Many central banks around the world have begun researching and testing various versions of digital currencies, with several participating in a consortium coordinated by the Bank for International Settlement (BIS). The People’s Bank of China (PBoC) is perhaps the most advanced in preparations to launch a digital currency, having expanded pilot programs from four major cities in recent months to key economic regions in Beijing-Tianjin-Hebei, the Yangtze River Delta, and the Guangdong, Hong Kong, and Macau area. As a consequence, more information about China’s digital currency electronic payment (DCEP)—as the new unit is called—has been gradually released. The development of the DCEP has revealed the significant advantages and potential drawbacks for both China’s digital currency project and the potential for widespread central bank digital currencies around the world.

How does DCEP work?

DCEP is the digital version of the yuan, China’s physical currency. As such DCEP is the legal tender of the country, being issued by the central bank and parts of its liabilities. In a centralized system, the PBoC issues DCEP to commercial banks against equivalent cash or banks’ deposits at the central bank. Commercial banks then distribute DCEP to their clients, assuming client facing interactions including Know Your Customer (KYC) due diligence. The PBoC can allow other intermediaries which can fulfill the same requirements to distribute its DCEP.

DCEP as a digital unit resides in digital wallets, whose app will be authorized by the PBoC and can be downloaded by users—it is still unclear whether downloading the app would require formal registration. It has been claimed that DCEP can be transmitted directly from wallets to wallets independent of banks or any other intermediaries via the Internet or phone connections, or absent those connections, by putting two mobile phones close together—probably using near field communication protocols.

In addition, it has also been highlighted that DCEP wallets can be used as easily as scanning each other’s QR codes on payment platforms such as Alipay or WeChat Pay. Indeed, 83 percent of payments in China in 2018 were made through mobile devices, compared to 17 percent through cash or bank cards. According to the PBoC, the DCEP can accelerate the progress toward a cashless society and enhanced financial inclusion. The ease of use together with the direct transmission between wallets independent of intermediaries suggest that banks will not necessarily keep records of DCEP transactions and it’s not clear how the authentication of transactions will work—the private-public key encryption usually associated with digital tokens is certainly not as easy for the public to use as scanning QR codes (not to mention the risk of losing or misplacing the private key).

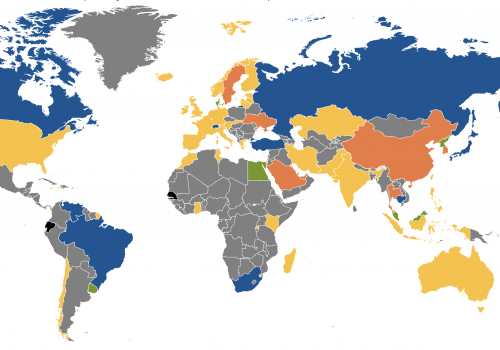

See the Atlantic Council’s work on central bank digital currencies:

Issues of anonymity of cash transactions and privacy protection

Based on information released so far, it looks like the PBoC can trace every movement of the DCEP given its electronic footprints and by monitoring activities of digital wallets. This means DCEP fails to afford users the complete anonymity of cash transactions. The PBoC pointing to the direct transmission of DCEP between wallets has said that there will be “controllable anonymity”—but this is true only for commercial banks, not for the PBoC itself.

The PBoC’s ability to monitor DCEP transactions can help improve the efficacy of monetary and fiscal policy operations as well as make it easier to fight financial crimes including money laundering and the financing of terrorism. However, this will significantly strengthen the government’s social credit scoring system, used to control its citizens by rewarding or punishing their behaviors. Basically, the more citizens that use DCEP instead of physical cash, the more the government can monitor and control their lives.

This is an important issue for other central banks contemplating digital currencies. These banks must demonstrate their ability to put in place very robust institutional safeguards against potential abuse of digital currency transactions data by corresponding governments.

Disintermediation of banks and implications for central bank policies

Should direct transmission of DCEP between digital wallets begin to replace the use of checks and electronic transfers of bank balances, banks be left out of the payment flows, depriving them of valuable access to clients’ financial activities. More importantly, if users acquire DCEP by drawing down their bank balances, this will shrink bank balance sheets, depriving them of a zero/low cost deposit funding source. Banks will have to rely on more costly and less stable wholesale funding markets.

