Reimagining Africa’s role in revitalizing the global economy

Introduction

The world economy now finds itself at a critical juncture, facing a series of extraordinary setbacks that have pushed down growth. Reigniting growth requires a unique combination of targeted policies, robust international cooperation, and a renewed look at the global economy, with a particular focus on Africa. Due to its burgeoning and youthful population, abundant natural resources, and a strategic geographical location that can facilitate global trade, Africa can play a major role in—and should be front and center of—any renewed efforts for revitalizing the global economy. A decade-long robust, inclusive, and green growth in Africa will not only move hundreds of millions living in the continent out of poverty but will also accelerate a global rebound and recovery. However, for this to materialize, Africa needs substantial investments in its failing and inadequate physical and social infrastructure. With access to basic infrastructure, alongside efficient institutions as well as its young population, massive natural endowments, and strategic location Africa can seize its economic potential and act as an engine of growth for the global economy for decades to come. Therefore, it is crucial to support Africa to unleash its immense economic potential, through massive and focused investments in the continent’s human capital and its physical and social infrastructure.

I. The global slowdown: An overview

The global economy has entered a prolonged period of slowdown. According to a 2023 World Bank report, “Nearly all the forces that have powered growth and prosperity since the early 1990s have weakened.” Even before the COVID-19 pandemic, an aging population, slowing productivity, and growing barriers to trade and the free movement of people were slowing global growth. Then came the triple back-to-back shocks: the pandemic, the Ukraine war, and persistently high inflation along with subsequent rapid rate hikes to fight it. Those shocks, combined with preexisting structural factors, have introduced strong headwinds for the global economy and its growth prospects in the next decade. If there is no significant policy intervention to revitalize the global economy, the potential result is a lost decade—not only for certain countries or regions, but for the entire world. According to the World Bank, the global potential gross domestic product (GDP) growth rate is expected to decline to its lowest level in three decades, i.e., 2.2 percent per year between now and 2030.

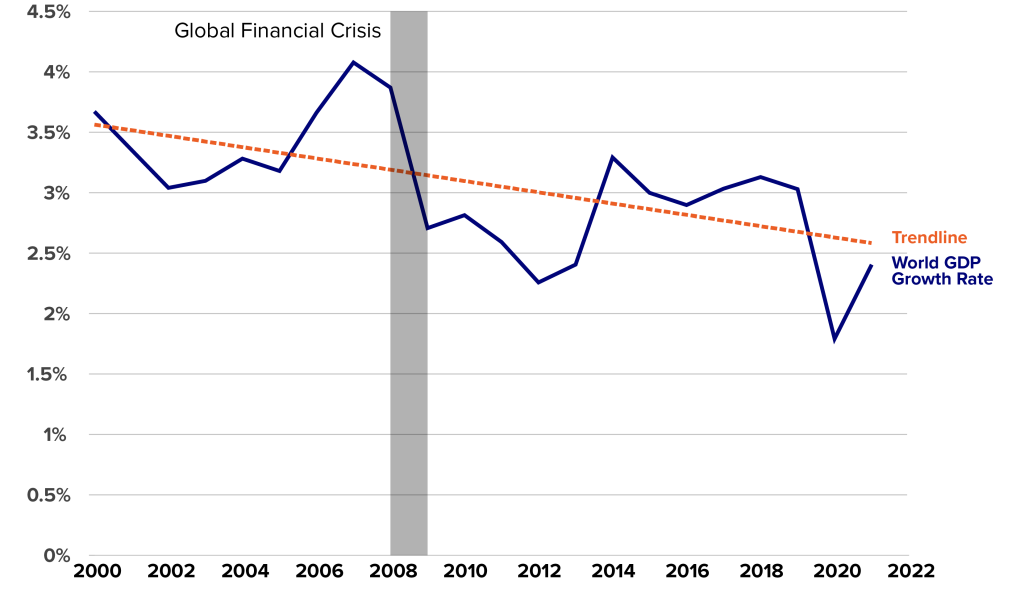

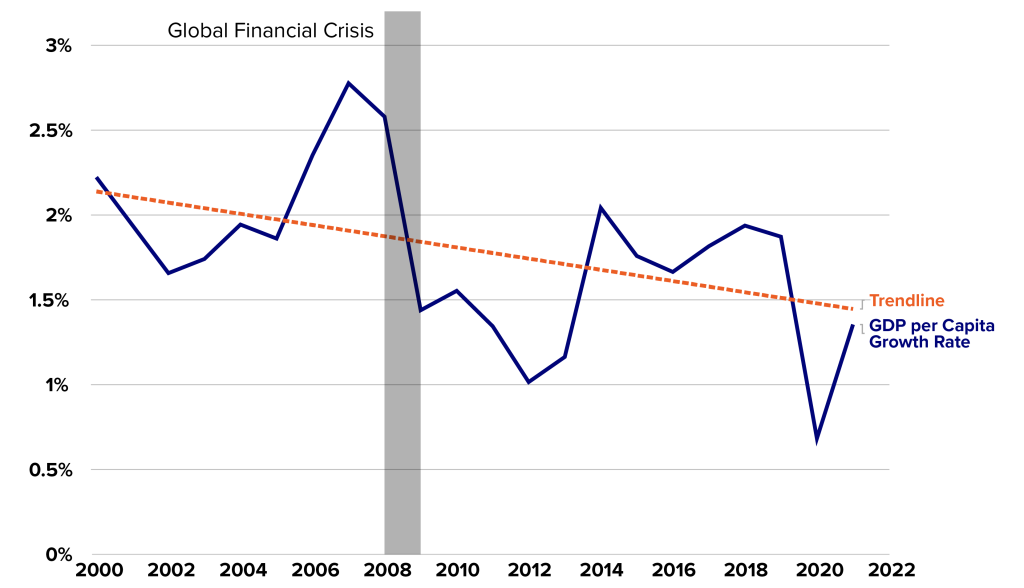

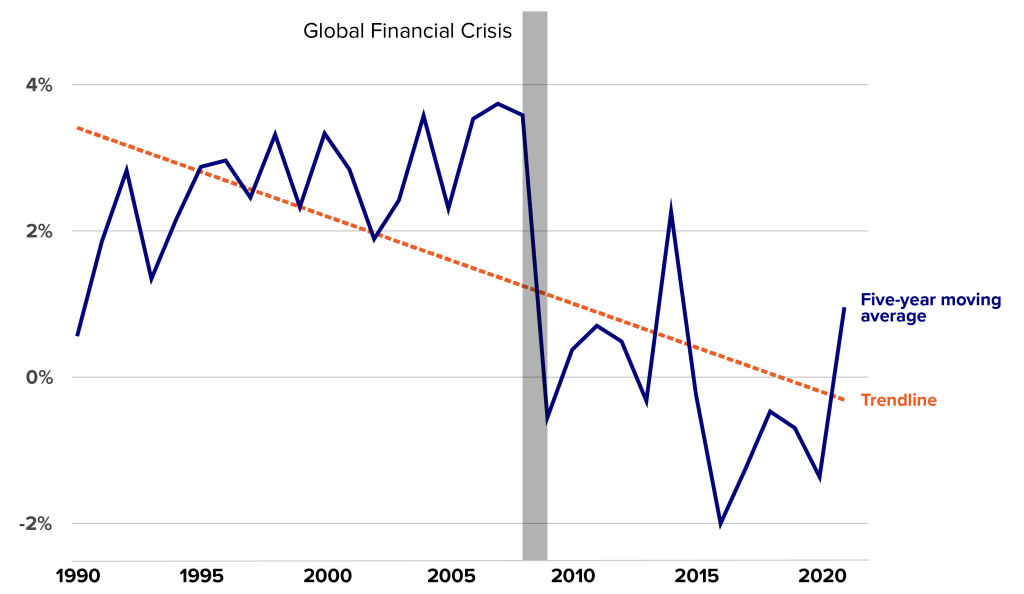

Figures 1A and 1B demonstrate that the current global slowdown, which has become more pronounced following the pandemic, has been gradually developing over the past two decades. The five-year moving average of the world’s real GDP growth rate has decreased from 3.7 percent in 2000 to 2.4 percent in 2021, as depicted in Figure 1A. Similarly, growth has also decelerated in terms of GDP per capita, as shown in Figure 1B. The five-year moving average of the world’s real GDP per capita growth rate has declined from 2.2 percent in 2000 to 1.4 percent in 2021.

