On April 8, 2020, the World Trade Organization (WTO) released sobering but not entirely surprising data and 2020 forecasts regarding plummeting cross-border trade volumes due to the pandemic. According to the data, world merchandise trade will experience deep drops (between -13 percent and -32 percent) during 2020 in all regions, with steeper drops expected in “complex value chains, particularly electronics and automotive products.”

Similarly, the Banque de France and the European Central Bank released dour economic growth forecasts. For example, the Banque de France estimates that “every two weeks of lockdown ‘costs’ [France] approximately 1.5 percent of lost annual gross domestic product (GDP) and at least 1 percent of additional government deficit.”

The April 14 World Economic Outlook confirms the deepening economic stress associated with the pandemic. Advanced economy GDP growth is projected to decrease by -6 percent during 2020; global GDP during 2020 is forecasted to decrease only -3 percent due to expected economic strength in emerging East Asia, particularly China. The forecast is highly variable. Among other things, the baseline assumptions for the estimates include assumptions that pandemic-related disruptions will be concentrated in the second quarter of 2020 and only a -8 percent loss of working days for 2020. More importantly, the International Monetary Fund (IMF) expressly indicated that “the rebound in 2021 depends critically on the pandemic fading in the second half of 2020.”

These early estimates may be optimistic because they are based on incomplete data. The pandemic has not yet peaked globally so the full extent of the damage is not yet knowable. Transatlantic policymakers must urgently find new ways to address this deepening crisis at the core of the interdependent economy that delivers economic growth and jobs. This requires finding ways right now to reactivate supply chains and increase confidence in supply chain control processes throughout this crisis.

In particular, leadership in defining common minimum standards for sanitizing the supply chain—if implemented now—could reinvigorate the transatlantic relationship even as it preserves jobs. While deep cultural divisions regarding phytosanitary standards have often created counter-productive flashpoints in the transatlantic trade relationship, the shared human vulnerability to the same pathogen provides policymakers with an opportunity to forge a new, mutually beneficial consensus.

The economic data is worse than it looks

The WTO and the IMF each currently maintain guarded optimism that trade volumes and economic growth might recover in 2021. However, as the IMF noted, the length of time that major developed economies remain shuttered will have a material impact on economic forecasts.

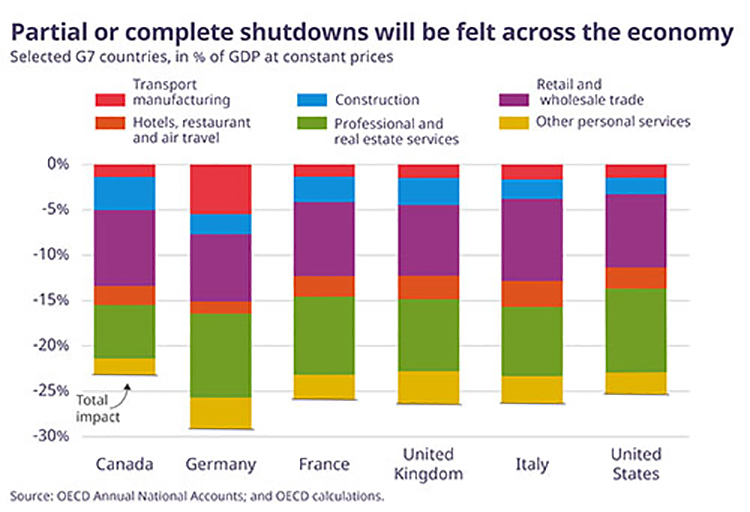

Emergence from economic lockdown will not translate into an immediate resumption of pre-pandemic activities. A broad range of companies beyond the medical and pharmaceuticals sectors are now keenly aware of their concentrated exposure to a single supplier in a foreign country for a key component in their products or operations. Companies large (like automobile manufacturers) and small (like wedding shops) that survive the pandemic have every incentive to increase reliance on local sourcing. Even if all companies want to resume regular business through supply chains, parallel and significant disruptions on the demand side due to high unemployment, illness, and death rates will mean that corporate trade activity will at a minimum remain weak, at least through the third quarter of 2020. As the Organization for Economic Cooperation and Development secretary general informed the Group of Twenty (G20) on March 27, all major economies and all major sectors will be adversely impacted during 2020:

Even where activity remains strong or has become elevated due to the pandemic, significant hurdles loom at mid-year. Increased reliance on digital goods and services in order to continue conducting knowledge-based business suggests strongly that data from the first and second quarters of 2020 will show a leap in commercial services exports. It will be interesting to see whether and to what extent strong growth in this segment will offset deep declines in cross-border trade aggregates in other services sectors, particularly transportation and travel services—which have been deeply disrupted by the pandemic.

