Expert survey series: Supply chains and the effects of COVID-19, geopolitics, and technological innovation

For the fourth installment of the GeoTech Center’s expert survey series, we asked a range of business leaders and tech experts how COVID-19 has impacted their industry’s or enterprise’s supply chains. Significant shortages of personal protective equipment and tests have plagued hospitals, and many countries’ dependence on China quickly became evident in the initial rush to obtain supplies. Food supply chains have also been significantly disrupted–for instance, infection rates at meat packing plants are five-times greater than those in similar geographies.

Plexiglass is the most recent example of another COVID-caused shortage, and runs on goods ranging from toilet paper to flour have periodically emptied the shelves of grocery stores, reflecting consumer fears about supply chain reliability. As part of our ongoing effort to aggregate expert opinion on future trends in technology and geopolitics, we asked experts how these disruptions impacted their companies and industries, whether they anticipate changes to their own supply chains in the future, and what they believe those changes will look like. 45 respondents replied to our survey, answering ten voluntary and anonymous questions (we attribute the smaller sample to the more niche topic area) with a response rate over 97 percent.

Key Findings

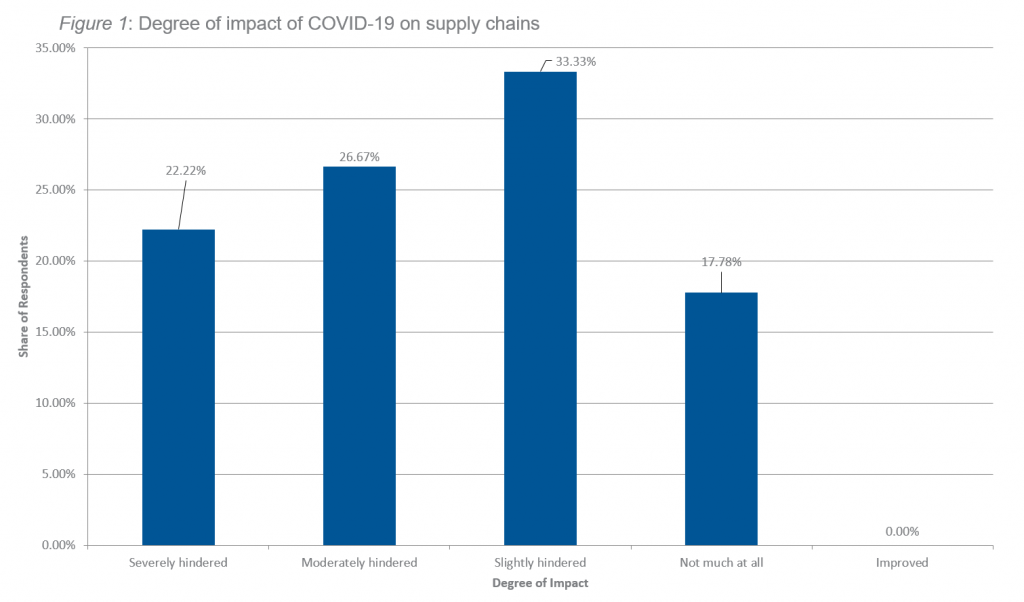

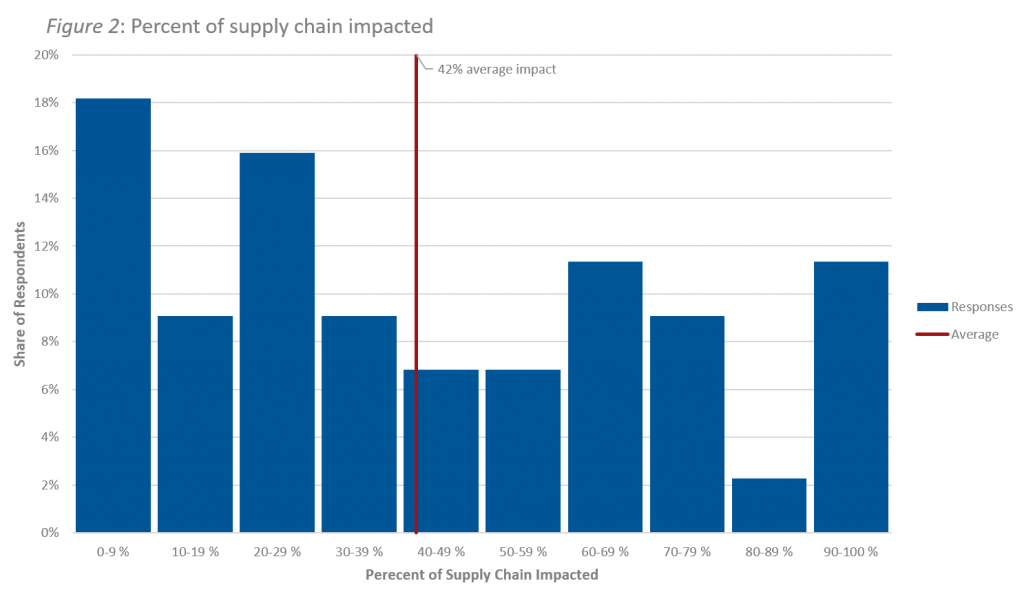

Despite larger global trends, slightly more than half of respondents indicated that they experienced few or no disruptions to their supply chains (see figure 1). When asked the percent of their supply chains that had been affected, approximately 27 percent of respondents indicated that less than 20 percent was disrupted, and 35 percent indicated disruption of between 60 and 100 percent of their supply chain (see figure 2).

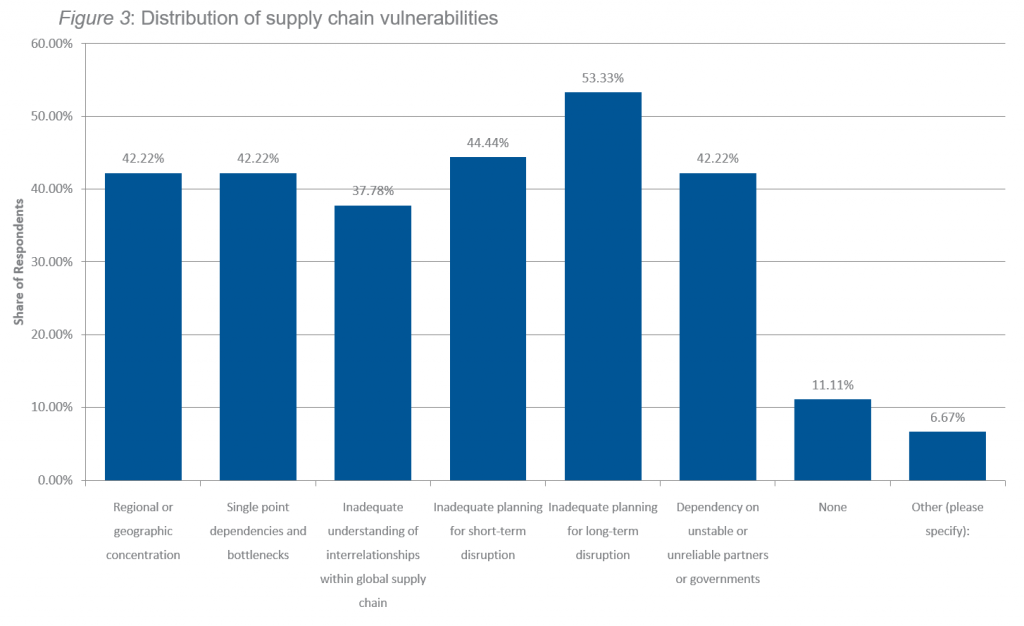

44 percent and 53 percent of respondents cited inadequate planning for both near and long-term disruptions as the top vulnerability in their supply chains, respectively. In addition, over 40 percent of respondents listed geographic or regional concentrations as well as bottlenecks and single point dependencies as core vulnerabilities (see figure 3). Overcoming these concentration risks and single-point dependencies may become a central component of contingency planning, which has gained popularity due to the pandemic.

