Global China Newsletter—US-China rivalry in the Middle East and Pacific as 5G Competition Intensifies

Subscribe to the Global China Hub

Deepening rivalry between China and the United States is reshaping regional dynamics far from either country’s shores.

This week Chinese Premier Li Qiang wrapped up a visit to Riyadh to meet with Saudi Crown Prince Mohammed Bin Salman, where the two discussed cooperation across a range of issues and Li urged progress on the countries’ stalled free trade discussions. The visit was the latest in a long list of intensifying Chinese diplomatic and economic engagements and attention to the Middle East, as demonstrated below.

While Beijing’s response to the current Gaza crisis has underscored China’s newfound approach to the Middle East, in reality Beijing’s choices since the October 7th Hamas attack on Israel reflect a larger and longer-term shift in its geopolitical strategy.

As Hub nonresident senior fellow Michael Schuman and Middle East Programs nonresident senior fellow Jonathan Fulton write in a new report and discuss in their launch event, the Middle East is now of rising importance to Beijing’s foreign policy agenda, and China’s drive for greater influence and mounting efforts to create wedges between the US and its partners may fundamentally reshape the region.

Beijing’s focus on a likely protracted global competition with Washington is affecting dynamics in nearly every other region and domain, from the Pacific islands to 5G penetration. Our editor in chief Tiff Roberts covers all this and more below in this edition of Global China.

But before I hand things over to Tiff, it is my great pleasure to introduce the new Senior Director of the Global China Hub, Dr. Melanie Hart. Melanie, who is coming from her role as China Coordinator for the Undersecretary of State for Economic Growth, Energy, and the Environment, is a leading China expert with deep experience heading innovative China programs inside and outside the government. I’m heading back into government myself to serve as the National Intelligence Officer for China, but will remain in close touch with the Global China Hub and continue benefitting from all the great research the Council produces on China.

I am so proud of what we’ve accomplished in the Hub’s first three years and even more excited to watch Melanie lead the Council’s China work to new heights. Tiff, take it away!

–David O. Shullman, Senior Director, Atlantic Council Global China Hub

China Spotlight

The Pacific Islands: a lesser known, yet intensifying, arena for US-China rivalry

Look around the world and it’s usually obvious where China focuses on building its geopolitical power. Take Southeast Asia, where Beijing has knit regional economies ever closer through its promotion of trade groupings like the Regional Comprehensive Economic Partnership (RCEP). And there is the African continent, a major recipient of Belt and Road Initiative infrastructure spending, where Beijing promotes its political and economic standing while building a “counterweight to the US global alliance system,” as the Hub’s Michael Schuman writes. That no doubt was part of Beijing’s calculus when launching the Forum on China-Africa Cooperation (FOCAC) in 2000. The triennial gathering of over 50 African nations just finished its latest meeting in China’s capital on September 6 with Beijing pledging $50.7 billion in credit and investment to the continent.

But there’s a lesser known, yet intensifying, arena where China is vying for influence: the Pacific Islands. That was on display August 26 to 30 when the Pacific Islands Forum (PIF) was held in Tonga’s capital, Nuku’alofa. Why do those distant, lightly-populated countries that include the Solomon Islands, Papua New Guinea, and Fiji matter to global players like China? They are part of its strategy of further isolating Taiwan; on January 15 Nauru was the latest country in the region to switch diplomatic relations from Taipei to Beijing (three of the countries that still recognize Taiwan are from the region including the Marshall Islands, Palau, and Tuvalu).

Beijing also apparently used its growing influence in the region to persuade participants to remove mention of Taiwan from the forum communique. “Outside powers’ interest in this vast maritime region has markedly increased, mainly due to its geographic relevance to the growing geopolitical rivalry in the Indo-Pacific between the United States and China,” writes GCH and Indo-Pacific Security Initiative nonresident fellow, Parker Novak. The Hub also recently co-hosted an event with the Indo-Pacific Security Initiative to raise the strategic importance of efforts by the US and its allies to deepen their relationships in the region.

Reasserting leadership in 5G and why it matters

But the geopolitical rivalry is not just about winning hearts and minds. It is also about taking the lead in setting technological standards, like 5G, where China is now ascendant. In a new report, Hub fellow Ngor Luong explains how 5G “enables faster, more reliable communication networks,” key to “national competitiveness, from military operations to economic benefits,” and outlines how the US must reassert its leadership in the fifth generation of wireless cellular technology (also discussed in an associated launch event).

