Nobel Prize-winning economist Amartya Sen,

The expansion of freedom is both the primary end … and the principal means of development.”

Development as Freedom

In the wake of Latin America’s “Lost Decade,” many Latin American countries adopted market-oriented investment laws in hopes of attracting global capital. Perceiving that the lack of public-sector constraint was a catalyst for the 1980s debt crisis, these institutions aimed to “tie the hands” of subsequent governments with procurement provisions. For example, Brazil’s 1993 Procurement Law was adopted in the wake of its Brady Bond restructuring in which Western bankers converted the country’s defaulted bank loans into global bonds. In essence, Brazil gained capital-market access in exchange for establishing market-friendly institutions, including laws that promoted public-sector efficiency through public procurement. Supported by the United States and international financial institutions, such as the International Monetary Fund (IMF) and the World Bank, this pattern was repeated throughout the region with most Latin American states constitutionally adopting such procurement laws.

If we fast forward through time and space to the early twenty-first century, this institutional architecture has successfully infused investment into Latin American markets. For example, over the last three decades, Brazil’s 1993 Procurement Law has helped catalyze a whopping 900 procurement projects totaling more than $338 billion:1Stephen B. Kaplan, Globalizing Patient Capital: The Political Economy of Chinese Finance in the Americas (Cambridge, United Kingdom: Cambridge University Press, 2021). a boon to the Brazilian business community. Surprisingly, however, in the prelude to the largest public tender in Brazil’s history—a $9 billion auction of its fifth-generation wireless network in 2021—the market-friendly Bolsonaro administration was considering legally barring China’s technology giant Huawei from participating, raising several questions. Politically, why would the Brazilian government interfere with the country’s constitutionally mandated procurement system,2Section XXI of Article 37 of the 1998 Brazilian constitution requires that public services are contracted through public tender. a bedrock of its free-market legacy? Economically, why would the Bolsonaro government threaten to block Huawei, a major technology provider in Brazil for over two decades, from building 5G networks?

The answer reflects geopolitics—mainly US concerns about Chinese technology posing a threat to data protection, intellectual property rights, and national security. For example, the 2022 US National Security Strategy aims to “counter the exploitation of American’s sensitive data and illegitimate use of technology, including commercial spyware and surveillance technology.”3White House, National Security Strategy, October 2022, https://www.whitehouse.gov/wp-content/uploads/2022/10/Biden-Harris-Administrations-National-Security-Strategy-10.2022.pdf. However, outright technology bans risk unintentionally casting a cloud over the historic US commitment to market institutions and economic freedom, which are important hallmarks of its historic soft power. Trade liberalization has been historically popular in much of Latin America,4Andy Baker, The Market and the Masses in Latin America: Policy Reform and Consumption in Liberalizing Economies (Cambridge: Cambridge University Press, 2009). notwithstanding recent deteriorating public satisfaction with democracy, which has fallen by about 10 percent since 2004.5Latin American Public Opinion Project, America’s Barometer, Vanderbilt University, 2021. The United States should thus concentrate on creating economic opportunities regionally, rather than risk geopolitics undermining longstanding market norms.

Exporting patient capital: Externalizing China’s state-led development model

In the mid-1990s, China struggled to raise global market financing for the construction of the Three Gorges Dam, a massive hydroelectric power plant and the largest water-supply development in human history. Due to its size and international concerns about environmental sustainability, multinational and bilateral lenders including the World Bank and the US Export-Import Bank balked at providing project financing to the state-owned contractor, China Three Gorges Corporation. Against this backdrop, the China Development Bank (CDB) opted to finance the dam, pioneering its new brand of “development finance,”6Chinese government and financial officials have also referred to this type of banking as “vendor financing,” “low-profit money,” and “for-profit development” in which the bank would increasingly occupy the market space between a policy bank and a commercial bank. Over the long run, however, once the dam produced electricity, not only was the project profitable, but China Three Gorges Corporation became a global market player, acquiring financial stakes in other global energy firms.7Henry Sanderson and Michael Forsythe, China’s Superbank: Debt, Oil and Influence–How China Development Bank Is Rewriting the Rules of Finance (New York: Bloomberg Press, 2013).

