One of the most significant challenges currently facing European leaders is how to shepherd their economies, particularly their businesses, into the modern era. In the United States, massive tech giants rapidly blossom from small startups, significantly impacting the economy over the past decade.

However, this welcome trend in the U.S. is less common in Europe. For the best path towards European growth, ministers and economists must act to ensure that education and training exists for young professionals looking to join new fields. At the same time, economic incentives and tax regulations should be streamlined to encourage new company formation.

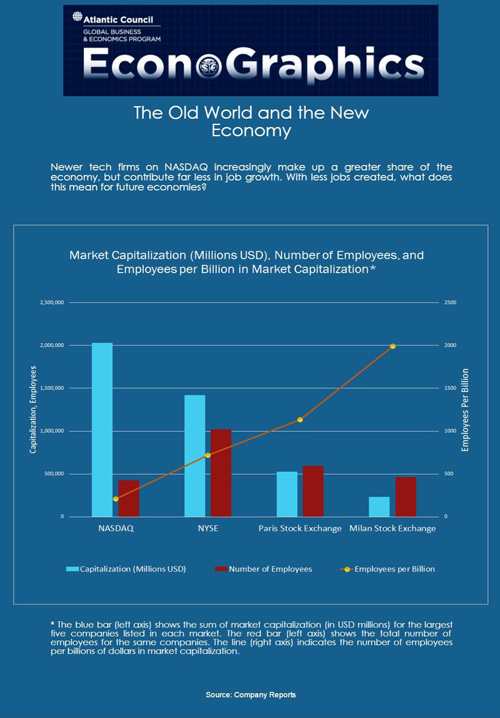

When comparing the total market capitalization of the top five firms in each exchange, shows that newer tech firms under the NASDAQ umbrella capture a significantly larger share of global market capitalization. In terms of market capitalization, the more traditional American firms on the NYSE (Exxon, GE) capture a smaller share of the overall market; Europeans firms in France and Italy have even less.

Most significantly, the ratio of employees to market capitalization shows that American firms in the NASDAQ employ a smaller fraction of the employees of European firms compared to their market capitalization. While these new firms are massive financial entities, they add less to the American economy in terms of job creation.

With this information in mind, European leaders should work towards encouraging economic success in the newer tech markets. At the same time, if companies like Facebook (337 billion market capitalization, nine thousand employees) continue to expand their role in the market, leaders should act to ensure they find new ways to create jobs.