Over the past six months, the Group of Seven (G7) has leveraged the combined force of the dollar, euro, pound, and yen to exact a heavy toll on the Russian economy. The backbone of this strategy rests on the way the world uses the dollar as an international reserve currency and the overwhelmingly preferred settlement mechanism in global currency exchanges. Nearly half of the world’s trade is conducted in dollars, which also comprise approximately 60 percent of global foreign-exchange reserves.

But everything has a price. By imposing sanctions and freezing assets in response to Russia’s invasion of Ukraine, the G7 has reawakened a long-simmering debate about dollar alternatives. The idea of “de-dollarization,” or reducing a country’s reliance on the dollar, has gained momentum: From Russia to China—and to many non-aligned countries in between—there is a fear that overreliance on the dollar gives the United States too much leverage.

But what are the realistic alternatives to the dollar that US and allied policymakers should be paying attention to?

How money moves

Let’s start with SWIFT: The Society for Worldwide Interbank Financial Telecommunications is a messaging system that banks use to conduct international transactions. Despite some misconceptions, no actual financial transactions occur on SWIFT: Its value lies in the role it plays in safe, secure, and efficient communication between banks. When it was founded in the 1970s, it connected 239 banks across fifteen countries. Today, it connects over eleven thousand financial institutions in more than two hundred countries and territories, making it the primary mode of communication about international transactions. SWIFT is a private cooperative, owned by two thousand entities; it is headquartered in Brussels and overseen by a group of banks including the US Federal Reserve (Fed), the European Central Bank, and several individual banks in the European Union, in addition to the banks of Japan, England, and Canada. The United States and the European Union, therefore, play a key role in its governance.

Since SWIFT does not hold any bank accounts, the actual fund clearance and settlement occurs using the Fed-owned Clearing House Interbank Payments System (CHIPS). On average, CHIPS cleared close to $1.8 trillion in transactions daily. The system has forty-three direct participants, which are all US banks or foreign banks with US branches, and eleven thousand indirect participants, which are banks without US branches who are engaged in the system through their accounts with direct participants. Through its participants, CHIPS covers over 96 percent of dollar-denominated cross-border transactions. CHIPS works in parallel with the Fed-owned Fedwire Funds Service to actually clear and settle transactions.

Together, SWIFT, CHIPS, and Fedwire broadly cover almost all dollar-denominated international transactions. They create a network effect that is nearly impossible to rival. How do their alternatives stack up in comparison?

Today’s challengers: Russia and China

Russia began developing its System for Transfer of Financial Messages (SPFS) after being hit by a round of sanctions following the 2014 annexation of Crimea. It functions as an alternative to SWIFT for transmitting information across four hundred domestic Russian banks and around fifty international entities primarily from Central Asia. Although reports have recently emerged about central banks in India, Iran, and China connecting to SPFS, the system is still primarily a mode for domestic interbank communication in Russia.

On the other hand, China’s Cross-Border Interbank Payments System (CIPS) is an alternative to the CHIPS system. It was created in 2015 to function as a settlement and clearance mechanism for yuan transactions. Like CHIPS, it is supervised by a central bank (in this case, the People’s Bank of China) and requires direct participants to be within its jurisdiction. Interestingly, participants can message each other through the CIPS messaging system, but 80 percent of transactions on CIPS rely on the SWIFT infrastructure. This is partly a result of the need to translate messages, which is more efficiently done through the SWIFT network. CHIPS has ten times as many participants as CIPS and processes forty times as many transactions as CIPS.

Yuan transactions only amount to 3.2 percent of all transactions using SWIFT. China’s political goals to internationalize its currency, which led to the creation of CIPS, conflict with the capital controls on the yuan, making the yuan less attractive as a currency than the dollar. That doesn’t mean there isn’t interest in expanding the role of CIPS: unverified reports suggest that the volume of transactions through CIPS has grown by 50 percent per year.

Both CIPS and SPFS offer incomplete alternatives to the powerhouse combination of SWIFT, CHIPS, and Fedwire. These challengers have a smaller network and smaller scope, but most importantly, they do not impact the prevalence of dollar-denominated international transactions.

Still, it is important to note that they were both created following the imposition of stricter financial sanctions on the countries that designed these systems. As US officials tighten sanctions measures, there will be more incentive for countries to participate and grow the network of these alternative payment rails. This is an important balancing act for sanctions policymakers.

The idea of getting around the dollar isn’t limited to US adversaries like Russia or competitors like China. Countries like India, Indonesia, Brazil, and South Africa are all exploring changes in the way they process cross-border payments and the possibility of reducing their reliance on the SWIFT system.

Playing a new card

Looped into these payment networks are credit- and debit-card schemes connecting consumers to merchants across the world. Visa, Mastercard, and American Express are the three largest companies that allow cross-border and domestic payments. Visa and Mastercard each reach close to 53 million global merchants in over two hundred countries. Chinese banks in 2002 launched an alternative payment network: UnionPay, which enjoyed a monopoly over China’s domestic markets until 2020, when China began to allow international card schemes. Today, UnionPay connects 55 million merchants in 180 countries, including 37 million merchants located outside of China.