Similarly, the CDB has catalyzed financial expansions internationally as part of China’s “go global” strategy. Brandishing a balance sheet that was on par with the United States’ Big Four banks, JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo,8“Large Commercial Banks, Ranked by Consolidated Assets,” Federal Reserve Statistical Release, March 2019; and David Sanders, “Top 25 Safest Banks in China in 2018,” Global Finance, November 1, 2018, https://www.gfmag.com/magazine/november-2018/safest-banks-china-2018. the CDB extended credit lines to national governments through joint development funds and other cofinancing initiatives. Whereas

Western commercial banks and even multilateral banks had to ensure individual projects were profitable over the short-to-medium term to appease their shareholders, the CDB had the ability to emphasize the longer term, as a form of “patient capital.”9Kaplan, Globalizing Patient Capital. Its mandate was to meet government objectives with market-oriented instruments, affording the bank more time to both reach profitability and comply with state guidelines. Although Chinese policy bankers also demand a return on their capital, they incorporate a longer payback period in their lending structure to encourage “market maximization.” In other words, they aim to grow China’s total corporate earnings within important markets, rather than boosting the profitability of a single project or firm.10Kaplan, Globalizing Patient Capital. Policy banks, such as the CDB and Export-Import Bank of China, are thus aiming to develop long-term markets rather than to maximize short-term profits.

During my field research in China over the past half decade, officials from both policy banks routinely referred to the importance of using “weighted outlooks for respective returns or revenues” from these projects.11Kaplan, Globalizing Patient Capital. According to one veteran policy bank manager: “It’s not one port or one project; it is bringing the whole picture together. There may be risk or uncertainty in any one element, but in the long run, the whole picture comes together.”12Kaplan, Globalizing Patient Capital.

For example, beginning in 2001, the CDB provided about $45 billion in lines of credit to telecommunication equipment makers13Sanderson and Forsythe, China’s Superbank. such as Huawei and ZTE, helping them become key players in the global technological marketplace in the early twenty-first century. They reached this status in part by taking advantage of “vendor financing,” a key element of China’s patient capital. In Brazil, for instance, Huawei used CDB lines of credit to lend money to local Brazilian companies who then purchased Huawei’s telecommunications equipment.14Sanderson and Forsythe, China’s Superbank; and “Huawei’s $30 Billion China Credit Opens Doors in Brazil, Mexico,” Bloomberg News, April 25, 2011. The CDB, and ultimately the Chinese government, did not judge the success of this banking activity on the profitability of one loan, but rather the extent to which they had created new telecommunications markets for Chinese firms overseas. Over the last two decades, China has expanded its web of commercial ties in the Brazilian telecommunications sector, where today the country’s three largest cellphone operators, Vivo, Claro, and Oi, are using Huawei technology in about two-thirds of their 3G and 4G networks.15Giovana Fleck, “Why Huawei Was Almost Excluded from the 5G Race in Brazil,” Civic Media Observatory, May 28, 2021.

The challenges of competing with China

Cheap financing gives China’s state-backed firms a competitive advantage when breaking into new markets overseas and thus a competitive edge globally. The United States, meanwhile, has aimed to compete with China using diplomatic levers and alliance channels. For example, it convinced such countries as Australia16“Huawei and ZTE Handed 5G Network Ban in Australia,” BBC News, August 23, 2018. and Canada17Annabelle Liang, “Canada to Ban China’s Huawei and ZTE from Its 5G Networks,” BBC News, May 20, 2022. to ban Huawei and ZTE from building their 5G networks. However, this has proven to be a less effective strategy in the developing world, where alternative providers (e.g., Ericsson and Nokia) have a smaller historic commercial presence, and where many countries must significantly upgrade their digital infrastructures. For example, Huawei has a longstanding commercial relationship in Argentina and Brazil, after constructing 70 percent18Jieyu Zhang, “5G Xianxing, Dazao Zhongguo-Agenting Keji Hezuo Xin Liangdian,” China Institute of International Studies, November 9, 2020. The 70 percent construction reference for Argentina refers to 2G, 3G, and 4G networks. and 85 percent19Margaret Myers and Guillermo García Montenegro, “Latin America and 5G: Five Things to Know,” The Inter-American Dialogue, December 14, 2019. of their mobile networks, respectively. Aiming to close its technological gap, Colombia—whose mobile connectivity has ranked behind a half dozen regional peers20Colombia ranked below Argentina, Chile, Mexico, Panama, Peru, and Uruguay on the 2019 GSM Association Mobile Connectivity Index. See Connected Society: The State of Internet Connectivity, GSM Association, 2019, https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2019/07/GSMA-State-of-Mobile-Internet-Connectivity-Report-2019.pdf. — has also had pilot tests of the 5G Huawei network.21Ranine Awwad, “Serious Steps to Deploy 5G Networks in Colombia,” Inside Telecom, July 9, 2020.