Figure 1. World GDP growthrate (Five-year moving average, 2000-2021)

Source: World Bank, author’s calculations.

Figure 2. World GDP per capita growth rate (Five-year moving average, 2000-2021)

Source: World Bank, author’s calculations.

The global slowdown can be attributed to various factors, many of which can be reversed through targeted and coordinated policies, including

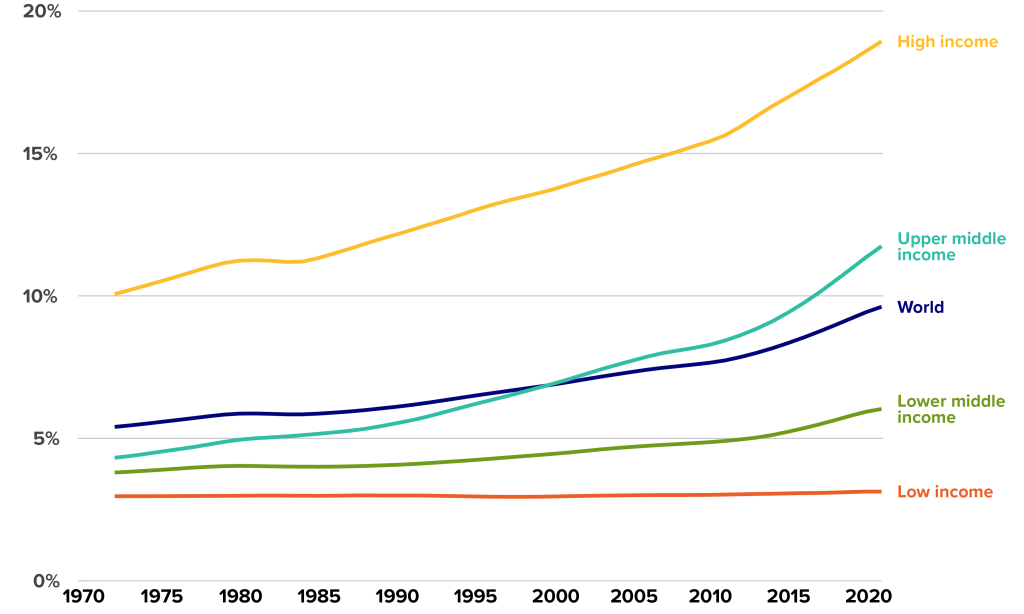

- Aging labor forces and consumer markets, especially in advanced economies, but also in many emerging markets and developing economies (EMDEs) (Figure 2A);

- declining global productivity;

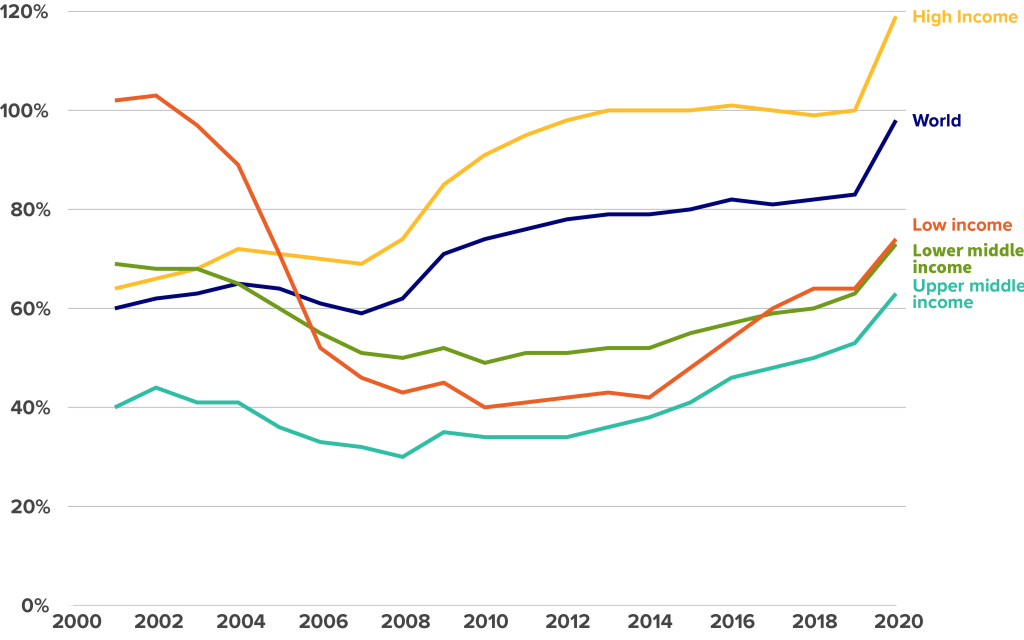

- the mounting debt burdens that have accumulated over the past decade (Figure 2B);

