The COVID-19 economic crisis could push 150 million people—1.4% of the world’s population—into extreme poverty by the end of 2021, disproportionately affecting developing countries and those already most vulnerable. As our societies build back better after the pandemic, these people cannot be left behind. Financial inclusion will be crucial to making the global recovery more sustainable and its benefits more widely shared.

At the November 21-22 Group of Twenty (G20) Summit in Riyadh, leaders emphasized the importance of financial inclusion as part of their actions to support the global economy, building upon an earlier agreement by G20 finance ministers.

But the G20 should do more. Technical solutions have already been identified and proved effective. What is really needed now is the political will to put financial inclusion firmly on the G20 agenda and move to the next level of action.

The COVID-19 economic crisis risks rolling back years of progress in fighting poverty

Global extreme poverty is expected to increase in 2020 for the first time in more than twenty years. In 2020, between 9.1% and 9.4% of the global population is likely to experience extreme poverty, a regression to 2017 levels (9.2%). The numbers look even worse compared to the projected pre-crisis trajectory: extreme poverty was supposed to fall to 7.9% in 2020.

The economic shock of the pandemic disproportionately affected developing countries, which have not been able to implement strong recovery plans due to higher interest rates and significant service fees. Natural resource market prices fell sharply, the textile industry slowed down worldwide, and tourism paused. Millions of people are at risk of losing their jobs or seeing their income drastically decreased while international remittance flows are declining.

Moreover, not all segments of the population and economy have been affected in the same way. Women, youth, disabled persons, refugees—but also micro-, small-, and medium-sized enterprises—have been hit harder by the loss of income, compounding the already poor financial access among these groups.

Bolstering financial inclusion is a proven solution to foster inclusive growth

The World Bank defines financial inclusion as “individuals and businesses hav(ing) access to useful and affordable financial products and services that meet their needs—transactions, payments, savings, credit, and insurance—delivered in a responsible and sustainable way.”

Financial inclusion provides a pathway towards the formal economy, an essential step to reducing poverty and extreme poverty, tackling inequalities, and fostering inclusive growth. When people have access to a bank account, they can save money, make income, and receive payments. It is also easier for accountholders to have access to other financial services, especially credit and insurance, to launch and develop their businesses, have access to education or healthcare, and better absorb financial shocks—such as a job loss or crop failure.

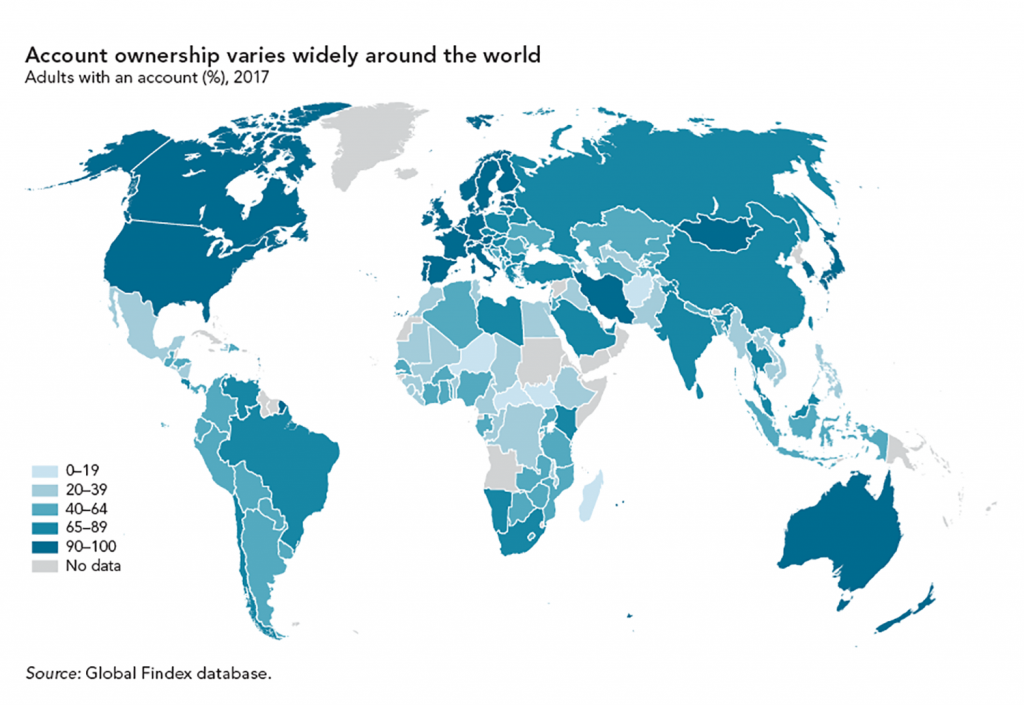

Thanks to global action, especially led by the G20 in coordination with international organizations, huge progress has been made to increase financial inclusion over the last decade. In 2017, 69 percent of adults had an account at a financial institution or via a mobile money provider, compared to only 51 percent in 2011.

But there is still much to be done. Worldwide, one-third of adults—1.7 billion—are still unbanked, almost all in the developing world, especially Bangladesh, China, India, Indonesia, Mexico, Nigeria, and Pakistan, although Sub Saharan Africa has the lowest penetration rate.

Moreover, while financial inclusion was increasing globally—notably thanks to the spread of the internet and mobile phones in underserved populations—the pandemic has threatened to halt that progress by constraining business activities and restricting the use of face-to-face financial services due to social distancing measures.