Why would Latin American countries risk such important development opportunities to help protect US national security, when the United States no longer has a near-technological monopoly?22Chad Bown, “The Return of Export Controls,” Foreign Affairs, January 24, 2023. In this regard, the strategic doctrine of Active Non-Alignment,23Carlos Fortin, Jorge Heine, and Carlos Ominami, eds., El No Alineamiento Active Y America Latina: Una Doctrina Para El Nuevo Siglo (Santiago, Chile: Editorial Catalonia Ltda., 2021) or avoiding aligning with either the United States or China, might appeal to many Latin American governments feeling caught in the middle of US-China competition. Beyond Brazil, the Trump administration reportedly also tied new Ecuadorean bilateral loans intended to help repay its Chinese debts to the US “Clean Network” program, effectively excluding Chinese telecommunications companies from building Ecuador’s 5G network.24Demitri Sevastopulo and Gideon Long, “US Development Bank Strikes Deal to Help Ecuador Pay China Loans,” Financial Times, January 14, 2021 Such initiatives risk obscuring the US commitment to public procurement laws, market openness, economic competition, and transparency in the hemisphere. Why not instead develop investment alternatives, as the United States has done with AT&T Mexico, collaborating with Nokia to support developing 5G innovation and infrastructure throughout the country?

China’s growing investment diversification: A US opportunity

After reaching a peak of $67 billion outstanding, or one-tenth of Latin America’s external debt in 2017, China has been steadily unwinding its Latin American state-to-state financial ties.25Kaplan, Globalizing Patient Capital. This financial deleveraging has been driven mostly by Ecuador and Venezuela, two countries where Chinese policy banks mispriced investment risk and became financially overextended. As a rising “developing country creditor,” China had hoped to offer a new brand of development financing by offering overseas lending without policy conditionality. Emphasizing South-to-South financial cooperation, China aimed to use its development finance to cultivate a Chinese commercial presence in key strategic sectors in developing economies. Avoiding the stringent macroeconomic conditions that are typically required by Western multilateral institutions, Chinese lending instead emphasized microeconomic incentives. Policy banks employed commercial conditions to hedge China’s bilateral credit risk through loan-for-oil deals, betting that oil proceeds would both help guarantee debt repayment and also expand China’s commercial footprint in the Latin American energy sector.26Stephen B. Kaplan and Michael Penfold, “The Story of the Creditor Trap: How China Reduced its Venezuelan Risk,” Foreign Affairs Latinoamérica, April/June 2019; and Stephen B. Kaplan and Michael Penfold, “China-Venezuela Economic Relations: Hedging Venezuelan Bets with Chinese Characteristics,” in Authoritarian Allies: Venezuela’s International Relations and Regime Survival, ed.Cynthia J. Arnson, Woodrow Wilson Center Reports on the Americas no. 43, 2021.

China has experienced a creditor learning curve, discovering that sovereign credit risk cannot simply be mitigated by collateralizing policy bank loans with natural resources. Even when loan repayment is tied to national commodity income, loan profitability is dependent on prudent local governance that sustains state-owned enterprises’ resource production. When there is substandard national resource governance, Chinese policy banks have little recourse beyond extending new funds in hopes of recovering natural resource collateral. As one former CDB official explained in a December 2019 interview for my book, Globalizing Patient Capital, “It’s not like lending to one province of China; you cannot order another country to do what you think is right.”27Author’s interview for Globalizing Patient Capital, December 16, 2019.

Chinese policy banks have thus adopted a defensive lending posture with many of their major Latin American borrowers by renegotiating state-to-state loan terms. Ironically, China’s patient investment has also yielded a patient restructuring approach, where China’s main state-backed overseas creditors have extended debt relief to highly indebted countries in hopes of recuperating their bad investments during better times. For example, the China Development Bank and Export-Import Bank of China, tend to avoid recognizing short- or medium-term losses in their banking portfolios, granting payment deferrals rather than outright debt forgiveness. After first approving Venezuelan debt relief in 2016, China extended its debt moratorium through the pandemic, allowing the country to defer its principal payments, reduce its underlying oil collateral, and extend repayment deadlines. In Ecuador, Chinese policy banks extended principal payment deferrals valued at $891 million between 2020 and 2022. More recently, President Guillermo Lasso successfully negotiated with China’s policy banks to extend bilateral debt relief on oil-backed debt servicing though 2025.

