Women in Venture Capital: “We don’t need to fix women—we need to fix the system,” says Middle East investment executive

On July 14, 2021 the Atlantic Council’s empowerME Initiative held a workshop on “Angel and Venture Capital Investments: How to become an Angel Investor or VC,” featuring a keynote fireside chat with Lazard Gulf Limited CEO Farah Foustok, which was moderated by Atlantic Council Nonresident Senior Fellow Nadereh Chamlou, and a panel discussion with HOF Capital General Partner Tala Al Jabri, Outliers Venture Capital Founding Partner Mohammed Almeshekah, OQAL Angel Investors Network Founder & Chairman of the Board of Trustees Faris AlRashed, and Purple Sage Ventures Founding Partner Liz Leahy, which was moderated by Atlantic Council empowerME Director and Resident Senior Fellow Amjad Ahmad.

This workshop is part of the Igniting Women’s Entrepreneurship and Innovation in Saudi Arabia program led by the Atlantic Council’s empowerME Initiative in partnership with the US Mission to Saudi Arabia, the American Chamber of Commerce Saudi Arabia, and Quantum Leaps. The program is bringing US entrepreneurs, experts, and business leaders together with their Saudi counterparts to build relationships, share knowledge, and develop partnership opportunities via hybrid workshops and networking sessions. If you are a Saudi woman interested in attending workshops on topics relating to entrepreneurship, venture capital and angel investing, and leadership, please sign up here to receive invitations.

Key takeaways:

Saudi Arabia’s changing venture capital and angel investing ecosystem

- Amjad Ahmad emphasized the opportunity the Middle East and Saudi Arabia. in particular, has to develop more women investors: “As a venture and capital growth investor in the Middle East for nearly two decades, I am heartened by the rise of entrepreneurship and venture capital (VC) in the last several years. As the industry continues to develop, we need to ensure it is accessible to women. Unfortunately, globally this has not been the case. To highlight one example, in a developed market like the US, only 4.9 percent of VC partners are women. The Middle East, and mainly Saudi—being one of the largest economies in the region—has an opportunity to implement the right policies, laws, and best practices to show global leadership in women’s participation in the investment industry.”

- Faris AlRashed shared data about changes he has witnessed as the founder of the first angel investing network in Saudi Arabia. Oqal has invested in ninety-eight companies from 2011 to today—14 percent of those with women founders. But looking at data from only the last three years, 32 percent of the companies Oqal funded have women founders. This shift is an indication that things are “moving strongly in the right direction,” said AlRashed. He added that, while he is seeing more women participating as angel investors, the investors are still primarily male. He pointed out that one angel investor network in Saudi Arabia is women-run and has only women investor and also pointed to the success of two of Oqal’s CEOs—one former and one current and both women—who now are partners in VC funds.

Paths to becoming an investor

- Farah Foustok did not take a direct path to becoming an investor. She worked at Morgan Stanley and left because she “looked around and didn’t see role models” or anyone she “could confide in or who could advise her.” She became an entrepreneur in Argentina and failed and lost everything. She eventually came back to the Middle East in 2005 and used her experiences as an entrepreneur to get into the investment field. She said, “you can reinvent yourself if you are determined and persistent” and practice “continuous upskilling and reinvesting in yourself.”

- Tala Al Jabri said that venture capital found her and what attracted her “was being exposed to innovation, a diversity of founders, and continuous learning.” She started as a management consultant but wished she could see her work through in a more meaningful way. As it turned out, her management consulting work was a stepping stone that she used to create opportunities for herself and get involved in venture capital investing.

- Liz Leahy “went to the school of VC by being an entrepreneur, raising funds, and having to sit in board meetings and answer questions.” Her experience as an entrepreneur helped prepare her to be a great investor because she understands what it takes to succeed as well as what questions to ask.

- Mohammed Almeshekah said, “there is no single path to venture” and pointed to examples of prominent investors who had diverse backgrounds and didn’t necessarily come from the financial sector.

Factors that make good investors

- Farah Foustok described “the importance of having mentors” and a “personal board of advisors” as well as a “global network.” She also urged people to “live and work by your values.”

