Since its origin in 2001 as shorthand for a set of fast-growing, populous emerging markets, the BRICS group of Brazil, Russia, India, China, and South Africa has emerged as a formidable economic and geopolitical power. The fifteenth BRICS summit this week in Johannesburg, South Africa, will be one of the most consequential in the bloc’s history. What comes out of the summit has the potential to fast-track the transition to a multipolar world through the expansion of the group and the forging of a new financial architecture not dependent on the US dollar.

Together, the BRICS countries have already overtaken the Group of Seven (G7) advanced economies in terms of their contribution to global gross domestic product, with the group now accounting for almost a third of worldwide economic activity measured by purchasing power parity. The consequences of this economic rise have reverberated through a number of areas, including trade. While trade between Russia and the G7 has fallen by more than 36 percent since 2014 under the weight of economic and financial sanctions, trade between it and the other BRICS nations has soared, increasing by more than 121 percent over the same period. China and India have become the largest importers of Russian oil following bans imposed by the European Union. China’s trade with Russia hit a record of $188.5 billion last year, a 97 percent increase from 2014 and around 30 percent greater than in 2021. The surge occurred as Russia more than doubled its rail exports of liquefied petroleum gas as part of a drive to diversify its exports under the harsh sanctions regime.

By opting not to comply with western-led economic and financial sanctions, the solidarity of BRICS has been a balm for Russia. The bloc has offered trade diversion and other relief to one of its founding members and, in the process, weakened the effectiveness of US-led sanctions as a tool for advancing economic and geopolitical interests.

A multipolar magnet

Thwarting the sanctions regime has had consequences that reach far beyond the impact of the crisis in Ukraine. Bolstered by their success on the economic and geopolitical fronts, the BRICS group is increasingly viewed by a growing number of countries in the Global South as an attractive agent of multilateralism. More than forty nations—including Algeria, Egypt, Thailand, and the United Arab Emirates, but also key Group of Twenty (G20) countries such as Argentina, Indonesia, Mexico, and Saudi Arabia—have formally expressed their interest in joining the BRICS in the lead-up to this week’s summit.

If the effectiveness of trade diversion by BRICS nations in weakening the impact of western sanctions against Russia is any indication, sanctions could become less effective as a tool for advancing the economic and geopolitical interests of the G7 after the admission of new BRICS members. In a zero-sum global trading environment, the bloc’s expansion would also accelerate the diversification of demand away from G7 countries and reduce members’ exposure to future geopolitical risks.

The focus in Johannesburg will certainly be on the admission of new members, as well as trade and investment facilitation in a challenging global environment where the escalation of trade and tech wars—along with the “friendshoring” of supply chains—has increased the risk of global growth deceleration and a hard landing in China. BRICS members are likely to discuss sustainable development in the climate change era, global governance reform, and an orderly process of increasing trade in local currencies. On the latter point, more and more emerging economies are exploring ways to conduct trade in non-dollar currencies following the imposition of sanctions against Russia.

The dollar remains the global reserve currency, and the pace at which other currencies have chipped away at its dominance has been incremental. But a growing number of experts, including senior US government officials, recognize that the aggressive use of economic and financial sanctions to advance US foreign policy could threaten the dollar’s hegemony in the years ahead. US Treasury Secretary Janet Yellen recently emphasized this point: “There is a risk when we use financial sanctions that are linked to the role of the dollar that over time it could undermine the hegemony of the dollar.”

A new reserve currency?

The significance of dedollarization takes on greater importance in light of rumors that the bloc might attempt to develop a BRICS-issued reserve currency to be used by members in cross-border trade. While the BRICS nations—which collectively enjoy a comfortable balance of payment surplus—have the financial wherewithal to establish such a currency or unit of account, they lack the institutional architecture and the scale to sustainably achieve this end.

Even assuming that its members are fully aligned geopolitically and more inclined to co-operate than to compete, adopting a common currency presents several challenges. As the creation of the euro, now the world’s second largest reserve currency, illustrated, hurdles will include: achieving macroeconomic convergence, agreeing on an exchange rate mechanism, establishing an efficient payment and multilateral clearing system, and creating regulated, stable, and liquid financial markets.

The United States was able to persuade other countries to use the dollar owing to its hegemonic position as the world’s industrial powerhouse and single-largest trading nation following the end of World War II, reinforced in the decades since by the size of the market for US treasuries, which are often considered to be the world’s leading reserve asset. If they wish to provide a competitive alternative, the BRICS countries would need to agree upon a state-of-the-art bond market. It would need to be big enough to absorb global savings and provide assets with low risk of default where surplus funds could be parked when not used for trade.