China’s mispricing of credit risk and debt difficulties have contributed to a deterioration in its political influence, creating a regional opportunity for the United States. For example, in Ecuador, public perceptions of China have deteriorated in recent years against the backdrop of growing concerns that the former Rafael Correa government had mortgaged as much as four years of Ecuador’s future oil production through its China loan-for-oil deals.28Kaplan, Globalizing Patient Capital. By 2021, nearly three-fifths of Ecuador’s population deemed China “untrustworthy,” compared to less-than-half of the population mistrusting China in 2014. The region has witnessed a similar pattern, with trustworthiness of the Chinese government falling by about 20 percent over the last decade.29Latin American Public Opinion Project, America’s Barometer, Vanderbilt University, 2021. Scholars have also found that public sentiment regarding China varies by economic sector, with Brazilian politicians representing regions hurt by Chinese import shocks more likely to hold negative views about China.30Daniella Campello and Francisco Urdinez, “Voter and Legislator Responses to Localized Trade Shocks from China in Brazil,” Comparative Political Studies 54, no. 7 (2021), 1131-1162.

In response to such negative optics and mispriced investment, China’s creditors have deleveraged their financial positions, and diversified away from their bilateral debt holdings in the region. Debt spirals and governance crises have threatened to erode China’s regional soft power, after it steadily developed deep trade and investment ties over the past two decades. To mitigate its sovereign risk, China is experimenting with market-based and multilateral solutions. With an eye to diversifying its sovereign risk beyond debt financing, China has created more than $40 billion in state-backed Latin American equity funds. Not only are these state-owned asset managers an important part of China’s 2013 Third Plenum market reforms, they also enable Chinese policy banks to increasingly engage with the private sector internationally by directly investing in Latin American corporate enterprises. Notwithstanding the lofty headline numbers, China’s state-backed equity investors have deployed only $2 billion in Latin America, or about 5 percent of the total funds committed by their shareholders.31Author’s interview with state-backed equity fund manager for Globalizing Patient Capital, January 14, 2020. China’s gradual shift in investment tools is also timed to take advantage of a changing Latin American context in which governments, including in Argentina and Brazil, have increasingly employed private procurement. In recent years, both countries passed public-private partnership laws to relieve national budgetary pressure by delivering public services outside the public balance sheet.

In the world of finance, shifting from debt-to-equity financing is a common way to mitigate credit exposure. The key question is whether China is moving forward quickly enough with these private-sector initiatives to avoid its mounting state-to-state problems. The growth of foreign direct investment (FDI) flows in recent years, which has surpassed state-to-state lending as the primary channel for new Chinese financial flows to the region,32Felipe Larraín and Pepe Zhang, “China’s Evolving Presence in Latin America,” America’s Quarterly, January 3, 2023. suggests China is adjusting fairly swiftly.

Leveraging US competitive advantages

With China employing more market-oriented investments regionally, the country is developing a greater presence in Latin America’s private sector, which is an area of historic competitive advantage for the United States. China initially made its foray into Latin American financing by offering its patient form of capital, characterized by its large financial scale and subsidies. These characteristics amplified policy banks’ risk tolerance, allowing them to more fluidly absorb short-term losses, sustain long-term investments, and avoid using policy conditionality to ensure debt repayment. These features of China’s development finance also helped cultivate a Chinese commercial presence in key strategic sectors within higher-risk economies.33Stephen B. Kaplan and Aparna Ravi, “Banking on the State: The Competitive Advantage of State-led Financing.” Institute for International Economic Policy Working Paper, 2003. To hedge sovereign credit risk from their state-to-state loans, however, policy banks employed commercial conditionality,34Kaplan, Globalizing Patient Capital. using natural resources as collateral for loans, as a means of repayment or in the event of a default.