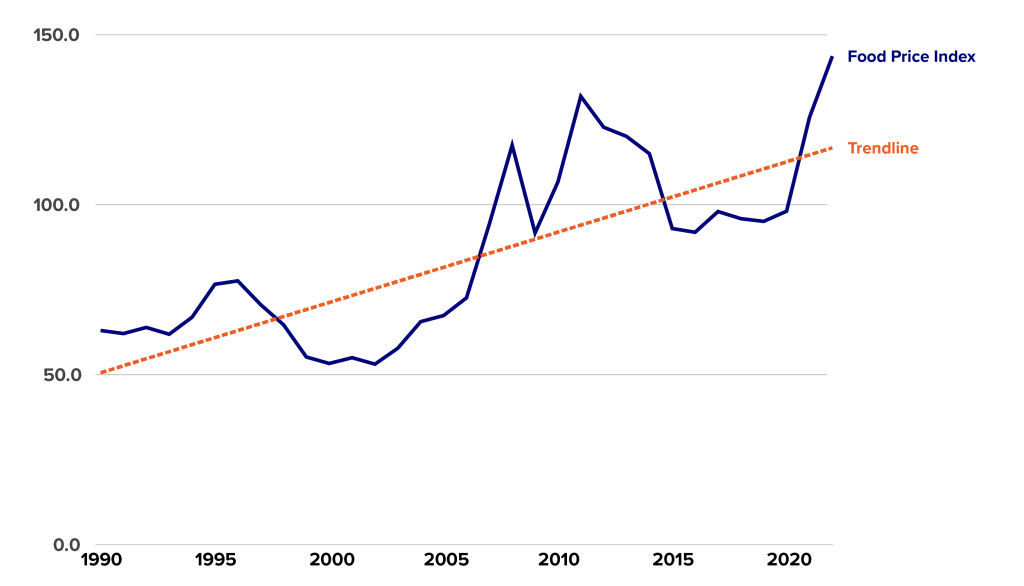

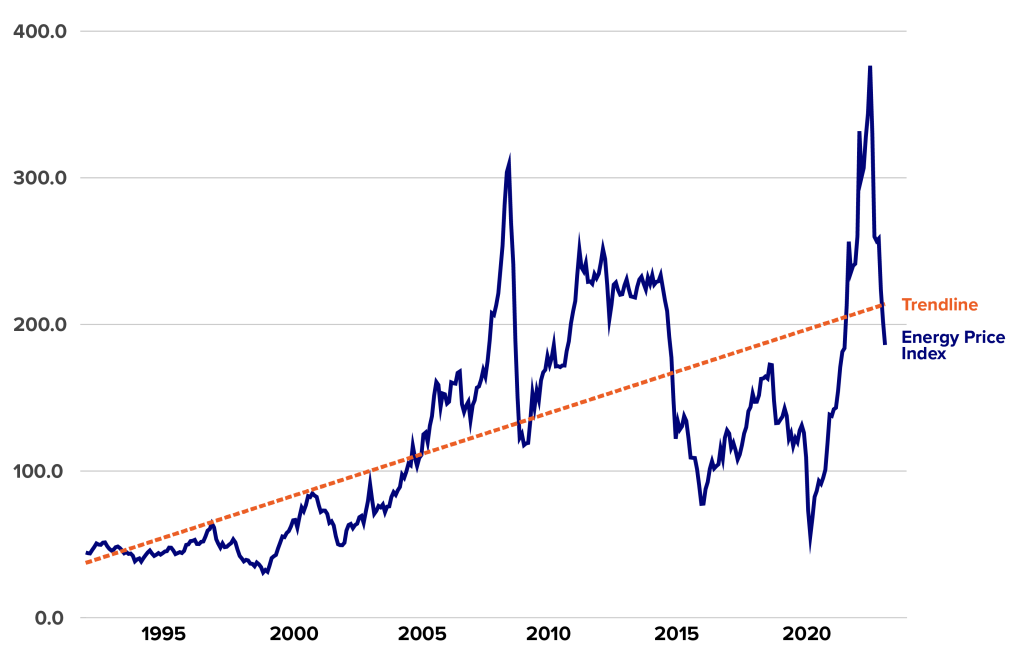

- the rising energy and food prices over the past three decades, which rose long before the Ukraine war (Figures 2C and 2D);

- the increasing geopolitical fragmentation, protectionism, and friend-shoring, and declining levels of international trade (Figure 2E); and

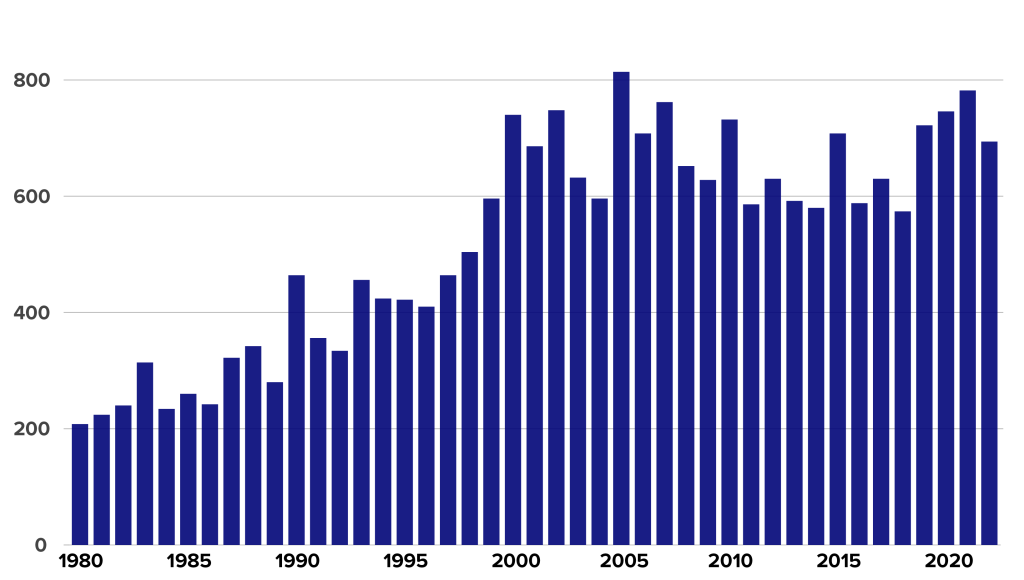

- the growing frequency and severity of natural disasters with ripple effects of security issues (Figure 2F).

Figure 3. Population 65+ as percentage of total population

Source: World Bank.

Figure 4. Average public debt-to-GDP ratio

Source: IMF, World Bank, author’s calculations.

Figure 5. Food price index

Source: Food and Agriculture Organization.

Figure 6. Energy price index

Source: Federal Reserve Economic Data.

Figure 7. Growth rate of share of trade in global GDP (Five-year moving average, 1990-2021)

Source: World Bank, author’s calculations.

Figure 8. Frequency of climate-related disasters (Annual recorded events in the Emergency Events Databse)

Source: The Emergency Events Databse (EM-DAT), Centre for Research on the Epidemiology of Disasters (CRED), Université catholique de Louvain.

II. Revitalizing global growth: Some coordinated policy responses

Reversing the above trends calls for a globally coordinated and targeted set of policies that would contribute to improvements in labor productivity and mobility, increasing aggregate demand, and promoting sustainable and inclusive growth at the global level. Some of these include the following.