Raising financial inclusion higher on the G20 agenda

The G20 already has clear financial inclusion objectives, having endorsed a concrete Action Plan in 2010, most recently updated in 2020. Given the emergency, however, it is now time to move up a gear in coordination with the implementing partners, and especially the Alliance for Financial Inclusion (AFI), the Consultative Group to Assist the Poor (CGAP), and the World Bank. Strong political will be crucial.

First, efforts must start with adapting, or sometimes creating, appropriate regulation. Since 2010, over fifty-five countries committed to furthering financial inclusion and over sixty have produced, or are drafting, a national strategy to meet this goal. To boost financial inclusion, governments must develop and implement policies and regulations that remove roadblocks in accessing financial services and products, for example by allowing the subscription to micro-insurance products. South Africa is a good example: the proportion of banked adults has risen from 46 percent to 64 percent in four years as six million bank accounts were opened.

These reforms must be a product of constructive dialogue between financial regulators, telecommunication operators, and competition and education authorities. Here the G20 and the implementing partners have a key role to play, especially by providing high-level principles, recommendations, data, indicators, studies, and technical expertise. Moreover, the G20 should use its political clout to encourage the international standard setting bodies to add financial inclusion in their guidance, as these are used by countries to set up their financial regulations.

Second, digital technology and fintech innovation have increased access to financial services worldwide, notably through the adoption of mobile money accounts. In Sub-Saharan Africa, over one-fifth of the adults use mobile money accounts, compared to only 4 percent worldwide. In Kenya, the rate has now surpassed 70 percent with Uganda and Zimbabwe passing 50 percent. Although still occupying a much smaller global share than traditional financial services, digital services are growing rapidly: between 2014 and 2017 the proportion of adults sending or receiving digital payments rose from 42 percent to 52 percent worldwide.

Digital services are quicker, more efficient, and less expensive than traditional financial services. They can make sending and receiving payments more affordable, help people get financial support from distant families in case of economic difficulties, or assist governments reduce corruption and improve efficiency. For instance, switching pension payments from cash to biometric smart cards helped India reduce leakage of funds by 47 percent. By stimulating financial access for low-income households, underserved groups, and small businesses, digital services can help mitigate the economic impact of the pandemic and foster a stronger recovery.

Accelerating growth of digital financial services will require efficient infrastructures (notably access to the internet), development of modern payment systems, and the creation of an “innovation-friendly environment.” This implies ad hoc regulation and financial education to protect consumers, thereby gaining their trust, as well as mitigating technological risks such as data protection, fraud, or cyber risks.

Third, micro-, small-, and medium-sized enterprises (MSMEs) face serious constraints in accessing finance, particularly in developing countries and especially in times of economic crisis. For example, in the Middle East and Central Asia, MSMEs account for only 7 percent of total bank lending, despite representing 96 percent of registered companies and employing half the labor force. This constrains their ability to grow or weather shocks. MSMEs are key to creating jobs, investing at a local level, and spurring innovation. Improving their access to finance is central to making the recovery more inclusive.

Economic crises hit women harder, and the COVID-19 outbreak was no exception. Because women have lower incomes and savings, tend to work in the informal sector, and have fewer social protections, the pandemic has caused particular damage. Women continue to lag behind in access to financial services: worldwide, 65 percent of women, compared to 72 percent of men, own an account—a gap of seven points that hasn’t evolved since 2011. This gender gap is far worse in some countries such as Bangladesh, Pakistan, and Turkey, where it reaches nearly thirty points. COVID-19 has dramatically reduced the financial security of millions of women and risks rolling back the progress made in the past years. Bolstering women’s economic empowerment must be an essential part of any recovery plan.

Remittance flows represent a major source of income for millions of families and businesses globally, and can help cushion the impact of the crisis. In sub-Saharan Africa, immigrants sent to their home countries $41 billion in 2017. The G20 recognized the importance of these flows by agreeing, in 2014, on a plan to lower the global average cost of transferring remittances to 5 percent. But flows are expected to decline by 14 percent in 2021 compared to 2019. The first step to recovering these crucial financial lifelines is to make it easier to send and receive remittances, notably by meeting the 5 percent cost target, or even lowering it (the UN Sustainable Development Goal targets 3 percent by 2030) as well as facilitating digital processes.

Finally, coordination across G20 and non-G20 countries as well as with the private sector will be key. Policymakers, non-governmental organizations and private companies should share good practices and experiences for fostering financial inclusion during the COVID-19 economic crisis. To better target individuals and MSMEs, it would be particularly useful to improve the quality of the data on demand and supply of financial services in underserved markets, and to make it more readily available.

All these steps rely on extensive existing work by the G20 and the implementing partners. What is really missing is the political will to fully seize the issue and make it a priority. With COVID-19 risking to roll back years of progress in fighting poverty, the urgency of action is greater than ever.

As the crisis hit, the G20 focused, rightly, on ensuring financial stability. Now that efforts are turning to the recovery, putting financial inclusion higher on the agenda can help ensure a fairer and more sustainable path for growth for the global economy.

Emilie Bel is a European and International Affairs expert with a financial background and a decade-long experience working in Brussels and Paris.

Further reading:

Image: "Family Photo" for annual G20 Summit World Leaders is projected onto Salwa Palace in At-Turaif, one of Saudi Arabia?s UNESCO World Heritage sites, in Diriyah, Saudi Arabia, November 20, 2020. REUTERS/Nael Shyoukhi//File Photo