A few days after Javier Milei’s surprising but decisive election victory, the contours of Argentina’s next government are slowly becoming visible. Milei has already backed off from his most radical campaign messages, discarding key election advisers in favor of a more moderate economics team and sending out conciliatory messages to China and other foreign governments. With the appointment of Luis Caputo, head of the central bank during the Macri administration, as economy minister, Milei has sent a clear message that his current coalition with Juntos por el Cambio, the conservative alliance, will extend into the beginning of his administration. The incoming president’s campaign pledge to move Argentina to the US dollar seems less and less likely in the near term.

These initial steps have provided reassurance to investors and signal the welcome transition of a maverick candidate into a more responsible, even if not mainstream, future head of government. They are also a sign that, now that the fate of his country will soon rest on his shoulders, Milei has realized that there are few realistic policy options for him to pursue. Foreign exchange reserves are exhausted, financial markets remain all but closed to Argentina, and an International Monetary Fund (IMF) program has run badly off track due to the actions of the outgoing administration. Moreover, China will remain a critical trade partner and possibly the only major source of bilateral financial assistance for the foreseeable future.

The question therefore remains how the Milei administration intends to reduce inflation and lower the fiscal deficit once in office.

In this situation, adopting the US dollar as Argentina’s official currency could have pushed the country into a severe depression that could have resulted in more people out of work and increased poverty. Since the country has far from enough dollars to replace its monetary base at the current exchange rate, dollarization would have implied another major depreciation of the peso. The resulting loss of purchasing power for peso holders, combined with deep cuts in subsidies and other public expenditure that would be needed to bring the budget into balance, would have been a serious hit to those without access to dollar income or foreign remittances.

Milei has said that dollarization still remains a consideration over the medium term. One could indeed imagine that, for a country with a long history of regular bouts of hyperinflation, abandoning the peso could finally bring about monetary stability and impose much-needed fiscal discipline. However, a strong currency whose exchange rate is influenced by factors entirely unrelated to the domestic cycle would bring its own set of problems, primarily for the competitiveness of exports, on which Argentina remains heavily dependent.

Most importantly, dollarization would not provide insurance against fiscal recklessness down the road once Argentina could again borrow in financial markets. The experience of dollarized economies such as Ecuador and El Salvador shows that the adoption of the US dollar is no panacea in the absence of sustained growth and responsible macroeconomic policies.

The question therefore remains how the Milei administration intends to reduce inflation and lower the fiscal deficit once in office. A rational course of action would be to reduce the public deficit, cease direct monetary financing, and raise real interest rates over the first half of the new president’s first term, leaving some measures in place to protect the poorest segment of the population. However, monetary and fiscal consolidation would only be a necessary, but not sufficient, condition to generate a sustainable uptick in long-term growth that would be needed to eventually raise Argentinean living standards.

The key to economic success indeed lies in removing the thicket of obstacles that have curbed the productive capacity of Argentina’s economy over the past decades. It is for this reason, no doubt, that the new president-elect promised to send a package of reforms to the national congress, which would be recalled on December 11, the new administration’s first day in office.

Alas, the chances of a strong reform package being passed into law appear low at first sight. The Peronist opposition would hardly agree to turn Argentina into a wholly free-market economy overnight, and Milei and his conservative allies have no legislative majority on their own. Moreover, most of Argentina’s provinces are still governed by the opposition, leaving Milei with only a small political power base. In fact, having thrown in his lot with the conservative alliance, Milei could find himself in a similar situation as former President Mauricio Macri, whose economic reform plans were largely dependent on winning a legislative majority for his second term.

It is therefore necessary to draw the right lessons from the failed 2015-2019 reform experiment. First, it would be a mistake for Milei to squander his large popular appeal in a rerun of the Macri experience. The outcome would be disastrous for Argentina, which has moved closer to a full-blown economic collapse in the meantime. Milei would instead need to make his case for economic reform directly to the Argentinean people, raising the cost for the opposition to refuse support for critical legislative steps.

Second, the IMF has a key role to play in forging a bipartisan reform consensus. Unlike the simple loan rollover during the Fernandez administration, the resumption of IMF lending this time would need to depend on the legislative implementation of growth-enhancing reforms. Given the multi-year time frame for such reforms, it would not be unusual for the IMF to engage with both the ruling and opposition parties.

Third, the United States and Europe, as the largest IMF shareholders, have a special responsibility in this regard, and they should lean on the IMF leadership and Argentina’s body politic to work toward an ambitious program outcome. Moreover, by identifying ways to directly support the Argentinean economy, they could increase the chances for program success, providing much-needed relief for the long-suffering Argentinean population.

Martin Mühleisen is a nonresident senior fellow at the Atlantic Council’s GeoEconomics Center and a former IMF official with decades-long experience in economic crisis management and financial diplomacy.

Further reading

Mon, Nov 20, 2023

The economic aftershocks from Milei’s win in Argentina

Fast Thinking By

Argentina’s economy is due for radical change from the Peronist status quo as libertarian TV personality Javier Milei is set to become the country’s next president.

Mon, Nov 20, 2023

Experts react: Can ‘lion king’ Milei tame Argentina’s roaring inflation?

New Atlanticist By

The former television personality known for his libertarian economic views and unruly mane will become Argentina’s next president. His first task will be dealing with runaway inflation.

Mon, Oct 23, 2023

Populism vs. the establishment: What to expect in Argentina’s presidential runoff

New Atlanticist By

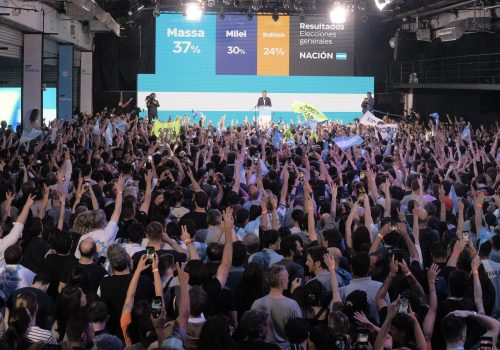

After a surprising first-round result, the November 19 election will now pit Economy Minister Sergio Massa against right-wing populist Javier Milei.

Image: A 100-dollar bill cut-out with Argentine presidential candidate Javier Milei's face printed on it is pictured during the closing event of his electoral campaign ahead of the November 19 runoff election, in Cordoba, Argentina, November 16, 2023. REUTERS/Matias Baglietto/File Photo