How Janet Yellen can help deliver the digital dollar

Updated on February 22, 2021

US Treasury Secretary Janet Yellen set Twitter ablaze during her confirmation hearing when she suggested that policymakers might “curtail” cryptocurrencies. The next day she gave a full written answer that highlighted the potential of digital currencies to foster financial inclusion, calming down the cryptosphere for a while. But the incident raised an urgent question: What precisely will the US Treasury Department do about the rise of digital currencies?

Given the sensitivity of the issue and other pressing problems, it would be understandable for Joe Biden’s new economic team to move slowly here. That would be a mistake: Secretary Yellen and Federal Reserve Chairman Jerome Powell should quickly harness the potential of these evolving financial tools, including a US-backed digital dollar.

The Treasury Department is confronting several momentous challenges at the moment, foremost among them the economic devastation wrought by COVID-19. The crisis has overshadowed the rapid ascendance of cryptocurrencies across the globe in 2020, but the two stories are actually intertwined.

Digital currencies could help contribute to a stronger economic recovery in the United States and across the world. They hold the promise of more effectively delivering stimulus, implementing monetary policy, and fostering financial inclusion among those who are unbanked or underbanked. Imagine the next round of stimulus checks being instantly delivered to every American’s phone instead of taking weeks to reach the public via a deposit or mailed check.

Cryptocurrency, of course, has become a catch-all term for various digital assets that co-exist. There are truly decentralized networks, the most famous of which is Bitcoin. There are systems run by government institutions and denominated in a country’s currency, known as central bank digital currencies (CBDCs) and also called a “digital dollar” in the American context. And there are private digital currencies like Facebook-initiated Diem and “stablecoins,” which are generally pegged to fiat currency.*

With Yellen’s prior experience leading the Federal Reserve, she is in a prime position to clear up confusion about crypto, explain the different options available, and debunk the myth that digital currencies are necessarily disconnected from the real economy. Moreover, while the concerns about money laundering that Yellen initially touched upon are obviously important, a leading analytics firm that works with law enforcement found that less than 1 percent of Bitcoin transactions are illicit.

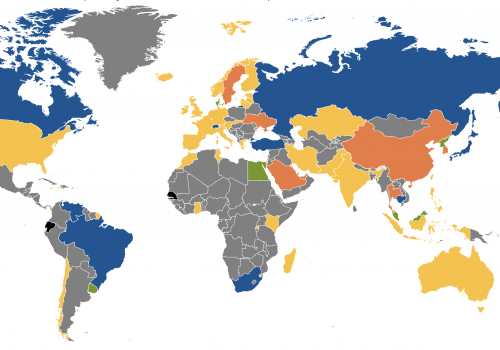

The rest of the world understands these realities. New global surveys conducted by the Atlantic Council and Harvard’s Belfer Center reveal that over seventy countries are exploring CBDCs.

Some nations are moving faster than others. China, for example, has deployed three large-scale pilot programs to distribute digital yuan for everyday payments. Earlier this month, China also announced a potential major partnership with the cross-border payment system SWIFT, signaling its intention to internationalize the digital yuan. The European Central Bank, under Christine Lagarde’s leadership, has engaged in extensive research and public consultations on CBDCs. The United States, on the other hand, has so far taken more of a wait-and-see approach—primarily by announcing that the Federal Reserve Bank of Boston will conduct a study on digital currencies over the next few years.

But studies alone simply won’t cut it given the rapid pace of change in this realm. Recently, the Atlantic Council and Harvard convened a meeting with representatives of the European Central Bank, the Bank of Japan, the Bank of England, the Riksbank in Sweden, the Bank of Canada, the International Monetary Fund, and the Federal Reserve. Many American allies were eager to learn what technical features and privacy configurations the United States will develop for its own version of a digital currency. Fast action from both the Fed and Treasury could help the United States become a standard-setter on privacy and security for digital currencies.

That action could begin with setting up an initiative inside Treasury to accelerate work on digital currencies, which in turn would send a critical signal to the Fed, Congress, and major financial institutions that Treasury will have a stronger voice in the creation of a public digital dollar.

The next step would be to establish a nuanced regulatory framework for digital currency. If the United States opts to deploy digital dollars through both public infrastructure and the private sector (as the Bank of England, for instance, is discussing), then Treasury regulations could play a key role in clarifying the legal landscape. Here too, Yellen can marshal her unique relationships across the federal government to increase coordination and transparent public consultations. During the Trump administration, by contrast, the inter-agency process on these issues broke down; Treasury’s eleventh-hour proposed rule-making on digital wallets, for example, surprised other federal agencies and was nearly rushed through during Christmas. (After an overwhelming public outcry, Treasury re-opened the rule-making process.)

Yellen and her colleagues should also be clear-eyed about the risks of inaction on CBDCs: The United States could fall significantly behind other countries on prototypes and relinquish its role in developing common technical standards. China, in the meantime, appears to be moving into this new frontier at full speed and consolidating its central bank’s control of other financial technologies like Alipay. In the next crisis or wave of the pandemic, Americans may find themselves envying others’ ability to distribute programmable stimulus funds to their citizens’ digital wallets on a few hours’ notice.

Yellen has spoken eloquently about the role of the dollar in securing global financial stability and prosperity. That conversation now also needs to happen in the digital realm. The future of the world’s reserve currency may depend on it.

Update: In an interview with Janet Yellen on Monday, Andrew Ross Sorkin of The New York Times highlighted the Atlantic Council’s new research on digital currencies around the world. He asked the Treasury secretary whether she would support a digital dollar, and she responded with the most forward-leaning answer a senior US government official has given yet. Unlike her predecessor, who believed a digital dollar might never be needed, Yellen focused on the many potential benefits of central bank digital currencies referenced in this article, including the ability to quickly and securely get money to those in need. The Biden administration seems to be signaling a new openness to creating a digital version of the world’s reserve currency.

Josh Lipsky is the director of the Atlantic Council’s GeoEconomics Center.

JP Schnapper-Casteras is a senior fellow with the Atlantic Council’s GeoEconomics Center.

*Update: This article originally referred to Diem as a digital currency of Facebook’s rather than a digital currency initiated by Facebook.

Further reading

Image: US Treasury Secretary Janet Yellen, the former Federal Reserve chair, holds a news conference after a two-day Federal Open Market Committee (FOMC) meeting in Washington, US REUTERS/Jonathan Ernst/File Photo