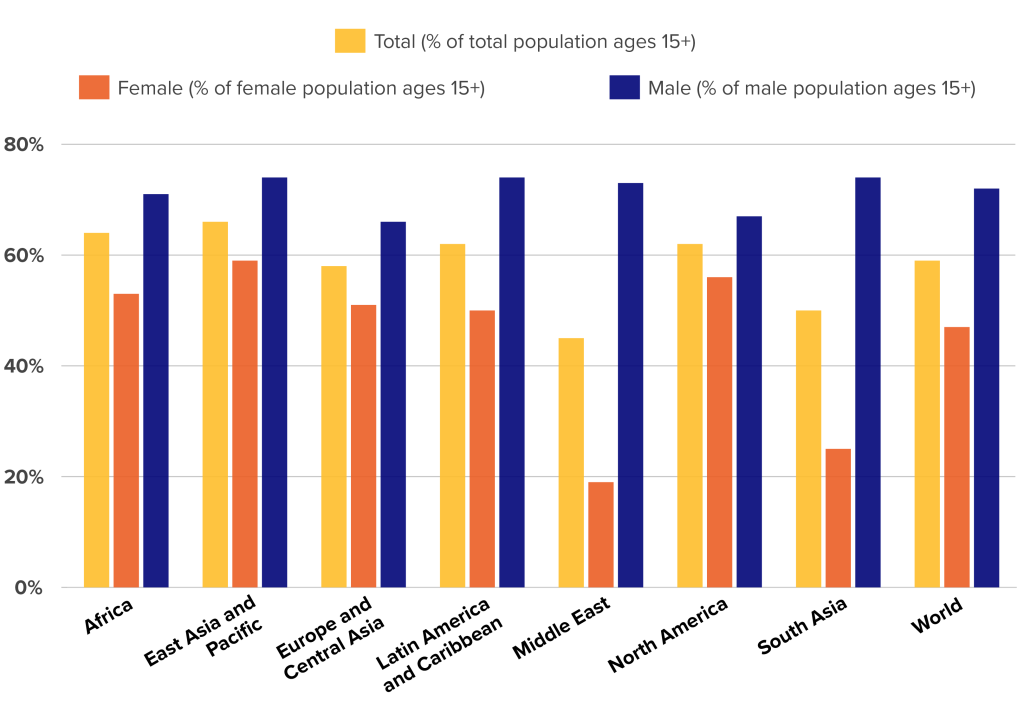

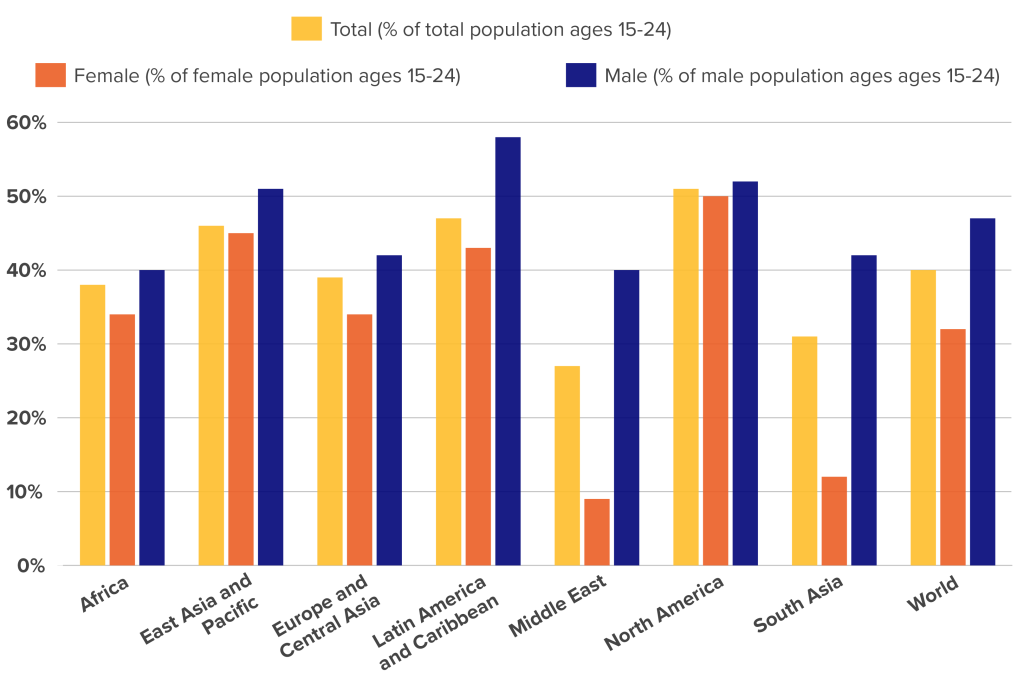

Increasing labor-force participation and facilitating the movement of labor: Globally, only 59 percent of the population above fifteen years of age is in the labor force. This is mainly driven by the lower participation of females and youths in the labor force. As seen in Figure 3A, globally, the female labor-force participation rate (47 percent) is less than two-thirds that for males (72 percent), with some regions—such as the Middle East and South Asia—having very large gender gaps in labor-force participation rates. Moreover, only 40 percent of the world’s youth (those aged 15–24) is in the labor force, with the Middle East again lagging behind the rest of the world—especially in terms of the female youth in the region (Figure 3B). Estimates show that increasing female and youth labor-force participation rates closer to the level of prime-age male workers (around 70 percent) could, on average, raise global potential growth by 0.2 percentage points by 2030.

Figure 9. Labor force participation rate

Source: World Bank, author’s calculations. Data as of 2021.

Figure 10. Youth labor force participation rate

Source: World Bank, author’s calculations. Data as of 2021.

One way to increase the world’s youth labor-force participation rate is to facilitate an easier movement of labor from regions of the world with a growing young labor force to regions where the population and the labor force are aging. This would require governments in aging economies (with the support of international organizations such as the World Bank, International Labor Organization (ILO), and United Nations (UN)), to reform immigration policies and promote certain types of visas to attract the needed skills for various sectors. Enabling greater labor mobility would support the global economy for two main reasons. First, it will allow richer countries with aging populations to capitalize on the demographic advantage of those regions that have a significant youth population. Second, the regions of the world with younger labor forces—Africa, South Asia, and the Middle East—will benefit from the remittances.

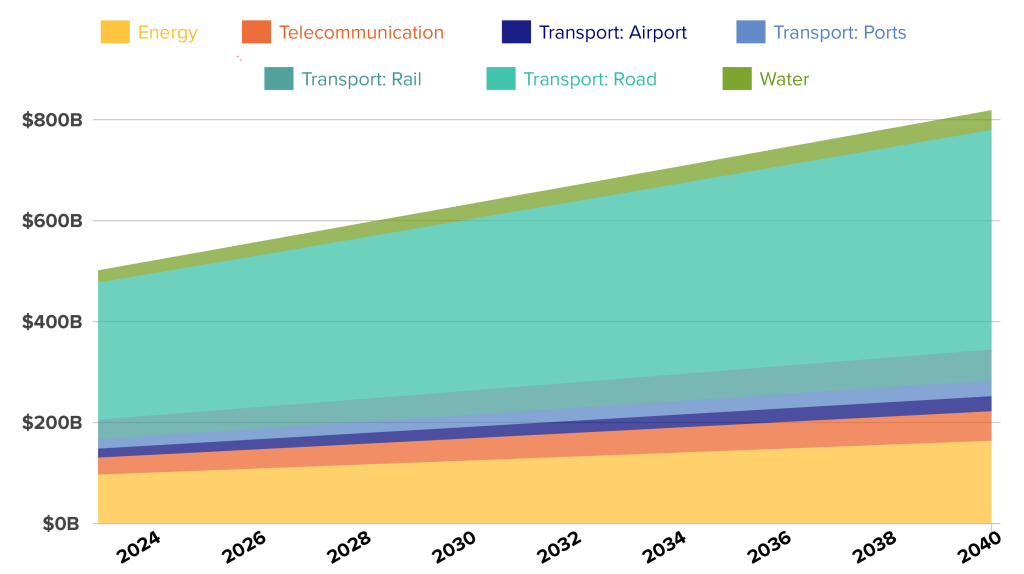

Expanding infrastructure investment: As seen in Figure 4, the current trends in infrastructure investments and needs will result in an $11.9-trillion shortage in infrastructure investment by 2040. The bulk of this gap will be in the transportation industry ($7.7 trillion), followed by the energy industry ($2.4 trillion). Moreover, adding the investments needed to achieve the Sustainable Development Goals (SDGs) by 2030, the world’s infrastructure investment gap would increase to $14 trillion by 2040. In other words, over the course of the next seven years, $2.1 trillion of additional infrastructural investment is needed to achieve the SDGs. Boosting global investment to about 2–3 percent of the world’s GDP over this decade, especially in the infrastructure sector, can increase potential growth by about 0.3 percentage points per year.

Figure 11. Global infrastructure investment gap (Amount needed to achieve SDGs, 2023-2040)

Source: Global Infrastructure Hub, author’s calculations.

With growing debt levels, the governments in many economies—especially EMDEs—have been facing increasingly limited capacity to invest in physical and social infrastructure. Hence, there is a need for a global push to strengthen and optimize the frameworks of private-public partnerships (PPPs) to foster increased engagement of the private sector in infrastructure initiatives. Moreover, quasi-state actors, such as sovereign wealth funds (SWFs) and public pension funds (PPFs) can also play a crucial role in infrastructure investment. With more than $33 trillion in assets under management (AuM), these institutional investors possess a distinct advantage in bridging the global infrastructure financing gap. This advantage stems mainly from the long-term investment horizons of institutional investors, which align with the secure, yet moderate, return expectations typically associated with large-scale infrastructure projects.

