For decades, conventional wisdom has held that natural gas supplies flow westward and southward from the Ukrainian border into the EU. However, given the tectonic shifts in the energy ecosystem and geopolitics, this paradigm no longer serves either party. In today’s rapidly evolving energy environment, it is high time to re-imagine the Trans-Balkan gas transit corridor and review its potential to enhance European energy security.

Reverse flows to Ukraine introduced in 2015 have proven the value of bidirectional east-west transit. And, for the first time on August 26 this year, the Gas Transmission System Operator of Ukraine (GTSOU) carried out a south-north transmission request. This request was placed by a local commodity trader and involved shipping natural gas up the Trans-Balkan pipeline from Greece through Bulgaria and Romania to Ukraine. The purchase helped demonstrate the technical viability of this route, even if it is not yet commercially viable.

The question of whether gas will continue to flow through the Trans-Balkan pipeline and whether the direction will be reversed was raised by ICIS almost a year ago. We have subsequently seen a sharp decline in flows. The projected transit volume for this entire year is 1 bcm at most. In other words, even this admittedly optimistic scenario indicates a utilization rate of a meager 3-4%.

A strategic asset with a transit capacity of 27 bcm per year, the Trans-Balkan gas corridor can and should be a guarantee of energy security for Southeastern Europe. If there are interruptions or maintenance work on TANAP or TurkStream, gas flows could still be assured.

This corridor currently gives countries in the Balkan region access to the gas markets of Central Europe and Ukraine’s storage facilities, which are the largest in Europe. However, without significant transit volumes, neither Ukraine nor Bulgaria and Romania can defend operational expenditure. It is therefore important to understand the very real risk of supply disruptions should this pipeline be marked for decommission.

Stay updated

As the world watches the Russian invasion of Ukraine unfold, UkraineAlert delivers the best Atlantic Council expert insight and analysis on Ukraine twice a week directly to your inbox.

There are several concurrent developments in and around the Eastern Mediterranean and the Black Sea that are bound to reshape regional energy system dynamics. These include four major gas field discoveries in the territorial waters of Israel, Egypt, and Cyprus; the latest find by Turkey; and the construction of a new LNG terminal in Greece. Meanwhile, rising tensions between Ankara and Athens; the tightening of US sanctions on TurkStream; and the latest escalation between Armenia and Azerbaijan all have the potential to shatter the status quo.

The complexity of the interplay between these diverse developments is such that no single scenario could definitively describe the path forward. What is clear, however, is that the conventional logic no longer applies to the Trans-Balkan gas corridor. What will it take to redeploy this route for the benefit of consumers in Central and Eastern Europe?

First and foremost, we have to find a way to boost the commercial viability of the route.

Arguably, Moldova can pick the lowest hanging fruit by virtue of updating its tariff calculation methodology and bringing it into line with common European practices. At present, the tariff approved by the Moldovan Regulator is about USD 11 per 1,000 m3/100km, while the “historical shipper” Gazprom is understood to be getting a 70% discount, paying only USD 3. Clearly, the current situation does very little to promote fair competition and must be corrected as a priority.

Secondly, Romania, which boasts the second-largest gas reserves in the EU, has yet to overhaul its legacy regulations that restrict exports to non-EU countries. So far, Ukraine and Romania have signed just one interaction agreement. GTSOU stands ready to sign four more agreements, given the number of additional interconnection points that exist between Ukraine and Romania.

At the moment, the process remains bogged down by delays that benefit nobody. Let us aim to conclude four further agreements in the next few months. As Romania is poised to ramp up domestic gas production, in particular from offshore fields in the Black Sea, it could play an ever-increasing role in the regional energy trade. Indeed, Romania stands to benefit most from bidirectional use of the Trans-Balkan pipeline.

Eurasia Center events

Lastly, the European Union and all 27 member states must stand firmly for the uniform application of the EU’s own Third Energy Package.

An exemption granted to Serbia in 2019 is currently impeding competition in the energy market. The 400km stretch of the pipeline going through Serbia, in which Gazprom has a controlling stake, boasts a capacity of 13.88 bcm per year. “The pipeline is not covered by the Third Energy Package and we regret that,” is how Energy Community Deputy Director Dirk Buschle described the situation in March 2019. To make this pipeline compliant with European energy regulations, a number of remedies and cures are available to Serbia. However, there is currently no political appetite in Belgrade to implement them.

