Energy sector diversification: Meeting demographic challenges in the MENA region

Executive summary

Countries in the Middle East and North Africa (MENA) region are expected to witness a substantial growth in population over the next three decades. Many of the hydrocarbon-rich nations in this region will need to meet a commensurate increase in job demand. This report focuses on four nations that are predominantly reliant on the oil and gas sector: Saudi Arabia, the United Arab Emirates (UAE), Kuwait, and Algeria. In all four nations, the majority of the local population is employed in the public sector, which, in the long term, will become economically unsustainable. In order to meet the growing job demand, these nations must both diversify their economies beyond the energy sector and expand their energy sectors beyond hydrocarbons. Doing so will create important employment opportunities in new industries.

Saudi Arabia, the UAE, and Kuwait all have strategies in place that, if followed, could pave the way towards a diversified knowledge-based economy. Algeria, on the other hand, is at a crossroads. Even as it is undergoing a political transition, the transition can create opportunities for the new government to change the country’s course and push economic reforms that are not only aimed at lowering the current unemployment rate but also at making the private sector more enticing. Additionally, all four nations will need to take steps to increase female participation in the workforce by easing current restrictions and making labor laws more favorable towards women.

The energy sector plays a large role in the economies of all four nations. This sector has a critical role to play in efforts to diversify the economy and teach skills that will be beneficial in the future or can be applied in other sectors as well. Moreover, all four nations also have sovereign wealth funds that either play, or can play, a key role in diversifying the economy, strengthening existing industries, and helping to create new industries altogether. This report offers the following recommendations on how these four nations can work towards meeting demographic challenges in relation to the economy, specifically the role of the energy sector:

- Governments can strengthen the private sector through increased foreign investment and by incentivizing entrepreneurship through reforms that open up the economy and make it more lucrative for investors.

- Governments can create laws and support structures that encourage women to work and increase female participation in the workforce.

- Opportunities should be provided to teach skills and impart knowledge relevant to the job market that will also be relevant in the future.

- Lessons should be learned from the experience of the energy sector and leveraged to achieve successes in other areas. For example, the state-owned oil and gas companies have successfully set up a structure that allows them to not only invest in their employees but also take care of the community by offering health care services, education, and more.

Introduction

The demographics of the MENA region are at an inflection point, and population trends will have profound implications for the economies of each state. The population across the region is currently estimated to be close to 449 million; two-thirds of the population is under the age of twenty-four, according to the World Bank. According to the United Nations, the population in the MENA region is expected to nearly double to 724 million by 2050. If current demographic trends continue, the region will need to create more than 300 million jobs by 2050. Given global efforts to decarbonize the energy system, the MENA region must diversify the economies of states that depend primarily on oil revenue and—in many cases—create employment opportunities in entirely new sectors.

A low standard of living and lack of job opportunities were the primary drivers of the Arab Spring pro-democracy uprisings that erupted in the region in 2011. The uprisings toppled regimes in some nations, while sparking civil war in others. Still others experienced protests, but eventually subdued them. Demographics was a significant factor in the Arab Spring. The youth gave voice to their economic frustrations and used social media to organize protests. Without necessary reforms, there is a high likelihood that some nations in the MENA region could find themselves engulfed in turmoil. This is already the case in Iraq and Lebanon, where citizens, especially the youth, have taken to the streets to protest corruption and a lack of good job opportunities. The protesters’ demands have included good governance and health services. Lebanese Prime Minister Saad Hariri and Iraqi Prime Minister Adil Abdul Mahdi both resigned from office in the face of these protests.

For many countries in the MENA region, hydrocarbons are the main source of revenue. While these countries have used oil revenue earned from decades of high oil prices to provide subsidies to their citizens, this practice is not sustainable in the long term. A sharp decline in global oil prices in 2014 created a new reality for these oil-dependent economies; it demonstrated the need for a diversified economy.

This report focuses on the economies and demographic trends in four members of the Organization of the Petroleum Exporting Countries (OPEC): Saudi Arabia, the UAE, Kuwait, and Algeria. While Algeria is very different politically, historically, and geographically from the Arab Gulf countries mentioned in this report, its inclusion is important as this North African nation is both projected to witness significant demographic changes in the coming decades and is a key hydrocarbon economy.

While on one hand, the projected population growth in each of these countries could lead to political instability, it could, on the other hand, support economic shifts away from hydrocarbons. All four countries are dependent on revenue from the hydrocarbon sector and, with the exception of Algeria, all have put plans in place to diversify their economies. In Algeria, a new government has the opportunity to implement pivotal economic reforms that could change the course of the nation. However, this government will first need to establish its legitimacy following an election in December 2019 that witnessed voter turnout of less than 40 percent and whose outcome sparked protests.

Saudi Arabia, the UAE, and Kuwait have all made strides towards economic diversification and have articulated economic goals in strategic plans—Vision 2030 (Saudi Arabia); Vision 2021 (the UAE); and National Development Plan, also known as New Kuwait (Kuwait). These three countries and Algeria will face challenges as they seek to diversify their economies and address the economic aspirations of their young populations.

Political trends, demographics, education, and employment

The demographic projections for the MENA region and the need to create 300 million jobs by 2050 are imperatives that loom over Saudi Arabia, the UAE, Kuwait, and Algeria. All four countries are working towards diversifying their economies. Despite some progress on this front, the state-owned oil and gas sector is the predominant public sector employer and the main source of revenue for each state. This section provides an overview of the demographic trends in each of the four countries, and examines population growth, population by age and gender, unemployment statistics, and education levels. It then connects these trends to the hydrocarbon sector by examining public and private employment by gender, as well as statistics on expatriates, both skilled and unskilled, working in these countries.