These worries extend beyond the US and include fears from other nations that adopting Chinese 5G technology could open the door to security risks. On September 10, Portugal announced its new government would continue to ban Chinese 5G equipment in its network, one of about a dozen European countries that have restrictions including Germany, Italy, France, the UK and Denmark. “To effectively counter China’s market-distorting behaviors,” the US must “promote globally accepted spectrum bands, improve the 5G global governance system, and build partnerships with key regions,” explains Luong in a separate note.

GDP disconnect between Beijing and outside economists

To listen to official voices from Beijing, the Chinese economy seems to be humming along. ”Overall, the national economy has continued to improve in the first half in a stable manner,” the National Bureau of Statistics said in a statement in July. That followed the release of figures showing GDP grew by 5% in the six months from January through June (but up only a disappointing 4.7% in the last quarter, its weakest rate in over a year). China is experiencing “relatively fast growth among major economies, which builds a sound foundation for the achievement of the annual GDP target,” of 5%, said Chinese economist Chen Fengying in an interview with the Global Times.

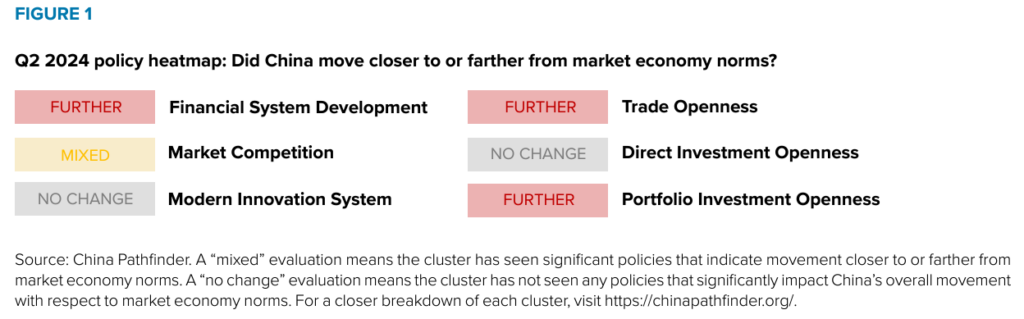

Most outside observers however, aren’t buying it. While China’s leaders still insist they can reach 5%, “our reading of high-frequency indicators and assessments from well-regarded Chinese economists … are at odds with that assurance,” note the Atlantic Council and Rhodium Group in the “China Pathfinder: Q2 2024 update.” “The gulf between economic data and official pronouncements grew through the second quarter of 2024. Property markets, stock prices and consumer sentiment all indicated weakness.” (Property investment fell by 10.1% in the first half while China saw core inflation-CPI excluding food and energy costs—at only 0.3 percent in August, its lowest level in more than three years, reflecting weak consumer demand.) In a recent article, The Economist put it bluntly: “The Chinese authorities are concealing the state of the economy.” This view has been echoed by economists and business journalists for many years, including by your own Global China Newsletter author when I highlighted this issue in a 2012 piece titled: “China Struggles to Publish Accurate Economic Data.”

ICYMI

- DFRL’s Kenton Thibaut published a new report: “Effective USG Strategies to Address PRC Information Influence.” It has three sections: the first baselines the PRC’s information influence strategy, the second outlines government equities with regards to PRC actions in the space, and the third outlines recommendations for USG on how to best address PRC actions.

- The US Treasury Department proposed an update to CFIUS rules to expand its jurisdiction over foreign real estate purchases near sensitive sites, driven by growing concerns over Chinese investments. While the update mainly adds sensitive sites to the review list, the GeoEconomics Center’s Sarah Bauerle Danzman explains that this raises concerns about its impact on greenfield investments and whether it might effectively function as a ban on Chinese real estate acquisitions near critical locations.

- The global aggregate goods trade deficit with China has doubled between 2017 and 2023, writes the GeoEconomics Center’s Mrugank Bhusari. As China moves up value-added supply chains and simultaneously doubles down on manufacture-driven growth, far more countries are now concerned about shielding their economies from a surge in Chinese exports.

- In the South China Sea, China’s aggression against the Philippines is not in some shadowy, ill-defined “gray zone,” writes Indo-Pacific Security Initiative director Markus Garlauskas. It’s a real and constant series of attacks on the country’s people and sovereignty.

The Global China Hub researches and devises allied solutions to the global challenges posed by China’s rise, leveraging and amplifying the Atlantic Council’s work on China across its sixteen programs and centers.