Importantly, users’ ability to move money from bank deposits to DCEP could frustrate central bank monetary policies. For example, during an economic downturn, a central bank may want to provide monetary stimulation to spur growth. However, if users prefer liquidity and run down their bank balances to fill up their DCEP wallets, this will reduce banks’ deposit bases, making it more difficult for them to extent credit to support economic activity which central banks try to promote.

Moreover, the ability to move money between bank deposits and DCEP could facilitate a digital bank run which can occur much faster than forming lines in front of bank branches to withdraw cash.

Equally importantly, the DCEP can enable the PBoC to impose negative interest rates on the holding of digital money in wallets—something a central bank cannot do with cash. This is a very serious matter—imposing negative interest rates is not simply a technocratic monetary policy move but could be seen by citizens as confiscation of their wealth by the state.

Finally, the central bank needs to provide appropriate regulatory framework for non-bank intermediaries allowed to distribute DCEP to the public.

Relationship with existing mobile payment platforms

Alipay and WeChat Pay control 90 percent of China’s digital payment market, which accounts for about 25 percent of retail spending, including on financial services. WeChat is regarded as China’s premier social media channel having more than1 billion users per month, many of whom make use of its financial and payment apps. Alipay is China’s biggest e-commerce platform, processing more than 120,000 transactions per second (TPS)—which is double the speed of Visa and MasterCard. Users fund and top up their digital wallets at these payment services with their bank balances or credit cards.

For the foreseeable future, such payment platforms can co-exist with the DCEP. However, being legal tender and fee-less, the DCEP will likely become widely adopted and will disintermediate the current payment platforms.

The DCEP will also make Facebook’s proposed libra stablecoins unnecessary. Under Facebook’s updated White Paper, the libra will come in different varieties, based on the currency of a country, not a basket of currencies, thus becoming more stable and not competing against the legal tender. While it benefits from the large membership of Facebook, the libra still needs to be exchanged into and out of the Facebook universe when people want to transact on things or services that require a legal tender. If the DCEP is available, the ease and low cost of transactions promised by the libra becomes less compelling.

The DCEP in international payment transactions

It has also been suggested that the DCEP can be used for international payment transactions, especially as an alternative to the US dollar. Indeed, for users in countries willing to use the RMB, for example those participating in the Belt and Road Initiative (BRI), the DCEP will be much more convenient and efficient, with lower transaction costs, than settling RMB bank balances through China’s Cross-border Interbank Payment System (CIPS). A more widely used DCEP for cross border transactions will be hindered, however, by the same factors holding back the international use of the RMB: China’s capital account is not fully open, the RMB is not freely convertible in whatever forms (bank balances, physical or digital yuan), and Chinese capital markets are much less developed compared to those in the United States.

Conclusions

The development of the DCEP raises fundamental questions about central bank digital currencies in general. The advantages include offering the public a more convenient, efficient, and low-cost payment mechanism as an alternative to physical cash. The DCEP can help the government improve the efficacy of its monetary policy operations (real-time monitoring of the movements of the digital currency), its fiscal policy operations (taxation including fighting tax avoidance), as well as crime prevention (including money laundering and financing terrorism).

The main drawback is that DCEP takes away the anonymity of cash transactions, reducing personal privacy and handing the government a powerful tool to monitor and control its citizens. The ability of a central bank to impose negative interest rates on holdings of DCEP also raises a disturbing prospect of government’s confiscation of citizens’ wealth.

More specifically, the DCEP raises the risks of disintermediation of the current banking system, posing possible financial stability risks including a digital bank run, giving rise to the need of regulating intermediaries in the DCEP ecosystem, and potentially frustrating central bank monetary policy objectives.

These issues should be fully investigated by central banks and results made available in a timely manner for a thorough public debate—especially on the problems of privacy protection and imposition of negative interest rates—before definitive steps are taken to launch central bank digital currencies.

Hung Tran is a nonresident senior fellow at the Atlantic Council, former executive managing director at the Institute of International Finance, and former deputy director at the International Monetary Fund.

Barbara C. Matthews is a nonresident senior fellow at the Atlantic Council. She is also CEO of BCMStrategy, Inc., a technology company using patented processes to measure public policy risks. When in government she served as the first US Treasury attaché to the European Union, with the Senate-confirmed diplomatic rank of minister-counselor.

Further reading:

Image: A China yuan banknote featuring late Chinese chairman Mao Zedong and a computer keyboard are seen reflected on an image of Chinese flag in this illustration picture taken November 1, 2019. REUTERS/Florence Lo/Illustration