Since Visa and Mastercard suspended their services in Russia, UnionPay has emerged as one of the only options for cross-border transactions for Russians. Another one of those options is Mir, Russia’s homegrown card scheme. Mir, which was developed during the 2014 round of sanctions on Russia, has become popular because it is used for pension and public-sector payments domestically and can be used by Russians living abroad. Over one hundred million Mir cards have been issued, and several countries, including Turkey and Iran, have expressed interest in joining Mir’s network. Additionally, Russian banks have been doing business with UnionPay for several years, and given UnionPay’s large network, Mir could partner with UnionPay to expand its reach with marketing or even co-branded cards.

A focus on fintech

Increasingly, fintech alternatives to traditional payments are cropping up in the form of wallets and platforms that enable primarily retail payments. AliPay and WeChat Pay, run by Chinese fintech companies, are the two most popular digital wallets globally. AliPay and WeChat Pay each have more than a billion users, while their closest competitors (ApplePay and GooglePay) have around four hundred million to five hundred million users each. While reports differ, some sources say AliPay is in use in up to 110 countries and WeChat Pay is in use in up to fifty countries. The digital wallets are primarily used in domestic payments, and transactions are designated in the local currency of the country.

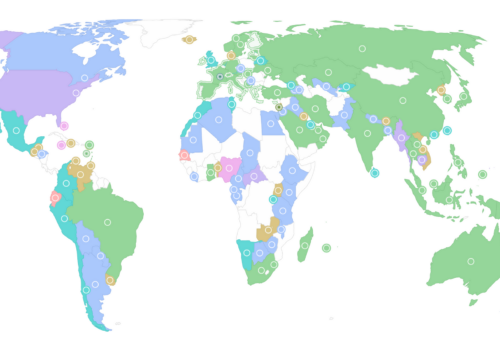

Central bank digital currencies (CBDC) have become popular among countries looking for an alternative to the dollar-based financial system because they can be faster, cheaper, and more efficient than the existing cross-border payments rails. According to Atlantic Council research, there are now twelve cross-border CBDC experiments underway. One of the projects, Multiple CBDC Bridge (mBridge), connects Thailand, Hong Kong, China, and the United Arab Emirates in a multi-currency exchange bridge, which offers a cheaper, more efficient, less risky, and faster transaction pipeline than existing systems. Wholesale CBDCs, which are intended for institutional transfers between banks, are a new way in which countries are both solving problems in the payments architecture while creating new networks of payments transfers. These systems, though not yet ready for full launch, could help countries bypass SWIFT and develop an alternative financial architecture.

Over time, these innovations could erode the way the dollar’s global dominance is used to make sanctions effective. That’s certainly the hope in Beijing: According to the International Monetary Fund (IMF), the People’s Bank of China has three hundred staff members solely dedicated to its CBDC—that’s larger that the entire staff of most other countries’ central banks.

How to keep the dollar on top

De-dollarization is not a new idea—but both fintech innovation and the weaponization of the dollar via sanctions have breathed new life into an old debate. Given China’s capital control over yuan transactions and its lack of liquidity, the dollar still reigns as the preferred stable and easily convertible currency for international payments. Transactions done with credit cards or fintech solutions still form a small portion of global foreign exchange flows and are not the main target of sanctions. And given the Fed’s interest rate hikes, the dollar’s value is surging.

But threats to the dollar are looming in the distance: The yuan’s share in global payments has seen an uptick this year, and given the energy crisis, countries could be convinced to offer ruble or yuan swap lines and increase the share of these currencies in their balance sheets. Over time, if the United States does not lead with allies in their own technological innovation, many countries will seek alternatives. There have been some early steps in this direction: Last week, the Biden administration released a slew of reports on digital asset regulations. Some of these reports detailed the possible design for a dollar-based CBDC. But since that may be years away, the Fed is set to test the Fednow Service in 2023, creating a much faster payments system within the United States.

While the dollar isn’t going anywhere any time soon, it may find it has some unexpected company in the international financial system sooner than it would like.

What is there to do? US leadership must work to curb the growing fragmentation in the global payments landscape. This can be achieved by clarifying domestic regulations, especially when it comes to the Fed’s authority in issuing digital dollars and the role of dollar-backed stablecoins. The United States cannot lead without a model; and for this, it will have to encourage innovation on CBDCs but also in the form of more efficient private-sector payments options. Finally, the United States has a crucial role in setting global standards and needs to be more active at the Group of Twenty (G20) and IMF on these issues. This would serve two purposes: It would ensure that innovation in the payments landscape does not lead to more fragmentation and also would make clear which countries are interested in collaborating—and which ones truly want to carve out a different path.

Ananya Kumar is the assistant director for digital currencies at the Atlantic Council’s GeoEconomics Center.

Josh Lipsky is the senior director of the GeoEconomics Center.

Further reading

Fri, Sep 16, 2022

How long before there’s a digital dollar?

New Atlanticist By

Experts from our GeoEconomics Center break down the new Treasury Department recommendations on digital assets.

Thu, Jul 28, 2022

Keeping everyone in the club: How sanctions complicate the Bretton Woods Institutions’ job

Econographics By Mrugank Bhusari, Maia Nikoladze, Amin Mohseni-Cheraghlou

With a voting majority at the Bretton Woods Institutions, the G7 and EU can collectively ask the institutions to comply with their sanctions. This is complicating the IMF and World Bank's functions.

Fri, Jun 17, 2022

Where do the “fence-sitters” sit on trade with Russia?

Econographics By

At least in terms of trade, seemingly neutral countries aren’t enabling Russia as much as their public positions might suggest.

Image: US one hundred dollar notes are seen in this picture illustration taken in Seoul on February 7, 2011. Photo via REUTERS/Lee Jae-Won