Major political trends

Algeria was not immune to the Arab Spring, but the government subdued demonstrations by early 2012. At the time, oil prices were around $100 per barrel. This made it relatively easy for then President Abdelaziz Bouteflika to increase public sector employment and expand subsidies without instituting any real reform.

In February 2019, however, Bouteflika’s decision to seek a fifth term in office reignited protests, forcing the president to resign in April. The presidential election on December 12, 2019, attracted a low turnout—less than 40 percent of eligible voters showed up to vote—and brought a Bouteflika loyalist, Abdelmadjid Tebboune, to power. Tebboune was also close to and the favorite candidate of Algeria’s de facto leader, army chief Gen. Ahmed Gaid Salah. Until at least late December 2019, unrest has continued with protesters demanding that the current political establishment be swept away in its entirety. Given the situation, Tebboune will first need to establish legitimacy before his government can undertake economic reforms. Salah’s unexpected death on December 23, 2019, just two weeks after the elections, added a surprising twist to Algeria’s current situation, and it remains to be seen how protesters will respond and to what extent the army will give Tebboune free reign to run the country without Salah at the helm.

Like Algeria, Saudi Arabia, Kuwait, and the UAE addressed the Arab Spring unrest by announcing an increase in social spending; some also changed governments. In March 2011, Saudi Arabia announced that it would spend $120 billion on public goods, including education, housing subsidies, and pensions. In the years following the Arab Spring, protests in Saudi Arabia centered on concerns over sectarian disenfranchisement rather than economic anxiety.

In Kuwait, the emir, Sheikh Sabah al-Ahmad Al Sabah, replaced then Prime Minister Sheikh Nasser al-Mohammed Al Sabah in November 2011 and dissolved parliament. Elections in February 2012 boosted the Islamic opposition’s numbers in parliament.

While the UAE did not experience street protests during the Arab Spring, its government increased spending on public goods, especially welfare benefits and salaries for public sector employees. It also expanded the electorate from 6,000 members to close to 130,000 members (all UAE nationals) for Federal National Council elections. At the same time, however, the government tightened restrictions on free speech and the media, and imprisoned activists who called for a more liberal political system and a fully elected parliament as was noted in national media.

The economic situation in all four countries was better during the Arab Spring, with oil prices around $40 higher than they are today. Between the economic reality of lower oil prices and growing populations, revenue from the hydrocarbon sector alone will not be enough to address citizens’ needs in the long run.

