just in time” supply chain model to a “just in case” supply chain provides a valuable example, one which a US-Canada minerals partnership would be well suited to develop and deploy with other likeminded friends and allies.

Establish and Optimize Public-Private Partnership Models Across the Supply Chain

Second, the United States and Canada must also discover the right public-private partnership models. Short-term market signals favor the status quo of cheap, untraceable minerals, and discourage costly, uncertain, and reputationally risky long-term investments downstream. Yet, longer-term thinking is beginning to take hold in the private sector. Tesla has outlined a plan to create a vertically integrated minerals supply chain focused on lithium and nickel to reduce the cost volatility of its lithium-ion batteries.46 As previously mentioned, GM has entered an agreement with miner Controlled Thermal Resources to supply battery-grade lithium from geothermal brines in California’s Salton Sea.47

As new supply chain activity gains momentum on both sides of the border, the United States and Canada must encourage and de-risk such investments. To do so, a key role for the private sector will be to improve the efficiency and certainty of new supply chain development, directly supporting new supply chain efforts where necessary, and continuing to enable research and innovation across the supply chain.

Regulation and permitting: One way government can enhance the role of the private sector in developing the supply chain is by streamlining regulation to lessen uncertainty in investment. According to the National Mining Association, it takes an average of seven to ten years to secure permitting in the United States. In Canada, meanwhile, permitting can be completed, on average, within two years, despite a comparable level of ecological protection.48 By working on common rules to govern resource extraction, the United States and Canada can ensure that a cross-border supply chain can be built quickly without compromising the environment, while also allowing the private sector decisions to open a new mine on either side of the border to be based on economic rationale, rather than bureaucratic considerations.

Securing offtake: A second way will be to help improve certainty around new minerals projects once they are up and running and providing certainty around offtake in order to limit the risk of being undermined by lower-cost, less sustainable competitors. In such instances, mineral price floors might also be required to ensure a minimum level of profit, and governments may also sign offtake agreements to protect the industry from the dumping of below-cost minerals into the North American market.

The US Department of Defense has delivered $40 million in combined funding under the Defense Production Act to co-located rare earths facilities in Mountain Pass, California, and Hondo, Texas.49 The US Department of Energy Loan Programs Office is also empowered to finance up to $20 billion worth of private sector battery projects through its Advanced Technology Vehicles Manufacturing Loan Program (ATVM).50

Direct investment: For more ambitious projects, governments will also need to make investments themselves where the private sector remains reluctant. Particularly in order to further diversify mineral supplies with resources elsewhere in the Americas—where investment risks are even greater—the US International Development Finance Corporation (DFC) is also playing a role. Through a groundbreaking $25-million equity deal with AngloIrish mining investment firm TechMet—premised on shoring up the firm’s position in a nickel and cobalt project in Brazil’s northeast—the DFC trod a novel path for assuring diversified battery metal supply, while simultaneously enforcing standards for sustainable development in one of Brazil’s poorest regions.51 By pooling US-Canadian development funding for similar direct investments in concert with ERGI, the two countries can tip the scales in favor of ESG-compliant mineral practices abroad, where market forces might otherwise push a race to the bottom on costs. Developing sound mineral governance can also raise barriers to entry, which will similarly raise consumer confidence in mineral supply chains, and coax further private capital from consumer-facing industries into the downstream overseas in a virtuous cycle.

Enabling innovation: The United States and Canada must capitalize on their robust innovation ecosystems to optimize supply chain activities, while also creating a circular and less mineral-intensive clean energy economy. In Canada, the federal government’s Strategic Innovation Fund now includes a CA$8-billion Net Zero Accelerator with a “Mines to Mobility” program that aims to promote a sustainable domestic supply chain for EV batteries.52 In February 2022, the US Department of Energy committed $3 billion to partnerships for its refining, manufacturing, and recycling under the Bipartisan Infrastructure Law, and followed up with $44 million for its Mining Innovations for Negative Emissions Resources (MINER) program, which funds projects in sustainable mineral production for clean energy technologies.53 By synchronizing a cross-border innovation strategy, the United States and Canada leverage their innovation leadership to create a mineral supply chain that can set a global standard for sustainability.