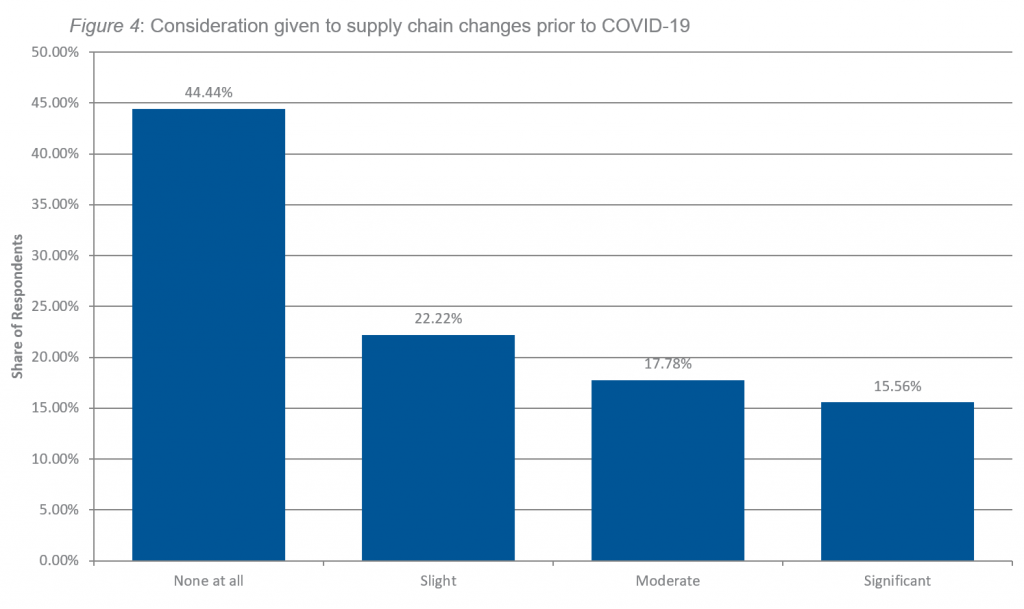

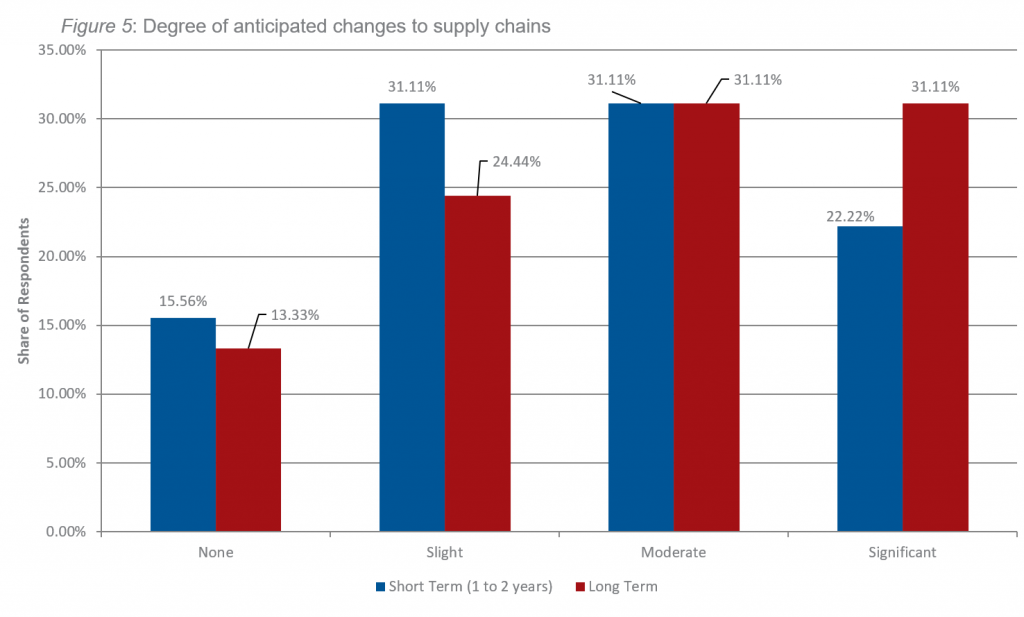

Prior to COVID-19, many simply did not consider global supply chain vulnerabilities: almost 45 percent of respondents noted they did not anticipate changes before the pandemic, while only 15 percent did to a significant degree (see figure 4). The pandemic, understandably, appears to have served as a wake-up call, as most respondents now anticipate alterations to their supply chains in the next few years. Only 15 percent of respondents conveyed that they did not expect changes over the next year or two. Approximately two-thirds anticipated slight or moderate changes, and over 20 percent expected significant changes. More anticipate changes when looking farther ahead, with two-thirds predicting moderate and significant adjustments to their supply chains in the long-term (see figure 5).