However, Chinese policy banks have also shown that they are susceptible to mispricing credit risk when their sovereign borrowers mismanage the economy or natural resource production. They have also used commercial conditionality, linked to these financial contracts, to promote trade by requiring local purchases of Chinese machinery, materials, and technology and by guaranteeing contracts with Chinese firms. Employing these commercial conditions, however, have intensified such historical regional problems as commodity dependency and industrial stagnation.35Barbara Stallings, Dependency in the Twenty-First Century?: The Political Economy of China-Latin America Relations (Cambridge University Press, 2020); and Kevin Gallagher, Latin America’s China Boom and the Fate of the Washington Consensus (Oxford, UK: Oxford University Press, 2016). The United States can thus exploit Latin America’s frustrations with commercial conditionality, or the fine print of these financing deals, to better compete with China in several ways regionally.

International institutions: Compelling China to be a multilateral stakeholder

In light of China’s development emphasis in its foreign policy, the Chinese government has been careful to participate in multilateral debt relief initiatives, such as the Debt Service Suspension Initiative (DSSI) and the Group of Twenty (G20) Common Framework agreement, since the onset of the pandemic. However, China has simultaneously favored bilateral debt negotiation in countries where the CDB is the lead creditor, arguing that the CDB is a commercial bank, falling out of the scope of official, coordinated debt relief. Given the considerable scale of both Chinese investments and the CDB’s exposure to Latin American debt,36The CDB holds 90 percent of Latin America’s outstanding Chinese debt exposure. such bilateral discretion could challenge the global governance standards advocated for by the IMF and the Paris Club, posing a risk to global financial stability.

China creditors often opt for bilateral discretion because they prefer “evergreening” strategies or waiting for an economic recovery to generate new life into their bilateral loans. In other words, they have restructured loan terms, and propped up sovereign borrowers (e.g., Ecuador and Venezuela) without recognizing bad debts or requiring significant economic reform. Why? China is willing to engage in regulatory forbearance to avoid recognizing short-term losses. The United States pursued a similar set of policies during the 1980’s Latin American debt crisis to safeguard its bank balance sheets from regional defaults. The Federal Deposit Insurance Corporation relaxed regulatory conditions, while US banks extended new credit to heavily indebted countries in hopes of facilitating debt repayment that was vital to bank profitability.37Stephen B. Kaplan, Globalization and Austerity Politics in Latin America (Cambridge: Cambridge University Press, 2013). Financial losses and developing country debts escalated by the end of the decade, leaving the region caught in chronic crises. Mired in a period of shrinking growth, runaway inflation, and development stagnation popularly known as the Lost Decade, Latin America’s struggles weighed on the global economy. Western banks were eventually forced to write off their bad loans as part of multilateral-sponsored reform programs that helped stabilize the region, and check inflation.

China’s bankers have similarly balked at debt forgiveness, but over time, they are going to require more policy tools beyond rescheduling bilateral debt terms and waiting for economic growth and financial recovery. Without an alternative framework for debt sustainability, China needs the Common Framework as much as the United States. The IMF provides a pathway to financial stability that is often grounded in tough policy conversations with its borrowers about economic reforms that bilateral creditors—particularly those like China who favor nonintervention—hope to avoid. Beyond the current discord about how to distribute financial burdens under the Common Framework, China is a multilateral stakeholder that ultimately needs financial stability for its national creditors as much as the West. For example, China authorized Argentina to use its central bank currency swap this summer to help enhance its near-term financial means to repay the IMF, a vital step to facilitating new fund disbursements under Argentina’s ongoing IMF program. In light of such aligned financial incentives, the United States should use its influence in international institutions, including the IMF, to more actively encourage greater Chinese participation in multilateral debt relief, an outcome that not only delivers greater financial stability for US creditors, but also Chinese creditors.

Fortify US dollar as Latin America’s reserve currency

The dollar continues to reign supreme as a reserve currency in international finance, accounting for $6.9 trillion, or about two-thirds of the world’s total foreign exchange reserves, while the Chinese renminbi’s accounts for a mere 2 percent of total exchange reserves.38“Currency Composition of Official Foreign Exchange Reserves,” International Monetary Fund. Renminbi internationalization is one of the key motivations for China’s integration internationally; however, foreign investors have been circumspect about using the currency as a low-risk safe investment given ongoing concerns about the predictability of its political and legal frameworks.39Eswar S. Prasad, Gaining Currency: The Rise of the Renminbi (Oxford: Oxford University Press, 2017). China is trying to counter this narrative by using global trade and investment as a conduit to promote renminbi-based transactions. Even though the renminbi has less historic visibility in Latin America, the Chinese authorities have raised the currency’s profile through currency swap agreements, completing central bank swap agreements with eight Latin American countries totaling $19 billion.40Douglas Arner and André Soares, A Globalized Renminbi: Will It Reshape Latin America?, Atlantic Council, 2016. These agreements not only give central banks direct access to the Chinese currency but they also provide Latin American countries with a potential financing alternative when they face liquidity constraints in US dollar markets – as observed in Argentina this summer.