- Mohammed Almeshekah said that the wisdom he hears from top investors about what makes a good investor is twofold: (1) “you’ve got to have a deep desire to live by and be part of the success of others” and (2) you’ve got to have “very strong convictions that you inherently build in the founders and businesses you invest in.” Almeshekah also emphasized that you must have “a hunger and desire for learning” to succeed in VC.

Steps needed to get more women to become investors

- Farah Foustok said more must be done to “convince women to come into the finance sector” and described her work to establish mentoring programs and leadership programs for women as a “leadership responsibility” for women in management with the ability to implement change. She outlined the work of Reach, the mentoring program she started in 2013, that pairs entry-level women in the workplace with mentors with fifteen-plus years of experience for a one-year program. She also discussed a speed mentoring program she spearheaded that offers participants access to men and women mentors, saying that it is essential that “men and women work together to make sure we invest in the next generation.” In the same vein, she discussed her work as the founder of the Gulf Cooperation Council chapter of the 30% Club, which is taking action to increase gender diversity on boards and senior management teams.

- Farah Foustok also highlighted the steps recommended by the B20 Women in Business Action Council under Chair Rania Nashar’s leadership. “We’re not fixing women, we’re fixing the system,” said Foustok, as she explained the three key initiatives of the Action Council’s plan: (1) creating an equal playing field for women in the workplace, (2) eliminating barriers to allow women to have access to finance and expertise, and (3) amplifying synergies because too many initiatives for women are done in isolation, which leads to a duplication of efforts. “What is needed is a collaboration between governments, stakeholders, and the private sector” to tackle these issues, said Foustok.

- Liz Leahy emphasized that, while VC used to be perceived as not accessible to women and very much “an apprenticeship job” that required a job offer from people you know, things are changing significantly in the United States with more of an emphasis on recruiting women, more women finding their way in, and more funds led by and for women starting. She recommends that people consider working in accelerators or incubators to learn more about VCs and added that “it’s an exciting time” because the “past year has given a pause for funders and entrepreneurs to coalesce.”

- Mohammed Almeshekah urged people interested in VC to “go and connect” with people in the field and to not “be shy about asking” for a meeting, advice, or even a job or internship. As he put it: “People are getting more and more exposed to networking. No one gets hired for a job through an application. They get asked or put themselves out there. Half of reaching your goals is asking for what you want.”

- Tala Al Jabri advises those interested in VC to “create opportunities for yourself” by thinking about your strengths, reaching out to people you want to learn from or collaborate with, and proposing partnerships.