Reflecting on these challenges, Anil Sooklal, South Africa’s ambassador-at-large to BRICS, reiterated in July that a BRICS currency will not be on the agenda during the summit, though expanding trade and settlement in local currencies will be. In fact, BRICS countries are already making strides in the use of local currencies in cross-border transactions. Their use is helping to sustain and boost cross-border trade between members, even amid a challenging operating environment of heightened geopolitical risks. It is also loosening the balance of payments constraints associated with dollar funding, bolstering local economies.

Although China and India may have diverging security interests, they each stand to benefit from the increased use of local currencies. BRICS nations are already using their own currencies for some bilateral trade payment settlement, and Saudi Arabia is considering signing a deal with China to settle oil transactions in renminbi. Meanwhile India is expanding the use of local currencies for bilateral trade payment and settlement beyond the BRICS group, inviting more than twenty countries to open special vostro bank accounts to settle trade in rupees. In a history-making move, India made its first oil payment to the United Arab Emirates in rupees earlier this month.

If the BRICS group expands its membership, then it could increase the risk of a divergence of interests and raise more coordination challenges—but it could also dramatically expand the group’s consumption power, with significant economic and geopolitical implications. Expansion could create scale and enhance the transition from bilateral to multilateral clearing, and perhaps ultimately toward a common BRICS currency. This would address one of the major challenges associated with the use of local currencies for bilateral trade payment settlement: the difficulty of deploying these currencies once imbalances arise. Lately, such challenges led to the suspension of bilateral trade arrangements that had allowed India to settle imports of Russian oil in rupees, with Russia accumulating billions of Indian rupees that it could not use.

Meanwhile, membership expansion could further weaken the effectiveness of US-led economic sanctions and accelerate the multipolarization of the global monetary order. Several members of the Organization of Petroleum Exporting Countries have already said they wish to join the BRICS group, which would increase the shared benefits associated with the use of local currencies for cross-border transactions and could further curtail the volume of global trade conducted in dollars.

To be sure, the stickiness of institutional arrangements, along with the breadth and depth of US financial markets is such that dollar dominance will remain a key feature of the global financial architecture for some time. But following membership expansion, the BRICS group could set in motion its transformation into an even more powerful geopolitical coalition that could accelerate the process of dedollarization and the transition to a multipolar world.

Hippolyte Fofack is the chief economist and director of research at the African Export-Import Bank (Afreximbank).

Further reading

Tue, Aug 8, 2023

China and India are at odds over BRICS expansion

New Atlanticist By Hung Tran

Beijing and New Delhi have different ideas about how the group should move forward, as India’s disagreement with China’s push to rapidly expand the organization’s membership demonstrates.

Tue, Jul 25, 2023

Is ‘friendshoring’ really working?

New Atlanticist By

The Biden administration has identified around 2,400 critical goods and materials that fall under its efforts to move supply chains out of China. Check out what the data reveal so far.

Thu, Feb 23, 2023

The African Union is at a crossroads. It’s time to seize its moment.

AfricaSource By Rama Yade

The African Union needs to be strong inside to be strong outside. The new chair will need to kick off an exploration of the Union's organization, identity, role, and means.

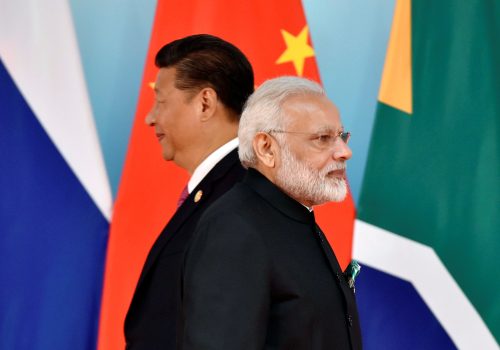

Image: President of Brazil Luiz Inacio Lula da Silva, President of China Xi Jinping, South African President Cyril Ramaphosa, Prime Minister of India Narendra Modi and Russia's Foreign Minister Sergei Lavrov pose for a BRICS family photo during the 2023 BRICS Summit at the Sandton Convention Centre in Johannesburg, South Africa, on August 23, 2023. GIANLUIGI GUERCIA/Pool via REUTERS