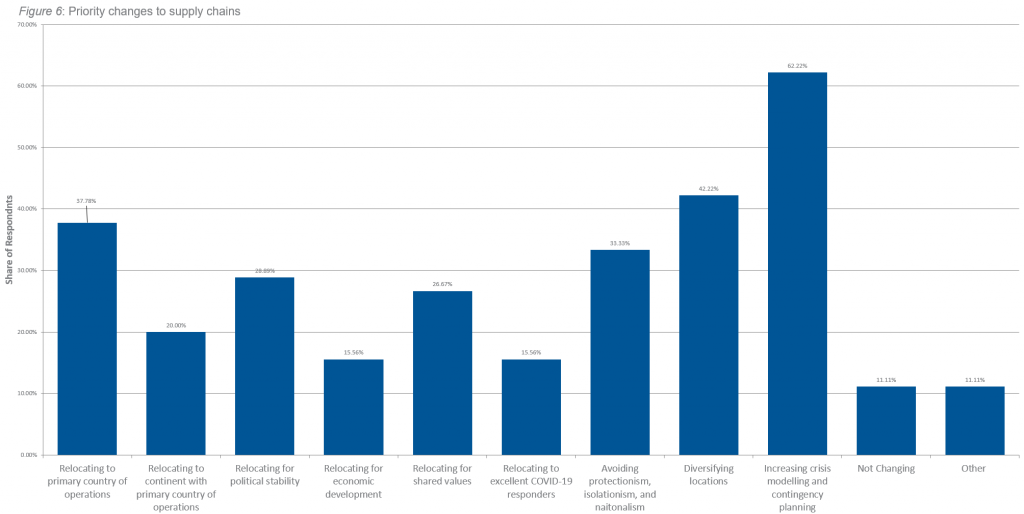

Within these changes, over 60 percent of respondents foresee more prioritization of contingency planning and crisis modelling in response to the pandemic’s disruptions. In addition to planning, they ranked location diversification of their supply chains as a top priority, followed by relocating them within the borders of the primary country of operation (see figure 6). This focus on re- or onshoring reflects not only growing concern about foreign dependencies but also increasing demand for self-sufficiency. Other responses indicated increased usage of technology, relocating component sources to non-adversarial countries, and a fear that some organizations simply don’t understand their supply chains enough to modify them.

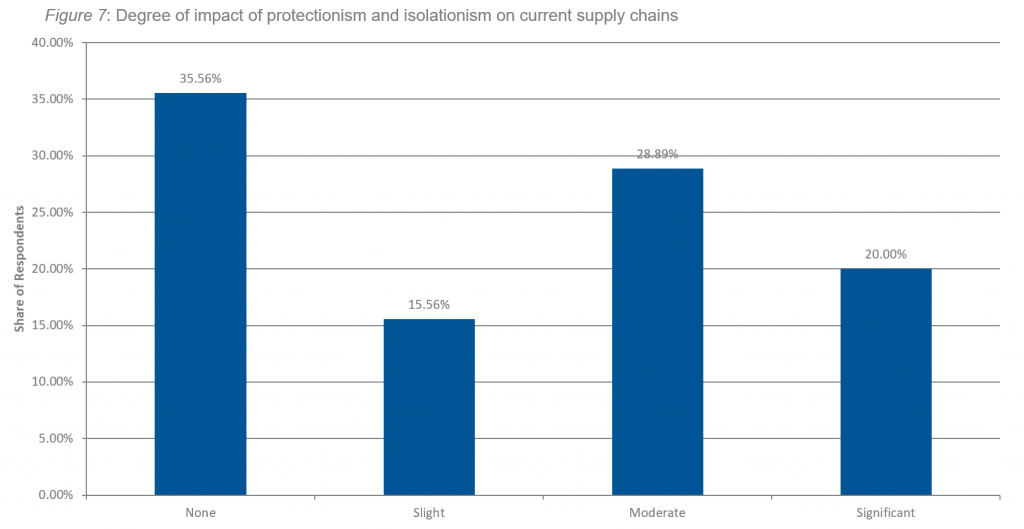

Amid an increase in global rhetoric of protectionism, some respondents were wary of rising economic nationalism and isolationist policies. A third of respondents considered it a concern for the future. When considering the current impact of protectionism on their supply chains, a third of respondents did not identify any impact, while half cited a moderate or significant one (see figure 7).