Demographic trends and expatriate contributions to local economies

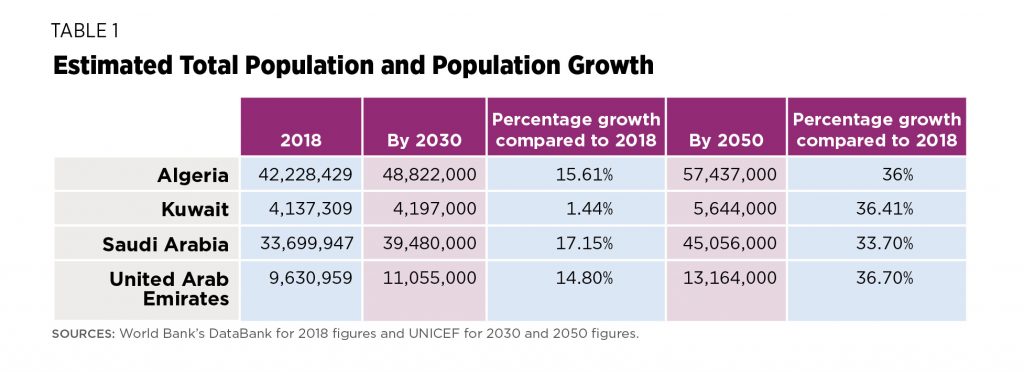

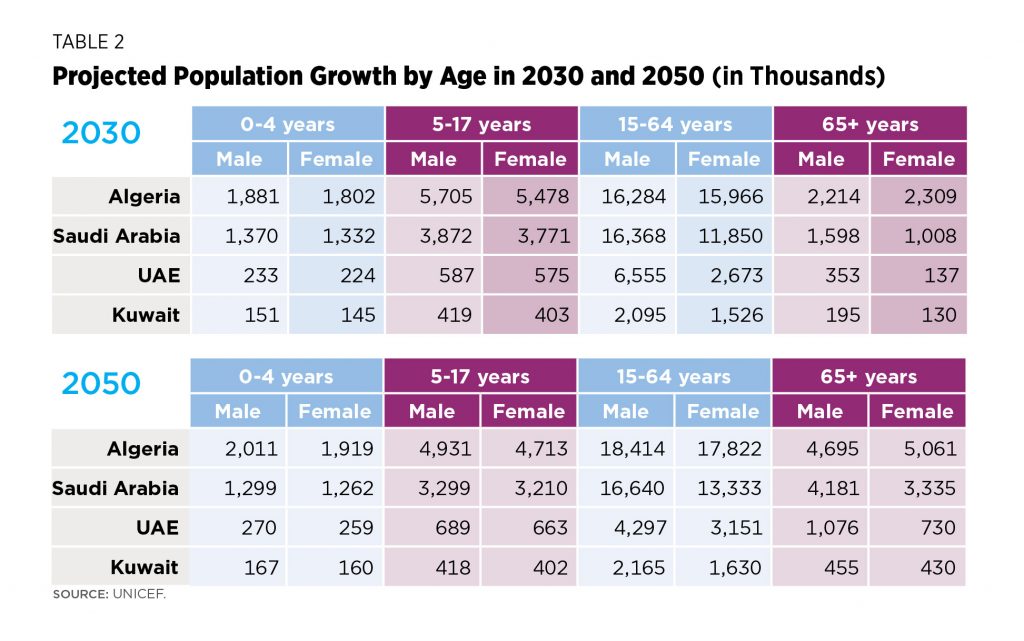

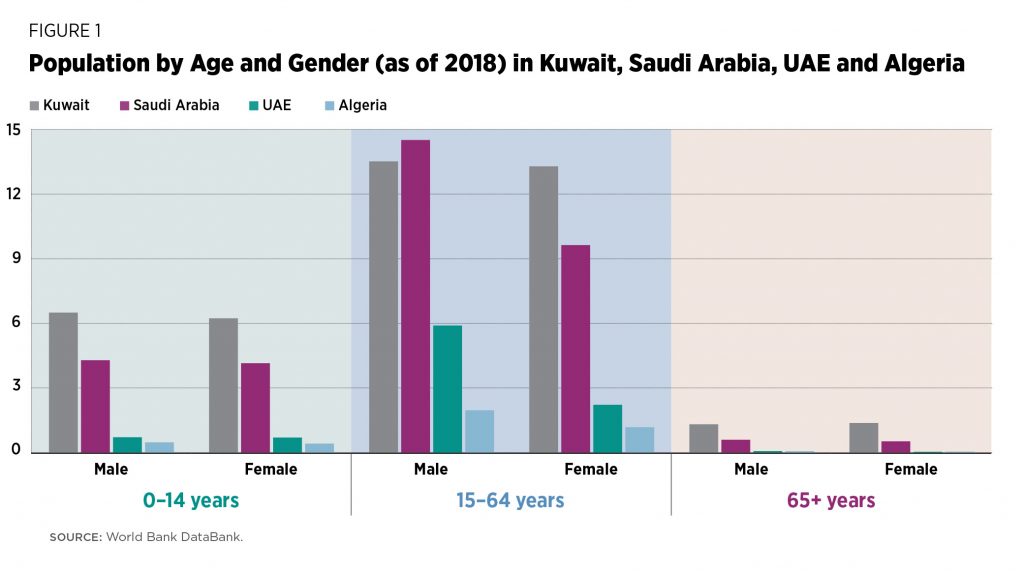

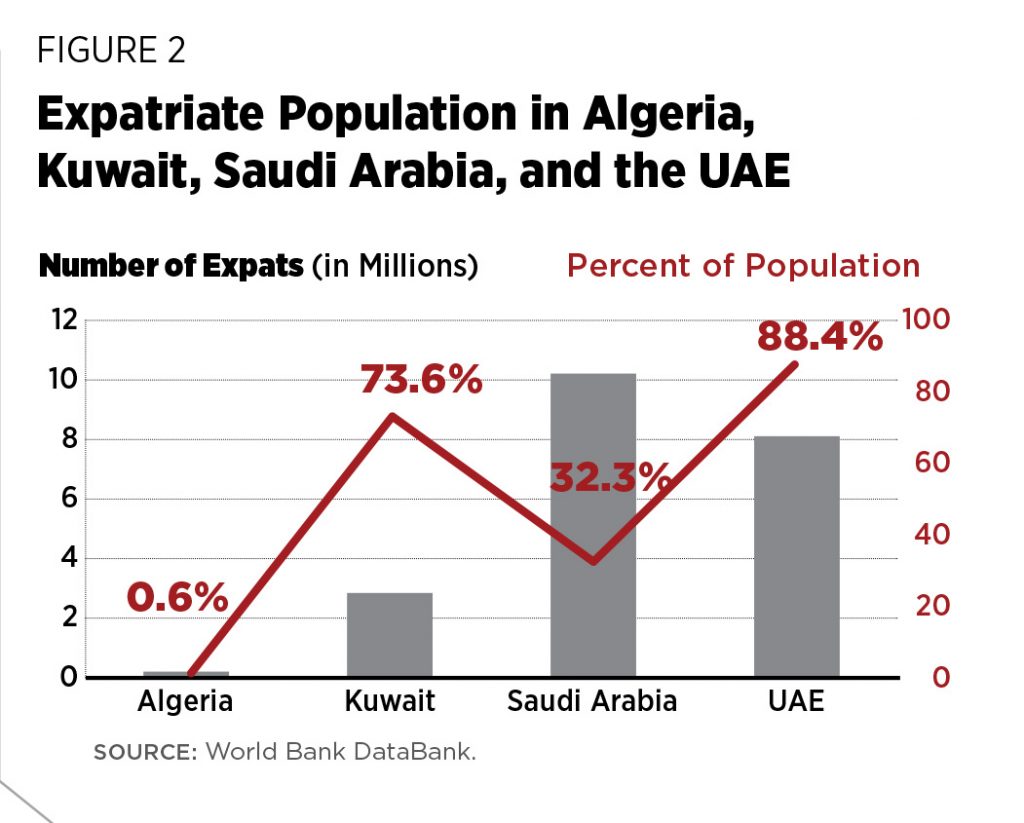

Currently, the majority of the population in each of the four countries is between the ages of fifteen and sixty-four. The zero to fourteen age bracket is in not far behind in terms of size (Figure 1). This means that the vast majority of the population is at a working age or will be within the next decade or so. In addition, as shown in Tables 1 and 2, Saudi Arabia, the UAE, Kuwait, and Algeria are expected to witness a population growth between 33 and 37 percent by 2050 compared to 2018 population estimates. More new jobs will need to be created in the first half of the century given that the majority of the population is projected to be at a working age between 2030 and 2050. Demographic and economic statistics for the Arab Gulf countries include expatriates who come to these countries in search of jobs. The Arab Gulf countries tend to rely heavily on expatriates, so much so that in the case of the UAE and Kuwait expatriates account for more than half of their entire populations at all economic levels (Figure 2). Algeria, on the other hand, has barely any expatriates in its labor force.