Define and Enforce “Sustainability” in the Minerals Supply Chain

Third, policymakers must also define “sustainable mining” to set standards for regulation to govern imports, local mining, and ESG-aligned financial disclosure. Industry leaders and analysts must help policymakers better understand where action should be taken across the supply chain—including which minerals and processes offer immediate opportunities for improvement. From there, standards can be set on greenhouse gas emissions, ecological impact, and labor and indigenous rights—crucial starting points for the United States, Canada, and allies. A report from McKinsey suggests that, despite mining’s current climate impact, mining could fully decarbonize through investments in operational efficiency, electrification, and renewable power, which would ultimately be cost saving.54 Where the private sector has been slow to adopt such practices, regulators should force its hand.

At the same time, policymakers should endeavor to ensure that a focus on sustainability in North American supply chains permeates a rapidly expanding market for minerals and metals. In addition to regulatory mandates, consumer preferences in the United States and Canada—already responsible for an ESG revolution in finance, which has created significant reputational risks and advantages for firms that sidestep or align with these criteria—will be invaluable for promoting a local clean energy supply chain that adheres to best-in-class environmental and labor standards and creates a market for high-standard production abroad. A supply chain that partners Canadian upstream actors with US downstream counterparts can also provide a cross-border testing ground for innovations that can improve resource governance through greater transparency, such as blockchain-based verification tools. Experimenting with the technology in the relatively controlled environments of the United States and Canada could determine whether the blockchain is ultimately a viable solution to supply chain misgovernance abroad.

Ultimately, creating a sustainable and well-governed minerals supply chain is critical to supporting the energy transition and ensuring the integrity of climate goals. Establishing leadership in supply chain governance, and promoting a lucrative market for responsible production elsewhere, may also offer an additional point of leverage for Washington and Ottawa as geopolitical competition comes to play an ever-greater role in shaping global mineral supply chains.

Leverage Innovation Ecosystems to Close the Mineral Lifecycle through Recycling and Reduce Mineral Intensity

Finally, Washington and Ottawa must also seek to close the mineral lifecycle through additional recycling. In this respect, much can be learned from allies. Japan has pioneered mineral recycling since the commencement of the 2010 embargo, while the European Union has made the circular economy a cornerstone of its Green Deal.55 For the United States and Canada to follow suit will require a concerted effort in additional minerals supply capacity, support for innovative business models, and an effort to drive social commitment to recycling. While this will not substitute for scaling up the amount of minerals in the North American economy as energy transition mineral demand grows exponentially, recycling will be critical to reducing environmental costs across the mineral lifecycle, while introducing additional supply resiliency and unlocking greater ESG-aligned financing opportunities.

The United States and Canada must use their innovation ecosystems and leverage as major demand centers to continue to invest in reducing the overall mineral intensity of digital and clean energy technologies. Novel battery chemistries are reducing cobalt needs by replacing the risky mineral with greater proportions of lithium and nickel—which are more easily unlocked through sustainable, open, and well-governed supply chains—and can immediately improve supply chain resilience and security. Further innovations aimed at simultaneously reducing dependency on mineral supply chains while improving the performance of clean energy technologies may be over the horizon, but nonetheless represent key areas where Washington and Ottawa would be well advised to secure a leadership role.

In conclusion, an all-of-the-above approach is vitally necessary for the United States and Canada to meet the minerals challenge of the energy transition and turn that challenge into an opportunity for global innovation leadership, in concert with allies. Enabling the global energy transition with secure and sustainable mineral supply chains is essential to reaching North America’s climate, sustainability, and economic leadership goals. To accomplish this, however, a multilateral effort will be necessary to break a mineral status quo that favors low-cost, concentrated, insecure, and poorly governed supply chains.

45 “The Opportunity for the Critical Minerals Sector,” Australian Department of Industry, Science, Energy and Resources, https://www.industry.gov.au/ data-and-publications/australias-critical-minerals-strategy/the-opportunity-for-the-critical-minerals-sector.

