The Inflation Reduction Act creates a $27 billion Greenhouse Gas Reduction Fund to accelerate the United States’ energy transition—and ensure that the transition is an equitable one. This GHG Reduction Fund is the product of more than thirteen years of legislative efforts to create a single, national, nonprofit green bank in the United States. This legislation is based on the Clean Energy and Sustainability Accelerator Act, which was originally sponsored by Senators Chris Van Hollen (D-MD) and Edward Markey (D-MA) in the Senate and Representative Debbie Dingell (D-MI) in the House of Representatives.

Of the $27 billion in the Greenhouse Gas Reduction Fund, $20 billion will be administered by the Environmental Protection Agency to support eligible nonprofit entities’ emissions-reduction projects. The other $7 billion in the fund will be available to states, municipalities, and tribal governments to implement programs enabling low-income and disadvantaged communities to benefit from zero-emissions technology.

The EPA will make at least two grant awards (the awards may go to the same entity), as the $20 billion fund is split into a $12 billion general fund and a historic $8 billion pot specifically allocated to support low-income and disadvantaged communities.

Senate budget reconciliation rules forced Congress to create a competitive bidding process, but the legislative intent of the GHG Reduction Fund—as made clear by its sponsors—is to allocate $20 billion for a single, nonprofit national green bank that will support a swift and equitable transition to a clean energy economy.

Supporters of green banks and the legislative sponsors of the legislation have pushed for the funds to be distributed through a national green bank for many reasons. The national green bank could ramp up quickly, establish national standards for loans, develop credit enhancement programs, and provide expertise and funding to local communities, state and local green banks, and other financial institutions including community development finance institutions (CDFIs). A national green bank would establish a revolving fund through interest on and repayment of loans, and through the sale of securitized loans.

The legislation requires grant awardees, once capitalized, to make direct investments into qualified, emissions-reducing projects at the national, regional, state, and local levels. Importantly, recipients must also make indirect investments into such projects by providing financial and technical assistance to a wide range of financial institutions.

If capitalized, a national green bank would create an open, inclusive, and ever-expanding network of state and local nonprofit financial institutions. This network would include existing and newly established green banks as well as CDFIs and credit unions that are committed to investing in the clean power platform.

Additionally, the national green bank would be a unique and potent weapon in the fight against climate change, providing low-cost financing, up to 100% upfront loans in low-income communities, credit enhancements, and other forms of financing. Such financing would lower the cost of projects that would otherwise stall due to a lack of upfront capital.

Over time, the national green bank’s investments will lead to a nationwide ecosystem of financing institutions, contractors, developers, and suppliers to drive the carbon-to-clean transition. Several features of the national green bank would allow it to make this transformative impact, including the following:

It delivers environmental and energy justice, and helps enable an equitable transition to a clean energy economy. The national green bank will develop and offer innovative financial products and other initiatives that specifically target the needs of low-income and disadvantaged communities. These products will include community ownership models that allow disadvantaged communities to build wealth; projects that generate substantial energy savings; and investments that replace polluting energy infrastructure, which causes substantial negative health impacts for nearby communities, with clean alternatives.

It is based on the proven green bank model already in place in seventeen states and the District of Columbia. The model for the national green bank has already been tested over the past decade, and it is proven to be financially sustainable and highly effective at bringing private capital into clean energy markets. The twenty-two state and local green banks of the American Green Bank Consortium have collectively used $2.5 billion of public and philanthropic funds to support $9 billion in overall investment in emissions-reducing projects. During that period, green banks have experienced default rates under one half of one percent.

It leverages existing community finance institutions and new green banks to build a national network. The national green bank will seed and provide technical support to state and local climate banks, minority depository institutions, CDFIs, credit unions, and other nonprofits. It will work with cities and states to create new green banks, and provide loan capital, operating grants, and equity support to any community-focused financial institution that is committed to investing in green projects.

It “crowds in” private investment, leveraging public dollars at a rate of up to $10 to $1. According to a study by Vivid Economics, the national green bank will leverage every public dollar to spur up to $10 dollars of total public-private investment over a ten-year period. It will do this by using co-investment and credit enhancements to entice private investors to invest in green projects; aggregating and securitizing loan assets so network members can reinvest their money quickly; and providing equity capital to any network members who are able to immediately borrow against it and increase overall investment.

It makes investment decisions to maximize emissions reductions per public dollar. The same study by Vivid Economics projects that investment decisions based on maximizing emissions reductions per public dollar will allow the national green bank to reduce annual carbon emissions in the United States by 92 million metric tons by its tenth year in operation.

It supports an existing project backlog of more than $21 billion. The national green bank is ready to begin investing immediately. The American Green Bank Consortium has an existing backlog of $21 billion dollars in near-investment-ready projects, including $200 million worth of projects targeting low-and-moderate income communities, nonprofits, public schools, and affordable housing that are shovel-ready today.

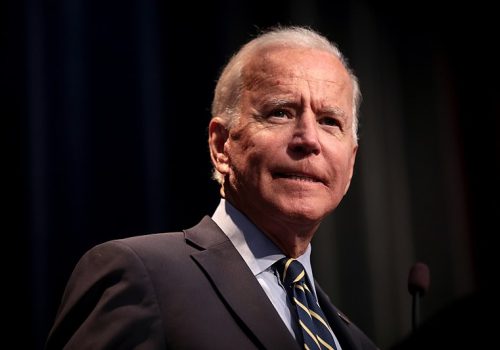

Capitalizing a national climate bank would provide a long-term, comparatively low-cost solution to reduce the United States’ reliance on fossil fuels and its greenhouse gas emissions, while lowering families’ energy bills and creating new clean energy jobs. It will play a key role in meeting President Joe Biden’s GHG emissions reduction targets and Justice40 commitments.

Ken Berlin is a Senior Fellow at the Atlantic Council Global Energy Center.

Meet the author

Related content

Learn more about the Global Energy Center

The Global Energy Center develops and promotes pragmatic and nonpartisan policy solutions designed to advance global energy security, enhance economic opportunity, and accelerate pathways to net-zero emissions.