The full text of this paper is split across the various articles linked below. Readers can browse in any order. To download a PDF version, use the button below.

Some argue that a process of deglobalization is underway. Brexit, for example, marks the first time since World War II that a nation has left a free trade agreement. US President Donald J. Trump withdrew from the Trans-Pacific Partnership (TPP), rejected the North American Free Trade Agreement (NAFTA) and the United States-Korea Free Trade Agreement (KORUS), renegotiated both NAFTA and KORUS, and has imposed tariffs on US allies under a dubious “national security” rationale. Since the collapse of the Doha Development Round in 2007, no effort has been made toward a new comprehensive World Trade Organization (WTO) global accord. Instead, consensus among major trading states that the WTO needs to be reformed has led to efforts to update and modernize that institution. Trump’s widespread imposition of tariffs on major trading partners and denigration of multilateral institutions, and creeping trade-restrictive measures worldwide—more than seven thousand adopted since 2008—are additional factors on which the future of the global trading system will turn.

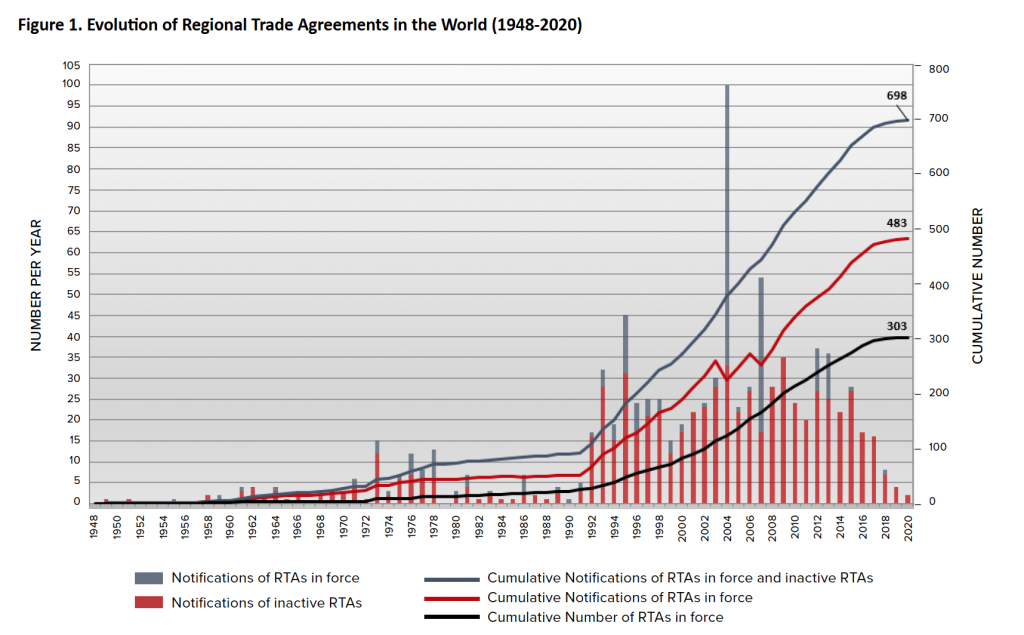

But a larger body of evidence suggests countertrends—more a transition in the patterns and character of globalization, less a decline in interdependence than a shift toward more market-driven regionalization—evident in shorter, more local and regional global value chains and proliferating regional and intra-regional trade agreements. In lieu of global trade talks, regional integration continues apace led by Asia (including South Asia), whose intra-regional trade in 2016 as a percentage of total reached 58 percent, surpassing that of NAFTA’s 56 percent (comprising of Canada, Mexico, and the United States), and second only to the European Union’s 27 member countries at 69 percent. But, more than NAFTA and EU27, Asian economic integration, driven largely by Japanese auto and electronics investment in the 1980s and 1990s, and now by China’s growth, is largely market-driven amidst what is known as a “noodle bowl” of overlapping bilateral and subregional free trade agreements (FTAs) and with the Asia-Pacific only now moving to consolidate such agreements into a comprehensive regional trade accord. While there is substantial intra-regional trade and investment, these three major economic clusters reflect the geographic concentration of world trade. Another indicator of change rather than deglobalization is that despite profound policy uncertainties, global trade, prior to the coronavirus-induced economic recession, had continued to grow at a faster pace than global annual economic growth. This buoyancy is a result of several factors, most prominently digitization, which has significantly lowered transaction costs, offsetting tariffs and accelerated still poorly measured trade in services and a growing role of the knowledge economy. This has facilitated the growth of global demand in developing nations—South-South trade—along with more regionalized supply chains. China’s Belt and Road Initiative (BRI), a massive infrastructure plan to facilitate Eurasian connectivity, is another driver. China has, to date, invested $257 billion in BRI construction projects totaling $432 billion. This has added a new factor to ongoing patterns of trade and investment: from US and Asian manufacturing investment in Association of Southeast Asian Nations (ASEAN) member states to the Asia-Middle East energy nexus that is driving oil and gas demand, and China’s booming trade and investment in Latin America and Africa, these new polycentric patterns of trade are altering globalization. This is also reflected in an explosion of regional trade agreements—from fifty in 1990 to more than three hundred by 2019. These agreements form a sometimes confusing web of intra-regional to bilateral accords (e.g., Chile has twenty-six bilateral agreements, the United States twenty, South Korea thirty-eight, all address limited tariff and non-tariff barriers).