Strength in commercial services segments will not be evenly distributed geographically. The digital giants in the US economy will stand out as weathering the pandemic crisis in rude health. Moreover, the broad expanse of the American continent provides many companies and individuals with opportunities to begin thinking creatively about geographic diversification strategies that maximize strategic utilization of areas with lower population density. The continental landmass of the United States, including Alaska, provides potential risk mitigation opportunities for people and companies that are not available in smaller countries.

Disparate economic impact as well as the necessity to deliver safety and security for citizens makes cross-border cooperation more difficult to achieve because they decrease incentives to compromise internationally. Some nations entered the pandemic with weak economies and limited fiscal space to provide support to their populations and health care systems. The temptation will be great to generate fiscal resources in creative ways from non-residents.

Pressure on pre-existing policy differences between the United States and Europe can only increase from here, particularly with respect to digital taxation and data privacy. A clear inflection looms particularly with respect to digital taxation policy. In order to offset these tensions, transatlantic policymakers would be wise to focus on initiatives where shared interests make agreement easier to achieve.

A quick win: Focus on supply chains

Under ordinary circumstances, phytosanitary standards would not fall under the “easy to achieve” category. But these are unique, difficult times. While not all humans are directly impacted by the coronavirus yet, all humans will soon be adversely impacted economically by supply chain disruptions associated with novel coronavirus. Quick action by policymakers now regarding phytosanitary standards can alleviate fears of virus transmission through the supply chain and, thus, prevent broad-based export restrictions regarding trade in agricultural commodities and broad-based import restrictions or quarantines. Specific suggestions include creating international standards for disinfecting cargo and freight with antiviral agents and decreasing temporarily to zero all import tariffs.

Working together to solve the common problem of sanitizing the supply chain and set a common standard regarding coronavirus protection protocols would deliver an additional benefit: it could reinvigorate an increasingly difficult transatlantic trade relationship. Successful work in this area would also generate positive impacts for global trade and economic growth as the transition to a post-pandemic world begins later this year. Agreement and implementation of science-based best practices for disinfecting containers would decrease the risk of trade disputes under the Agreement on the Application of Sanitary and Phytosanitary Measures (SPS Agreement) while providing third countries with the knowledge needed to resume quickly their traditional exporting roles.

The WTO has already begun creating a working relationship with the World Health Organization (WHO) focused on the intersection of trade and sanitary standards. Building on its recent joint statement with the WHO and the World Food Organization, the WTO has already called on food producers to ensure that their workers and produce “are protected to minimize the spread of the disease within this sector and maintain food supply chains.” WTO Deputy Director Alan Wolff this last week called for “increasing technical guidance on sanitary standards” in order to keep agriculture supply chains operational.

Transatlantic cooperation right now on these issues would literally save lives as well as jobs by accelerating these initiatives and providing a common standard for antiviral protections based on advanced science. In the interim, the WTO could serve a valuable function by providing a forum for articulating common minimum agreed standards for SPS review processes and triage functions that could separate high-risk imports from low-risk imports.

The time for tactical transatlantic tariff spats has passed. Policymakers in European capitals and Washington can—and should—choose to be part of the solution. Leadership now will provide the foundation for securing repair and reconstruction of supply chains later in the year, when we will need it.

Barbara C. Matthews is nonresident senior fellow at the Atlantic Council. She is also Founder and CEO of BCMstrategy, Inc., a start-up company that uses patented technology to quantify public policy risks and anticipate outcomes. Matthews as served in senior positions within government on both sides of the Atlantic, first as senior counsel to the House Financial Services Committee and then as the first US Treasury Attache to the European Union with the Senate-confirmed diplomatic rank of minister-counselor.

Further reading:

Image: A container ship is seen as hundreds of shipping containers are seen stacked at a pier at the Port of New York and New Jersey in Elizabeth, New Jersey, U.S., March 30, 2020. REUTERS/Mike Segar/File Photo