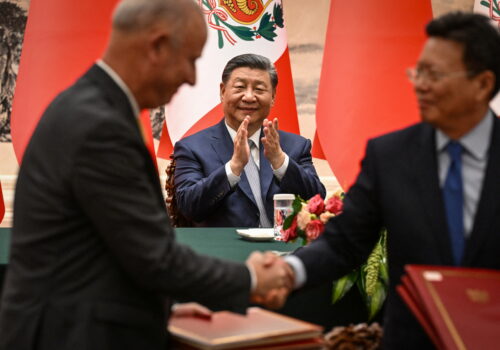

In the waning days of his term, President Joe Biden is visiting Peru and Brazil, his first trip to South America as president. The six-day tour, which runs through November 19, takes him to the Asia-Pacific Economic Cooperation (APEC) annual meeting in Lima and the Group of Twenty (G20) summit in Rio de Janeiro. At both stops he will seek to regain US momentum but without much to offer following Democratic Party losses last week. Moreover, Biden’s trip comes late and without much hope for policy continuity. On the flip side is Chinese leader Xi Jinping, who arrives in Peru to inaugurate a new megaport, built and run by state-owned Chinese companies, that further marks Beijing’s growing investments in large-scale regional infrastructure in the region.

What must the United States do differently in its approach to Latin America and the Caribbean? “Prioritize, invest, message, and align”—the four elements of a strategy the Atlantic Council released earlier this year to counter malign Chinese (and Russian) influence in Latin America and the Caribbean.

Prioritizing can mean a range of things across the US bureaucracy, but presidential-level visits are critical forcing and signaling mechanisms to the rest of the government of a country’s or region’s importance. When he came into office, Biden set high expectations that he would personally prioritize showing up in Latin America and the Caribbean, given his fourteen trips to the region as vice president. Until this week, no visits have materialized except for one trip to Mexico in 2023.

For the United States, the problem is that President Donald Trump likewise did not prioritize travel to the region in his first term. He only went once, to Argentina* in 2018 for a G20 meeting. Notably, a G20 meeting is also the reason behind Biden’s trip to Brazil this week. This means that until Thursday the past two presidents had made a total of two trips to any one of the thirty-three countries in the Western Hemisphere (notwithstanding Canada). This is the same number of trips that Xi made to the region in the same timeframe (Brazil in 2019; Argentina and Panama in 2018).

But prioritizing only goes so far as countries clamor for investment. The region’s economic potential is immense. It’s home to almost 20 percent of the world’s oil reserves, 57 percent of the world’s identified lithium, 37 percent of the world’s copper reserves, and 30 percent of the world’s primary forest, among other precious resources. Brazil, in particular, can be a global breadbasket and help to reduce food shortages globally.

And while China is ramping up its investments in the region—including in strategic sectors such as telecommunications, technology, and critical minerals—US companies do not make investment decisions in the same way as their Chinese counterparts and thus often choose not to even bid on key infrastructure projects. This includes the case of the expansion of the Bogotá metro, in which no US company actually placed a bid, while three Chinese firms and a Spanish firm were the final contenders for the project. Initiatives such as the International Technology Security and Innovation Fund, appropriated under the CHIPS and Science Act of 2022, was a step in the right direction, but the five hundred million dollars in funding for the State Department to focus on secure telecommunications development and semiconductor supply chains will only go so far. This is made clear by the fact that Costa Rica, Panama, and Mexico are the only countries in the region to have signed a partnership agreement under the initiative.

What will be critical is long-term continuity of US investment frameworks in the region. Biden launched the Americas Partnership for Economic Prosperity (APEP) in June 2022 to advance investment in the region, and Trump launched América Crece in December 2019 with similar objectives albeit with APEP bringing an additional bureaucratic framework that could transcend the administration. However, changes in administration mean that such programs can often have a limited shelf life. This is one reason why an effort such as an Americas economic security investment program should be launched early in the next administration to build on efforts to advance US economic ties.

The United States has many of the tools it needs to invest in the region—indeed, around half of the United States’ worldwide free trade agreement partners are in Latin America and the Caribbean. What is missing is a thorough review of how well those agreements are working to deepen US commercial ties with the region. Even though agreements are in place, businesses often do not maximize the potential they can offer.

Messaging and alignment on major issues are fundamental to rounding out an updated strategy to counter malign Chinese influence. This includes combatting disinformation and meeting the region on its own terms. Here, it’s welcome news that in Marco Rubio, whom Trump nominated this week to be secretary of state, the United States may soon have a Spanish-speaking top diplomat. That will elevate US messaging to its regional counterparts.

What will also be pivotal is the United States and its neighbors finding alignment on issues of mutual concern, with security being chief among them. This will be a tightrope for the incoming Trump administration in its quest to deter greater Chinese influence in the hemisphere. If immigration enforcement becomes the top hemispheric policy priority for the United States, it will only push more countries into the Chinese orbit. Alignment is fundamental for countering China.

Jason Marczak is the vice president and senior director of the Atlantic Council’s Adrienne Arsht Latin America Center.

Correction: A previous version of this article misstated the country Trump visited for a G20 meeting in 2018. It was Argentina.

Further reading

Thu, Nov 14, 2024

China’s advances in Latin America should concern Trump

Inflection Points Today By Frederick Kempe

As Chinese leader Xi Jinping and US President Joe Biden visit Peru and Brazil this week, the contrast between the US and Chinese approaches to the region is stark.

Mon, Feb 26, 2024

Redefining US strategy with Latin America and the Caribbean for a new era

Report By Jason Marczak, María Fernanda Bozmoski, Matthew Kroenig

The strategic interest of the United States and the countries of Latin America and Caribbean (LAC) lies in strengthening their western hemisphere partnership. However, the perception of waning US interest and the rise of external influences necessitate the rejuvenation of and renewed focus on this partnership.

Wed, Nov 13, 2024

As Biden bids farewell, Xi advances China’s influence in Latin America at the APEC Summit in Peru

New Atlanticist By Martin Cassinelli, Caroline Costello

Beijing is successfully pairing its economic diplomacy with action, and the United States should be concerned.

Image: US President Joe Biden is greeted by Gustavo Adrianzen, the Prime Minister of Peru, at Jorge Chavez International Airport ahead of the APEC summit in Lima, Peru, November 14, 2024. REUTERS/Leah Millis