In May, the Biden administration took a big step forward in its trade saga with China by imposing large tariff increases on, among other goods, Chinese-made electric vehicles (EVs). Now Europe has joined the fray. Earlier this month, the European Commission announced that tariffs on some Chinese-made EVs from certain Chinese companies would rise up to 38.1 percent in the European Union (EU).

These new tariffs on both sides of the Atlantic signal greater alignment between Washington and Brussels on China. That is good news for the transatlantic partnership. But the technical differences in the latest salvos by the United States and Europe point to important differences in where Washington and Brussels are starting from and where they each might move next.

The Biden administration’s tariffs, announced on May 14, cover a wide range of strategic industries deemed critical to national security. These industries include steel, aluminum, microchips, EVs, and batteries. The most eye-grabbing figure was US tariffs on Chinese EVs quadrupling to 100 percent. The news from Brussels on June 12 delivered a similar but smaller effort, and one based less on a national-security framing. Moreover, Europe’s new tariffs are part of an ongoing investigation into Chinese practices, and therefore they are provisional.

Chinese-made EVs account for around 25 percent of the European market, with Beijing exporting 430,000 such vehicles to the continent in 2023.

The European Commission began its probe into Beijing’s massive subsidies of key sectors in October 2023. It has focused on the threat of cheap Chinese imports flooding the European market, driving down prices, and hurting Europe’s automotive sector. The investigation reflects a calculated approach, aligning with the EU’s new de-risking approach, but still, as is typical for the bloc, centering on adherence to World Trade Organization-complying trade defense regulations.

Unlike Washington’s tariffs, which apply to the entire sector, the new European tariffs target specific Chinese companies. They do not, in the words of German Vice Chancellor Robert Habeck, amount to “punitive tariffs.” Europe’s tariffs on battery EVs will cover a wide umbrella of companies, including Western brands with production facilities and joint ventures in China. This leaves open the option for carmakers to relocate their production to Europe, thereby avoiding the tariffs.

Much of the difference between Washington and Brussels is due to the different immediate market threats posed by Chinese EVs. The United States imported fewer than three thousand EVs from China last year, and the tariffs are in part intended to prevent Chinese market share from growing. In Europe, in contrast, China is already a major player. Chinese-made EVs account for around 25 percent of the European market, with Beijing exporting 430,000 such vehicles to the continent in 2023, a number that has quadrupled in the past five years. The EU decision therefore must be seen as an attempt to strike a balance between protecting Europe’s internal automobile industry and avoiding escalation into a trade war with Beijing.

Another factor is European unity—or lack thereof. European Commission President Ursula von der Leyen has underscored that Europe “will not waver from making tough decisions needed to protect its economy and its security” and she has not shied away from directly confronting China’s leadership on Chinese overcapacity “flooding the European market.” But von der Leyen is well out in front of many of her European counterparts with her economic security agenda. Export-oriented members, such as Germany, Sweden, and Greece, have expressed reservations toward the increased tariffs, and the Commission’s announcement came only after an eleventh-hour push by Germany to lower the tariffs.

This hesitance from certain member states is spurred on by Beijing, which has fought the investigation since its inception and sought to sow division within the bloc. Even though Europe’s countervailing duties are likely insufficient to offset the advantage China holds in production, Beijing has warned that the EU’s moves could lead to a trade war. On June 17, Beijing opened a dumping probe into imports of pork from the EU in response to Brussels’ tariff announcement.

Prior to the news of the EV tariffs, China also threatened retaliatory tariffs targeting German carmakers, French luxury products, and the European aviation and agricultural sectors, highlighting the breadth of China’s appetite to hit back at sectors that will hurt specific EU countries.

Another difference between the US and EU tariffs is the finality of these announcements. The Biden administration can move relatively quickly and decisively, but the European Commission’s tariff announcement is provisional. The investigation is still ongoing, and final tariffs will come four months after the provisional tariffs’ imposition on July 4. The EU’s tariffs could realistically be lowered during this time if China continues to push back and if EU member states get skittish. The EU and China have already begun consultations on the tariffs, which may bring about some revisions to the EU’s actions.

Finally, there is the issue of leadership. The United States will hold an election in November, but Washington is generally united on its approach toward China. As the Biden administration’s extension of many of the Trump administration’s policies toward Beijing signal, tariffs and a hardline approach on China will likely feature in any next US administration. There is far less certainty of consistent support in Europe, however.

Over the summer, the European Commission leadership will turn over. If von der Leyen were to win a second term leading the next Commission, it would solidify the EU’s increasingly tough trade policy approach toward China, signaling continuity and alignment with Washington. But nothing is guaranteed. Von der Leyen has yet to be nominated by the EU’s member states or confirmed by the European Parliament. She will certainly defend her Commission’s decisions on China, but she may be forced to make concessions on future action to secure her post. This trade saga is far from over.

Jacopo Pastorelli is a program assistant with the Atlantic Council’s Europe Center.

James Batchik is an associate director at the Atlantic Council’s Europe Center.

Further reading

Wed, Jun 12, 2024

Europe is gearing up to hit Chinese EVs with new tariffs. Here’s why.

New Atlanticist By

The European Commission just proposed new tariffs on China-made electric vehicles of up to 38 percent. Atlantic Council experts explain why—and what might happen next.

Sat, Jun 1, 2024

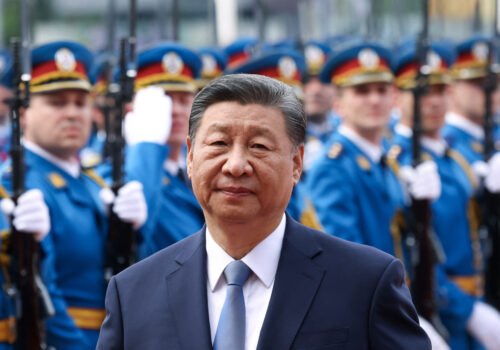

Xi Jinping visited Europe to divide it. What happens next could determine if he succeeds.

New Atlanticist By Zoltán Fehér

The Chinese leader's mission during his May 5-10 trip to France, Serbia, and Hungary was to sow division in Europe and to rally countries against “de-risking.”

Tue, Jun 4, 2024

Katherine Tai on how US and EU trade approaches must ‘evolve’ to deal with China and other global challenges

New Atlanticist By Katherine Golden

The US trade representative said that the United States and EU should establish a community of democracies to adapt their trade approaches to a changed world.

Image: BYD stand at the International Motor Show, IAA Mobility 2023 (05.09.-10.09.2023) on Sept 7, 2023 at the Exhibition Center in Munich, Muenchen, Bavaria, Germany. Photographer: ddp images