The impact of coronavirus on Gulf economies

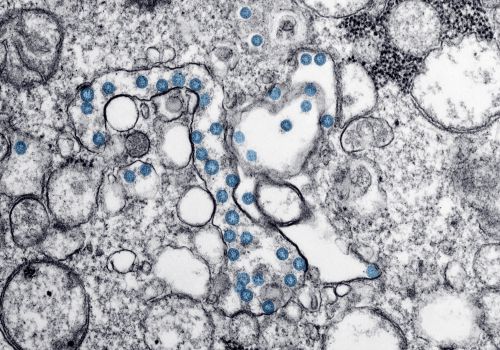

As the world responds to the coronavirus, public health is of course the first level of concern, and in looking at how it is affecting the Gulf Cooperation Council (GCC) states this is certainly an issue. Iran has emerged as the most affected state after China, and with this there has been an increase in cases throughout the Middle East, resulting in concerns about the region’s health care systems’ capacity to confront the pandemic.

Beyond the obvious public health crisis, the coronavirus has had a significant impact on Gulf economies, as it has with other countries around the world. What sets the GCC states apart is the damage that can be done by a Chinese slowdown. The consequence of an over-reliance upon energy exports, long understood to be a structural weakness in their economies, has become even more apparent.

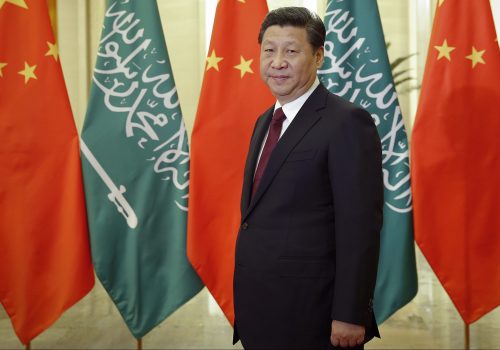

Early in the outbreak the GCC states publicly expressed support for China and Gulf rulers sent aid. Dubai’s iconic Burj Khalifa was lit up in solidarity, displaying the Chinese flag as well as the Chinese phrase, “Let’s go Wuhan!” Saudi’s King Salman committed to sending aid during a call with President Xi Jinping, and Qatar sent five cargo freighters carrying 300 tons of medical supplies, donated by Qatar Airways. The material and moral support was appreciated, and the UAE was singled out when the spokesman for China’s Foreign Ministry included it in a list of states that offered “sincere and friendly understanding, support and help.”

This is not unexpected. In recent years China has emerged as the biggest economic partner for the GCC, and in both directions, there has been substantial political and diplomatic outreach. When UAE Crown Prince Mohamed bin Zayed said his country “is confident in their ability to overcome this crisis… is ready to provide all support to China,” he was signaling an important message of support to one of the UAE’s most strategically important partners.

Despite the pledges of support, the coronavirus has had a significant impact on Gulf economies and the line between sensitivity and vulnerability has been become somewhat blurred. Economic relations have been the bedrock of bilateral relations between China and Middle East states, with Chinese consumer and industrial products making a big splash in MENA markets. GCC-China trade is different, however. As a natural consequence of energy exports from the Gulf, trade is balanced heavily in the GCC’s favor. The UAE, with its re-exports out of Jebel Ali, is an exception, consistently buying more from China than it sells. (It’s worth noting that Bahrain does too, though the volume of bilateral trade is negligible.) In good times this is very good indeed, with substantial revenue coming into Gulf state coffers.

The obvious downside is that the loss of a major market like China—even temporarily—can hurt. To a degree, this is true of every state. However, Gulf states are especially reliant on energy to drive their economies, with 85 to 90 percent of federal budget revenues coming from energy exports. This is compounded by the fact that 67 percent of Gulf energy exports are sold to East Asia, meaning other non-Chinese trade partners are also suffering economically and cannot pick up the slack.

Oman is a case study in vulnerability; in 2017 China accounted for approximately 44 percent of its exports. This is down slightly from the year before, when it was about 48 percent. In the summer of 2017, a group of Chinese financial institutions issued a $3.55 billion loan that allowed the Omani government to cover its fiscal deficit. At the end of last year, Oman’s state-owned Electricity Holding Company sold a 49 percent stake to Grid Corporation of China, raising $1 billion. Even so, the government still projected a 2019 budget deficit of over $7 billion, or approximately 9 percent of its GDP. With an economy that is already in trouble, China going offline hits Oman especially hard.

Other Gulf states are less vulnerable but still quite sensitive to a Chinese economic downturn. Saudi Arabia has enjoyed a windfall with US sanctions against Iran, leading to a dramatic increase in oil exports to China, up nearly 100 percent between August 2018 and July 2019. Before the coronavirus outbreak, China averaged between 1.8 – 2 million barrels per day from Saudi; that has dropped by 500,000 bpd. While far less leveraged than Oman, the Saudis are highly sensitive to a sudden slowdown in demand from the world’s largest oil consumer.

One thing that becomes increasingly obvious in the Gulf is the desperate need for sustainable economic diversification. All of the GCC states have embarked upon “Vision” development programs that are designed to steer them away from single-resource rentier models in the hope that they can transition to post-hydrocarbon ones. However, these programs rely on revenue from energy exports to build their post-energy sectors, and lower oil prices in recent years strain those efforts. The current shock to global energy markets, with prices down around 15 percent since the start of the year, makes it especially difficult to manage.

Beyond the impact on trade, there are other economic effects that have already impacted the Gulf. Saudi Arabia has suspended Umrah—an Islamic pilgrimage to Mecca that can take place at any time—for citizens and residents, and suspended entry of foreign pilgrims coming to visit Mecca and Medina. Beyond the religious consequences for those affected, there is a material result as well, as pilgrimage is an important source of revenue for Saudi Arabia. Dubai, the rare regional economy not based on energy, is no better off. Its hospitality industry has enjoyed a boom in Chinese tourists in recent years, receiving nearly 1 million in 2019. Hotels were already experiencing their lowest average daily rate since 2003, and with business travel being curtailed and conferences canceled, that sector is experiencing a coronavirus crash. With so much riding on Dubai Expo 2020, the threat of a prolonged public health crisis could be devastating to the emirate’s economy. While more resilient, Abu Dhabi is feeling the impact too; a cycling race that was to be held in late February was canceled when two Italian participants were diagnosed. As a result, two of its five-star Yas Island hotels, the Crown Plaza and W, have been locked down.

While a global pandemic is about more than economic issues, it does underscore some of the strengths and weaknesses in state capacity. For the GCC states perhaps one major takeaway is the urgent need for their “Visions” to become a reality.

Jonathan Fulton is a senior nonresident fellow with the Atlantic Council. He is also an assistant professor of political science at Zayed University in Abu Dhabi. Follow him on Twitter: @jonathandfulton.

Image: Travellers wear masks as they arrive at Dubai International Airport (Reuters)