GET UP TO SPEED

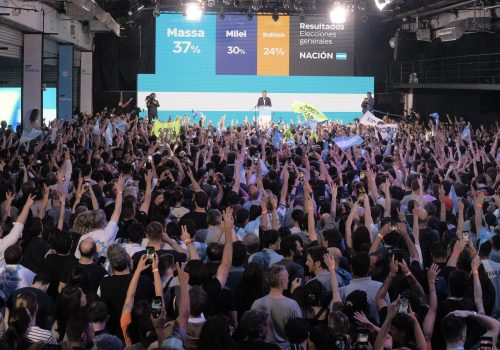

Break out the chainsaws. Argentina’s economy is due for radical change from the Peronist status quo as libertarian TV personality Javier Milei is set to become president, following a surprisingly comfortable win on Sunday over the current economy minister. Milei—who often wielded a chainsaw on the campaign trail to represent his eagerness to cut government spending—has vowed to dollarize the economy and get rid of the central bank. But will he get it all done, and what would such changes mean for a member of the Group of Twenty (G20) major world economies? Our experts are revved up to provide the answers.

TODAY’S EXPERT REACTION COURTESY OF

- Jason Marczak (@jmarczak): Vice president and senior director of the Adrienne Arsht Latin America Center

- Martin Mühleisen (@Muhleisen): Nonresident senior fellow at the GeoEconomics Center and a former director for strategy, policy, and review at the International Monetary Fund.

- Isabel Chiriboga (@IsabelMariaCM): Program assistant at the Adrienne Arsht Latin America Center

Shock to the system

- Milei has struck a milder tone since the first-round election and has gotten more establishment figures such as former President Mauricio Macri in his corner. His victory speech was conciliatory, though Milei did note “no space exists for gradualism.” Now the overriding question, Jason tells us, is: “Will the more measured Milei of the last few weeks govern, or will his presidency reflect some of the more extreme rhetoric seen in parts of his campaign?”

- In Martin’s view, Milei “might just be the type of shock that finally gets Argentina out of its decades-long economic misery,” but “it could all go south very quickly.” Investors so far are cheering: Monday saw positive reactions in both the Argentinian stock and bond markets to Milei’s win.

- And if it goes south? Martin says the big early test after Milei’s December 10 inauguration will be whether Argentina can avoid defaulting to external lenders. But implementing his program carries risks. “Dollarization and fiscal austerity would be highly deflationary, meaning that unemployment and poverty rates could skyrocket, throwing Argentina into a disorderly tailspin and, possibly, leading to mass protest and civil unrest,” Martin adds.

Subscribe to Fast Thinking email alerts

Sign up to receive rapid insight in your inbox from Atlantic Council experts on global events as they unfold.

Getting it done

- Getting Argentina’s economy onto the dollar rather than the troubled peso is a simple idea that will be hard to execute. Isabel tells us that Milei’s “plans for achieving dollarization remain unclear,” and such an effort “will have limited success unless it is accompanied by significant growth,” which could come from more investment in sectors such as agriculture, energy, and tourism.

- While Milei has promised to make Argentina one of only a handful of countries in the world without a central bank, Isabel points to the need to separate the Central Bank of Argentina more clearly from the government. That means “limiting the central bank’s ability to finance the public sector, addressing the issue of excessive peso printing to fund public spending and the resulting scarcity of dollars due to the country’s volatile exchange rate.”

- Martin envisions Milei “starting with a tighter monetary stance and fiscal consolidation aimed at slowly bringing inflation under control.” While major reforms will require a majority in congress, which Milei does not have, “given the country’s dire situation, his popularity as an outsider might offer a last chance to break a decade-old political logjam that saw the two established parties letting the country suffer rather than support proposals put forward by the other side.”

Regional reaction

- A major moment for Milei on the global stage will come just before he’s inaugurated: The December 5-7 Summit of Mercosur Heads of State in Rio de Janeiro. The summit, Jason says, will test the critical relationship between Argentina and Brazil, led by leftist President Luiz Inácio Lula da Silva, and it will also be “a pivotal meeting to decide on the future direction of Mercosur and its potential trade agreement with the European Union.”

- As Milei finds his footing with other regional leaders, he should also keep an eye on a cautionary tale to the north: Ecuador, which dollarized its economy in 2000. Quito’s results, Isabel points out that “while Quito’s outcomes have yielded economic stabilization, they have also constrained the government’s financial capacity to address Ecuador’s needs, leading to a substantial fiscal deficit, stagnant growth, and shortages of basic resources for the general population.”

Further reading

Mon, Nov 20, 2023

Experts react: Can ‘lion king’ Milei tame Argentina’s roaring inflation?

New Atlanticist By

The former television personality known for his libertarian economic views and unruly mane will become Argentina’s next president. His first task will be dealing with runaway inflation.

Mon, Oct 23, 2023

Populism vs. the establishment: What to expect in Argentina’s presidential runoff

New Atlanticist By

After a surprising first-round result, the November 19 election will now pit Economy Minister Sergio Massa against right-wing populist Javier Milei.

Mon, Oct 16, 2023

Four questions (and expert answers) about new Ecuadorian President Daniel Noboa

New Atlanticist By

On October 15, Noboa was elected Ecuador’s next president, beating out Luisa González, a protégé of former President Rafael Correa.

Image: A cardboard doll depicts the right-wing conservative presidential candidate Milei with a chainsaw and the snake that his party has adopted as a symbol for its ideas. The self-proclaimed "anarcho-capitalist" likes to appear with a chainsaw.