46 Alice Yu and Jason Sappor, “Tesla’s Ambitious Cost-Cutting Plans Positive for Nickel, Lithium if Realized,” S&P Global Market Intelligence, October 2, 2020, https://www.spglobal.com/marketintelligence/en/news-insights/research/teslas-ambitious-cost-cutting-plans-positive-for-nickel-lithium-ifrealized.

47 Andrew J. Hawkins, “General Motors Strikes a Deal to Source Lithium in the US for Its Electric Car Batteries,” Verge, July 2, 2021, https://www. theverge.com/2021/7/2/22559718/gm-lithium-ctr-ev-battery-investment-salton-sea.

48 “Delays in the US Mine Permitting Process Impair and Discourage Mining at Home,” National Mining Association, May 2021, https://nma.org/wpcontent/uploads/2021/05/Infographic_SNL_minerals_permitting_5.7_updated.pdf.

49 “DOD Announces Rare Earth Element Awards to Strengthen Domestic Industrial Base,” US Department of Defense, November 17, 2020, https://www. defense.gov/News/Releases/Release/Article/2418542/dod-announces-rare-earth-element-awards-to-strengthen-domestic-industrial-base/; “DOD Announces Rare Earth Element Award to Strengthen Domestic Industrial Base,” US Department of Defense, February 1, 2021, https://www.defense. gov/News/Releases/Release/Article/2488672/dod-announces-rare-earth-element-award-to-strengthen-domestic-industrial-base/.

50 “Critical Materials—Loans and Loan Guarantees,” US Department of Energy, June 2021, https://www.energy.gov/sites/default/files/2021-06/DOELPO_Program_Handout_Critical_Materials_June2021_0.pdf.

51 “TechMet Secures $25m Funding from US Government Agency,” NS Energy Business, October 6, 2020, https://www.nsenergybusiness.com/news/ techmet-receives-25m-investment-from-dfc/.

52 Pierre Gratton and Brendan Marshall, “Canada Must Invest in Critical Minerals,” Policy Options, February 10, 2022, https://policyoptions.irpp.org/ magazines/february-2022/canada-must-invest-in-critical-minerals/.

53 “Biden Administration, DOE to Invest $3 Billion to Strengthen U.S. Supply Chain for Advanced Batteries for Vehicles and Energy Storage,” US Department of Energy, February 11, 2022, https://www.energy.gov/articles/biden-administration-doe-invest-3-billion-strengthen-us-supply-chainadvanced-batteries; “The Biden-Harris Plan to Revitalize American Manufacturing and Secure Critical Supply Chains in 2022,” White House, February 24, 2022, https://www.whitehouse.gov/briefing-room/statements-releases/2022/02/24/the-biden-harris-plan-to-revitalize-americanmanufacturing-and-secure-critical-supply-chains-in-2022/.

54 Lindsay Delevingne, et al., “Climate Risk and Decarbonization: What Every Mining CEO Needs to Know,” McKinsey Sustainability, January 28, 2020, https://www.mckinsey.com/business-functions/sustainability/our-insights/climate-risk-and-decarbonization-what-every-mining-ceo-needs-to-know.

55 Hiroko Tabuchi, “Japan Recycles Minerals from Used Electronics,” New York Times, October 4, 2010, https://www.nytimes.com/2010/10/05/business/ global/05recycle.html; “Circular Economy Action Plan,” European Commission, November 2021, https://ec.europa.eu/environment/strategy/circulareconomy-action-plan_en.

AUTHORS

Reed Blakemore is deputy director at the Atlantic Council Global Energy Center; Paddy Ryan is program assistant at the Atlantic Council Global Energy Center; and Randolph Bell is senior director and Richard Morningstar Chair of Global Energy Security at the Atlantic Council Global Energy Center.

SUPPORTED BY

The Global Energy Center develops and promotes pragmatic and nonpartisan policy solutions designed to advance global energy security, enhance economic opportunity, and accelerate pathways to net-zero emissions.

Subscribe to our newsletter

Sign up to receive our weekly DirectCurrent newsletter to stay up to date on the program’s work.