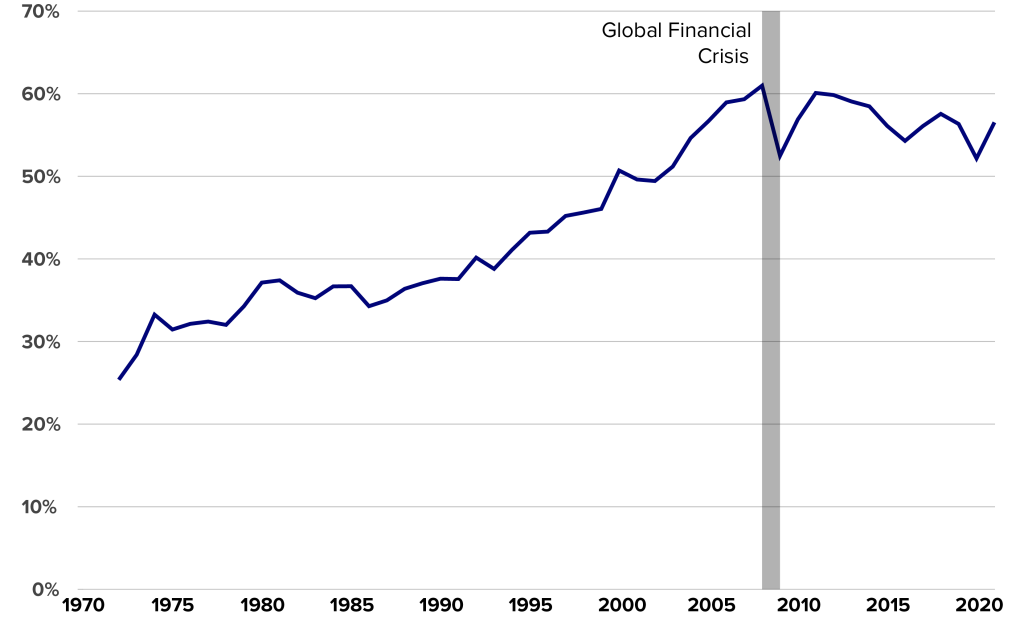

Re-globalization and reducing the costs of and barriers to trade: The ratio of world trade to GDP grew from 25.3 percent in 1972 to 61 percent in 2008, an average annual rate of 2.5 percent (see Figure 5). With the onset of the 2008–2009 global financial crisis (GFC), world trade-to-GDP ratio dropped by more than 8 percentage points and has not yet recovered to the levels seen in 2008. Looking at the five-year moving average of the growth rate of the trade-to-GDP ratio (as seen earlier in Figure 2E), while the decade preceding the GFC was characterized by the rise of global trade and globalization, the post-GFC decade can mainly be seen as one of declining global trade and rising protectionism, especially after 2014.

Figure 12. Trade as share of world GDP

Source: World Bank.

According to the International Monetary Fund (IMF), trade barriers have increased from less than four hundred in 2009 to about 2,500 in 2022. Recent policy decisions, such as reshoring and friend-shoring, could expose individual countries and the global economy to greater fragmentation and vulnerability to shocks. Moreover, according to the World Bank, the expenses related to shipping, logistics, and regulations significantly contribute to trade costs, often resulting in the doubling of prices for internationally traded goods.

Reversing these global protectionism and geoeconomic fragmentation trends could add 0.2 to 7 percent to the global output, depending on how severe the protectionism and geoeconomic fragmentation could get. However, reversing these trends, which have been in the making for more than a decade, will require a momentous effort by all economies around the world—especially the members of the Group of Twenty (G20), among whom geoeconomic fragmentation has been rapidly rising. At the same time, enhancing the trade regulatory and physical infrastructure is another area that needs to be addressed. This is where investment in physical infrastructure (discussed in some detail above) can help reverse declining trends in global trade.

The process of strengthening the role of trade in the global economy necessitates robust reform of the World Trade Organization (WTO). However, reaching a consensus on intricate trade issues remains a challenge due to the WTO’s diverse membership, the growing complexity of trade policies, and heightened geopolitical and geoeconomic tensions. Plurilateral agreements, and creating several regional mini-WTOs among select groups of WTO members, can provide a viable way forward in certain areas.

Reversing climate change and reducing global emissions: As seen earlier in Figure 2F, the severity and frequency of climate-related natural disasters have risen substantially over the past three decades, and experts link this trend to climate change and global warming. The economic cost of these disasters is also on the rise. According to the World Meteorological Organization, out of more than twenty-three thousand recorded disasters since 1970, more than eleven thousand can be directly linked to weather, climate, and water hazards. These devastating events led to a staggering 2.06 million fatalities, and incurred financial losses amounting to $3.64 trillion. Certain countries, particularly smaller states, have experienced significantly greater devastation than what is indicated by the average impact, amounting to approximately 5 percent of their annual GDP.

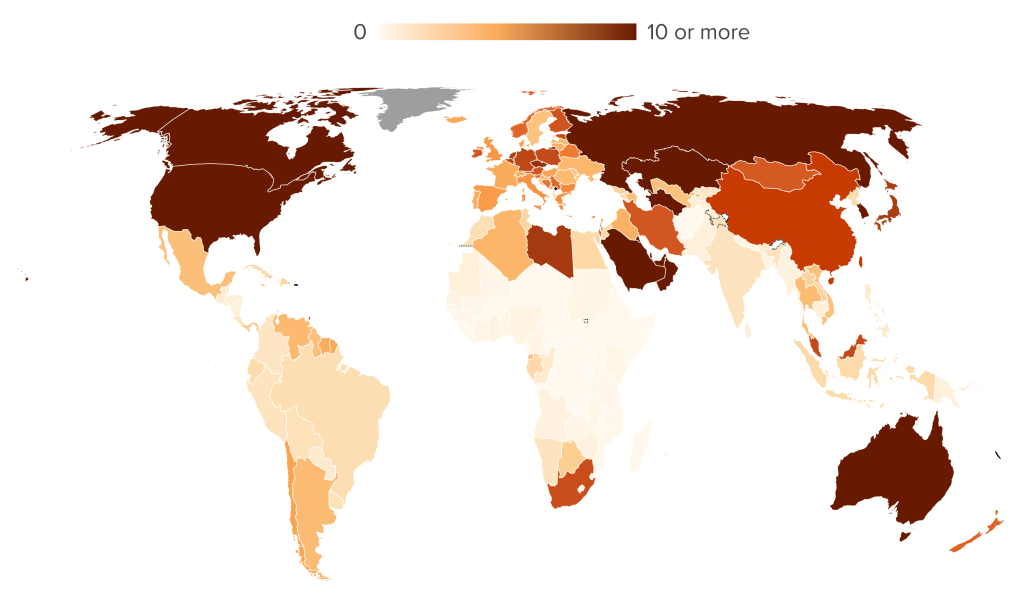

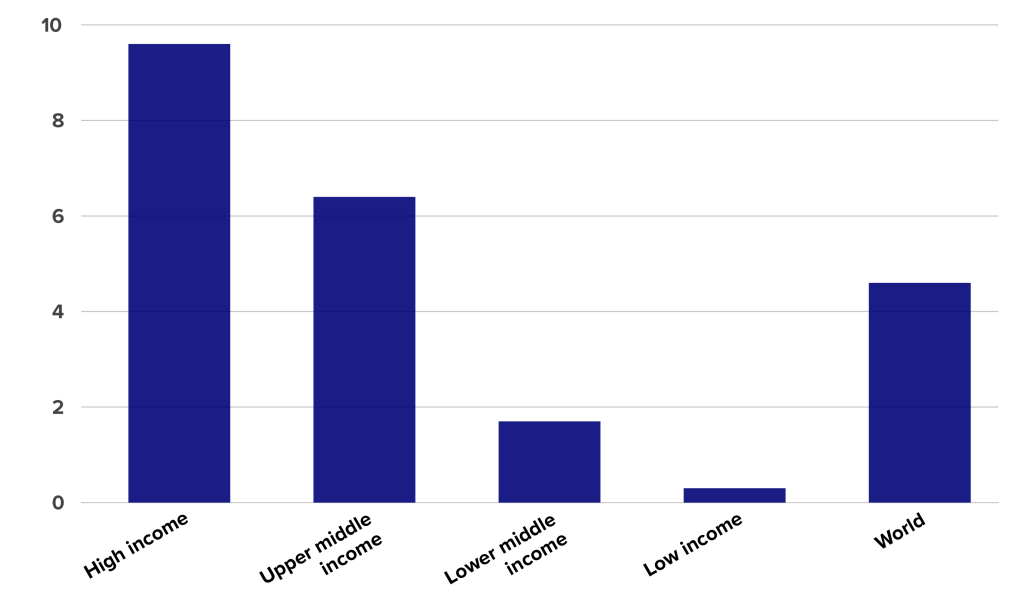

Reducing the detrimental impacts from climate change calls for a coordinated global response, with the world’s major emitters and the largest emitters per capita in high-income economies taking the lead. As seen in Figures 6 and 7 carbon-dioxide (CO2) emissions per capita in high-income economies are thirty-two times larger than those in low-income economies.