The Arab Gulf has depended on expatriates for decades. However, these countries have restrictions on granting citizenship to foreigners. Saudi Arabia, the UAE, and Kuwait are each now pushing for Saudization, Emiratization, and Kuwaitization, policies that aim to raise the number of their nationals in the public and private sectors over the number of expatriates. These policies aim not only to reduce the relatively high unemployment rate—as in the case of Saudi Arabia—but also to eliminate any structural divisions in the labor markets in these nations and increase local contributions to the economy. However, policies that support nationalization come with challenges that could impact reaching the desired goal, as there are certain jobs, especially those that are manual-labor intensive, that citizens of these nations would not do, and which would continue to be carried out by mostly South and Southeast Asians. Moreover, these Arab Gulf nations will need to invest in building human capacity within their populations to ensure that they have the professional skills, knowledge, and tools that would match the needs of the private sector. With its goal of Saudization, Saudi Arabia has expanded the number of employment opportunities for Saudis and increased fees and taxes on foreign workers. As a result, the cost of living and the cost of hiring foreigners have increased. This has led to a sharp increase in the number of foreigners leaving Saudi Arabia.

While the UAE has pushed for Emiratization, it is also taking measures to retain a professional class of skilled expatriates. In May 2019, the UAE announced a long-term residency program, also known as the golden card, which allows residents and foreign investors to acquire a ten-year visa that may be renewed in ten-year increments. So far, only five categories of expatriates can apply for the golden card: investors, scientists, entrepreneurs/innovators, chief executives, and outstanding students. The golden card is not available to any other categories of workers who represent the bulk of non-Emirati nationals living in the UAE.

In Kuwait, as part of its Kuwaitization effort, the government plans to make the public sector 100 percent Kuwaiti. In March 2019, members of parliament called on the government “to cut the expatriate workforce by half over the next five years,” a target that the Economist Intelligence Unit considers “unachievable, given the number of planned infrastructure projects in Kuwait.”