To reinforce dollar supremacy and improve the financial inclusion, efficiency, and safety of the US dollar payment system, US authorities should research the merits of a central bank digital currency (CDBC) in Latin America. By using trade to promote renminbi internationalization, China is betting that technological development will enhance the direct convertibility of bilateral currencies and reduce the world’s need for the dollar as a reserve currency. Today, the dollar is involved in almost nine-tenths of all currency transactions globally,41Carol Bertaut, Bastian von Beschwitz, and Stephanie Curcuru, “The International Role of the U.S. Dollar,” Post-COVID Edition,” FEDS Notes, Board of the Governors of the Federal Reserve System, June 23, 2023. affording the United States two key important economic and geopolitical advantages. Economically, long-standing demand for US dollars places a premium on its US Treasury assets, which translates to low interest rates for its government and firms that are vital for economic growth. Geopolitically, US dollar dominance allows the US government to use its global financial network to monitor international transactions and apply economic sanctions. To maintain these relative national advantages, the United States should secure the dollar’s place as a global intermediary by leveraging its technological expertise and regulatory infrastructure to build an unrivaled digital dollar hub for the international financial system.

Increase the scale and operations of the US Development Finance Corporation

The US Development Finance Corporation (DFC) has about $4.4 billion outstanding in active projects in the Western Hemisphere, or more than one-third of its total global projects.42“DFC Transaction Data”, Development Finance Corporation, September 30, 2022. These calculations do not include legacy transactions from OPIC, DCA, and USAID. https://www.dfc.gov/our-impact/transaction-data This development financing represents about 2 percent of regional FDI flows today. The DFC employs its financial resources—including loans, loan guarantees, equity investments, political risk insurance, and technical assistance—to help spur private investment in developing country markets. Importantly, the DFC’s mandate, which was created under the BUILD Act in 2018,43The BUILD Act stands for “The Better Utilization of Investments Leading to Development Act of 2018.” has sought to primarily expand development opportunities in low- and middle-income countries.44“Top Management Challenges Facing the DFC in FY 2023,” Office of Inspector General, Development Finance Corporation, November 2022. However, the DFC is also a commercial tool that has helped create market opportunities internationally in sectors where the United States has a competitive advantage, including clean technology, education, finance, healthcare, and information technology.

Given China’s large presence in South America’s high middle-income economies, the DFC should expand its scope and scale in the region’s largest markets, where commercial opportunities often intersect with strong development needs. To date, the DFC has extended 93 percent of its Latin American portfolio to higher middle-income countries, including Colombia, Ecuador, Mexico, and Peru. Beyond the Andes and North America, however, the rest of South America only accounts for one-quarter of the DFC’s Latin American exposure.45“DFC Transaction Data”, Development Finance Corporation, September 30, 2022. https://www.dfc.gov/our-impact/transaction-data. There are many remaining fertile opportunities in markets with sizable private sectors, including Argentina, Brazil, and Chile. China’s state-to-state financing has been effective at breaking into these markets, but the United States is brimming with sophisticated market players who would benefit competitively from enhancing the institutional foundations of the region’s marketplace.

To maintain its effectiveness, the DFC should thus focus on its institutional advantage of market development, and avoid any potential political interference. When the United States aims to leverage DFC financing to extract political concessions, or influence national investment governance, it risks undermining its own messaging about market governance and capital development. Much of the region still views China’s telecommunications firms as offering a development opportunity in digital infrastructure.46Jorge Malena, “The Extension of the Digital Silk Road to Latin America: Advantages and Potential Risks,” Asia Unbound (blog), Council on Foreign Relations and Brazilian Center for International Relations, 2021. The US concerns regarding data privacy and national security have merit, but are best channeled into foreign policy by instead presenting the region with competing development opportunities through the DFC. Such developmental efforts are more likely to grow regional support for US goals for twenty-first century globalization and help restore US economic and political leadership.