Figure 13. CO2 emissions per capita (Metric tons (2019))

Source: World Bank – World Development Indicators, World Bank Official Boundaries

Figure 14. CO2 emissions per capita by income level (Metric tons (2019))

Source: World Bank.

According to a report from the World Bank Group, if developing countries invest an average of 1.4 percent of their GDP annually toward adaptation and mitigation strategies, they could potentially achieve a remarkable 70-percent reduction in emissions by the year 2050. Such investments would also enhance their resilience to climate change impacts. The report estimates that, within lower-income countries, the financing requirements can surpass 5 percent of their GDPs, necessitating additional assistance from high-income countries and multilateral development banks (MDBs).

III. Revitalizing global growth: Why Africa matters

Through unlocking its economic potential, Africa can address its developmental needs, contribute significantly to global economic growth, and create a more prosperous and economically stable future for its people and the world. Africa’s role in reversing the global economic slowdown lies in leveraging its young and growing population, natural resources, and strategic location.

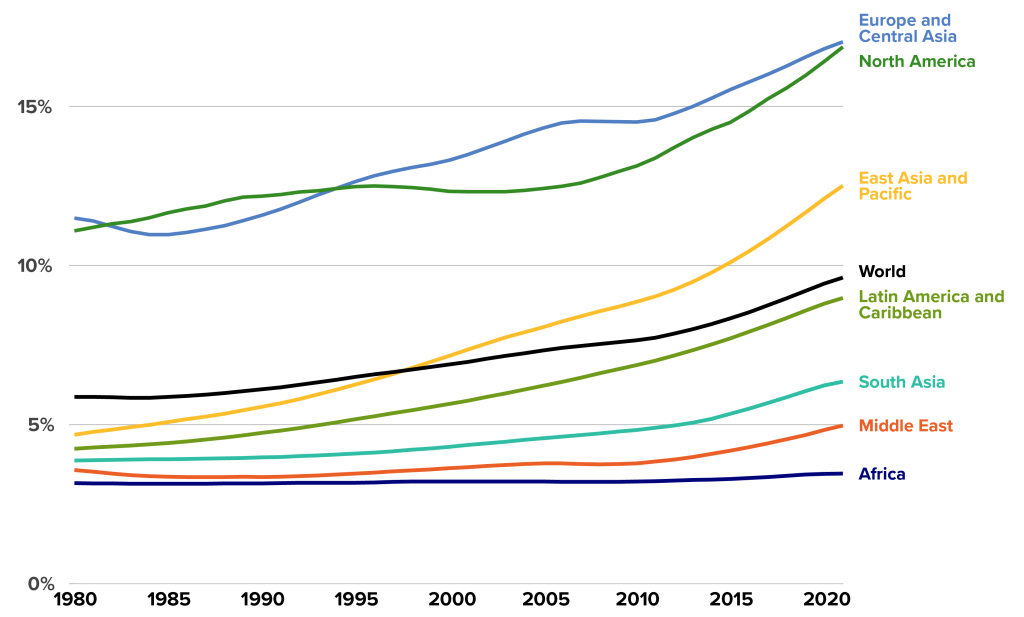

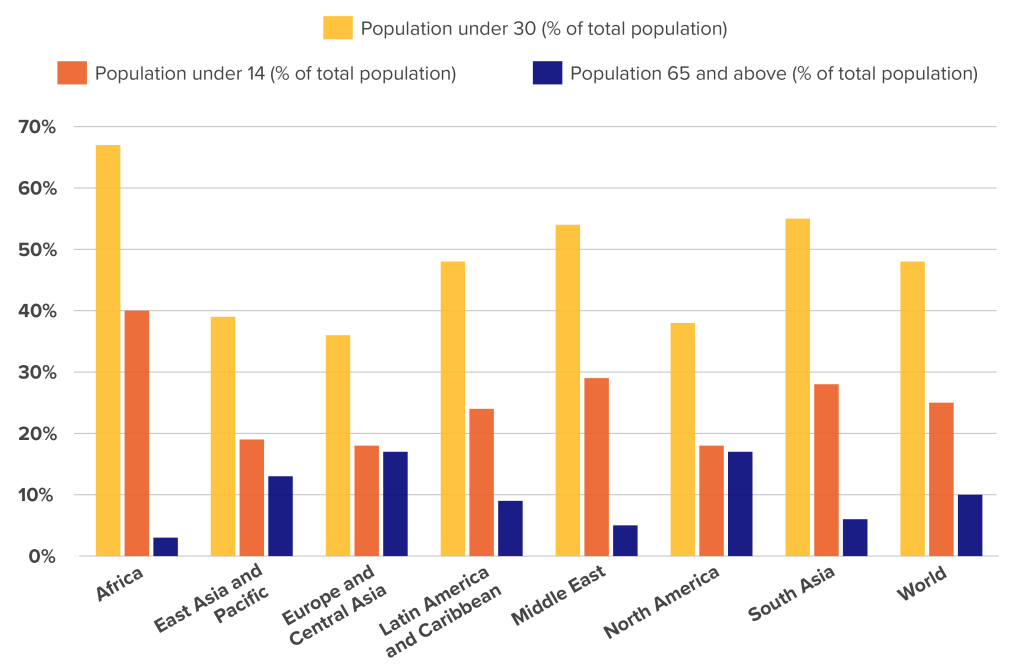

Population, consumer markets, and labor forces: As seen in Figure 8, while all regions of the world have been aging—albeit at widely different paces—the share of population sixty-five and above in Africa has remained at a mere 3 percent over the past four decades. With nearly two-thirds of its population under the age of thirty, and 40 percent under the age of fourteen, the continent enjoys having the youngest population structure in the world (see Figure 9). This means that Africa will benefit from a growing young-consumer market (with a high marginal propensity to consume) and an ample supply of young workers for at least the next three to four decades. Nigeria is a case in point, as it will be the third most-populous country in the world in 2050 after India and China.

Figure 15. Population 65+ as percentage of total population

Source: World Bank, author’s calculations.

Figure 16. Age breakdown of population

Source: World Bank, author’s calculations. Data as of 2021.

With Africa’s population expected to double by 2050—from its current 1.4 billion to 2.8 billion—Africa’s growing and young consumer market will be the main driver of global demand for consumer, education, health, technological, and infrastructural products and services. For example, the doubling of population will translate to a 50-percent increase in demand for housing and all that is needed to have a modern household, from electricity and water connections to basic appliances and furniture to municipality services. As of 2018, the continent had an estimated housing shortage of fifty-one million units and, at the current lackluster housing-construction rates, this gap is expected to increase to seventy-five million by 2050. Hence, the continent boasts an already enormous demand for housing and consumer goods and services, which is only expected to grow for decades to come. Additionally, the housing sector is well known for its job-creation potential.

According to the International Finance Corporation (IFC), each housing unit will create five full-time jobs in Africa. This means that closing the housing gap by 2050 will lead to the creation of 375 million jobs in Africa, practically absorbing all the informal-sector employment—which currently represents 83 percent of employment in Africa—and the unemployed population, and increasing the number of employed African adults age fifteen and up by more than 80 percent. This, in turn, will boost household income and aggregate demand in the region, igniting a positive loop of higher income and higher aggregate demand and imports into the continent, translating to higher aggregate demand for global consumer and technological goods and services. In other words, closing the housing gap in Africa can contribute significantly to global growth in the next three decades, while also providing the growing young population of the continent with housing and job opportunities.

