The road to recovery in Europe remains a work in progress, as European Central Bank (ECB) leader Mario Draghi faces legacies of the 2008 recession. One notable challenge remaining for the European economy is Non-Performing Loans (NPLs).

NPLs continue to be an obstacle to the provision of credit throughout Europe, and in turn significantly dampen economic growth. One of the main goals of the ECB is to facilitate lending. To achieve this goal, the ECB has utilized monetary tools and an ambitious program of quantitative easing (QE). Fortunately, the latest figures indicate regional recovery is on the way. However there are still steps to be made, as NPLs limit the positive push QE provides in increasing the provision of credit.

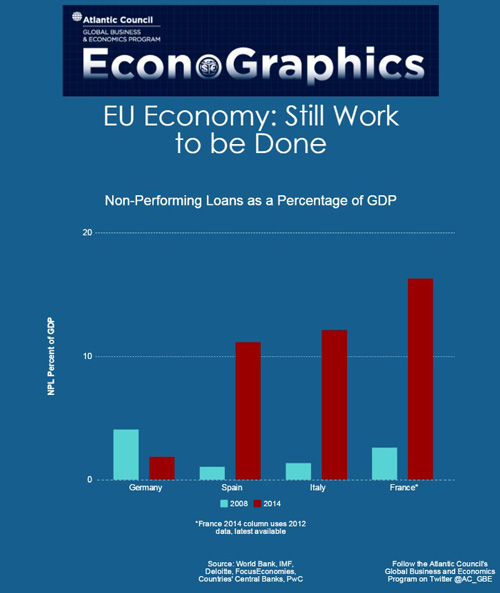

Comparing NPLs as a percentage of GDP from before the crisis to now, it is apparent that NPLs are a significant share of certain countries’ economies. NPLs in both Spain and Italy hover just over ten percent of each countries’ respective GDP, while France fares worse. NPLs provide these countries with a significant opportunity to capitalize on market growth.

Although important progress has been made towards fixing the European economy, obstacles remain on the path to growth. Managing NPLs to ensure the flow of credit in Europe is a critical step in the right direction.