China’s faltering zero COVID policy

As Beijing doubles down on “dynamic clearing,” widely known as the “zero COVID” policy, our experts continue to unpack the domestic political drivers, economic repercussions, and the political, diplomatic, and human costs.

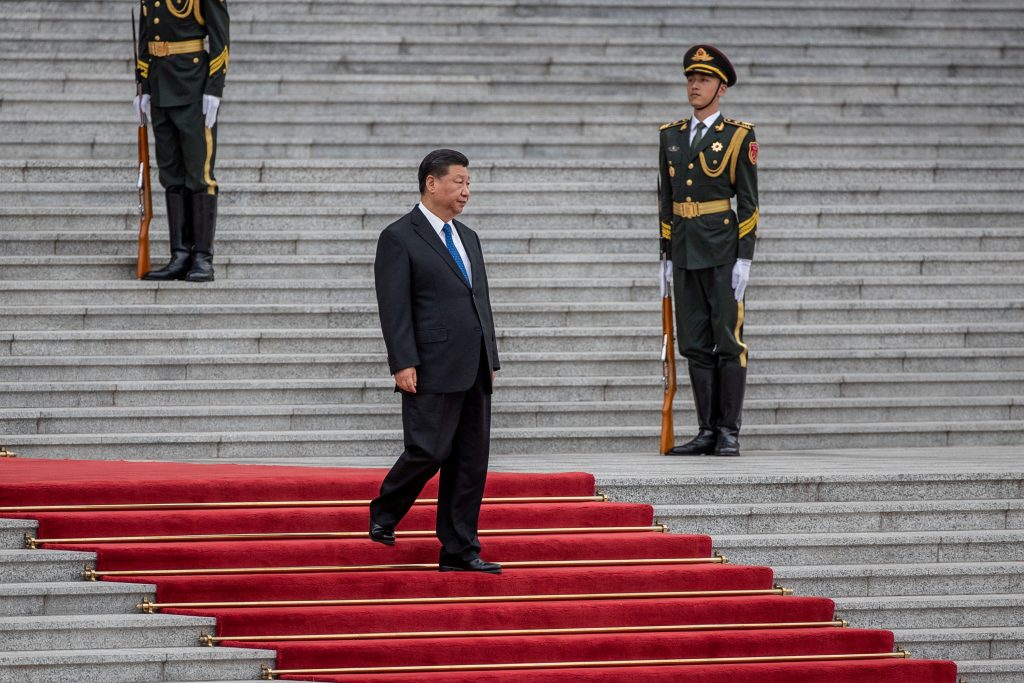

How badly has the recent turn in Beijing’s policy undermined the domestic narrative of China’s superior pandemic response and the stature of Xi Jinping’s rule? Explore content below to learn more.