Considering that the youth labor-force participation rate (LFPR) is around 38 percent in Africa (see Figure 3B above), the continent needs to create about ten million jobs per year for the next 20–30 years in order to employ every new youth entrant into the labor force. Clearly, jobs created from closing the housing gap will address this growing demand and more. Given this capacity, supportive policies can be devised to increase Africa’s youth LFPR to level to that of North America (51 percent). Such policies will increase the needed volume of new jobs to 13–14 million per year, which can all be absorbed by efforts to close the housing gap on the continent. Moreover, increasing youth LFPR in the world’s youngest continent and creating jobs for them will only add to higher LFPR at the global level, increasing the world’s workforce productivity and employment-to-population ratio. As highlighted earlier, such policies would contribute to global growth.

The same sorts of reasoning and statistics presented above for the housing sector can also be applied to the increasing demand for energy, basic infrastructure, education, entertainment, and healthcare services in Africa over the next few decades. In short, as the continent’s middle class grows and disposable incomes increase, African consumers will play a vital role in driving demand for basic infrastructure and goods and services, both domestically and internationally. This could be a major component of a robust global rebound because, on average, household consumption is responsible for about 60 percent of the world’s GDP.

Natural resources: Africa is home to an incredible amount of diverse natural capital. Nearly 30 percent of the world’s mineral reserves, 12 percent of its oil reserves, and 8 percent of its natural gas are located in Africa. The continent is also home to 40 percent of the world’s gold reserves. Moreover, the continent boasts the largest reserves of cobalt, diamonds, uranium, and platinum in the world. In other words, 30 percent of world’s rare-earth deposits are in Africa. These elements are central to the global economy, and their importance is rising rapidly—especially in various strategic high-tech industries such as semiconductors, batteries, and green energy. Finally, the continent also possesses 65 percent of the world’s arable land, making it central to long-term food production and security.

Given its natural resources, Africa has the potential to play a significant role in the global energy transition and climate mitigation for three main reasons. First, Africa—especially Northern Africa—possesses abundant renewable energy resources. By tapping into these resources, Africa can contribute significantly to global green-energy production and reduce reliance on fossil fuels. For example, equipping a mere 1 percent of the Sahara Desert area with concentrated solar power plants would be more than sufficient to meet the electricity demand of all of Europe, the Middle East, and Africa. Moreover, the Sahara’s strong solar radiation makes it ideal for the generation of green hydrogen (for example, in Morocco) that can be transported to Europe using the current oil and gas pipeline between the two continents. Hence, Africa has the potential to become a major global exporter of green energy.

Second, Africa is home to abundant mineral reserves, including key resources used in battery technologies, such as lithium, cobalt, and nickel. These minerals are essential for the production of batteries for electric vehicles (EVs) and energy-storage systems. Africa’s role in global battery technology lies in responsibly extracting and processing these minerals, potentially becoming a significant supplier to the growing EV and green-energy storage markets.

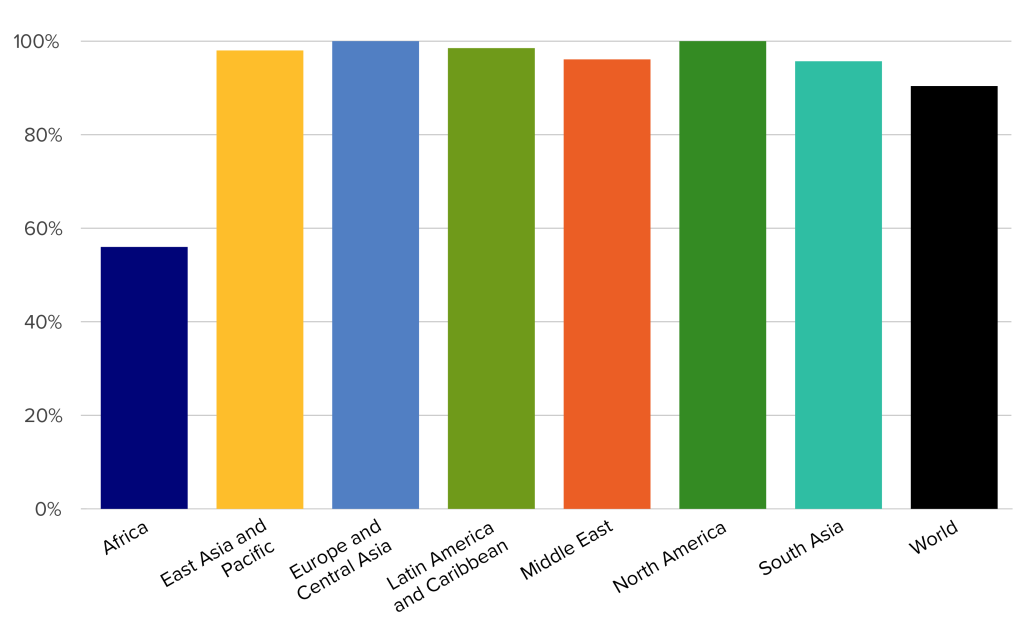

Third, considering that Africa’s population is expected to double by 2050, meeting this rapidly rising energy demand from renewable sources is crucial in addressing global climate challenges. Many parts of Africa still lack access to electricity. As seen in Figure 10, electricity access is nearly universal in all regions of the world, only 56 percent of Africans have some sort of access to electricity. This means that about 600 million Africans lack access; in other words, 80 percent of the total 750 million people who don’t have access to electricity in the world are in Africa. Africa has the great opportunity to leapfrog the technology in electricity generation and distribution—just as it leapfrogged landlines in many parts of the continent and embraced mobile/digital communication—and tap into its immense potential for renewable electricity generation, alongside off-grid and mini-grid solutions, as the path forward for expanding access to electricity for its rapidly growing population. The same is true for Africa’s transportation industry, as the continent can address its growing demand for private and public transportation through EVs. These will drastically reduce Africa’s greenhouse-gas emissions in the growing electricity and transportation industries, making Africa a global leader in providing its population with access to affordable and renewable energy, which is articulated as Goal 7 of the SDGs. Although Africa’s share of global emissions is projected to increase from around 4 percent in 2023 to 11 percent in 2050, any African contributions to reducing global emissions without significantly harming its growth projections will be welcomed by the global community. Ivory Coast, Senegal, Uganda, Togo, and Cameroon, as well as six cities in South Africa, have already made great strides on this front.

Figure 17. Access to electricity (Share of population by continent)

Source: World Bank, author’s calculations. Dara as of 2020.

It is important to highlight here that while Africa is only a small contributor to global emissions, the continent has started taking important initiatives for the green transition. Starting with the 1997 Kyoto Protocol and extending to the 2016 Paris Agreement (COP21), a significant number of African nations have embraced and ratified environmental pacts. The proliferation of consciousness-raising campaigns is evident, and exemplified by initiatives like the African Union’s Agenda 2063, conservation funds such as the Blue Fund, the Desert to Power project by the African Development Bank, and the Great Green Wall endeavor aimed at cultivating vegetation across the Sahel region.

Various countries are actively engaged in this movement. Burkina Faso, for instance, is home to the largest solar-power facility in West Africa, while President Macky Sall’s Green Emerging Senegal Plan is driving eco-friendly strategies in Senegal. In Ethiopia, nearly 100 percent of the nation’s electricity is sourced from renewable resources (96 percent from hydropower).

In short, by leveraging its renewable energy resources, promoting local manufacturing and innovation, and actively participating in global collaborations, Africa can contribute to the advancement of green energy and battery technology worldwide, and position itself as a key player in the global shift toward clean, and renewable energy sources. This will contribute significantly to the global sustainable-development agenda, enhance energy access, and reduce carbon emissions—all of which are key ingredients for a global recovery.