Education and unemployment: How demographic trends exacerbate a growing problem

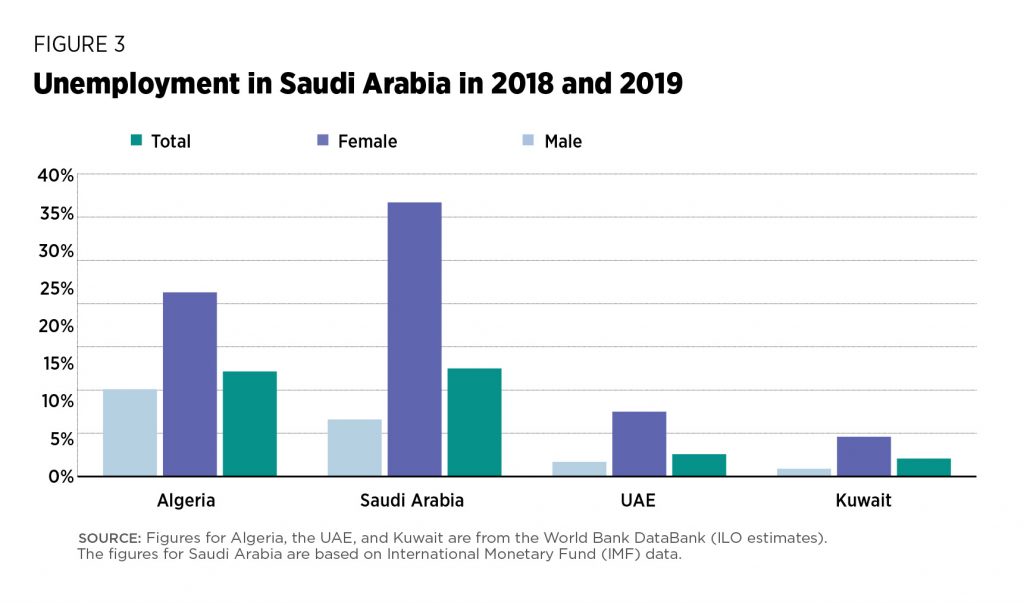

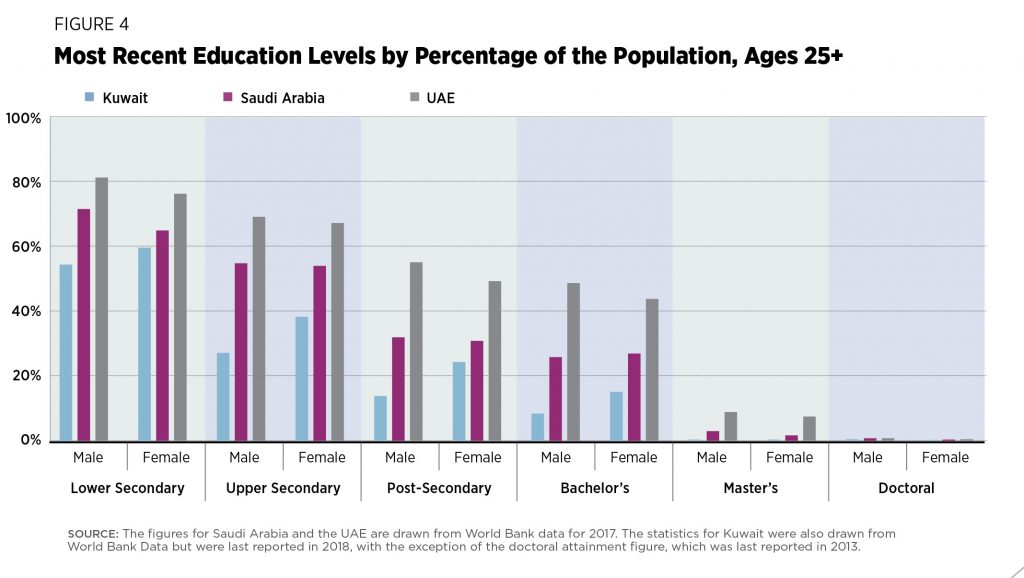

Algeria and Saudi Arabia have high unemployment rates of around 12 percent. The UAE and Kuwait, on the other hand, have low unemployment rates of 2.5 percent and 2 percent, respectively. In all four nations, women make up the majority of the unemployed despite the fact that in Kuwait and Saudi Arabia they have higher levels of education than men and are not far behind men in this regard in the UAE (Figure 4). In Algeria, employed women tend to be more highly educated than men—more than 40 percent of employed women in Algeria have a tertiary education, compared to 10 percent of employed men. Unemployment among Algerians remains particularly high for women (20 percent) and the youth (28.3 percent). Given the high unemployment rates in Algeria and Saudi Arabia, the current and future job prospects for the populations in these two countries is of concern.

The state of public sector employment and the importance of increasing private sector options

Across the four countries examined in this report, nationals prefer to work in the public sector because of better pay and benefits. Expatriates, on the other hand, are mostly employed in the private sector. The private sector is dominated by jobs in construction and infrastructure, relies mainly on manual labor, and offers low pay. However, there is also a professional or white-collar private sector in countries such as the UAE and Saudi Arabia, where foreign businesses have set up offices, most often in free trade zones—areas that have certain benefits that do not apply elsewhere in the country. For example, allowing foreign businesses to maintain 100 percent ownership of their operations, allowing business profits to be returned to the company’s country of origin, and providing tax exemptions.

Women in the workforce in these four countries tend to work predominantly in the public sector, although their overall levels of participation are low. The International Monetary Fund (IMF) estimates that the gross domestic product (GDP) per capita would rise significantly if these nations raise the employment rate for women to the same level as that for men. By 2040, the UAE could see GDP boosted by 12 percent, while Algeria’s GDP would increase by around 40 percent, according to the IMF. For this to happen, labor market restrictions, such as limits on the industries in which women can work, would need to be eased or eliminated. Moreover, there is great fiscal pressure on all four governments’ budgets due to the heavy reliance on public sector employment. The majority of these budgets tend to go toward paying salaries. Reforms are needed to reduce the financial burden on these governments and make the private sector more enticing. This will help meet the future job demand and diversify the economy.

In Saudi Arabia, around 70 percent of Saudi nationals are employed in the public sector, while 80 percent of expatriates work in the private sector. In 2018, Saudi women made up 23 percent of the workforce—an increase of 5 percent compared to 2017. This was a consequence of reforms instituted by the government that have lowered barriers for women to work, such as allowing women to drive, easing male guardianship rules, and enacting labor laws that are supportive of part-time work and leave. In the energy sector, Saudi Aramco—the state-owned energy company—has approximately 70,000 employees of which around 85 percent are Saudi nationals. Although Saudi Aramco is state-owned, it is run relatively efficiently, and—with the recent international public offering (IPO) and purchase of SABIC—has taken steps to operate like an international oil company by diversifying its portfolio and increasing its investments abroad. A high public sector employment rate overall may help maintain stability in Saudi Arabia; however, it may also serve as an impediment to efforts to diversify the Saudi economy beyond the public sector and create new employment opportunities in industries beyond hydrocarbons.

Like Saudi Arabia, the UAE has a high percentage of its nationals working in the public sector. It is estimated that 60 percent of public sector employees were Emiratis and only 0.5 percent of private sector employees were Emiratis in 2018. Emirati women hold approximately 66 percent of public sector jobs and 75 percent of jobs in the education and health sectors. While the energy sector plays a key role in the energy diversification process and provides a large portion of the government’s revenues, it accounts for only a small percentage of total employment nationwide.

Kuwaiti nationals make up about 30 percent of the country’s population, yet nearly 80 percent of public sector employees are Kuwaiti nationals. Most Kuwaiti women work in the public sector, and among women in the workforce, over half are in professional positions and only 2 percent are in senior or managerial positions. The most recent figures, from 2014, show that, similar to Saudi Aramco, Kuwait’s state-owned energy sector consists of mostly Kuwaiti nationals at 94.4 percent (81.7 percent male versus 12.7 percent female), while the remainder are expatriates (4 percent male versus 1.5 percent female).

In Algeria, the public sector (including state-owned enterprises and public banks) dominates the economy. The wage gap between men and women in Algeria seems to be insignificant and women tend to have better quality jobs than men in the public sector. The public sector is especially more attractive for women as it guarantees equal treatment and provides flexible work hours. At the same time, the government provides allowances to women who stay at home, which may discourage them from participating in the workforce. If Algeria were to streamline some of the positive aspects of work in the public sector and extend them to the private sector, it could eliminate the difference between the two. This could also make the private sector stronger and more enticing. Algeria is expected to have one of the largest population growths in the coming decades. Improvements in the private sector would not only help meet the rising job demand, but also help alleviate the financial burden on the government.