Poll Results

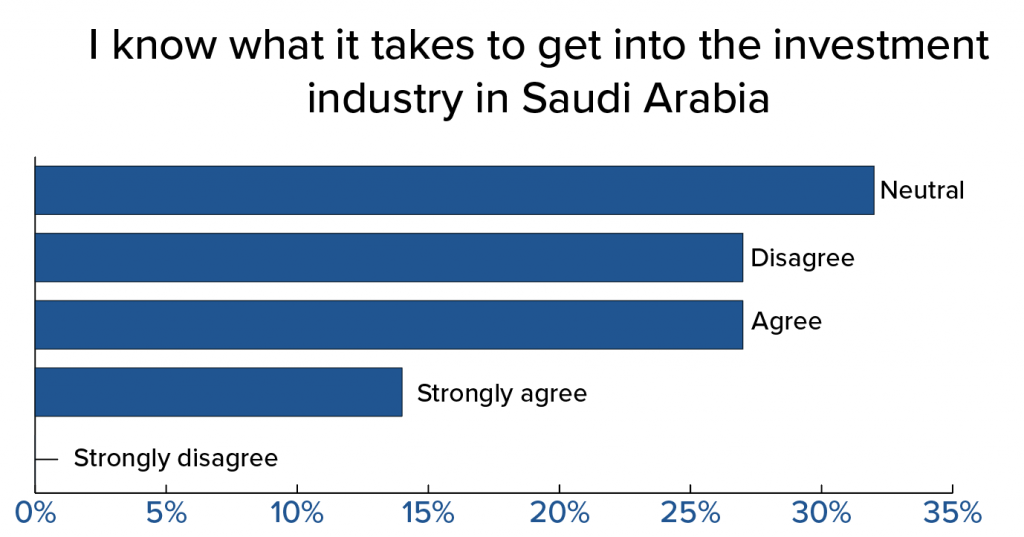

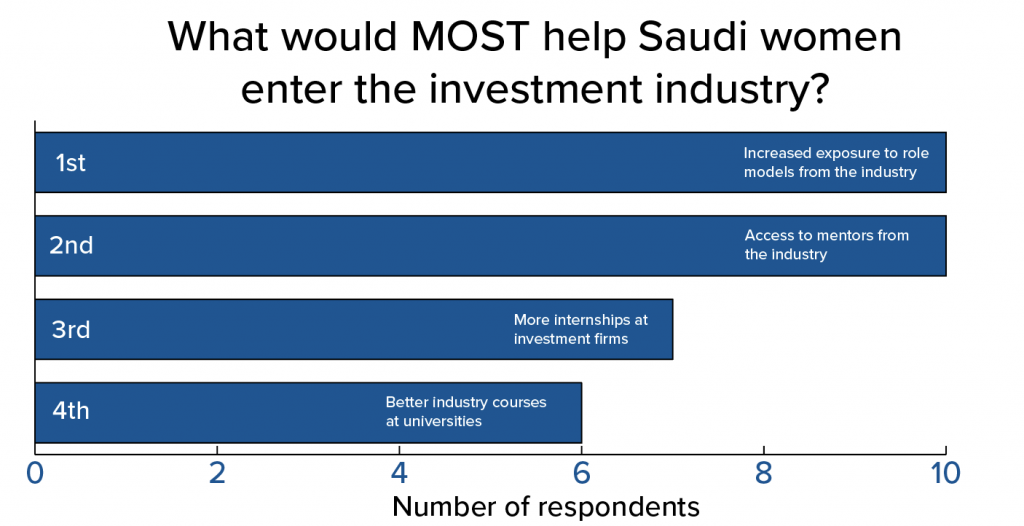

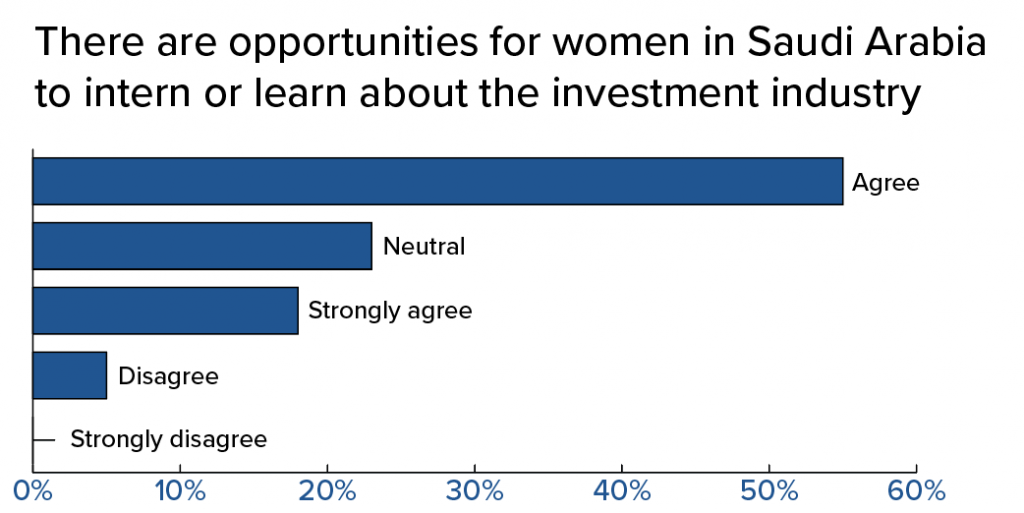

At the workshop, attendees took a poll related to investment careers for women in Saudi Arabia. As the results below indicate, a majority of the participants agree or strongly agree that there are investment career opportunities for Saudi women, but the majority of them are also not sure how to get into this field. A majority of participants said that increased exposure to role models from the industry as well as industry mentors would help more Saudi women get into investment careers.

Stefanie H. Ali is deputy director of the Atlantic Council’s empowerME Initiative. Follow her @StefHausheer.