Source: World Trade Organization

Is a rules-based architecture possible?

If current trends persist, the future of an inclusive regional and/or global trade architecture is uncertain. The complexity of the US-China economic relationship, China’s mercantile industrial policies, and trade differences will require sustained negotiations to reach new understandings. Many of the possibilities and parameters for both regional and global trade regimes over the coming decade will be shaped by the outcome of these negotiations.

At the global level, avoiding the worst case—a fragmented global trade regime—will require a sort of concerted US-EU-Japan-South Korea-Australia effort in the WTO and, more broadly, the G20, to push back and challenge Chinese policies that have been inconsistent with its WTO commitments and are driving efforts to radically reform the WTO. This allied cooperation should expand to building consensus on harmonizing standards and norms for 5G telecommunications, AI, CRISPR/gene editing, and other emerging technologies.

No less urgent or important for a rules-based economic system is the future of the WTO. Its long-term challenge—how to pursue future trade liberalization as a technology revolution unfolds with a more multipolar set of stakeholders—is daunting enough. But, the WTO faces a quiet and more urgent crisis that is impacting its ability to function: uncertainty about the WTO’s enforceable dispute settlement system. Detailed assessment is beyond the scope of this report, but a recent PIIE report offers an important critique and path forward. Reforming WTO processes and fixing the dispute settlement system is in the common interest, otherwise there is no legitimate referee for the world trade system.

The International Monetary Fund (IMF), the World Bank, and the WTO have issued a joint paper and the EU and China have also offered white papers on how to reform the WTO. The United States backed sweeping reform and has offered ideas for e-commerce reform that largely build on the provisions in the original TPP. It has also issued a lengthy critique of the WTO dispute settlement system. Beyond the current negotiations on e-commerce, all actors cite the urgent need to fix the now dysfunctional dispute settlement system, and, more broadly, as the EU paper says, “rebalance the system and level the playing field, address market access, discrimination and regulatory barriers to all sectors of the economy.” There are a range of issues such as more transparency and obligatory reporting requirements (e.g., on subsidies), a strengthened trade review mechanism, and graduating “developing economies” assuming more responsibilities and obligations that are needed to level the trade playing field. This will almost certainly be a protracted process, something that should be a continuing priority in the G20. At the end of the day, success is likely to be elusive. Whether the United States and the EU can find a mutually acceptable formula to reform the WTO’s dispute settlement system is an open question. Nonetheless, the financial dimension of globalization is arguably the most impacted by the 2008 crisis. Global cross-border capital flows have dropped by 65 percent, with much of the decline resulting from a plunge in cross-border lending.

Image: Container barge passing by in Shanghai, China. Increasingly, the center of gravity of the global trade and financial system is shifting East, toward China, and South. Source: Markus Winkler for Unsplash