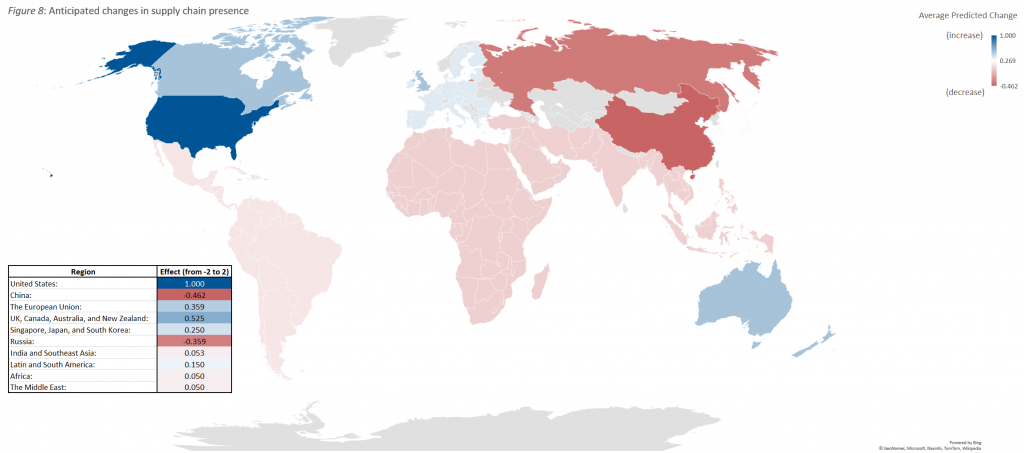

These two trends together – focus on geographic distribution and concerns about protectionism – are reflected in responses anticipating a geographic reorganization. Over half of respondents expected a significant or somewhat decreased presence of supply chain components in China, while 75 percent expect a significant or moderate increase in the United States. Similar expectations emerged for the European Union, the UK, Canada, Australia, and New Zealand, for which half of respondents expect an increase in components (see figure 8).

Despite these anticipated shifts, a quarter to a third of respondents expect little to no change to supply chain components in each of those regions. Given the difficulties of restructuring supply chains–development of physical infrastructure, workforce changes, materials requirements, and so on–it is unsurprising that many are skeptical that such change can occur, especially in a movement away from China.

Behind the numbers

Despite these challenges, there are several trends worth watching, each of which has been accelerated by COVID-19. First, reshoring (the practice of relocating supply chains to an enterprise’s country of operation) was already underway prior to the pandemic due to trade wars and tariffs. Based on our respondents’ prioritization of contingency planning and geographic diversification, we expect greater pressure to move away from concentration in China in order to mitigate dependency risks. Second, many democratic governments are intervening to incentivize the reshoring of domestic multi-national corporations. For instance, Japan has introduced a $220 million initiative to help their firms diversify from China to ASEAN, and other estimates of its overall reshoring efforts find an expenditure of up to $2 billion in subsidies and loans. The focus on regional groups and alignment with countries of similar values is not limited to Japan. The United Kingdom recently introduced a ten country pact to add resilience and security to their 5G infrastructure and other tech supply chains. Regional agreements are also emerging, from Australia and New Zealand to the Baltic States to Western and Northeastern pacts within the United States. As leaders coordinate economic reopening, they often take the chance to integrate additional supply chain components, like PPE.

The push and pull of incentives for and against reshoring illustrates an ongoing transformation of globalization. The pandemic has accelerated changes already underway while prompting significant reassessments of dependencies and risks. Many even predict the death of globalization, though those fears are likely premature. The global structure of trade and supply chains will shift, however, as governments and businesses seek resilience by shifting away from concentrated supply chains and integrating geopolitical considerations into these decisions in ways that have been largely absent for the past thirty years. Respondents’ emphasis on planning and modelling demonstrates that future supply chain changes are still being charted, and, accordingly, those transformations can still be shaped, either by a second wave of infections or by informed and cooperative decisions from both industry and policymakers.

Looking ahead

Global supply chains are susceptible to significant disruption from both natural and man-made events. The pandemic has highlighted these vulnerabilities by straining old instabilities, inequities, and insecurities, and it will continue to do so without changes to make supply chains more resilient.

At the same time, geopolitical shifts are pushing critical economies towards isolationism and trade restrictions, which threaten to exacerbate supply chain challenges. Understanding global connections, risks, and opportunities requires policymakers to pursue a wide variety of pilot projects and to cultivate successes that expand global notions of what is possible.

Future surveys will examine these issues and relationships in depth by polling about how trust in manufacturing components and geopolitical relationships interact with supply chains. Ideally, industry expertise and the support of policymakers around the world will reduce vulnerabilities, expand trade, grow productivity, and ultimately ensure that supply chains continue serve everyone in turbulent times, making certain that new technologies benefit people, prosperity, and peace globally.

Previous expert survey series post:

The GeoTech Center champions positive paths forward that societies can pursue to ensure new technologies and data empower people, prosperity, and peace.