Economic diversification

The sharp drop in oil prices in 2014 underscored the volatility of the oil market and threw the vulnerabilities of hydrocarbon-dependent economies into sharp relief. It made clear that these nations are unlikely to have sustainable and prosperous economies over the long term due to their heavy reliance on one sector. Many of these nations, including the three Arab Gulf states and Algeria, felt an urgent need to diversify.

The concept of economic diversification is not new for the Arab Gulf countries. Saudi Arabia attempted to diversify its economy away from oil in the 1970s, as did Kuwait and the UAE. Most of these countries focused on building a financial market. This goal, however, remains unrealized. This section takes a closer look at how the hydrocarbon sector supports the economies of the four nations in question, diversification efforts in these four nations, and the role of the energy sector and sovereign investors in these efforts.

How the hydrocarbon sector supports the economy

In Algeria, hydrocarbons make up around 95 percent of the country’s exports; 40 percent of Algeria’s 2018 budget was supported by oil and gas revenues. The oil price drop resulted in a drawdown of Algeria’s reserves from $178 billion in 2014 to $88.6 billion by June 2018. Algeria’s total debt increased to 41.9 percent of the country’s GDP by 2018, according to the World Bank. As a result of the lower oil prices, the Algerian government took steps to improve the business and investment climate, reform energy subsidies, and modernize its monetary policy framework. However, given the current political uncertainty in the country, it is unlikely that any real reform will take place in the near future. The IMF has predicted that Algeria’s economic growth will slow over the next few years with an annual change of 2.7 percent in 2019 and an annual change of 0.5 percent by 2023.

In Saudi Arabia, oil and oil products account for 79 percent of the country’s exports; roughly 87 percent of Saudi Arabia’s budget comes from oil revenues. In 2018, Saudi Arabia had a budget deficit of 4.6 percent of its GDP, a significant improvement compared to 2017 when, due to better oil prices and the effects of structural reforms that impacted the government’s balance positively, the deficit was 9.3 percent of its GDP. However, Saudi Finance Minister Mohammed al-Jadaan said in October 2019 that the kingdom’s 2020 budget deficit would increase to 6.5 percent of its GDP (around $50 billion) due to the lower oil prices. The government, as a result, will not be able to invest as much in its economy or continue its efforts to develop a nonhydrocarbon economy. Moreover, while the kingdom seeks “to accelerate economic diversification . . . progress will be constrained by the slow pace of reform and labour market shortcomings,” according to the Economist Intelligence Unit.

The UAE has succeeded in decreasing its dependence on oil and gas. In 2017, oil and gas products made up 40 percent of the country’s exports and the oil and gas sector accounted for close to 30 percent of the UAE’s GDP. After 2014, the UAE adjusted to lower oil prices and decreased its overall expenditure. The Emirati government pushed for fiscal consolidation, as demonstrated by the 2018 merger of the Abu Dhabi Investment Council and Mubadala Investment Company, which boosted Mubadala’s assets to more than $225 billion. In 2017, National Bank of Abu Dhabi and First Gulf Bank formed the First Abu Dhabi Bank, which, with around $190.3 billion in assets, became the largest lender in the country.

Among the four countries that are the focus of this report, Kuwait depends the most on the hydrocarbon sector. More than half of its GDP comes from oil, while more than 90 percent of its budget, as well as its exports, comes from the oil and gas sector. Unlike Saudi Arabia or the UAE, Kuwait has a parliamentary system of government that is often mired in political gridlock. This has created an unstable political environment and inconsistencies in economic policy, while hampering progress towards economic diversification. As a consequence of the political gridlock between parliament and the executive branch, no parliament or government has completed a full term since 2003. For Kuwait to make any real progress in diversifying its economy and reducing its dependence on the oil and gas sector, it is necessary to achieve greater political stability.

Common among all four nations is the social contract in which the government provides subsidies and other support to its respective populations in return for their support. How this came about in Algeria is different from the three Arab Gulf countries. In Algeria, Bouteflika relied on subsidies and government handouts to ensure the political elite remain in power. In the relatively young Arab Gulf nations, on the other hand, oil revenues have been shared with their citizens from the beginning, ensuring that the ruling elite remain at the top. Today, these nations often distribute oil wealth through subsidies. In the UAE, for example, Emiratis receive free housing, land, or interest-free loans to purchase a home, among many other benefits and subsidies. Kuwaitis benefit from free health care, education, and interest-free loans for housing. In addition to various benefits and subsidies, such as free education, Saudi Arabia spent $13 billion in handouts to state employees in 2018 in an effort to offset the higher cost of living after the government raised taxes on food and utilities as a result of higher gasoline prices. The four governments in question already have large financial burdens due to high numbers of public sector employees. While all four were able to provide financial support to their citizens when oil prices were soaring, they will need to cut back in such a way that would not lead to social unrest now that lower oil prices seem to be the new reality.

Diversification plans and efforts

Each of the three Arab Gulf countries that are the focus of this report have articulated their national development strategies for economic reform in the twenty-first century. Saudi Arabia has put forward Vision 2030, Kuwait’s plan is titled New Kuwait by 2035, and the UAE’s plan is Vision 2021. Each plan is geared towards equipping citizens with the right skill set to ensure sustainable and prosperous economies in the long term. Moreover, the plans push labor market reforms and seek to create new jobs. This will not only go towards diversifying economies, but also meeting future job demand. Algeria, while it is working to implement some economic reforms, does not have a strategy in place like the three Arab Gulf nations. The World Bank was to provide the Algerian government with technical assistance in the design and drafting of Algeria’s Vision 2030 with an expected delivery date of a report in September 2018. It is unclear, however, whether this goal has been met as no report has been published and more information is not available.