The DFC also can leverage the longstanding US strengths in financial intermediation, transparency, and accountability. Building robust legal frameworks for public finance and procurement has helped enhance private-sector activity, competition, and efficiency in Latin America over the course of the last few decades. Why interfere with such foundational regional market institutions by introducing politics into the public tender process? Alternatively, the United States can use its voice in multilateral and regional institutions including the World Bank and Inter-American Development Bank to further develop local administrative, legal, and financial expertise in procurement governance and public-private partnerships. Through such institutional efforts, the United States can help incentivize more Chinese financing flows through the local private sector, where it’s more likely to behave similarly to traditional market financing. In addition, the DFC can help simultaneously foster synergies between the US private sector’s technical expertise and local firms’ economic knowledge, creating mutual market gains.

China has begun to answer the region’s call for value-added manufacturing investment and technological spillover in such sectors as renewable energy, electric battery production, and clean transportation. However, China is still overcoming some negative optics throughout the region due to the high commercial content of its Latin America financial foray. Against this backdrop, the United States should leverage its private sector to deliver local development opportunities, but without the commercial conditionality of China’s development finance.

About the author

Stephen B. Kaplan is an Associate Professor of Political Science and International Affairs at George Washington University; and a faculty affiliate of the Institute for International Economic Policy.

The Scowcroft Center for Strategy and Security works to develop sustainable, nonpartisan strategies to address the most important security challenges facing the United States and the world.

The Adrienne Arsht Latin America Center broadens understanding of regional transformations and delivers constructive, results-oriented solutions to inform how the public and private sectors can advance hemispheric prosperity.

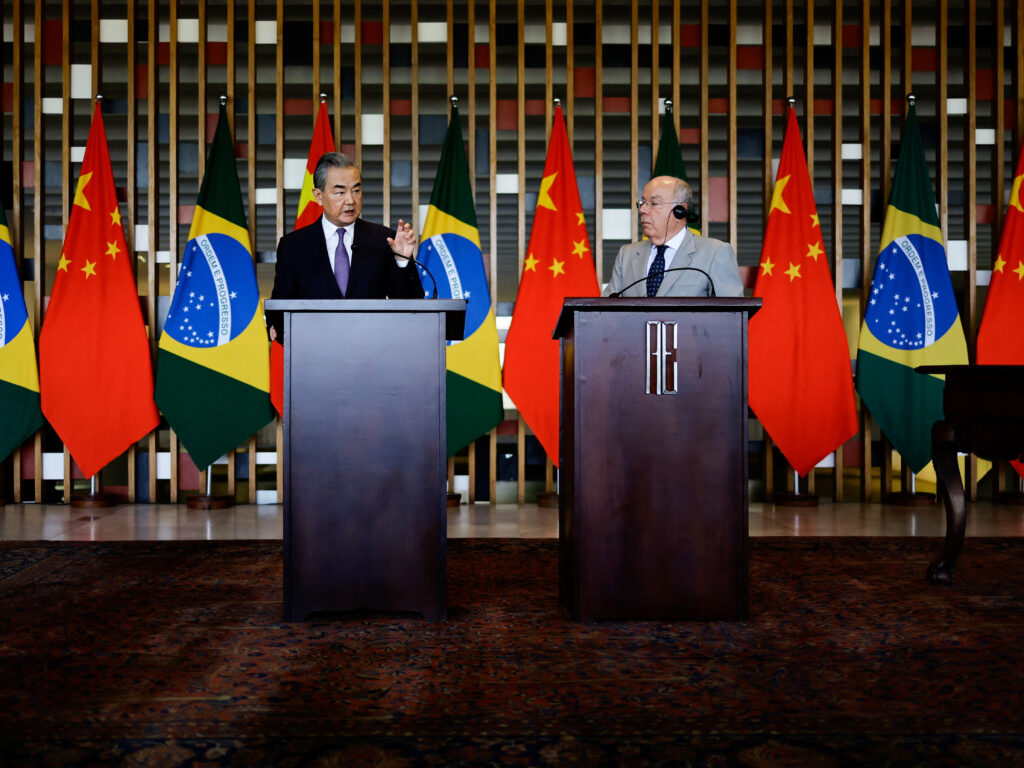

Image: Chinese Foreign Minister Wang Yi meets with Brazil's Foreign Minister Mauro Vieira at the Itamaraty Palace, in Brasilia, Brazil January 19, 2024. REUTERS/Ueslei Marcelino