Trade and connectivity: Africa is surrounded by seas and oceans on all sides, making it easy to trade with most of its economies. Of the fifty-four countries in the continent, thirty-eight have access to open waters. The remaining landlocked economies can access open waters through at least one neighboring country. Given Africa’s geographical position and its potential as a trading hub, leveraging its strategic location can enhance its participation in global trade, strengthen economic ties with other regions, and drive overall economic growth and development. Africa’s location holds strategic importance in global trade for several reasons. First, the continent is geographically positioned as a gateway between the Atlantic and Indian Oceans, linking multiple regions, such as the Middle East and Europe. This location allows for efficient trade routes and connectivity between Africa, Europe, the Americas, Asia, and the Middle East.

Second, Africa is home to important maritime trade routes. Its coastal regions, including the Gulf of Guinea, the Red Sea, and the Cape of Good Hope, serve as critical maritime trade routes. These routes are crucial for shipping goods between continents, facilitating international trade and commerce. Also, Africa’s proximity to the Suez Canal is of significant advantage. Annually, 12 percent of the world’s trade is carried through this canal. The Suez Canal, located in Egypt, connects the Mediterranean Sea to the Red Sea, providing a vital shortcut for maritime trade between Europe, Asia, and Africa. This access greatly reduces shipping distances and the cost for goods passing through the region.

Third, and related to the above, is Africa’s abundant natural wealth. As highlighted earlier, Africa is immensely rich in natural resources, and its strategic location facilitates the export of these resources to various markets worldwide, driving economic activities and trade partnerships.

Efforts are under way to establish and expand trade corridors within Africa. Projects like the Trans-Saharan Highway, Trans-African Railway, African Integrated High-Speed Railway Network, Niger-Benin crude pipeline, and other infrastructure developments aim to enhance intra-African trade and improve connectivity, fostering regional integration and expanding Africa’s role in global trade. On the policy front, too, venues for regional integration are being explored. For example, efforts toward regional integration, such as the African Continental Free Trade Area (AfCFTA), aim to establish a single market across the continent. This initiative can enhance intra-African trade, increase investment flows, and create a more favorable business environment, positioning Africa as a key player in global trade.

Conclusion

Vietnam, despite its limited access to natural and energy resources compared to Africa, has experienced an impressive sevenfold increase in its GDP over the past thirty years (from $45 billion in 1990 to $332 billion in 2021). If Africa can achieve similar growth rates in the next three decades, it has the potential to contribute a staggering $20 trillion to the global economy in 2050.

This is not unrealistic. Africa managed to triple its GDP, from $900 billion to $2.7 trillion, between 1990 and 2021. Moreover, during the same period, Ethiopia’s GDP increased by 7.6 times—more than the increase in Vietnam—while the economies of Ghana, Tanzania, and Egypt grew by five, 4.6, and 3.7 times, respectively. By leveraging the heterogeneity among its fifty-four economies,

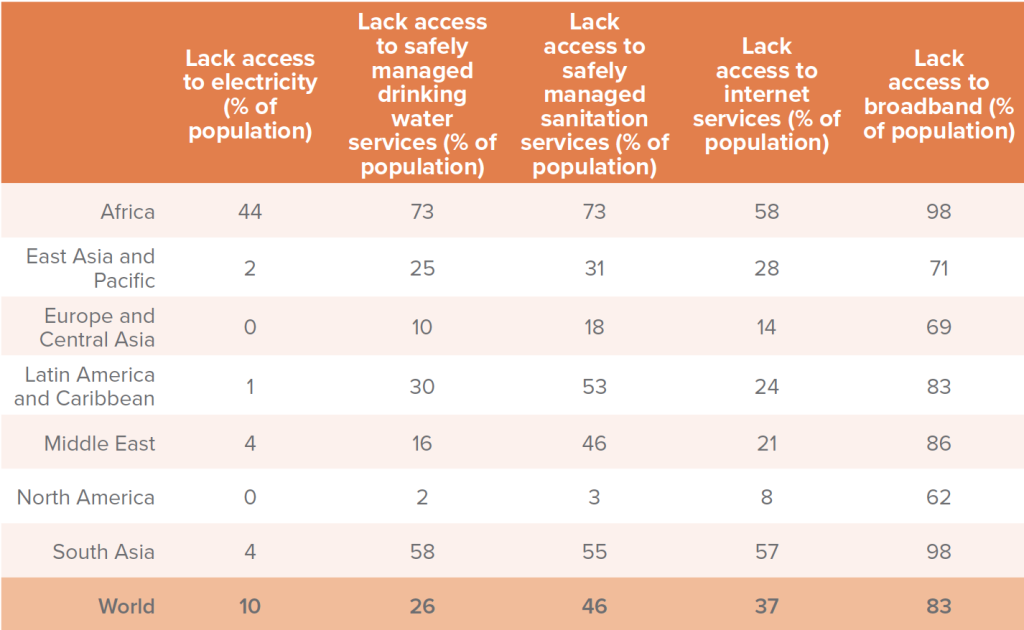

Africa can build upon this performance through fostering greater regional trade and labor-market integration, increasing climate resilience, and better integrating its labor and commodity markets in the global supply chain. Through such coordinated policies, Africa has the potential to grow at an average annual rate of 5–7 percent in the next three decades—resulting in an African economy that is 4–7 times larger by 2050. This could result in a global economic boom led by a generation of ambitious young Africans ready to innovate, produce, and consume. No other region in the world possesses the same potential for growth. To achieve its potential and contribute to a robust global rebound, Africa needs a concentrated “Big Push” financial and technical investment in its physical and social infrastructure and labor markets. The case of physical infrastructure is of particular importance. Over the past two decades, Africa stands out as the sole region where road density has experienced a notable decline. Approximately 43 percent of the continent’s roads have been paved, but South Africa accounts for 30 percent of the total. Also, as seen in Table 1, 44 percent of Africans lack access to electricity, 73 percent lack access to safely managed drinking water and sanitation services, 58 percent do not use the internet, and 98 percent don’t have access to broadband services.

Table 1. Lack of access to basic infrastructure (2021)

Source: World Bank.

Hence, Africa’s existing infrastructure gap is the main bottleneck for unlocking its immense economic potential. Massive investments in transportation, electricity, water, sanitation, and communication infrastructure are needed for the continent to seize its position in the global economy and act as its engine of growth. According to the African Development Bank, the annual investment gap in Africa’s infrastructure is around $100 billion. Moreover, many African countries need help with developing their governance, financial, and legal institutions. The Bretton Woods Institutions (BWIs) can play a crucial role in supporting Africa to get the “Big Push” it needs. A more active, focused, and multifaceted long-term engagement of the World Bank, IMF, and yes, WTO in Africa’s development will help crowd inthe much-needed institutional and private-sector investment in the region’s physical, social, financial, and legal infrastructure.

Some critically important areas for BWIs to revisit are debt relief/restructuring, assisting with climate adaptation and resilience efforts, supporting overall governance capacity of African economies, promoting private-public-partnerships in physical and social infrastructure investment, accelerating African regional integration, prioritizing Africa’s integration into the global economy and supply chains, and reinforcing multilateralism and international cooperation. It is through such coordinated programs and policies that BWIs can support African economies seize the opportunity to jumpstart their economies and contribute to a sustained economic growth in the continent for decades to come, with of course significant ripple effects on revitalizing global growth.

Related content

About the author

Amin Mohseni-Cheraghlou is the macroeconomist with the GeoEconomics Center and an assistant professor of Economics at the American University in Washington, DC. He leads GeoEconomics Center’s Bretton Woods 2.0 Project.

At the intersection of economics, finance, and foreign policy, the GeoEconomics Center is a translation hub with the goal of helping shape a better global economic future.