European solidarity is clearly in jeopardy here. As individual member states or EU aspirants pursue their separate interests, the EU as a whole stands to lose out.

Now that Ukraine has completed the unbundling process of its energy sector, the EU must ensure the mandatory and universal application of its own rules and regulations in Romania, Bulgaria, and Serbia. The gas market does not end at the borders of the European Union. Neighbors who have committed to comply with the provisions of the Third Energy Package also deserve reciprocation.

Despite the current state of affairs, I am optimistic that the Trans-Balkan pipeline will soon be delivering on its promise and helping revitalize regional economies, boosting the ongoing energy transition away from carbon-intensive coal, and contributing to the diversification of gas imports to Europe. For its part, Ukraine stands ready to deploy its extensive transit and storage network for our common benefit.

Ultimately, the principles of fair competition are only as useful as our willingness to enforce them. When Europe defends its interests by rightfully recognizing the geopolitical and national security implications of the natural gas trade, all of its members and neighbors stand to benefit.

Sergey Makagon is CEO of the Gas Transmission System Operator of Ukraine.

Further reading

The views expressed in UkraineAlert are solely those of the authors and do not necessarily reflect the views of the Atlantic Council, its staff, or its supporters.

The Eurasia Center’s mission is to enhance transatlantic cooperation in promoting stability, democratic values, and prosperity in Eurasia, from Eastern Europe and Turkey in the West to the Caucasus, Russia, and Central Asia in the East.

Follow us on social media

and support our work

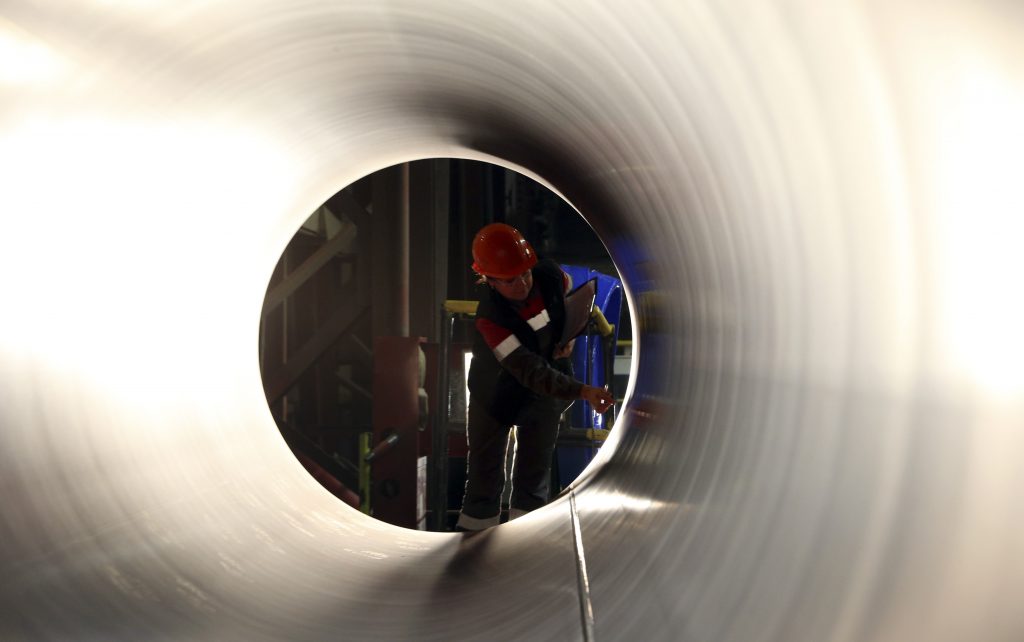

Image: Ukraine's Naftogaz has applied to the German authorities to participate in the certification process of Vladimir Putin's Nord Stream 2 pipeline, which is viewed in Kyiv as a geopolitical weapon aimed at Ukrainian statehood. (REUTERS/Sergei Karpukhin)