What is a Central Bank Digital Currency (CBDC)? A CBDC is virtual money backed and issued by a central bank. As money and payments have become more digital, the world’s central banks have realized that they need to provide a public option—or let the future of money pass them by.

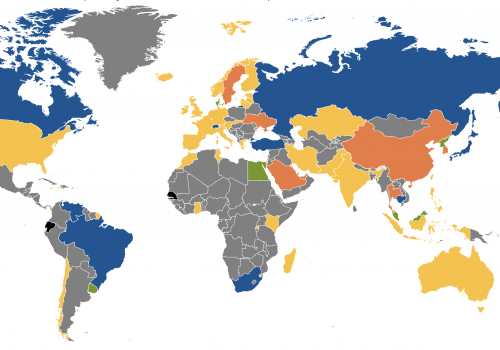

Hover over a country to see its status. Click on a country to learn more.

Last updated: July 2025

Key findings

Cross-border CBDC projects

Click on a project to learn more about participating countries and use cases

Timeline: Race for the future of money

Number of countries and currency unions exploring CBDC over time

CBDCs in circulation

The ABCs of CBDCs

What is a CBDC?

A Central Bank Digital Currency (CBDC) is the digital form of a country’s fiat currency that is also a claim on the central bank. Instead of printing money, the central bank issues electronic coins or accounts backed by the full faith and credit of the government.

But don’t digital currencies already exist?

There are already thousands of digital currencies, commonly called cryptocurrencies. Bitcoin is the most well-known fully decentralized cryptocurrency. Another type of cryptocurrency are stablecoins, whose value is pegged to an asset or a fiat currency like the dollar. Cryptocurrencies run on distributed-ledger technology, meaning that multiple devices all over the world, not one central hub, are constantly verifying the accuracy of the transaction. But this is different from a central bank issuing a digital currency.

So why would a government get into digital currencies?

There are many reasons to explore digital currencies, and the motivation of different countries for issuing CBDCs depends on their economic situation. Some common motivations are: promoting financial inclusion by providing easy and safer access to money for unbanked and underbanked populations; introducing competition and resilience in the domestic payments market, which might need incentives to provide cheaper and better access to money; increasing efficiency in payments and lowering transaction costs; creating programmable money and improving transparency in money flows; and providing for the seamless and easy flow of monetary and fiscal policy.

What are the challenges?

There are several challenges, and each one needs careful consideration before a country launches a CBDC. Citizens could pull too much money out of banks at once by purchasing CBDCs, triggering a run on banks—affecting their ability to lend and sending a shock to interest rates. This is especially a problem for countries with unstable financial systems. CBDCs also carry operational risks, since they are vulnerable to cyber attacks and need to be made resilient against them. Finally, CBDCs require a complex regulatory framework including privacy, consumer protection, and anti-money laundering standards which need to be made more robust before adopting this technology.

What are the national security implications of a CBDC?

New payments systems create externalities that impact the daily lives of citizens, and can possibly jeopardize the national security objectives of the country. They can, for example, limit the United States’ ability to track cross-border flows and enforce sanctions. In the long term, the absence of US leadership and standards setting can have geopolitical consequences, especially if China and other countries maintain their first-mover advantage in the development of CBDCs. Our work on digital currencies at the GeoEconomics Center is at this nexus of the future of money and national security.

Research Team: Ananya Kumar, Alisha Chhangani, Ethan Garcia

Contributions from: Nitya Biyani, Stefan de Villiers, Matt Goodman, Niels Graham, Leila Hamilton, William Howlett, Amy Jeon, Grace Kim, Reddy Lee, Roberto Lopez-Irizarry, Abhinav Vishwanath, Varsha Shankar, Greg Brownstein, Jessie Yin, and Phillip Meng.

Sign up to receive emails on new research & reports, program highlights, and events.