The plans of the three Arab Gulf countries share commonalities: they each articulate a strategy to become knowledge-based economies, make greater investments in technology, and increase foreign investments while decreasing their dependence on expatriates. These countries are pushing their citizens to study science, technology, engineering, and mathematics (STEM). This would not only benefit the oil and gas sector, it would also bolster a knowledge-based economy. As each of the governments rely heavily on revenues from the hydrocarbon sector, each country’s energy sector has a key role to play in a diverse economy.

The role of the energy sector

The energy sector will continue to play a critical role in the economies of each of these four nations as they seek to achieve a diversified economy. Saudi Aramco, for example, is an integral part of Vision 2030. The Saudi government plans to sell 5 percent of the state-owned company, hoping for a $2 trillion valuation. In the fall of 2019, Saudi Aramco listed an initial 1.5 percent of its shares on Tadawul, Saudi Arabia’s local stock exchange. These shares were valued at $8.53 per share, valuing the company at $1.7 trillion on the first day, but eventually reached $10.13 per share, valuing the company at $2.03 trillion by close of market on day four. By the end of December, Saudi Aramco’s valuation was approximately $1.9 trillion. The offering raised $25.6 billion, which the Saudi government plans to invest in industries such as tourism, technology, and education in an effort to diversify the economy. The UAE has already successfully used the Abu Dhabi National Oil Company (ADNOC) to raise funds to reinvest in the economy, and to help build new industries and strengthen other sectors. ADNOC, a state-owned company, sold 10 percent of its distribution unit in December 2017, raising $851 million. Kuwait’s development plan does not lay out the energy sector’s role. However, given that Kuwait’s economy and its government rely so heavily on the hydrocarbon sector, this sector will have a role to play in economic diversification. The same is true for Algeria.

Given the likelihood of a peak in oil demand in the future, as well as concerns about lower oil prices, oil-dependent countries as well as oil companies will need to reconsider their future. Additionally, climate change may drive investments away from the oil and gas sector, while the impacts of climate change could threaten industry infrastructure. As countries and companies consider how to transition away from oil and combat climate change, renewable energy has become a focus for many.

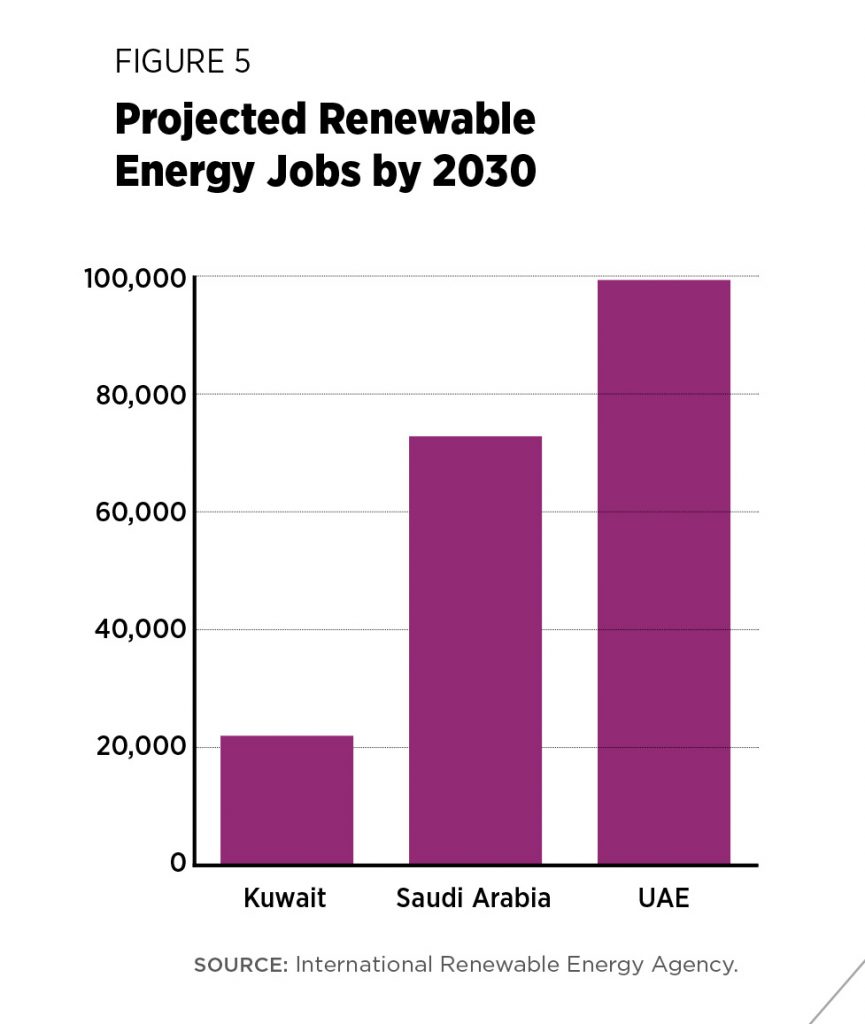

Saudi Arabia, the UAE, and Kuwait are all eyeing the renewable energy sector as a way to help meet future job demand. This sector is expected to see growth for at least the next decade. The International Renewable Energy Agency estimates close to 100,000 renewable energy jobs in the UAE, around 75,000 in Saudi Arabia, and a little over 20,000 in Kuwait by 2030 (Figure 5). Algeria, on the other hand, does look at renewables as a way to diversify its energy mix and improve energy efficiency, but not enough progress has been made in formulating specific plans. Technology is playing a key role as well, not just in the renewable energy industry, but in the job market at large. Automation is expected to take over many more jobs, particularly in the renewable energy sector. While a labor force is required in the manufacturing stage in the renewable energy sector, once built, a large part becomes automated and does not require the same level of employment. Knowledge and skills in technology, however, can provide new job opportunities in different sectors and industries.

The role of sovereign investors

Sovereign investors play a critical role in economic diversification efforts. In order to safeguard the economic future of the three Arab Gulf countries in question, their governments put portions of their hydrocarbon revenues into sovereign wealth funds (state-owned investment funds), which serve as long-term investment vehicles and aim to provide economic stability by minimizing the impact of the fluctuation of the commodity markets. The Abu Dhabi Investment Authority (ADIA), which has close to $700 billion in assets under management, is Abu Dhabi’s largest sovereign investor. However, as the fund manager of and an economic stabilizer for the government, ADIA does not have an economic diversification mandate. Abu Dhabi instead established Mubadala with the objective of helping diversify the UAE’s economy through the financial returns it generates. With two-thirds of Mubadala’s portfolio invested in the non-hydrocarbon sector, the returns tend to be diversified and protect against low commodity prices. Moreover, through international partnerships, Mubadala, along with ADNOC, as mentioned above, has played a role in either starting new industries or expanding and strengthening existing ones, such as health care, financial markets, sports, and tourism. Mubadala not only reinvests its returns on foreign investments domestically, it also uses foreign investments to gain knowledge of industries and brings that expertise back to the UAE.

Riyadh has put a similar responsibility on the Public Investment Fund (PIF). Until recently, the PIF only had domestic assets. It was not until Riyadh established Vision 2030 and gave the PIF a prominent role in the economic diversification process that the fund started to invest in foreign assets. Saudi Arabia wants the PIF to become the largest sovereign investor in the world (that distinction is currently held by the Norwegian sovereign wealth fund, which has more than $1 trillion in assets) and to replace oil as the government’s main source of revenue. While the PIF’s portfolio is diversified, it lacks foreign assets on a scale that could help decrease Saudi Arabia’s reliance on revenue from the hydrocarbon sector.

While the Kuwait Investment Authority (KIA) has a mandate to help diversify the economy, like Mubadala and the PIF, it also manages Kuwait’s assets and mainly invests the country’s hydrocarbon revenue abroad to ensure economic stability. KIA, which was established in the 1950s, is considered the oldest sovereign wealth fund in the world. It was not until the late 1990s, however, that the Kuwaiti government added economic diversification efforts to its objectives. KIA does not publicly disclose its assets or geographical breakdown, making it difficult to determine how diversified its portfolio is and to what extent the fund is supporting the Kuwaiti government’s efforts to diversify the economy.

Algeria’s Revenue Regulation Fund (RRF), which was established in 2000, aims to “manage and preserve its oil wealth and earnings.” The Sovereign Wealth Fund Institute valued RRF at $77.2 billion in 2013. There is little known information on how the fund is structured or functions. What is known is that the Algerian government has not put any restrictions on the fund’s withdrawals for spending. Without a proper structure, mandate, accountability, or some transparency it is unlikely that RFF can play, or is playing, a role in the economic diversification effort in Algeria.

For any of the nations in question to develop a truly diversified economy, they will need to establish entirely new industries, which will need to happen, in part, by creating partnerships with businesses willing to bring new industry and knowledge with them. The PIF, KIA, and RRF lack transparency, unlike Mubadala, which could impact their ability to build partnerships or attract foreign investments at large. Moreover, the nations covered in this report will also need to provide their populations with opportunities to learn skills and knowledge that will give them job security.

A look ahead

It is critical that each of the four countries that are the focus of this report succeed in building a diversified economy that can meet the demographic challenges and the job demand. Turmoil and instability in any of the four countries will likely have a regional and a global impact. Algeria’s new government should devise an economic strategy that is aimed at ensuring job security for its people. Saudi Arabia, the UAE, and Kuwait can be successful if they follow through on their stated visions and implement the reforms needed to achieve them.

Each of these nations should lower the barriers to the diversification of their economies. They must also ensure that there are enough jobs for their growing populations. This report recommends focusing on the following areas:

- Open up the economy. The governments should implement reforms that make it easier for foreign investors to invest and that incentivize entrepreneurship by citizens to strengthen the private sector.

- Increase female participation. The governments should put in place laws and a support structure that allows and encourages women to work. They must hold companies accountable for hiring women by setting quotas and publishing annual reports that include statistics on employment by gender.

- Teach skills and knowledge relevant to the job market and provide opportunities to current employees to continue developing skills that will be relevant in the future. Knowledge of new technologies will be necessary as the oil and gas sectors in these nations seek to decarbonize. Furthermore, new industry sectors—whether renewables within the energy sector or entirely different industries like sports or tourism—will require new skill sets and job training opportunities. In addition, implementing policies that would help close the gap between skills and needs or employers’ expectations would increase job opportunities and employers’ willingness to hire locals over expats.

- Use the energy sector as an example. Companies such as Saudi Aramco and ADNOC invest in their employees by providing education, trainings, and skills development. Saudi Aramco also invests in its communities by providing health care services and education, among other things. Other companies could learn from these examples when it comes to building a structure that increases employee retention as well as provides employees with the necessary skills to ensure the company remains successful and that its staff is able to grow.

The demographics in the MENA region are changing. Regional governments will need to implement reforms that can meet new demands. They have the means to do so, but they will need to work together and seek assistance from the international community to create the tools to do it.

About the author

Subscribe to the Global Energy Center newsletter

Sign up to receive our weekly DirectCurrent newsletter to stay up to date on the program’s work.